Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

Looking to the Future: What the Experts Are Saying

As our lives, our businesses, and the world we live in change day by day, we’re all left wondering how long this will last. How long will we feel the effects of the coronavirus? How deep will the impact go? The human toll may forever change families, but the economic impact will rebound with a cycle of downturn followed by economic expansion like we’ve seen play out in the U.S. economy many times over.

Here’s a look at what leading experts and current research indicate about the economic impact we’ll likely see as a result of the coronavirus. It starts with a forecast of U.S. Gross Domestic Product (GDP).

According to Investopedia:

“Gross Domestic Product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period. As a broad measure of overall domestic production, it functions as a comprehensive scorecard of the country’s economic health.”

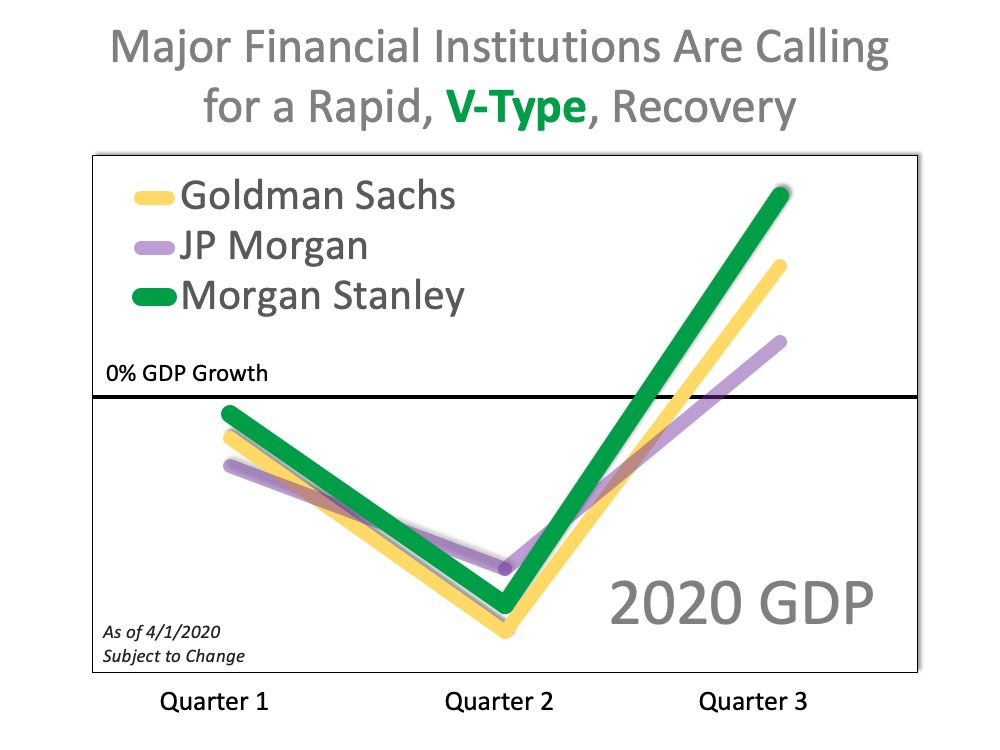

When looking at GDP (the measure of our country’s economic health), a survey of three leading financial institutions shows a projected sharp decline followed by a steep rebound in the second half of this year: A recent study from John Burns Consulting also notes that past pandemics have also created V-Shaped Economic Recoveries like the ones noted above, and they had minimal impact on housing prices. This certainly gives hope and optimism for what is to come as the crisis passes.

A recent study from John Burns Consulting also notes that past pandemics have also created V-Shaped Economic Recoveries like the ones noted above, and they had minimal impact on housing prices. This certainly gives hope and optimism for what is to come as the crisis passes.

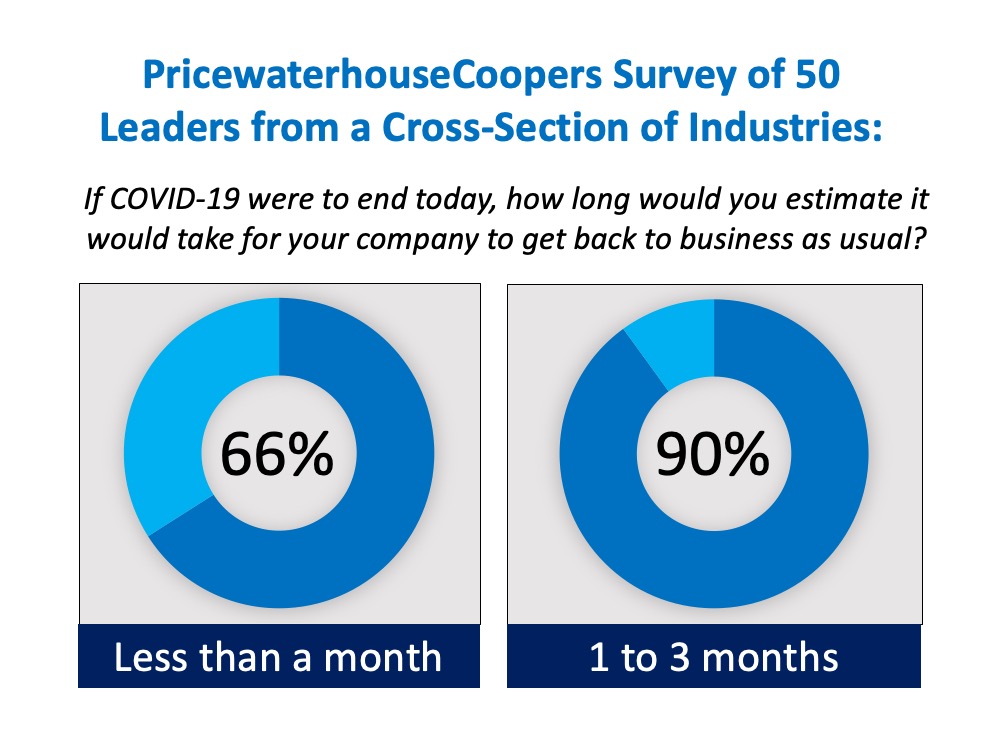

With this historical analysis in mind, many business owners are also optimistic for a bright economic return. A recent PricewaterhouseCoopers survey shows this confidence, noting 66% of surveyed business owners feel their companies will return to normal business rhythms within a month of the pandemic passing, and 90% feel they should be back to normal operation 1 to 3 months after: From expert financial institutions to business leaders across the country, we can clearly see that the anticipation of a quick return to normal once the current crisis subsides is not too far away. In essence, this won’t last forever, and we will get back to growth-mode. We’ve got this.

From expert financial institutions to business leaders across the country, we can clearly see that the anticipation of a quick return to normal once the current crisis subsides is not too far away. In essence, this won’t last forever, and we will get back to growth-mode. We’ve got this.

Bottom Line

Lives and businesses are being impacted by the coronavirus, but experts do see a light at the end of the tunnel. As the economy slows down due to the health crisis, we can take guidance and advice from experts that this too will pass.

The #1 Thing You Can Do Now to Position Yourself to Buy a Home This Year

The last few weeks and months have caused a major health crisis throughout the world, leading to a pause in the U.S. economy as businesses and consumers work to slow the spread of the coronavirus. The rapid spread of the virus has been compared to prior pandemics and outbreaks not seen in many years. It also has consumers remembering the economic slowdown of 2008 that was caused by a housing crash. This economic slowdown, however, is very different from 2008.

One thing the experts are saying is that while we’ll see a swift decline in economic activity in the second quarter, we’ll begin a sharp rebound in the second half of this year. According to John Burns Consulting:

“Historical analysis showed us that pandemics are usually V-shaped (sharp recessions that recover quickly enough to provide little damage to home prices), and some very cutting-edge search engine analysis by our Information Management team showed the current slowdown is playing out similarly thus far.”

Given this situation, if you’re thinking about buying a home this year, the best thing you can do right now is use this time to get pre-approved for a mortgage, which you can do from the comfort of your home. Pre-approval will help you better understand how much you can afford so that you can confidently do the following two things when you’re ready to buy:

1. Gain a Competitive Advantage

Today’s low inventory, like we’ve seen recently and will continue to see, means homebuyers need every advantage they can get to make a strong offer and close the deal. Being pre-approved shows the sellers you’re serious about buying a home, which is always a plus in your corner.

2. Accelerate the Homebuying Process

Pre-approval can also speed-up the homebuying process so you can move faster when you’re ready to make an offer. Being ready to put your best foot forward when the time comes may be the leg-up you need to cross the finish line first and land the home of your dreams.

Bottom Line

Pre-approval is the best thing you can do right now to be in a stronger position to buy a home when you’re ready. Let’s connect today to get the process started.

The Best Advice Does Not Mean Perfect Advice

The angst caused by the coronavirus has most people on edge regarding both their health and financial situations. It’s at times like these when we want exact information about anything we’re doing – even the correct protocol for grocery shopping. That information brings knowledge, and this gives us a sense of relief and comfort.

If you’re thinking about buying or selling a home today, the same need for information is very real. But, because it’s such a big step in our lives, that desire for clear information is even greater in the home buying or selling process. Given the current level of overall anxiety, we want that advice to be truly perfect. The challenge is, no one can give you “perfect” advice. Experts can, however, give you the best advice possible.

Let’s say you need an attorney, so you seek out an expert in the type of law required for your case. When you go to her office, she won’t immediately tell you how the case is going to end or how the judge or jury will rule. If she could, that would be perfect advice. What a good attorney can do, however, is to discuss with you the most effective strategies you can take. She may recommend one or two approaches she believes will be best for your case.

She’ll then leave you to make the decision on which option you want to pursue. Once you decide, she can help you put a plan together based on the facts at hand. She’ll help you achieve the best possible resolution and make whatever modifications in the strategy are necessary to guarantee that outcome. That’s an example of the best advice possible.

The role of a real estate professional is just like the role of the lawyer. An agent can’t give you perfect advice because it’s impossible to know exactly what’s going to happen throughout the transaction – especially in this market.

An agent can, however, give you the best advice possible based on the information and situation at hand, guiding you through the process to help you make the necessary adjustments and best decisions along the way. An agent will get you the best offer available. That’s exactly what you want and deserve.

Bottom Line

If you’re thinking of buying or selling, contact a local real estate professional to make sure you get the best advice possible.

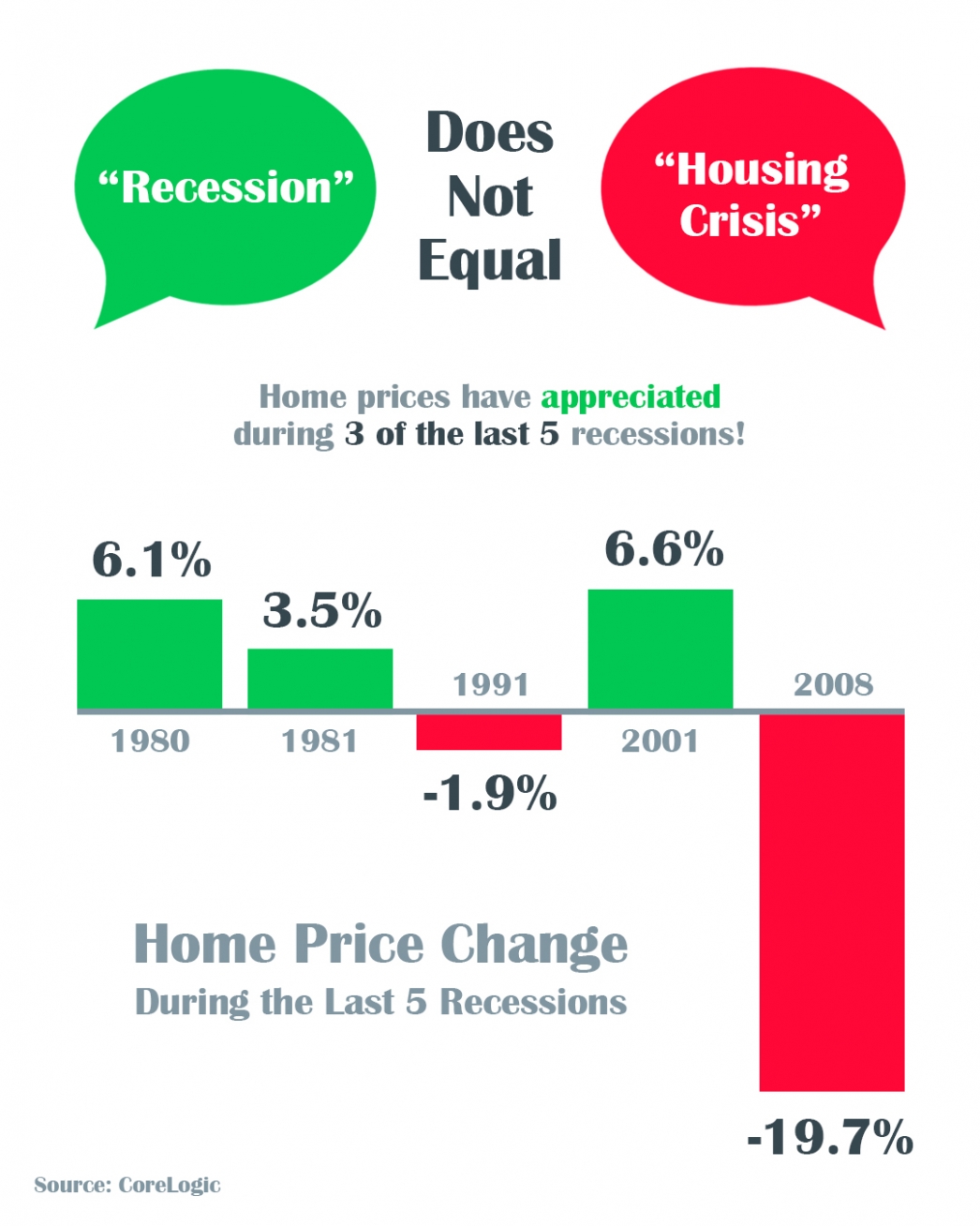

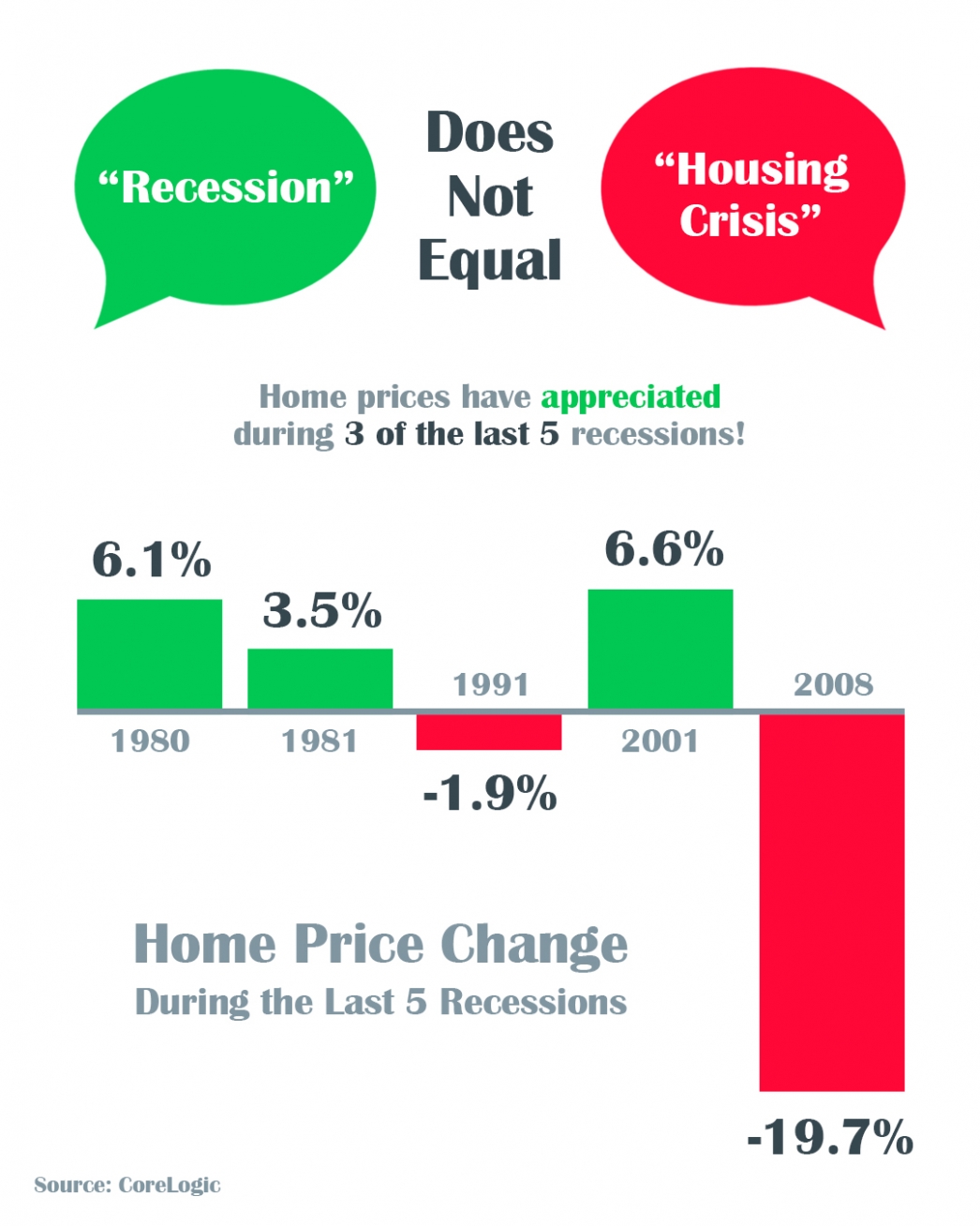

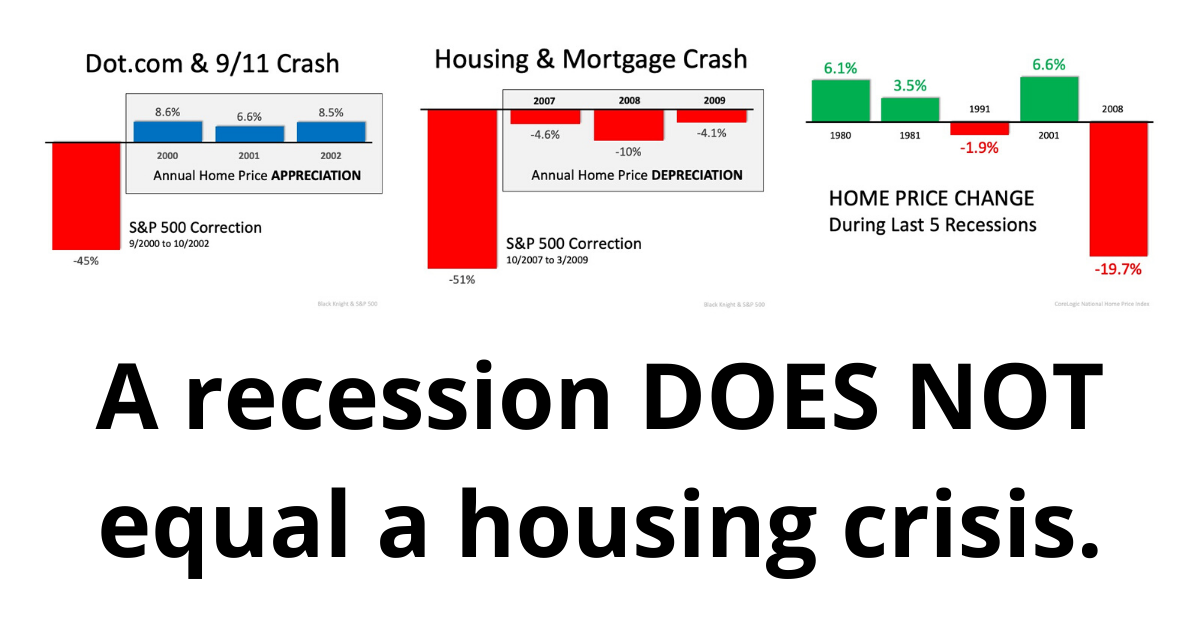

A Recession Does Not Equal a Housing Crisis [INFOGRAPHIC]

Some Highlights

- The COVID-19 pandemic is causing an economic slowdown.

- The good news is, home values actually increased in 3 of the last 5 U.S. recessions and decreased by less than 2% in the 4th.

- All things considered, an economic slowdown does not equal a housing crisis, and this will not be a repeat of 2008.

Should I wait???

With everything that is happening in the US and around the world related to COVID-19, many people are wondering, “Should I wait?”… should I wait to sell my home, should I wait to buy a home? There are still many people listing homes for sale and buyers still looking for those homes. Yes, we’ve had to stop all home tours but we’re creative people and there are great resources out there to help like 3D video tours, photos, FaceTime, Zoom meetings, Docusign, eRecording for the county and all sorts of workarounds.

A recession does not equal a housing crisis or “crash” as we saw in 2008.

9/11 has a lot in common with what is happening today. People are avoiding crowds and the same part of the economy is under pressure, restaurants, airlines, hotels, bars, and so on.

If you take a look at the related graph, you see that during the DOT com scare and after the 9/11 terrorism attacks, the stock market showed volatility like we’re seeing today. However, the housing market wasn’t affected, and home prices actually appreciated.

A great analogy was presented to me, 2008 was like a tornado that ripped through and shredded everything and we had to rebuild. All the systems we counted on in banking, mortgage, lending were demolished and it effected everyone. The COVID-19 is more like a giant snowstorm that has hit and we’re all stuck inside. But eventually, it will clear and we will be able to get back out to go about our regular lives… to work, to travel, to our favorite restaurant or bar, movies or theater, and our kids will go back to school. While we may not know what the future holds if you are pausing on buying OR selling a home because you think a recession will cause another housing crisis… they’re not the same thing, and you could be missing out on today’s record-low mortgage rates. Which are still HISTORICALLY low.

Are you thinking about selling your home to move into the right size home for your family? Or ready to downsize to fit your current needs? Do you have questions about selling your home in this market? Give me a call today at 408-465-9290 or DM me to go over your real estate goals.

Two Big Myths in the Home buying Process

The 2020 Millennial Home Buyer Report shows how this generation is not really any different from previous ones when it comes to homeownership goals:

“The majority of millennials not only want to own a home, but 84% of millennials in 2019 considered it a major part of the American Dream.”

Unfortunately, the myths surrounding the barriers to homeownership – especially those related to down payments and FICO® scores – might be keeping many buyers out of the arena. The piece also reveals:

“Millennials have to navigate a lot of obstacles to be able to own a home. According to our 2020 survey, saving for a down payment is the biggest barrier for 50% of millennials.”

Millennial or not, unpacking two of the biggest myths that may be standing in the way of homeownership among all generations is a great place to start the debunking process.

Myth #1: “I Need a 20% Down Payment”

Many buyers often overestimate what they need to qualify for a home loan. According to the same article:

“A down payment of 20% for a home of that price [$210,000] would be about $42,000; only about 30% of the millennials in our survey have enough in savings to cover that, not to mention the additional closing costs.”

While many potential buyers still think they need to put at least 20% down for the home of their dreams, they often don’t realize how many assistance programs are available with as little as 3% down. With a bit of research, many renters may be able to enter the housing market sooner than they ever imagined.

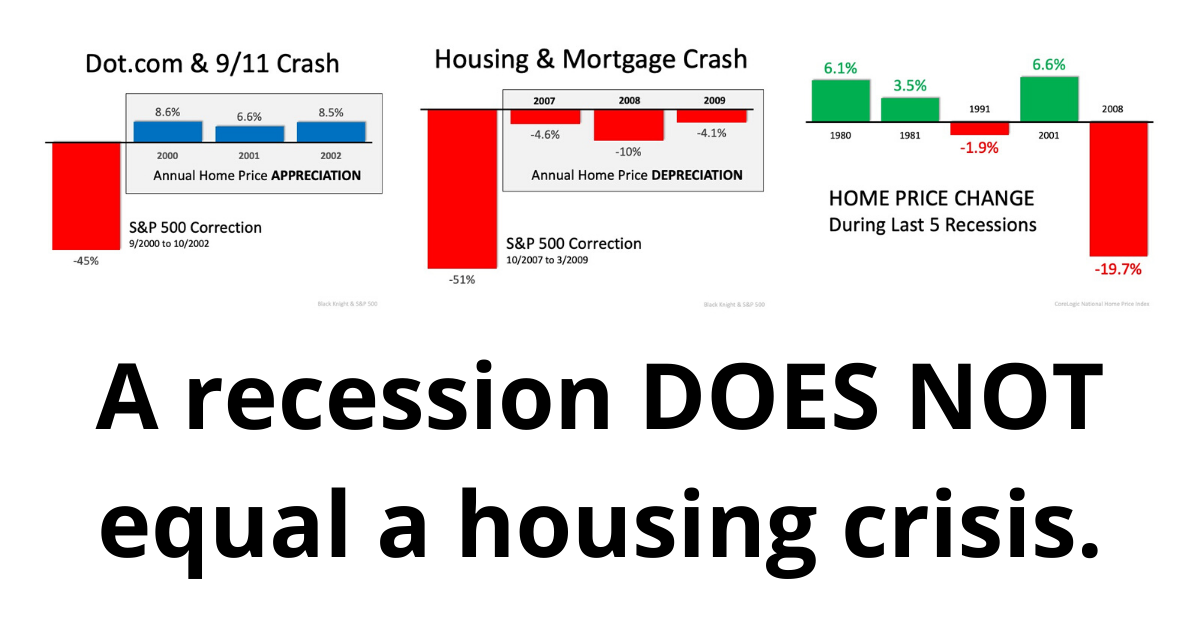

Myth #2: “I Need a 780 FICO® Score or Higher”

In addition to down payments, buyers are also often confused about the FICO® score it takes to qualify for a mortgage, believing they need a credit score of 780 or higher.

Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved) loans, shows the truth is, over 50% of approved loans were granted with a FICO® score below 750 (see graph below): Even today, many of the myths of the home buying process are unfortunately keeping plenty of motivated buyers on the sidelines. In reality, it really doesn’t have to be that way.

Even today, many of the myths of the home buying process are unfortunately keeping plenty of motivated buyers on the sidelines. In reality, it really doesn’t have to be that way.

Bottom Line

If you’re thinking of buying a home, you may have more options than you think. Let’s connect to answer your questions and help you determine your next steps.

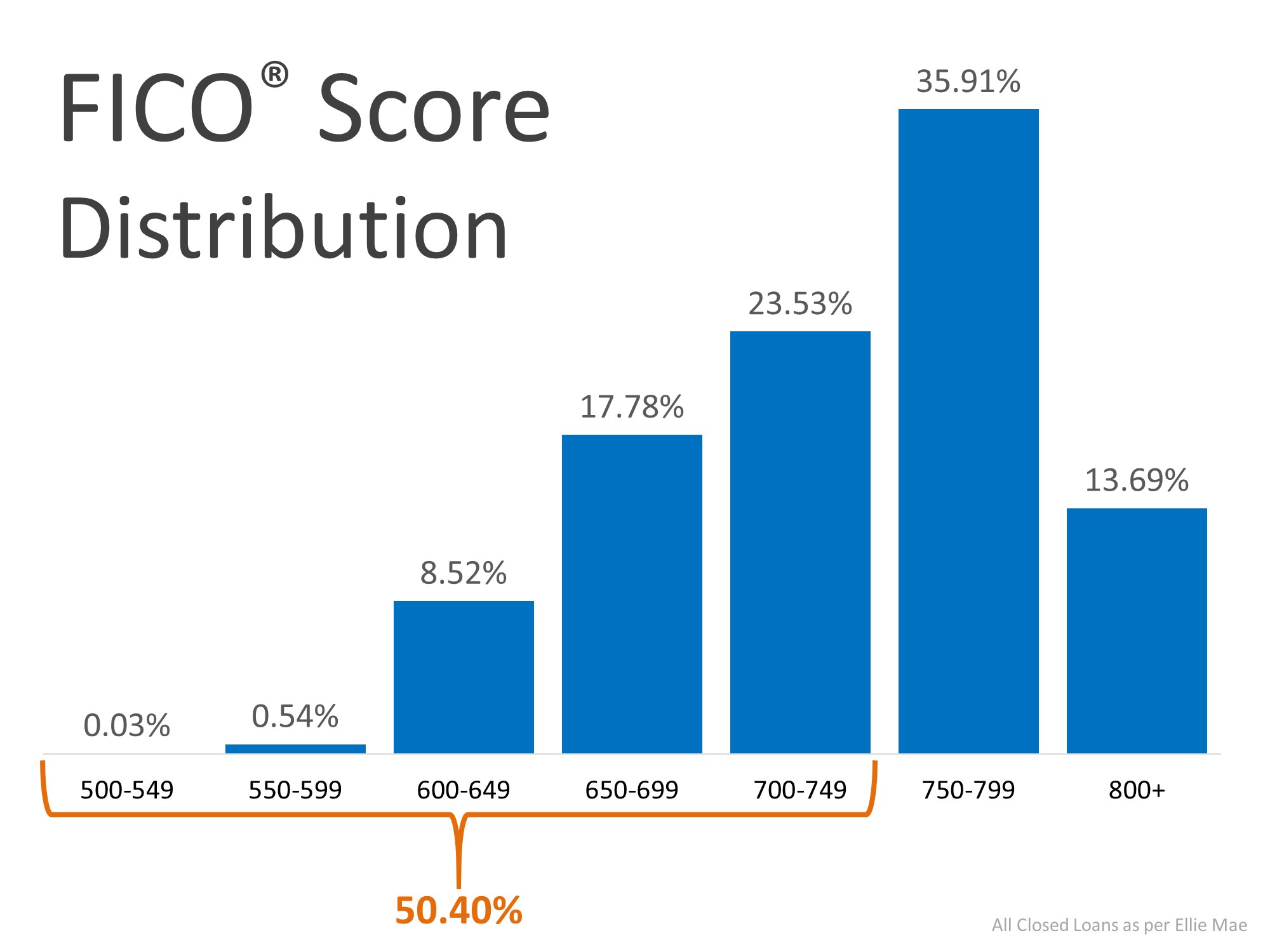

Real Estate Is Soaring, But Not Like 2008

Unlike last year, the residential real estate market kicked off 2020 with a bang! In their latest Monthly Mortgage Monitor, Black Knight proclaimed:

“The housing market is heating entering 2020 and recent rate declines could continue that trend, a sharp contrast to the strong cooling that was seen at this same time last year.”

Zillow revealed they’re also seeing a robust beginning to the year. Jeff Tucker, Zillow Economist, said:

“Our first look at 2020 data suggests that we could see the most competitive home shopping season in years, as buyers are already competing over…homes for sale.”

Buying demand is very strong. The latest Showing Index from ShowingTime reported a 20.2% year-over-year increase in purchaser traffic across the country, the sixth consecutive month of nationwide growth, and the largest increase in the history of the index.

The even better news is that buyers are not just looking. The latest Existing Home Sales Report from the National Association of Realtors (NAR) showed that closed sales increased 9.6% from a year ago.

This increase in overall activity has caused Zelman & Associates to increase their projection for home price appreciation in 2020 from 3.7% to 4.7%.

Are we headed for another housing crash like we had last decade?

Whenever price appreciation begins to accelerate, the fear of the last housing boom and bust creeps into the minds of the American population. The pain felt during the last housing crash scarred us deeply, and understandably so. The crash led us into the Great Recession of 2008.

If we take a closer look, however, we can see the current situation is nothing like it was in the last decade. As an example, let’s look at price appreciation for the six years prior to the last boom (2006) and compare it to the last six years: There’s a stark difference between these two periods of time. Normal appreciation is 3.6%, so while current appreciation is higher than the historic norm, it’s certainly not accelerating beyond control as it did leading up to the housing crash.

There’s a stark difference between these two periods of time. Normal appreciation is 3.6%, so while current appreciation is higher than the historic norm, it’s certainly not accelerating beyond control as it did leading up to the housing crash.

Today, the strength of the housing market is actually helping prevent a setback in the overall economy. In a recent post, Odeta Kushi, Deputy Chief Economist for First American explained:

“While the housing crisis is still fresh on the minds of many, and was the catalyst of the Great Recession, the U.S. housing market has weathered all other recessions since 1980. With the exception of the Great Recession, house price appreciation hardly skipped a beat and year-over-year existing-home sales growth barely declined in all the other previous recessions in the last 40 years…In 2020, we argue the housing market is more likely poised to help stave off recession than fall victim to it.”

Bottom Line

The year has started off very nicely for the residential housing market. If you’re thinking of buying or selling, now may be the time to get together to discuss your options.

10 Steps to Buying a Home [INFOGRAPHIC]

![10 Steps to Buying a Home [INFOGRAPHIC] | MyKCM](https://desireestanley.com/files/2020/03/20200228-MEM-EN-1046x837.jpg)

![10 Steps to Buying a Home [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/02/25113646/20200228-MEM-EN-1046x837.jpg)

Some Highlights:

- If you’re thinking of buying a home and you’re not sure where to start, you’re not alone.

- Here’s a guide with 10 simple steps to follow in the homebuying process.

- Be sure to work with a trusted real estate professional to find out the specifics of what to do in your local area.

The #1 Reason to List Your House Right Now

The success of the U.S. residential real estate market, like any other market, is determined by supply and demand. This means we need to look at how many potential purchasers are in the market versus the number of houses that are available to buy. With early 2020 housing data now rolling in, it’s quite evident there are two big stories impacting this year’s residential real estate market:

1. Buyer demand is already extremely strong

2. Housing supply is at a historically low level

Demand

ShowingTime is a firm that compiles data from property showings scheduled across the country. The latest ShowingTime Showing Index reveals how showings have increased in each of the country’s four regions for five months in a row.

Supply

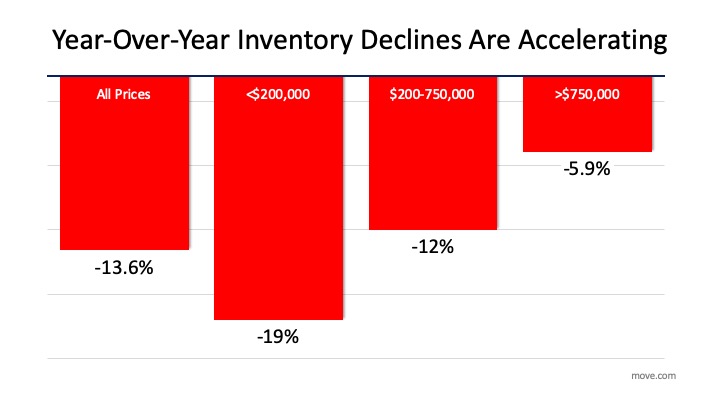

Move.com also just released information indicating that the number of homes currently for sale has declined rapidly and now sits at the lowest level in almost a decade. They explained,

“National housing inventory declined 13.6 percent in January, the steepest year-over-year decrease in more than 4 years, pushing the supply of for sale homes in the U.S. to its lowest level since realtor.com began tracking the data in 2012.”

In response to these numbers, Danielle Hale, Chief Economist at realtor.com, said,

“Homebuyers took advantage of low mortgage rates and stable listing prices to drive sales higher at the end of 2019, further depleting the already limited inventory of homes for sale. With fewer homes coming up for sale, we’ve hit another new low of for sale-listings in January.”

The decrease in inventory impacted every price range, too. Here’s a graph showing the data released by move.com:

Bottom Line

Since there’s a historic shortage of homes for sale, putting your home on the market today could drive an excellent price and give you additional negotiating leverage when selling your house. Let’s get together to determine if listing your house now is your best move.

How the Housing Market Benefits with Uncertainty in the World

It’s hard to listen to today’s news without hearing about the uncertainty surrounding global markets, the spread of the coronavirus, and tensions in the Middle East, just to name a few. These concerns have caused some to question their investment plans going forward. As an example, in Vanguard’s Global Outlook for 2020, the fund explains,

“Slowing global growth and elevated uncertainty create a fragile backdrop for markets in 2020 and beyond.”

Is there a silver lining to this cloud of doubt?

Some worry this could cause concern for the U.S. housing market. The uncertainty, however, may actually mean good news for real estate.

Mark Fleming, Chief Economist at First American, discussed the situation in a recent report,

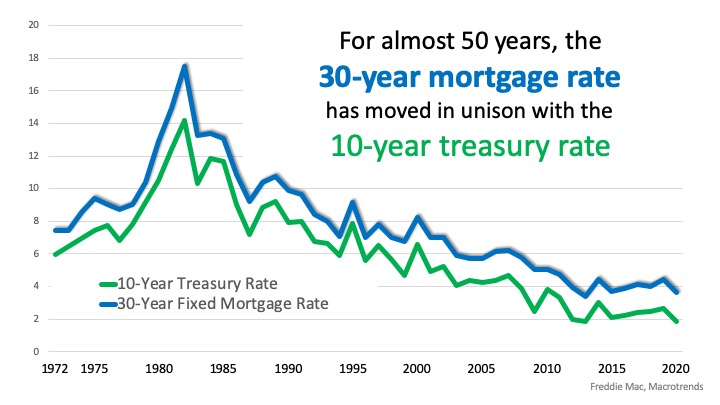

“Global events and uncertainty…impact the U.S. economy, and more specifically, the U.S. housing market…U.S. bonds, backed by the full faith and credit of the U.S. government, are widely considered the safest investments in the world. When global investors sense increased uncertainty, there is a ‘flight to safety’ in U.S. Treasury bonds, which causes their price to go up, and their yield to go down.”

Last week, in a HousingWire article, Kathleen Howley reaffirmed Fleming’s point,

“The death toll from the coronavirus already has passed Severe Acute Respiratory Syndrome, or SARS, that bruised the world’s economy in 2003…That’s making investors around the world anxious, and when they get anxious, they tend to sell off stocks and seek the safe haven of U.S. bonds. An increase in competition for bonds means investors, including the people who buy mortgage-backed bonds, have to take lower yields. That translates into lower mortgage rates.”

The yield from treasury bonds is the rate investors receive when they purchase the bond. Historically, when the treasury rate moves up or down, the 30-year mortgage rate follows. Here’s a powerful graph showing the relationship between the two over the last 48 years: How might concerns about global challenges impact the housing market in 2020? Fleming explains,

How might concerns about global challenges impact the housing market in 2020? Fleming explains,

“Even a small change in the 10-year Treasury due to increased uncertainty, let’s say a slight drop to 1.6 percent, would imply a 30-year, fixed mortgage rate as low as 3.3 percent. Assuming no change in household income, that would mean a house-buying power gain of $21,000, a five percent increase.”

Bottom Line

For a multitude of reasons, 2020 could be a challenging year. It seems, however, real estate will do just fine. As Fleming concluded in his report:

“Amid uncertainty, the house-buying power of U.S. consumers can benefit significantly.”

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link