Is Now a Good Time to Refinance My Home?

With interest rates hitting all-time lows over the past few weeks, many homeowners are opting to refinance. To decide if refinancing your home is the best option for you and your family, start by asking yourself these questions:

Why do you want to refinance?

There are many reasons to refinance, but here are three of the most common ones:

1. Lower Your Interest Rate and Payment: This is the most popular reason. Is your current interest rate higher than what’s available today? If so, it might be worth seeing if you can take advantage of the current lower rates.

2. Shorten the Term of Your Loan: If you have a 30-year loan, it may be advantageous to change it to a 15 or 20-year loan to pay off your mortgage sooner rather than later.

3. Cash-Out Refinance: You might have enough equity to cash out and invest in something else, like your children’s education, a business venture, an investment property, or simply to increase your cash reserve.

Once you know why you might want to refinance, ask yourself the next question:

How much is it going to cost?

There are fees and closing costs involved in refinancing, and The Lenders Network explains:

“As an example, let’s say your mortgage has a balance of $200,000. If you were to refinance that loan into a new loan, total closing costs would run between 2%-4% of the loan amount. You can expect to pay between $4,000 to $8,000 to refinance this loan.”

They also explain that there are options for no-cost refinance loans, but be on the lookout:

“A no-cost refinance loan is when the lender pays the closing costs for the borrower. However, you should be aware that the lender makes up this money from other aspects of the mortgage. Usually charging a slightly higher interest rate so they can make the money back.”

Keep in mind that, given the current market conditions and how favorable they are for refinancing, it can take a little longer to execute the process today. This is because many other homeowners are going this route as well. As Todd Teta, Chief Officer at ATTOM Data Solutions notes about recent mortgage activity:

“Refinancing largely drove the trend, with more than twice as many homeowners trading in higher-interest mortgages for cheaper ones than in the same period of 2018.”

Clearly, refinancing has been on the rise lately. If you’re comfortable with the up-front cost and a potential waiting period due to the high volume of requests, then ask yourself one more question:

Is it worth it?

To answer this one, do the math. Will it help you save money? How much longer do you need to own your home to break even? Will your current home meet your needs down the road? If you plan to stay for a few years, then maybe refinancing is your best move.

If, however, your current home doesn’t fulfill your needs for the next few years, you might want to consider using your equity for a down payment on a new home instead. You’ll still get a lower interest rate than the one you have on your current house, and with the equity you’ve already built, you can finally purchase the home you’ve been waiting for.

Bottom Line

Today, more than ever, it’s important to start working with a trusted real estate advisor. Whether you connect by phone or video chat, a real estate professional can help you understand how to safely navigate the housing market so that you can prioritize the health of your family without having to bring your plans to a standstill. Whether you’re looking to refinance, buy, or sell, a trusted advisor knows the best protocol as well as the optimal resources and lenders to help you through the process in this fast-paced world that’s changing every day.

The #1 Reason to List Your House Right Now

The success of the U.S. residential real estate market, like any other market, is determined by supply and demand. This means we need to look at how many potential purchasers are in the market versus the number of houses that are available to buy. With early 2020 housing data now rolling in, it’s quite evident there are two big stories impacting this year’s residential real estate market:

1. Buyer demand is already extremely strong

2. Housing supply is at a historically low level

Demand

ShowingTime is a firm that compiles data from property showings scheduled across the country. The latest ShowingTime Showing Index reveals how showings have increased in each of the country’s four regions for five months in a row.

Supply

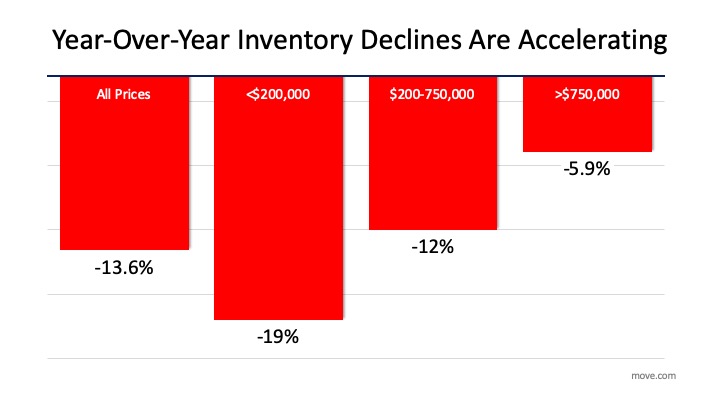

Move.com also just released information indicating that the number of homes currently for sale has declined rapidly and now sits at the lowest level in almost a decade. They explained,

“National housing inventory declined 13.6 percent in January, the steepest year-over-year decrease in more than 4 years, pushing the supply of for sale homes in the U.S. to its lowest level since realtor.com began tracking the data in 2012.”

In response to these numbers, Danielle Hale, Chief Economist at realtor.com, said,

“Homebuyers took advantage of low mortgage rates and stable listing prices to drive sales higher at the end of 2019, further depleting the already limited inventory of homes for sale. With fewer homes coming up for sale, we’ve hit another new low of for sale-listings in January.”

The decrease in inventory impacted every price range, too. Here’s a graph showing the data released by move.com:

Bottom Line

Since there’s a historic shortage of homes for sale, putting your home on the market today could drive an excellent price and give you additional negotiating leverage when selling your house. Let’s get together to determine if listing your house now is your best move.

Interest Rates Over Time [INFOGRAPHIC]

![Interest Rates Over Time [INFOGRAPHIC] | MyKCM](https://desireestanley.com/files/2020/02/20200221-MEM-1046x837.jpg)

![Interest Rates Over Time [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/02/20093247/20200221-MEM-1046x837.jpg)

Some Highlights:

- With interest rates hovering at near historic lows, now is a great time to look back at where they’ve been, and how much they’ve changed over time.

- According to Freddie Mac, mortgage interest rates are currently hovering near a five-decade low.

- The impact your interest rate has on your monthly mortgage payment is significant. An increase of just $20 dollars in your monthly payment can add up to $240 per year or $7,200 over the life of your loan. Maybe it’s time to lock in now while rates are still low.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

![10 Steps to Buying a Home [INFOGRAPHIC] | MyKCM](https://desireestanley.com/files/2020/03/20200228-MEM-EN-1046x837.jpg)

![10 Steps to Buying a Home [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/02/25113646/20200228-MEM-EN-1046x837.jpg)