Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

Should You Buy a Retirement Home Sooner Rather than Later?

Every day in the U.S., roughly 10,000 people turn 65. Prior to the health crisis that swept the nation in 2020, most people had to wait until they retired to make a move to the beach, the golf course, or the senior living community they were looking to settle into for their later years in life. This year, however, the game changed.

Many of today’s workers who are nearing the end of their professional careers, but maybe aren’t quite ready to retire, have a new choice to make: should I move before I retire? If the sand and sun are calling your name and you have the opportunity to work remotely for the foreseeable future, now may be a great time to purchase that beach bungalow you’ve always dreamed of or the single-story home in the sprawling countryside that might be a little further out of town. Whether it’s a second home or a future retirement home, spending the next few years in a place that truly makes you smile every day might be the best way to round out a long and meaningful career.

Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

“The pandemic was unexpected, working from home was unexpected, but nonetheless many companies realized that workers can be just as productive working from home…We may begin to see a boost in people buying retirement homes before their retirement.”

According to the 20th Annual Transamerica Retirement Survey, 3 out of 4 retirees (75%) own their homes, and only 23% have mortgage debt (including any equity loans or lines of credit). Since entering retirement, almost 4 in 10 retirees (38%) have moved into a new home. They’re making a profit by selling their current homes in today’s low inventory market and using their equity to purchase their future retirement homes. It’s a win-win.

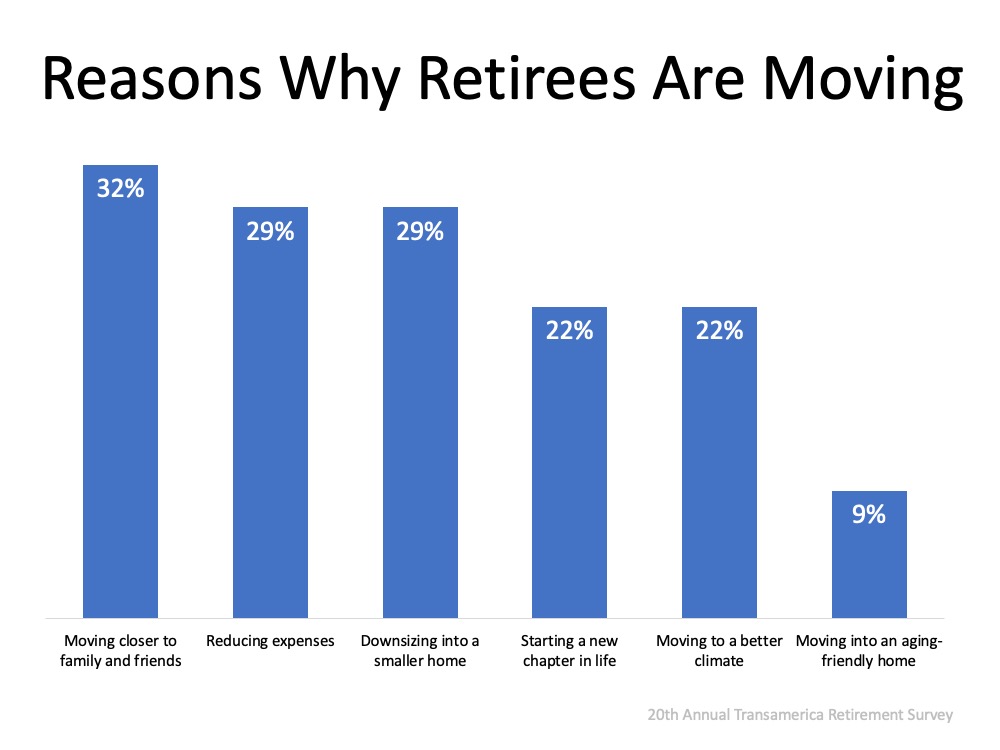

Why These Homeowners Are Making Moves Now

The health crisis this year made us all more aware of the importance of our family and friends, and many of us have not seen our extended families since the pandemic started. It’s no surprise, therefore, to see in the same report that 32% of those surveyed cited the top reason they’re making a move is that they want to be closer to family and friends (See graph below): The survey also revealed that 73% percent of retirees currently live in single-family homes. With the overall number of homes for sale today hitting a historic low, and with the buyer demand for single-family homes skyrocketing, there’s never been a more ideal time to sell a single-family home and make a move toward retirement. Today’s market has the perfect combination of driving forces to make selling optimal, especially while buyers are looking to take advantage of low interest rates.

The survey also revealed that 73% percent of retirees currently live in single-family homes. With the overall number of homes for sale today hitting a historic low, and with the buyer demand for single-family homes skyrocketing, there’s never been a more ideal time to sell a single-family home and make a move toward retirement. Today’s market has the perfect combination of driving forces to make selling optimal, especially while buyers are looking to take advantage of low interest rates.

If you’re one of the 73% of retirees with a single-family home and want to move closer to your family, now is the time to put your house on the market. With the pace homes are selling today, you could essentially wrap up your move – start to finish – before the holidays.

Bottom Line

Whether you’re looking to fully retire or to buy a second home with the intent to use it as your retirement home in the future, the 2020 fall housing market may very well work in your favor. Let’s connect today to discuss your options in our local market.

A Homeowner’s Net Worth Is 40x Greater Than a Renter’s

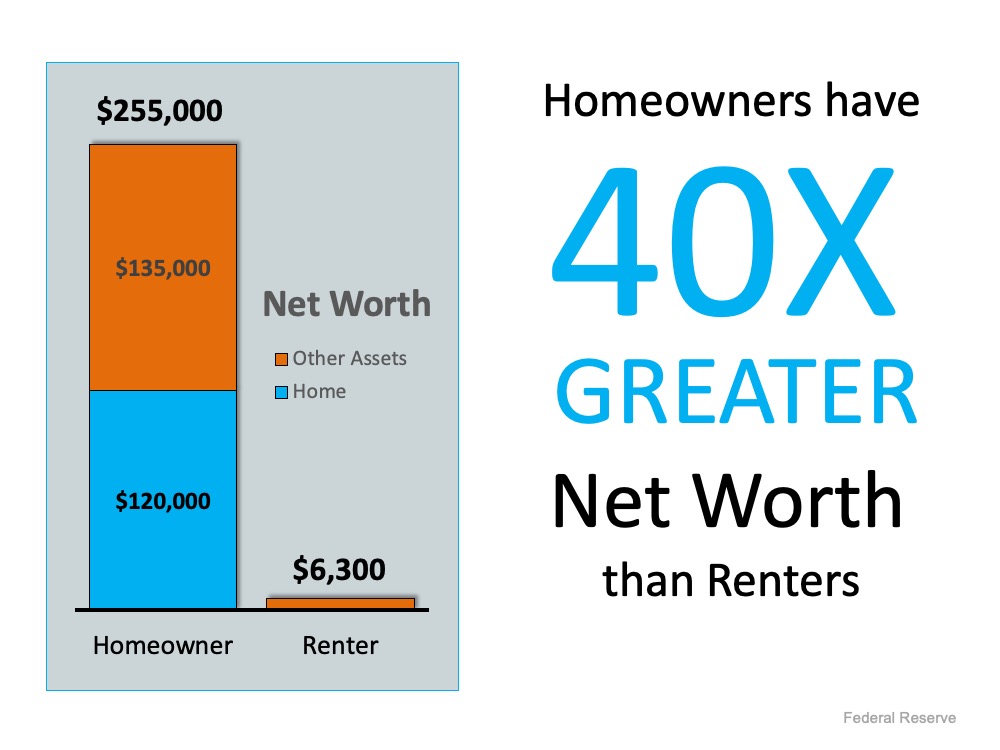

One of the best ways to build your family’s financial future is through homeownership. Recent data from the Federal Reserve indicates the net worth of a homeowner is actually over 40 times greater than that of a renter. Maybe it’s time to start thinking about buying a home, especially when they’re so affordable in today’s market.

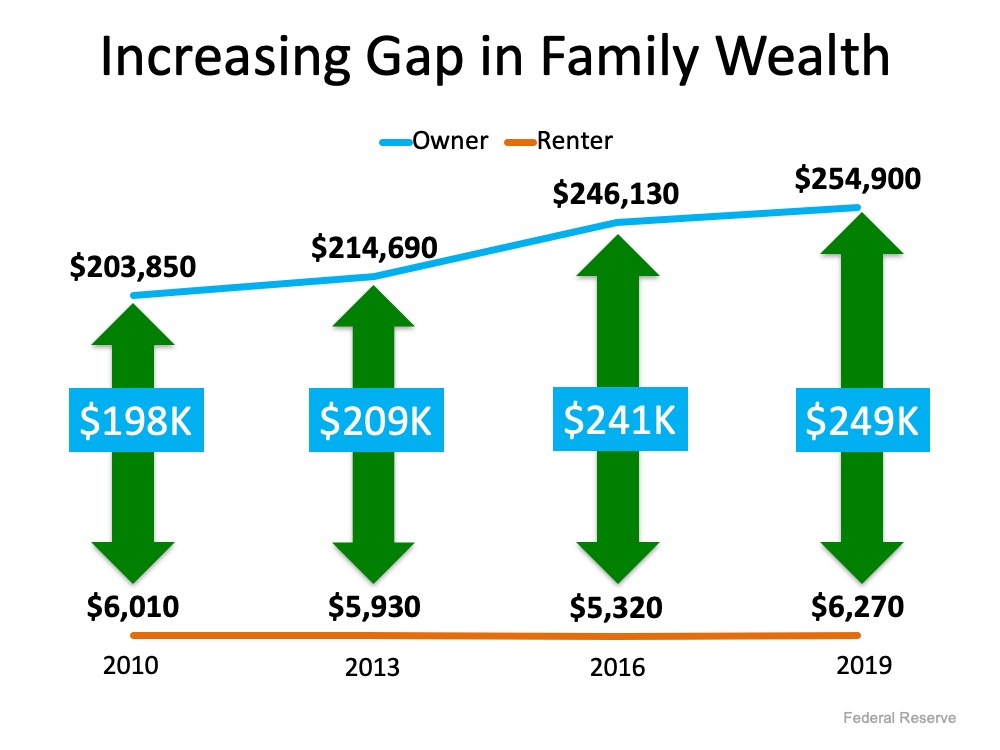

Every three years the Survey of Consumer Finances shows the breakdown of how owning a home helps build financial security. In the graph below, we see that the average net worth of homeowners continues to grow, while the net worth of renters tends to hold fairly steady and be significantly lower than that of homeowners. The gap between owning and renting just keeps getting wider over time, making homeownership more and more desirable for those who are ready.

Owning a home is a great way to build family wealth.

For many families, homeownership serves as a form of ‘forced savings.’ Every time you pay your mortgage, you’re contributing to your net worth by increasing the equity you have in your home (See chart below): The impact of home equity is part of why Gallup reports that Americans picked real estate as the best long-term investment for the seventh year in a row. According to this year’s survey, 35% of Americans chose real estate over stocks, savings accounts, gold, and bonds.

The impact of home equity is part of why Gallup reports that Americans picked real estate as the best long-term investment for the seventh year in a row. According to this year’s survey, 35% of Americans chose real estate over stocks, savings accounts, gold, and bonds.

Today, there are great opportunities available for those planning to buy a home. The housing market has made a full recovery, and all-time low-interest rates are giving homebuyers a big boost in purchasing power. If you’re ready, buying a home this fall can set you up to increase your net worth and create a safety net for your family’s future.

Bottom Line

To learn how you can use your monthly housing cost to build your family’s net worth, let’s connect so you have a trusted professional to guide you through the homebuying process.

Is it Time to Move into a Single-Story Home?

Once the kids have left the nest, you may be wondering what to do with all of the extra space in your home. Chances are, you don’t need four bedrooms anymore, and it may be a great time to sell your house and downsize, maybe even into a single-story home. You’ve likely gained significant equity if you’ve lived in your home for a while, so making a move while demand for your current house is high could be your best step forward toward the retirement goals you set out to achieve several years ago.

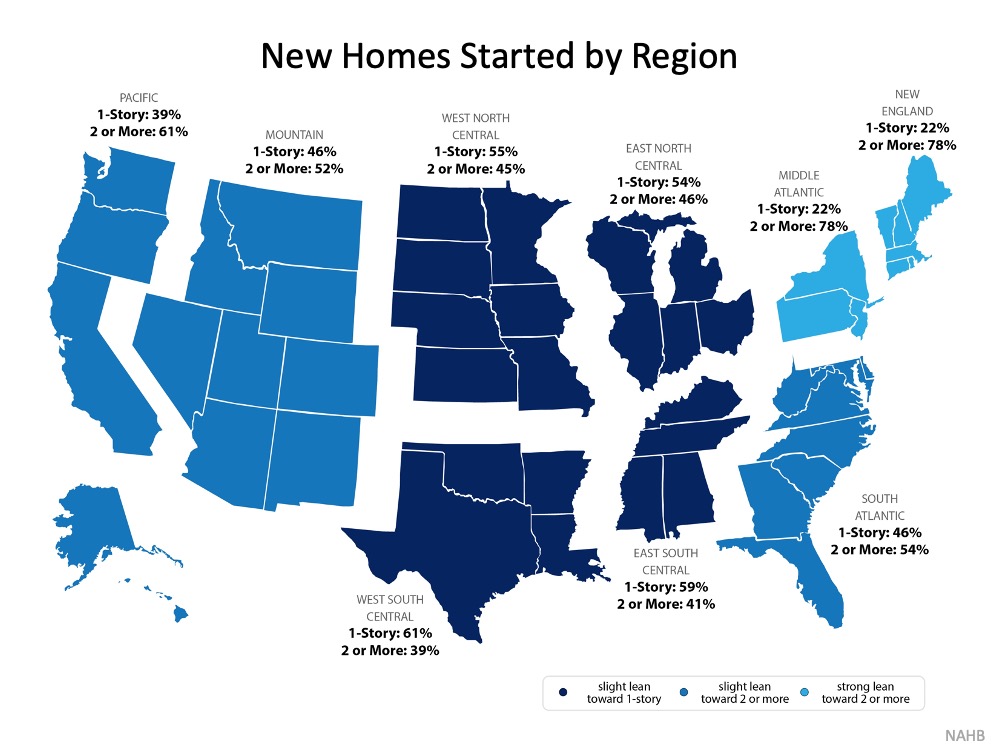

The dilemma, though, is where to go next. A big concern for many homeowners who are ready to sell is finding a home to move into, given today’s lack of houses available for sale. There is, however, some good news: the number of single-family 1-story homes being built today is on the rise, improving your odds of finding the right home for your changing needs. In a recent article, The National Association of Home Builders (NAHB) explains:

“Nationwide, the share of new homes with two or more stories fell from 53% in 2018 to 52% in 2019, while the share of new homes with one story grew from 47% to 48%.”

Here’s a map showing the breakdown of newly constructed homes being built by region, and the percentage of 1-story and 2-story homes in that mix:

What are the benefits of buying a one-story home?

Still not sure about buying a single-story home? An article from Home Talk covers several advantages of switching from two floors to one:

1. Energy Efficient

“It is easier to heat and cool a single-story house [than] it would be to regulate the temperatures of a multi-story house.”

Most single-story homes only need one heating or cooling unit, and they typically stay cooler than a two-story home, both of which can lead to significant savings.

2. Easier to Maintain

“Doing a general cleaning in a single story requires less effort and you will be able to see all areas that need cleaning and the areas are easily accessible.”

Cleaning and maintenance of a single-story home can take less time and effort, and better upkeep helps improve the overall value of the home.

3. Accessible for Everyone

“A single-story house can be accessed by anyone, whether they are young children or the senior citizens.”

If you’re looking for a house that provides a safe and easily accessible environment at any age, a single-story home may be optimal.

4. Good Resell Potential

“When buying a single-story house, you should consider the resale value should you think of reselling it in case of a circumstance that can happen. Look at the growth rate of that area. Due to the high demand of these types of houses it is [easy] to resell them and depending on the growth rate of an area, it increases in value significantly.”

Single-story homes have a lot of benefits and are often in higher demand. This bodes well for future resale opportunities.

Bottom Line

There are many benefits to downsizing into a one-story home. Doing so while demand for your current house is high might make it easier than ever to make a move. Let’s connect if you’re ready to purchase the single-story home you need while homes are so affordable today.

Why Pricing Your House Right Is Essential

In today’s real estate market, setting the right price for your house is one of the most valuable things you can do.

According to the U.S. Economic Outlook by the National Association of Realtors (NAR), existing home prices nationwide are forecasted to increase 4.7% in 2020 and 4.1% in 2021. This means experts anticipate home values will continue climbing into next year. Today, low inventory is largely keeping prices from depreciating. Danielle Hale, Chief Economist at realtor.com, notes:

“Looking at the sheer number of buyers, low mortgage rates, and limited sellers, the strength of home prices–which are now growing at the highest pace since January 2018–makes sense.”

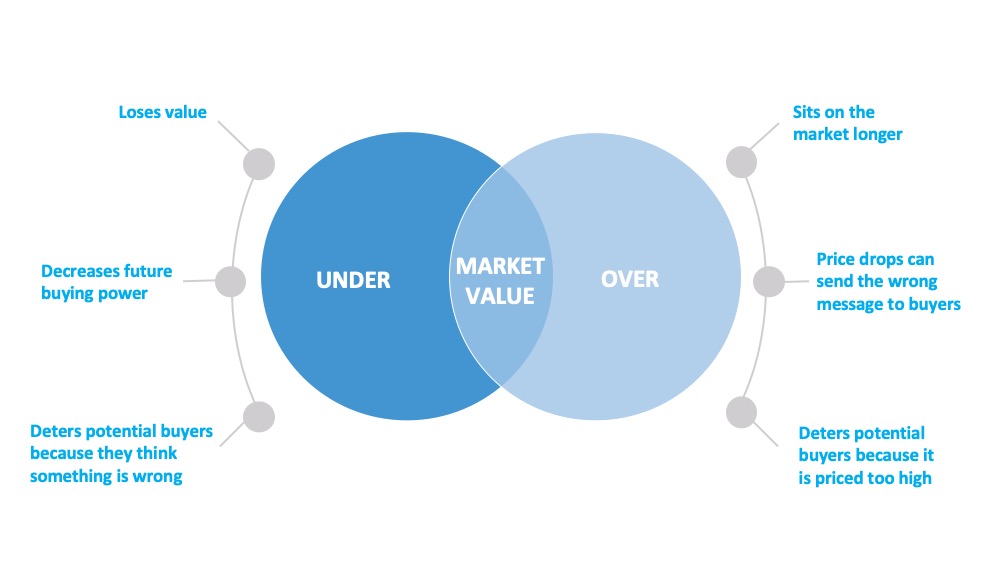

When it comes to pricing your home, the goal is to increase visibility and drive more buyers your way. Instead of trying to win the negotiation with one buyer, you should price your house so that demand is maximized and more buyers want to take a look.

How to Price Your Home

As a seller, you might be thinking about pricing your house on the high end while so many of today’s buyers are searching harder than ever just to find a home to purchase. You’re thinking, higher price, greater profit, right? But here’s the thing – a high price tag does not mean you’re going to cash in big on the sale. It’s actually more likely to deter buyers and have them looking at the houses your neighbors are selling instead.

Even today, when the advantage tips toward sellers because there are so few houses for sale, your house is more likely to sit on the market longer or require a price drop that can send buyers running in the other direction if it isn’t priced just right.

A Trusted Real Estate Professional Will Help

It’s important to make sure your house is priced correctly by working in partnership with a trusted real estate professional. When you price it competitively, you won’t be negotiating with one buyer over the price. Instead, you’ll have multiple buyers competing for the home, and that’s what ultimately increases the final sale price.

The key is making sure your house is priced to sell immediately. That way, it will be seen by the most buyers. More than one of them may be interested, and your house will be more likely to sell at a competitive price.

Bottom Line

If you’re thinking about listing your house this fall, let’s discuss how to price it right so you can maximize your exposure and your return.

Rising Home Equity Can Power Your Next Move [INFOGRAPHIC]

![Rising Home Equity Can Power Your Next Move [INFOGRAPHIC] | MyKCM](https://desireestanley.com/files/2020/10/20201002-MEM-1046x2104-2.jpg)

![Rising Home Equity Can Power Your Next Move [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/10/01135342/20201002-MEM-1046x2104.jpg)

Some Highlights

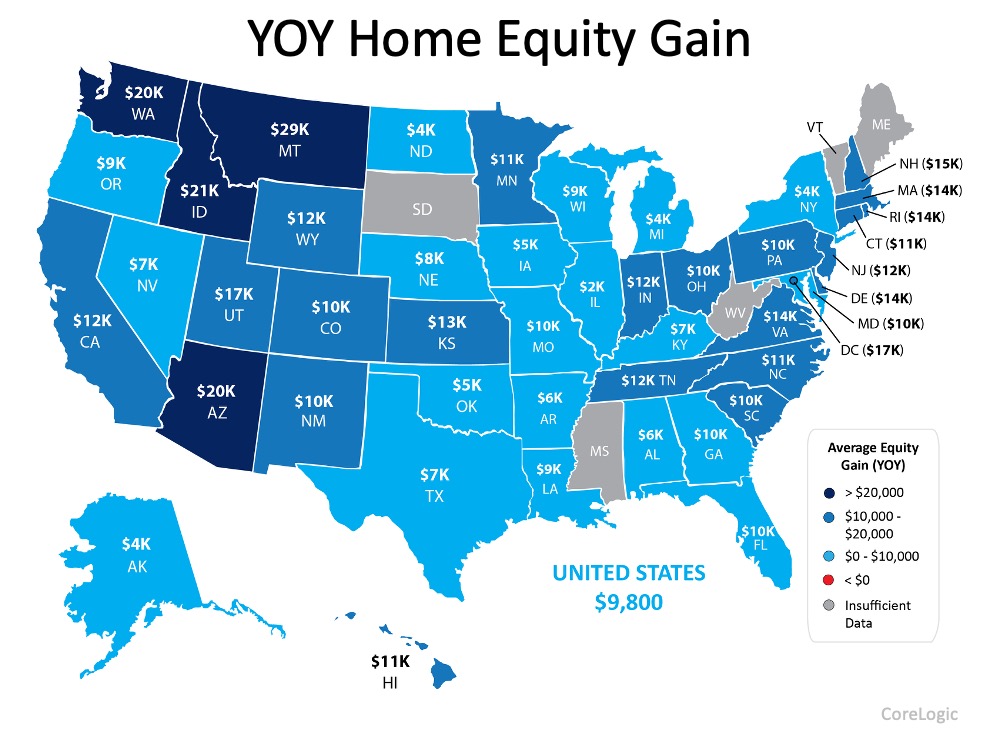

- According to CoreLogic, homeowners across the country are gaining significant equity.

- Over the past year, the average homeowner gained $9,800 in equity, growing their overall net worth.

- If you’re ready to sell your house and begin looking for your dream home, let’s connect to plan how your equity can make that possible.

Buyers Are Finding More Space in the Luxury Home Market

A year ago, additional space and extra amenities had a very different feel for homebuyers. Today, the health crisis has brought to light how valuable more square footage and carefully designed floorplans can be. Home offices, multi-purpose rooms, gyms, and theaters are becoming more popular, and some families are finding the space they need for these upgrades in the luxury market.

The Institute for Luxury Home Marketing (ILHM) explains:

“With quarantine concerns still top of mind for many luxury buyers, we see large, sprawling estates making their comeback.

For instance, the last six months have seen a resurgence in the buying of mega mansions and estate-size homes – specifically properties that offer space (both inside and outside), separate home offices, gyms, and private amenities such as swimming pools, yoga studios, and recreation rooms.”

This was not the case at this time last year, as the most recent Luxury Market Report from ILHM emphasizes:

“Exactly one year ago, we reported that demand for large properties, mega mansions, private estates, and luxury ranches had reduced significantly over the previous few years; especially from the younger generation of luxury property buyers.”

For today’s buyers looking for larger homes, steady increases in equity might be what makes a move possible. Leveraging home equity makes it easier to afford the down payment on a luxury home, and current low-interest rates are making mortgage payments more affordable than they have been in years. The report from ILHM also notes:

“Luxury real estate prices may continue to strengthen further into the third quarter, as the affluent continue to see large investment returns from the currently strong stock market.

Coupled with the low interest rates, the policies granting (and insisting) on working from home implemented by many employers, and the concerns of the pandemic, all translate to the affluent increasingly trading in their city lifestyle for a home that has it all.”

Clearly, today’s strong gains in home equity paired with record-low interest rates make fall a great time to move up into the luxury market to meet those changing needs.

Bottom Line

If you’re ready to gain some breathing room in a larger home, let’s connect so you have the guidance you need to find more space in the luxury home market.

Where Are Home Values Headed Over the Next 12 Months?

As shelter-in-place orders were implemented earlier this year, many questioned what the shutdown would mean to the real estate market. Specifically, there was concern about home values. After years of rising home prices, would 2020 be the year this appreciation trend would come to a screeching halt? Even worse, would home values begin to depreciate?

Original forecasts modeled this uncertainty, and they ranged anywhere from home values gaining 3% (Zelman & Associates) to home values depreciating by more than 6% (CoreLogic).

However, as the year unfolded, it became clear that there would be little negative impact on the housing market. As Mark Fleming, Chief Economist at First American, recently revealed:

“The only major industry to display immunity to the economic impacts of the coronavirus is the housing market.”

Have prices continued to appreciate so far this year?

Last week, the Federal Housing Finance Agency (FHFA) released its latest Home Price Index. The report showed home prices actually rose 6.5% from the same time last year. FHFA also noted that price appreciation accelerated to record levels over the summer months:

“Between May & July 2020, national prices increased by over 2%, which represents the largest two-month price increase observed since the start of the index in 1991.”

What are the experts forecasting for home prices going forward?

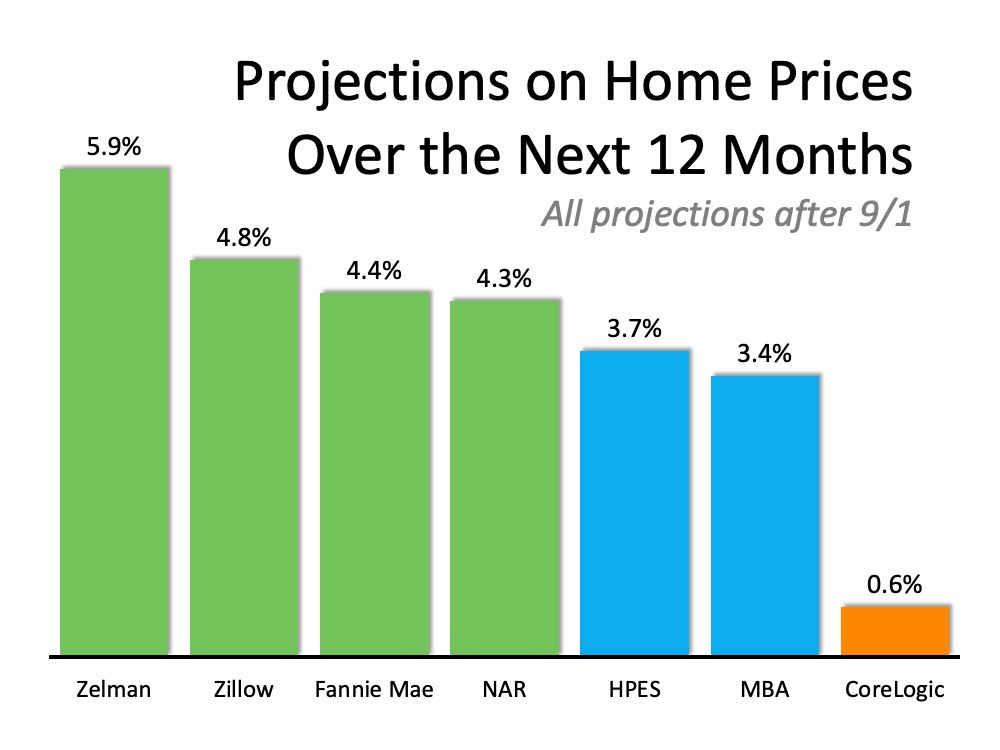

Below is a graph of home price projections for the next year. Since the market has changed dramatically over the last few months, this graph shows forecasts that have been published since September 1st.

Bottom Line

The numbers show that home values have weathered the storm of the pandemic. Let’s connect if you want to know what your home is currently worth and how that may enable you to make a move this year.

Housing Market on Track to Beat Last Year’s Success

Back in March, as the nation’s economy was shut down because of the coronavirus, many were predicting the real estate market would face a major collapse. Some forecasts called for a 15-20% decline in transactions. However, six months later, it seems as though the housing market has fully recovered.

Mark Fleming, Chief Economist at First American, announced last week:

“Since hitting a low point during the initial stages of the pandemic, the only major industry to display immunity to the economic impacts of the coronavirus is the housing market. Housing has experienced a strong V-shaped recovery and is now exceeding pre-pandemic levels.”

The Economic & Strategic Research Group at Fannie Mae upgraded its forecast for home sales last week:

“Housing data over the past month continued to show a strong V-shape rebound, helping drive the broader economy. Existing home sales jumped to a pace not seen since 2006…We have substantially upgraded our forecasts for both new and existing home sales. For 2020, total home sales are now expected to be 1.3% higher than in 2019.”

The National Association of Realtors (NAR) agrees. In their last Pending Sales Report, NAR shared projections from Chief Economist Lawrence Yun:

“Yun forecasts existing-home sales to ramp up to 5.8 million in the second half. That expected rebound would bring the full-year level of existing-home sales to 5.4 million, a 1.1% gain compared to 2019.”

Yun’s forecast for 2021 was even more optimistic, stating, “Home sales will ramp up again next year, increasing between 8% – 12%.”

Bottom Line

The housing market has come roaring back and looks as though it may even surpass last year’s success.

Frank Martell, President and CEO of CoreLogic, hit the nail on the head when he said, “On an aggregated level, the housing economy remains rock solid despite the shock and awe of the pandemic.”

Why Pricing Your Home Right Matters This Fall [INFOGRAPHIC]

![Why Pricing Your Home Right Matters This Fall [INFOGRAPHIC] | MyKCM](https://desireestanley.com/files/2020/09/20200925-MEM-1046x588-2.jpg)

![Why Pricing Your Home Right Matters This Fall [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/09/24122226/20200925-MEM-1046x588.jpg)

Some Highlights

- As a seller today, you may think pricing your home on the high end will result in a higher final sale price, but the opposite is actually true.

- To sell your home quickly and for the best possible price, you should eliminate buyer concerns by pricing your home competitively right from the start.

- Let’s connect today to make sure you have the guidance you need to price your home right this fall.

Home Equity Gives Sellers Options in Today’s Market

Homeownership is one of the best ways to invest in your financial future, especially as your home equity grows. Home equity is a form of forced savings that can work to your advantage as the value of your home appreciates. Across the country, home equity was increasing before the health crisis swept our nation, and it continues to grow throughout the year, giving sellers powerful options in this market.

According to the just-released Q2 Homeowner Equity Insights Report by CoreLogic:

“U.S. homeowners with mortgages (roughly 63% of all properties) have seen their equity increase by a total of nearly $620 billion since the second quarter of 2019, an increase of 6.6%, year over year.”

Dr. Frank Nothaft, Chief Economist for CoreLogic, attributes much of the equity growth to rising home prices:

“The CoreLogic Home Price Index registered a 4.3% annual rise in prices through June, which supported an increase in home equity.”

As the map below shows, CoreLogic also indicates that home equity is increasing in every state:

“In the second quarter of 2020, the average homeowner gained approximately $9,800 in equity during the past year.”

What Does This Mean for Sellers?

When equity is rising, as it is today, you may have more invested in your home than you realize. Mark Fleming, Chief Economist at First American, notes:

“As homeowners gain equity in their homes, they are more likely to consider using that equity to purchase a larger or more attractive home – the wealth effect of rising equity. In today’s housing market, fast rising demand against the limited supply of homes for sale has resulted in continued house price appreciation.”

If you’ve been considering making a move – whether that’s to get into a bigger home or to downsize to a smaller one – it’s a great time to reach out to a real estate professional to learn how to put your equity to work for you. You may be in a position to pay that equity forward toward your next home purchase and afford it sooner rather than later.

Bottom Line

If you’re thinking of selling, let’s connect so you can take advantage of what the current market has to offer today.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link