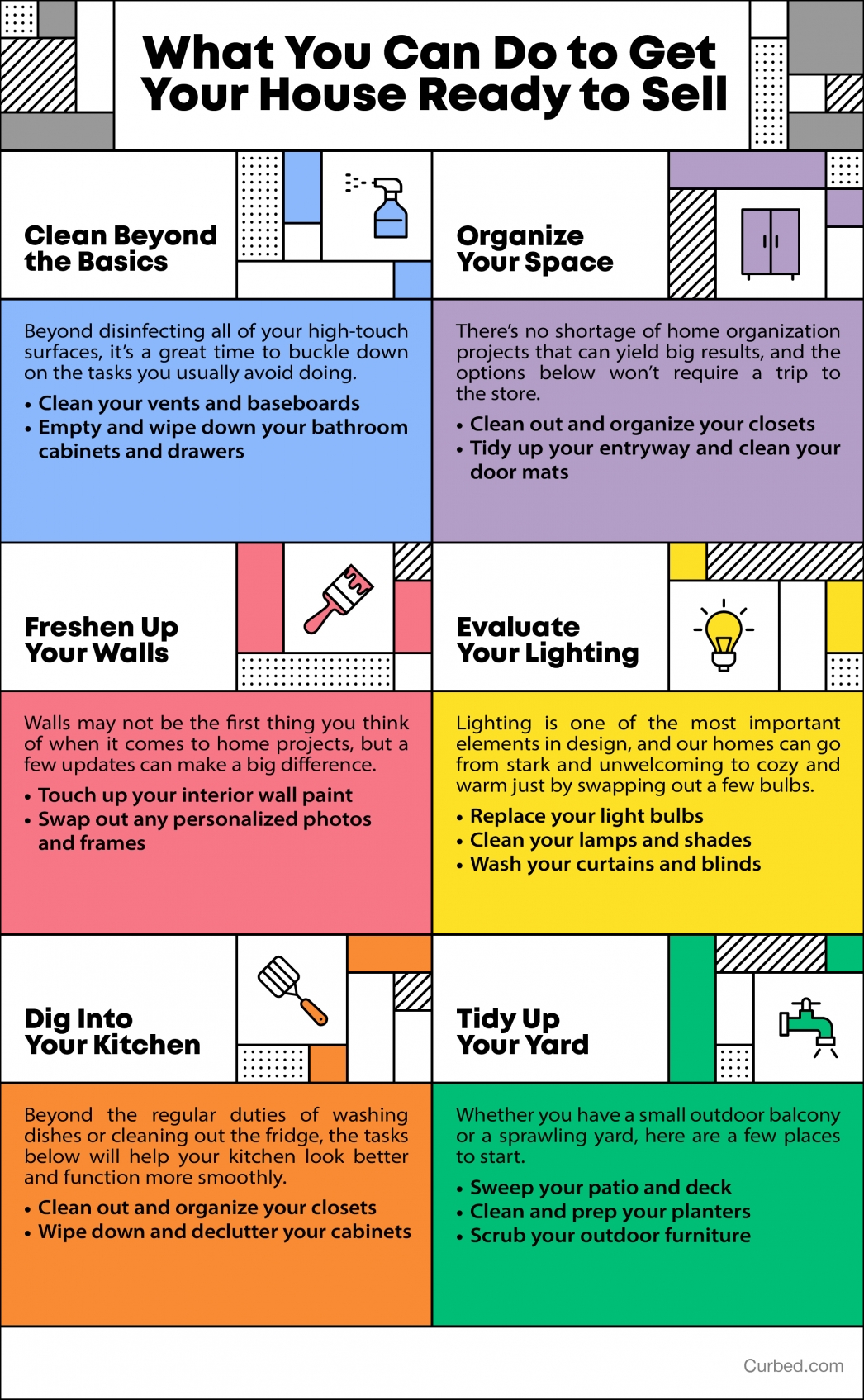

What You Can Do to Get Your House Ready to Sell [INFOGRAPHIC]

Some Highlights:

- Believe it or not, there are lots of things you can do to prep your house for a sale without even going to the store.

- Your real estate plans don’t have to be completely on hold even while we’ve hit the pause button on other parts of daily life.

- Tackling small projects from cleaning the corners you may normally skip to tidying up your yard are easy and necessary wins if you’re thinking of listing your house and making a move.

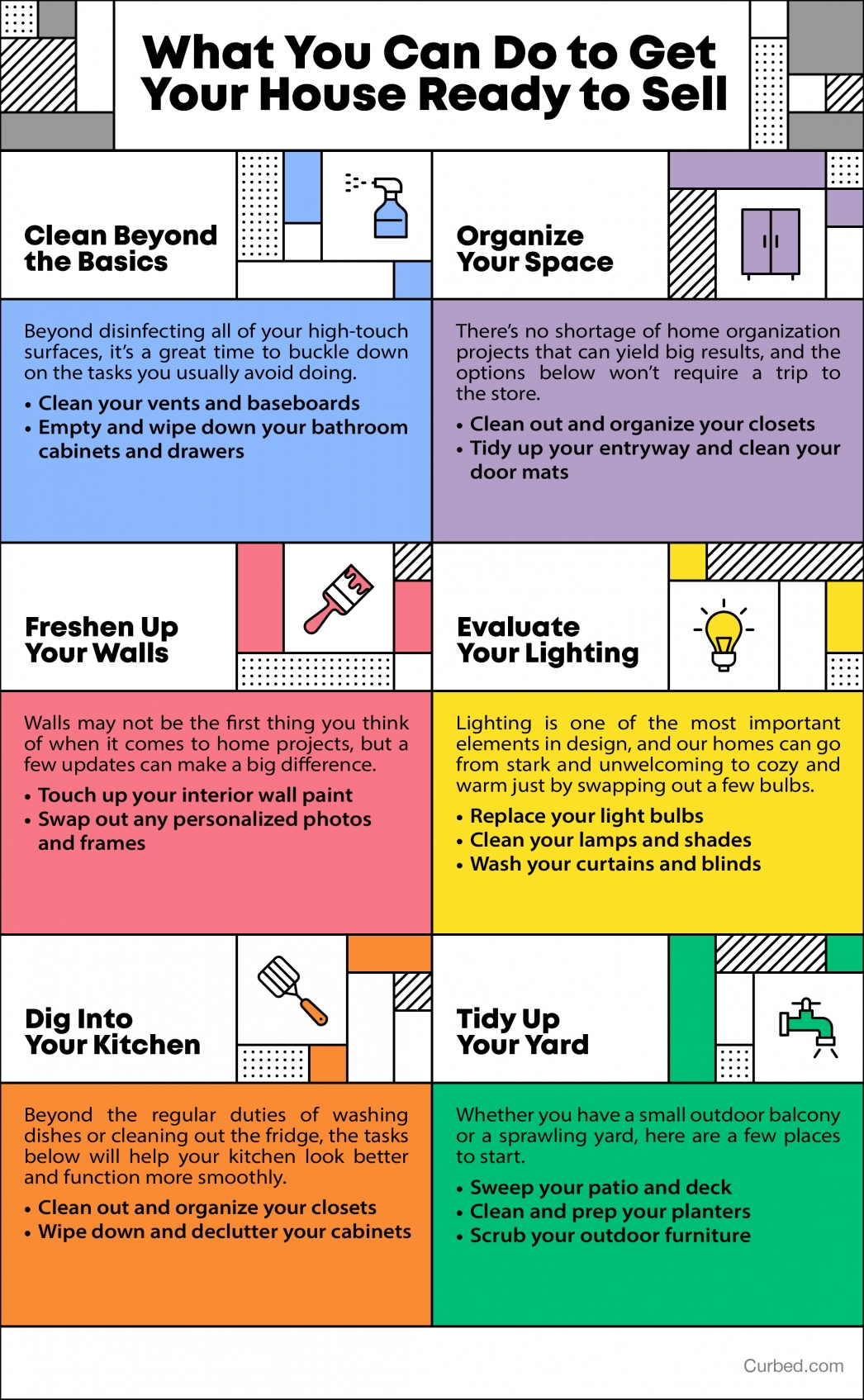

How to Find the Perfect Real Estate Agent

There’s a ton of real estate information available in the news today and on the Internet. It can be extremely confusing, especially in times of uncertainty like we’re facing right now.

If you’re thinking of buying or selling this year, you need an agent who can help you:

- Make sense of this rapidly evolving housing market

- Navigate everything from virtual showings to new online marketing strategies

- Price your home correctly at the beginning of the selling process

- Determine what to offer on your dream home without paying too much or offending the seller

Dave Ramsey, a financial guru, advises:

“When getting help with money, whether it’s insurance, real estate or investments, you should always look for someone with the heart of a teacher, not the heart of a salesman.”

Hiring an agent who has a finger on the pulse of the current market will make your buying or selling experience so much easier.

So, how do you identify who truly understands what’s happening right now? How do you know who will take the time to simply and effectively explain what today’s market conditions mean to you and your family?

Check out the agent on social media. What are they posting on Instagram, Facebook, Twitter, and more? Are they using their social media platforms to share relevant, helpful information, or are they just posting memes and recipes? The best agents are committed to educating the consumer so they can feel confident when buying or selling a home.

Bottom Line

What agents are posting online will help you determine who meets the criteria Dave Ramsey suggested you look for: someone with the heart of a teacher. Let’s connect today, so you can work with a true trusted real estate professional.

The Housing Market Is Positioned to Help the Economy Recover [INFOGRAPHIC]

![The Housing Market Is Positioned to Help the Economy Recover [INFOGRAPHIC] | MyKCM](https://desireestanley.com/files/2020/04/20200403-MEM-EN-1046x1308.jpg)

![The Housing Market Is Positioned to Help the Economy Recover [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/04/02095400/20200403-MEM-EN-1046x1308.jpg)

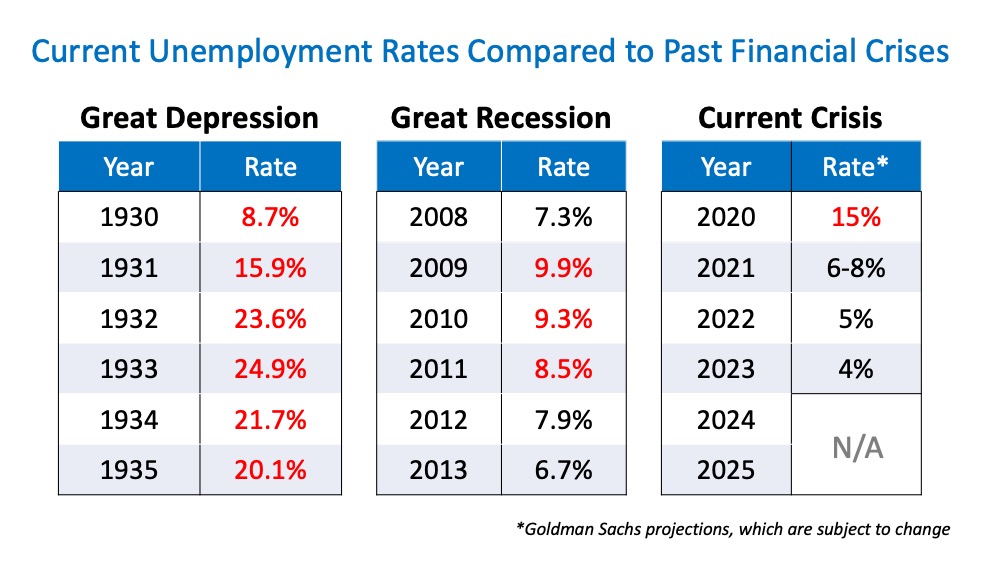

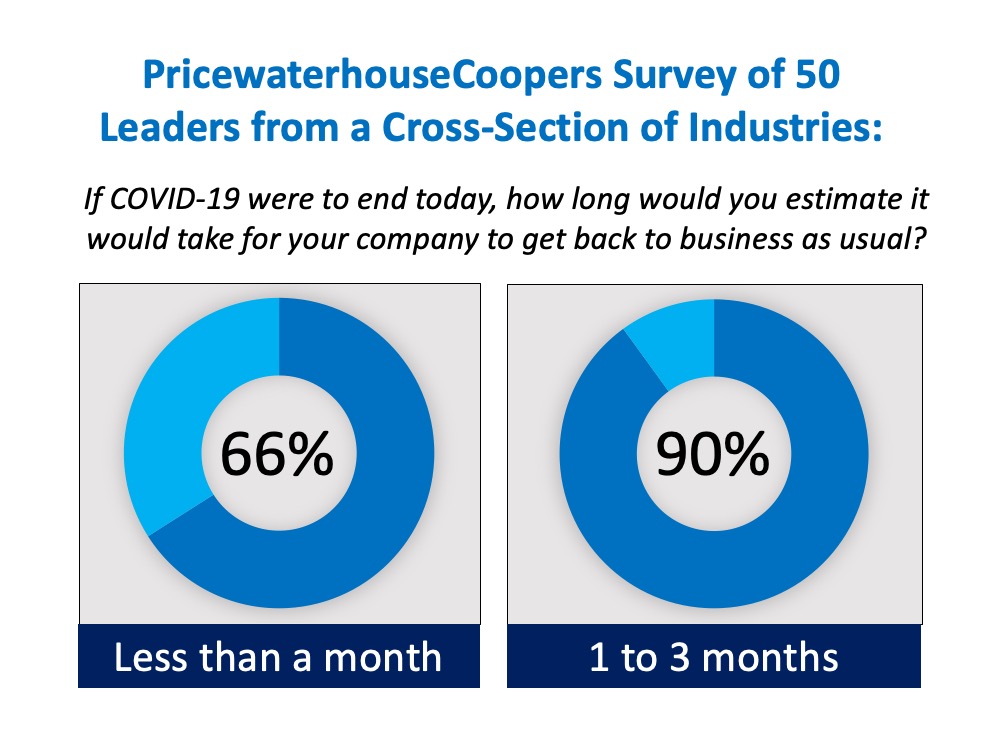

Some Highlights

- Expert insights are painting a bright future for housing when the economy bounces back – and it will.

- We may be facing challenging economic times today, but the housing market is poised to help the economy recover, not drag it down.

- Let’s connect to make sure you’re informed and ready when it’s time to make your move.

Don’t Let Frightening Headlines Scare You

There’s a lot of anxiety right now regarding the coronavirus pandemic. The health situation must be addressed quickly, and many are concerned about the impact on the economy as well.

Amidst all this anxiety, anyone with a megaphone – from the mainstream media to a lone blogger – has realized that bad news sells. Unfortunately, we will continue to see a rash of horrifying headlines over the next few months. Let’s make sure we aren’t paralyzed by a headline before we get the full story.

When it comes to the health issue, you should look to the Centers for Disease Control and Prevention (CDC) or the World Health Organization (WHO) for the most reliable information.

Finding reliable resources with information on the economic impact of the virus is more difficult. For this reason, it’s important to shed some light on the situation. There are already alarmist headlines starting to appear. Here are two such examples surfacing this week.

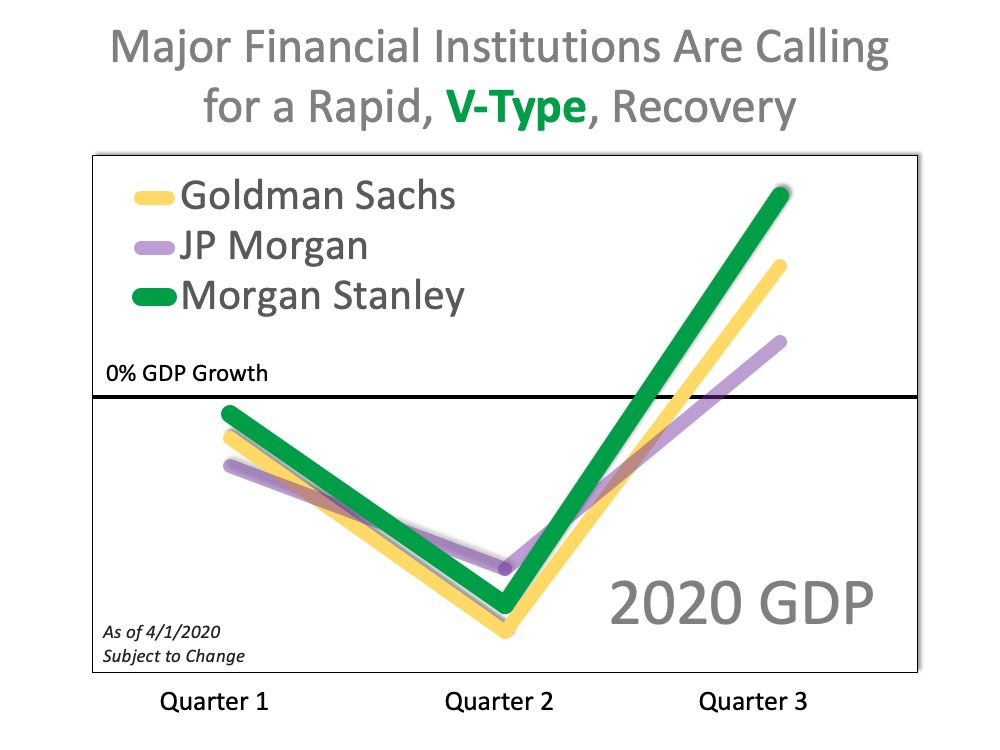

1. Goldman Sachs Forecasts the Largest Drop in GDP in Almost 100 Years

It sounds like Armageddon. Though the headline is true, it doesn’t reflect the full essence of the Goldman Sachs forecast. The projection is actually that we’ll have a tough first half of the year, but the economy will bounce back nicely in the second half; GDP will be up 12% in the third quarter and up another 10% in the fourth.

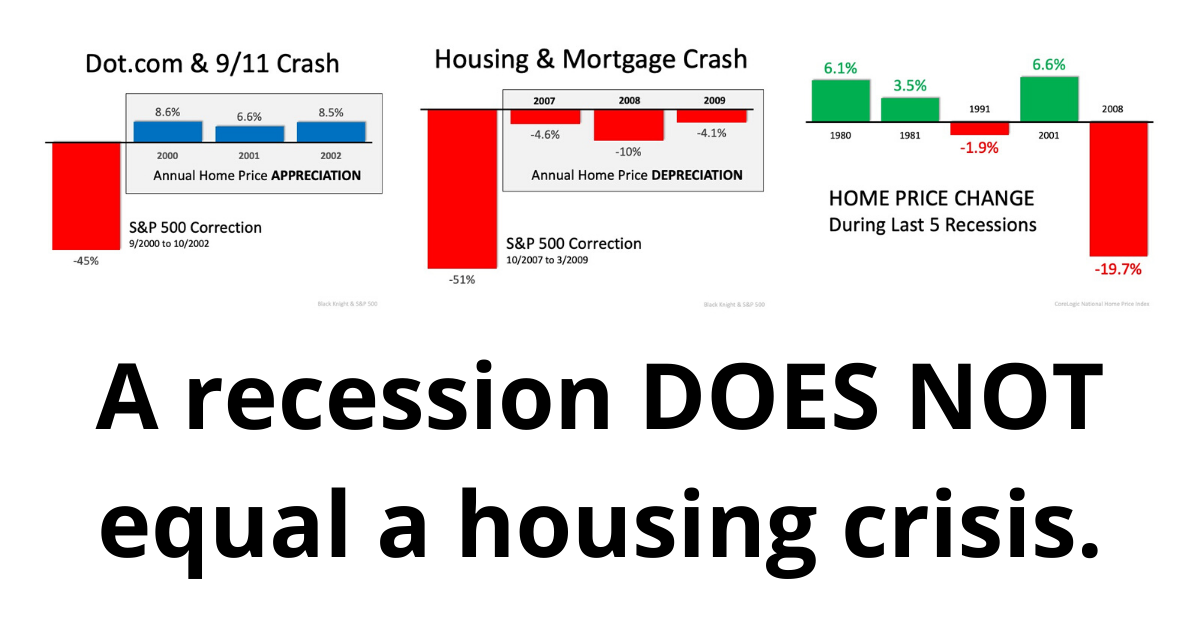

This aligns with research from John Burns Consulting involving pandemics, the economy, and home values. They concluded:

“Historical analysis showed us that pandemics are usually V-shaped (sharp recessions that recover quickly enough to provide little damage to home prices), and some very cutting-edge search engine analysis by our Information Management team showed the current slowdown is playing out similarly thus far.”

The economy will suffer for the next few months, but then it will recover. That’s certainly not Armageddon.

2. Fed President Predicts 30% Unemployment!

That statement was made by James Bullard, President of the Federal Reserve Bank of St. Louis. What Bullard actually said was it “could” reach 30%. But let’s look at what else he said in the same Bloomberg News interview:

“This is a planned, organized partial shutdown of the U.S. economy in the second quarter,” Bullard said. “The overall goal is to keep everyone, households and businesses, whole” with government support.

According to Bloomberg, he also went on to say:

“I would see the third quarter as a transitional quarter” with the fourth quarter and first quarter next year as “quite robust” as Americans make up for lost spending. “Those quarters might be boom quarters,” he said.

Again, Bullard agrees we will have a tough first half and rebound quickly.

Bottom Line

There’s a lot of misinformation out there. If you want the best advice on what’s happening in the current housing market, let’s talk today.

Is Now a Good Time to Refinance My Home?

With interest rates hitting all-time lows over the past few weeks, many homeowners are opting to refinance. To decide if refinancing your home is the best option for you and your family, start by asking yourself these questions:

Why do you want to refinance?

There are many reasons to refinance, but here are three of the most common ones:

1. Lower Your Interest Rate and Payment: This is the most popular reason. Is your current interest rate higher than what’s available today? If so, it might be worth seeing if you can take advantage of the current lower rates.

2. Shorten the Term of Your Loan: If you have a 30-year loan, it may be advantageous to change it to a 15 or 20-year loan to pay off your mortgage sooner rather than later.

3. Cash-Out Refinance: You might have enough equity to cash out and invest in something else, like your children’s education, a business venture, an investment property, or simply to increase your cash reserve.

Once you know why you might want to refinance, ask yourself the next question:

How much is it going to cost?

There are fees and closing costs involved in refinancing, and The Lenders Network explains:

“As an example, let’s say your mortgage has a balance of $200,000. If you were to refinance that loan into a new loan, total closing costs would run between 2%-4% of the loan amount. You can expect to pay between $4,000 to $8,000 to refinance this loan.”

They also explain that there are options for no-cost refinance loans, but be on the lookout:

“A no-cost refinance loan is when the lender pays the closing costs for the borrower. However, you should be aware that the lender makes up this money from other aspects of the mortgage. Usually charging a slightly higher interest rate so they can make the money back.”

Keep in mind that, given the current market conditions and how favorable they are for refinancing, it can take a little longer to execute the process today. This is because many other homeowners are going this route as well. As Todd Teta, Chief Officer at ATTOM Data Solutions notes about recent mortgage activity:

“Refinancing largely drove the trend, with more than twice as many homeowners trading in higher-interest mortgages for cheaper ones than in the same period of 2018.”

Clearly, refinancing has been on the rise lately. If you’re comfortable with the up-front cost and a potential waiting period due to the high volume of requests, then ask yourself one more question:

Is it worth it?

To answer this one, do the math. Will it help you save money? How much longer do you need to own your home to break even? Will your current home meet your needs down the road? If you plan to stay for a few years, then maybe refinancing is your best move.

If, however, your current home doesn’t fulfill your needs for the next few years, you might want to consider using your equity for a down payment on a new home instead. You’ll still get a lower interest rate than the one you have on your current house, and with the equity you’ve already built, you can finally purchase the home you’ve been waiting for.

Bottom Line

Today, more than ever, it’s important to start working with a trusted real estate advisor. Whether you connect by phone or video chat, a real estate professional can help you understand how to safely navigate the housing market so that you can prioritize the health of your family without having to bring your plans to a standstill. Whether you’re looking to refinance, buy, or sell, a trusted advisor knows the best protocol as well as the optimal resources and lenders to help you through the process in this fast-paced world that’s changing every day.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

![Buying a Home: Do You Know the Lingo? [INFOGRAPHIC] | MyKCM](https://desireestanley.com/files/2020/03/20200313-MEM-EN-1046x1308.jpg)

![Buying a Home: Do You Know the Lingo? [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/03/09122748/20200313-MEM-EN-1046x1308.jpg)