Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

Should You Buy a Retirement Home Sooner Rather than Later?

Every day in the U.S., roughly 10,000 people turn 65. Prior to the health crisis that swept the nation in 2020, most people had to wait until they retired to make a move to the beach, the golf course, or the senior living community they were looking to settle into for their later years in life. This year, however, the game changed.

Many of today’s workers who are nearing the end of their professional careers, but maybe aren’t quite ready to retire, have a new choice to make: should I move before I retire? If the sand and sun are calling your name and you have the opportunity to work remotely for the foreseeable future, now may be a great time to purchase that beach bungalow you’ve always dreamed of or the single-story home in the sprawling countryside that might be a little further out of town. Whether it’s a second home or a future retirement home, spending the next few years in a place that truly makes you smile every day might be the best way to round out a long and meaningful career.

Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

“The pandemic was unexpected, working from home was unexpected, but nonetheless many companies realized that workers can be just as productive working from home…We may begin to see a boost in people buying retirement homes before their retirement.”

According to the 20th Annual Transamerica Retirement Survey, 3 out of 4 retirees (75%) own their homes, and only 23% have mortgage debt (including any equity loans or lines of credit). Since entering retirement, almost 4 in 10 retirees (38%) have moved into a new home. They’re making a profit by selling their current homes in today’s low inventory market and using their equity to purchase their future retirement homes. It’s a win-win.

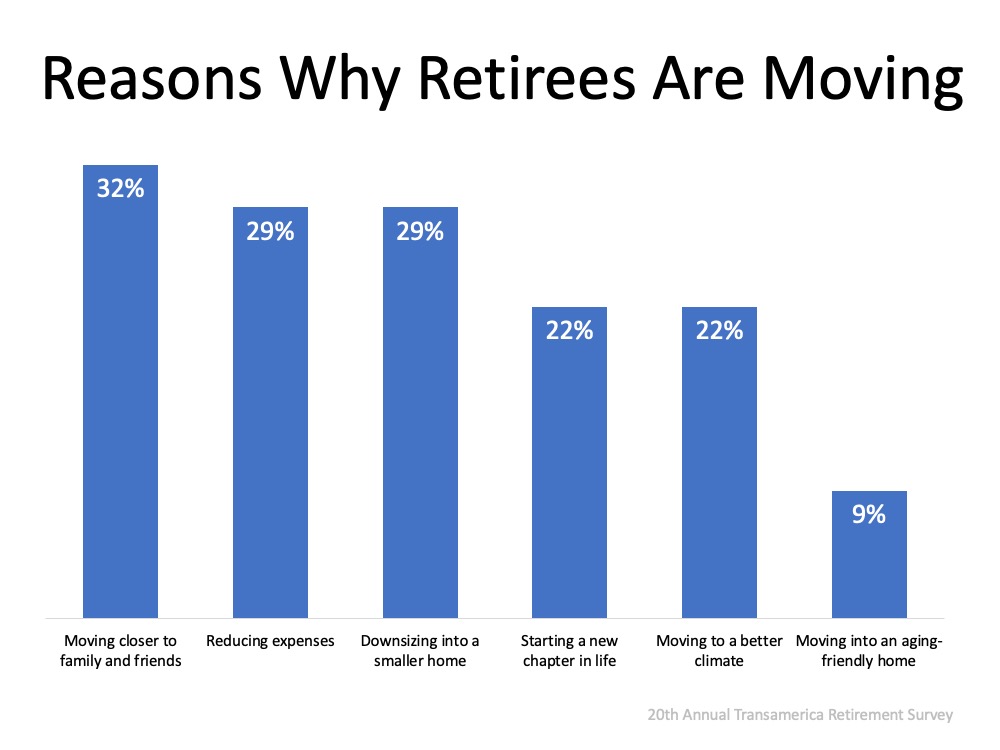

Why These Homeowners Are Making Moves Now

The health crisis this year made us all more aware of the importance of our family and friends, and many of us have not seen our extended families since the pandemic started. It’s no surprise, therefore, to see in the same report that 32% of those surveyed cited the top reason they’re making a move is that they want to be closer to family and friends (See graph below): The survey also revealed that 73% percent of retirees currently live in single-family homes. With the overall number of homes for sale today hitting a historic low, and with the buyer demand for single-family homes skyrocketing, there’s never been a more ideal time to sell a single-family home and make a move toward retirement. Today’s market has the perfect combination of driving forces to make selling optimal, especially while buyers are looking to take advantage of low interest rates.

The survey also revealed that 73% percent of retirees currently live in single-family homes. With the overall number of homes for sale today hitting a historic low, and with the buyer demand for single-family homes skyrocketing, there’s never been a more ideal time to sell a single-family home and make a move toward retirement. Today’s market has the perfect combination of driving forces to make selling optimal, especially while buyers are looking to take advantage of low interest rates.

If you’re one of the 73% of retirees with a single-family home and want to move closer to your family, now is the time to put your house on the market. With the pace homes are selling today, you could essentially wrap up your move – start to finish – before the holidays.

Bottom Line

Whether you’re looking to fully retire or to buy a second home with the intent to use it as your retirement home in the future, the 2020 fall housing market may very well work in your favor. Let’s connect today to discuss your options in our local market.

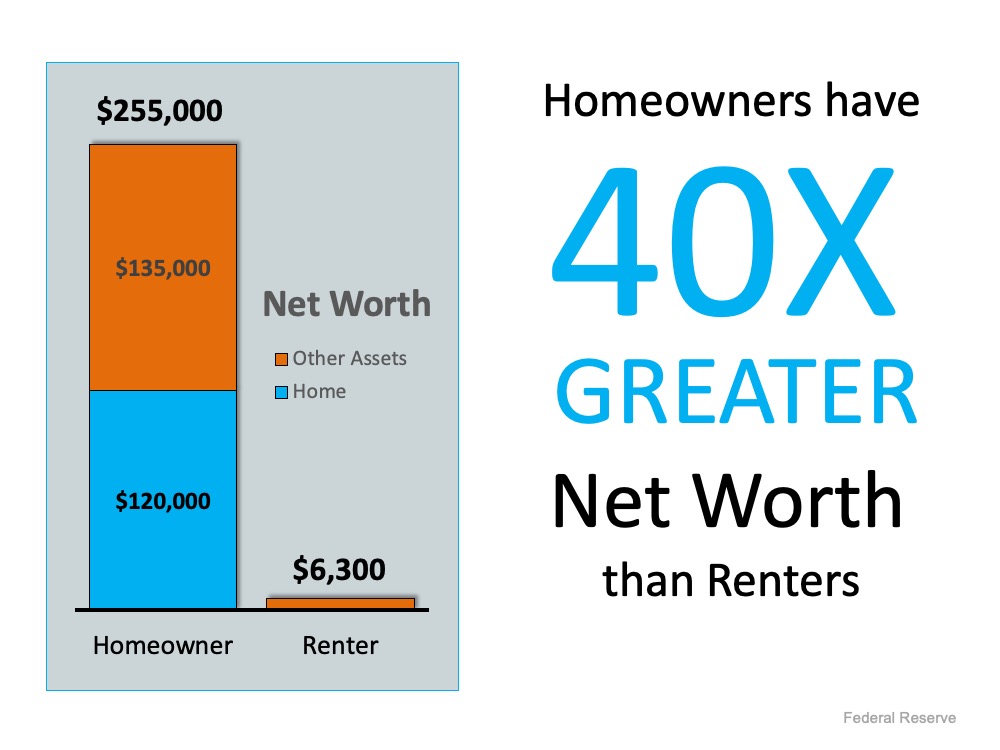

A Homeowner’s Net Worth Is 40x Greater Than a Renter’s

One of the best ways to build your family’s financial future is through homeownership. Recent data from the Federal Reserve indicates the net worth of a homeowner is actually over 40 times greater than that of a renter. Maybe it’s time to start thinking about buying a home, especially when they’re so affordable in today’s market.

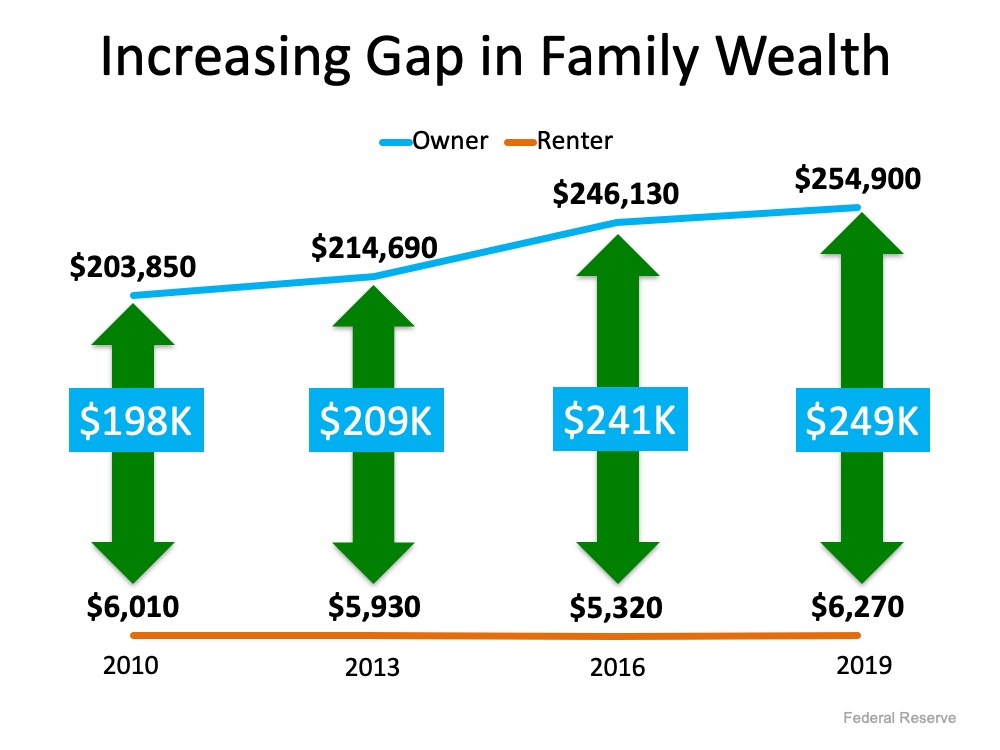

Every three years the Survey of Consumer Finances shows the breakdown of how owning a home helps build financial security. In the graph below, we see that the average net worth of homeowners continues to grow, while the net worth of renters tends to hold fairly steady and be significantly lower than that of homeowners. The gap between owning and renting just keeps getting wider over time, making homeownership more and more desirable for those who are ready.

Owning a home is a great way to build family wealth.

For many families, homeownership serves as a form of ‘forced savings.’ Every time you pay your mortgage, you’re contributing to your net worth by increasing the equity you have in your home (See chart below): The impact of home equity is part of why Gallup reports that Americans picked real estate as the best long-term investment for the seventh year in a row. According to this year’s survey, 35% of Americans chose real estate over stocks, savings accounts, gold, and bonds.

The impact of home equity is part of why Gallup reports that Americans picked real estate as the best long-term investment for the seventh year in a row. According to this year’s survey, 35% of Americans chose real estate over stocks, savings accounts, gold, and bonds.

Today, there are great opportunities available for those planning to buy a home. The housing market has made a full recovery, and all-time low-interest rates are giving homebuyers a big boost in purchasing power. If you’re ready, buying a home this fall can set you up to increase your net worth and create a safety net for your family’s future.

Bottom Line

To learn how you can use your monthly housing cost to build your family’s net worth, let’s connect so you have a trusted professional to guide you through the homebuying process.

Is it Time to Move into a Single-Story Home?

Once the kids have left the nest, you may be wondering what to do with all of the extra space in your home. Chances are, you don’t need four bedrooms anymore, and it may be a great time to sell your house and downsize, maybe even into a single-story home. You’ve likely gained significant equity if you’ve lived in your home for a while, so making a move while demand for your current house is high could be your best step forward toward the retirement goals you set out to achieve several years ago.

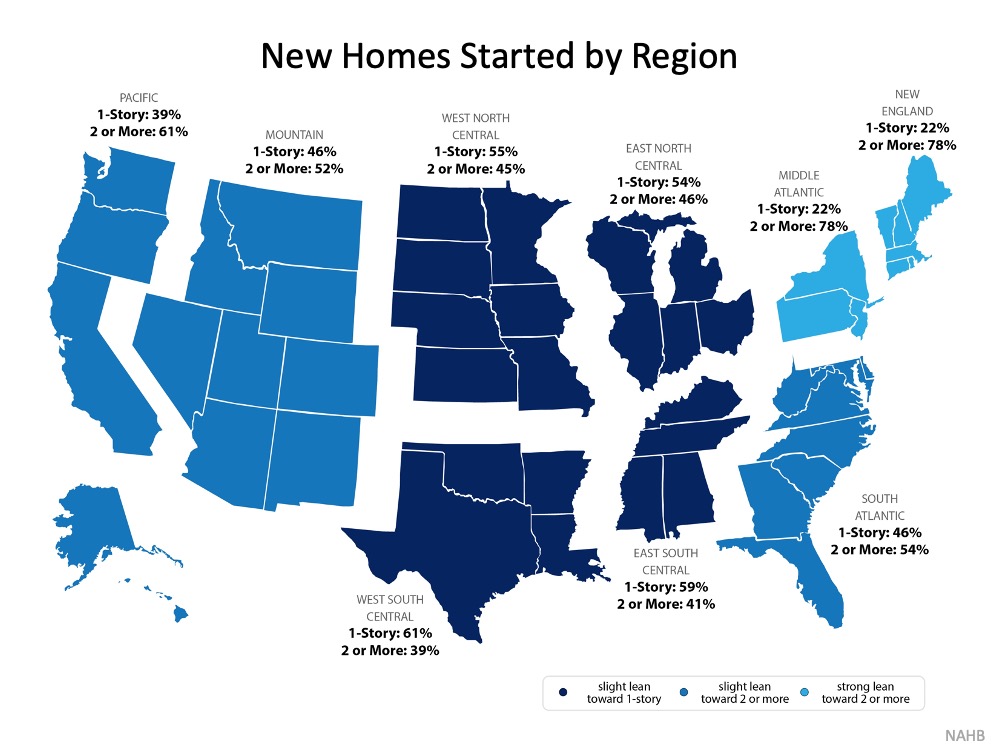

The dilemma, though, is where to go next. A big concern for many homeowners who are ready to sell is finding a home to move into, given today’s lack of houses available for sale. There is, however, some good news: the number of single-family 1-story homes being built today is on the rise, improving your odds of finding the right home for your changing needs. In a recent article, The National Association of Home Builders (NAHB) explains:

“Nationwide, the share of new homes with two or more stories fell from 53% in 2018 to 52% in 2019, while the share of new homes with one story grew from 47% to 48%.”

Here’s a map showing the breakdown of newly constructed homes being built by region, and the percentage of 1-story and 2-story homes in that mix:

What are the benefits of buying a one-story home?

Still not sure about buying a single-story home? An article from Home Talk covers several advantages of switching from two floors to one:

1. Energy Efficient

“It is easier to heat and cool a single-story house [than] it would be to regulate the temperatures of a multi-story house.”

Most single-story homes only need one heating or cooling unit, and they typically stay cooler than a two-story home, both of which can lead to significant savings.

2. Easier to Maintain

“Doing a general cleaning in a single story requires less effort and you will be able to see all areas that need cleaning and the areas are easily accessible.”

Cleaning and maintenance of a single-story home can take less time and effort, and better upkeep helps improve the overall value of the home.

3. Accessible for Everyone

“A single-story house can be accessed by anyone, whether they are young children or the senior citizens.”

If you’re looking for a house that provides a safe and easily accessible environment at any age, a single-story home may be optimal.

4. Good Resell Potential

“When buying a single-story house, you should consider the resale value should you think of reselling it in case of a circumstance that can happen. Look at the growth rate of that area. Due to the high demand of these types of houses it is [easy] to resell them and depending on the growth rate of an area, it increases in value significantly.”

Single-story homes have a lot of benefits and are often in higher demand. This bodes well for future resale opportunities.

Bottom Line

There are many benefits to downsizing into a one-story home. Doing so while demand for your current house is high might make it easier than ever to make a move. Let’s connect if you’re ready to purchase the single-story home you need while homes are so affordable today.

Rising Home Equity Can Power Your Next Move [INFOGRAPHIC]

![Rising Home Equity Can Power Your Next Move [INFOGRAPHIC] | MyKCM](https://desireestanley.com/files/2020/10/20201002-MEM-1046x2104-2.jpg)

![Rising Home Equity Can Power Your Next Move [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/10/01135342/20201002-MEM-1046x2104.jpg)

Some Highlights

- According to CoreLogic, homeowners across the country are gaining significant equity.

- Over the past year, the average homeowner gained $9,800 in equity, growing their overall net worth.

- If you’re ready to sell your house and begin looking for your dream home, let’s connect to plan how your equity can make that possible.

Buyers Are Finding More Space in the Luxury Home Market

A year ago, additional space and extra amenities had a very different feel for homebuyers. Today, the health crisis has brought to light how valuable more square footage and carefully designed floorplans can be. Home offices, multi-purpose rooms, gyms, and theaters are becoming more popular, and some families are finding the space they need for these upgrades in the luxury market.

The Institute for Luxury Home Marketing (ILHM) explains:

“With quarantine concerns still top of mind for many luxury buyers, we see large, sprawling estates making their comeback.

For instance, the last six months have seen a resurgence in the buying of mega mansions and estate-size homes – specifically properties that offer space (both inside and outside), separate home offices, gyms, and private amenities such as swimming pools, yoga studios, and recreation rooms.”

This was not the case at this time last year, as the most recent Luxury Market Report from ILHM emphasizes:

“Exactly one year ago, we reported that demand for large properties, mega mansions, private estates, and luxury ranches had reduced significantly over the previous few years; especially from the younger generation of luxury property buyers.”

For today’s buyers looking for larger homes, steady increases in equity might be what makes a move possible. Leveraging home equity makes it easier to afford the down payment on a luxury home, and current low-interest rates are making mortgage payments more affordable than they have been in years. The report from ILHM also notes:

“Luxury real estate prices may continue to strengthen further into the third quarter, as the affluent continue to see large investment returns from the currently strong stock market.

Coupled with the low interest rates, the policies granting (and insisting) on working from home implemented by many employers, and the concerns of the pandemic, all translate to the affluent increasingly trading in their city lifestyle for a home that has it all.”

Clearly, today’s strong gains in home equity paired with record-low interest rates make fall a great time to move up into the luxury market to meet those changing needs.

Bottom Line

If you’re ready to gain some breathing room in a larger home, let’s connect so you have the guidance you need to find more space in the luxury home market.

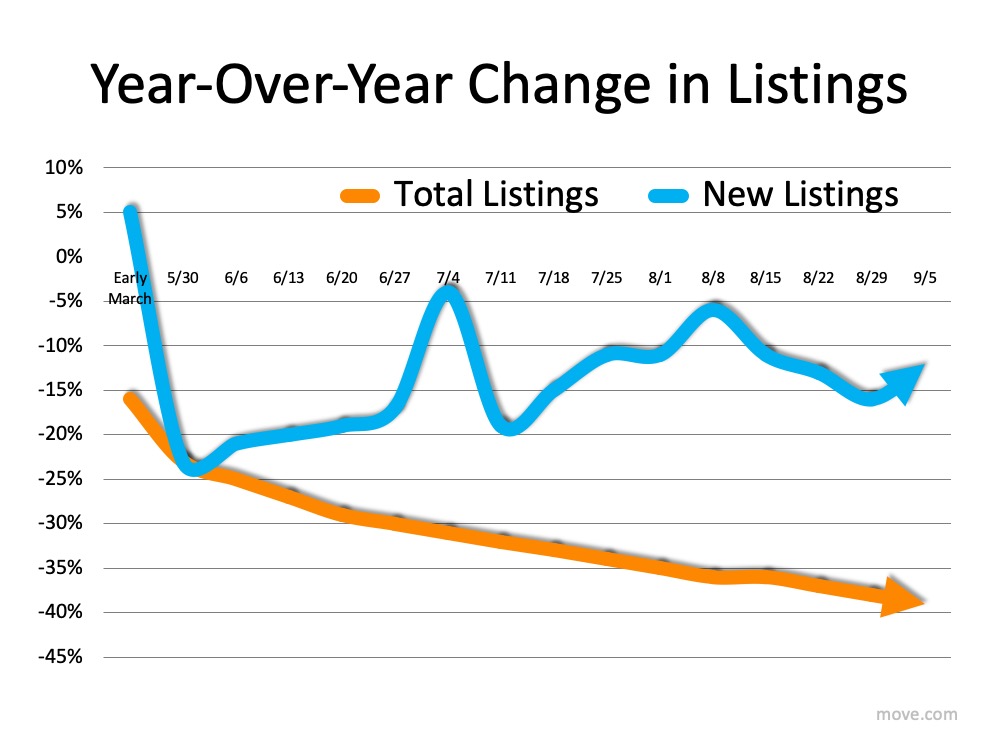

How Low Inventory May Impact the Housing Market This Fall

Real estate continues to be called the ‘bright spot’ in the current economy, but there’s one thing that may hold the housing market back from achieving its full potential this year: the lack of homes for sale.

Buyers are actively searching for and purchasing homes, looking to capitalize on today’s historically low-interest rates, but there just aren’t enough houses for sale to meet that growing need. Sam Khater, Chief Economist at Freddie Mac, explains:

“Mortgage rates have hit another record low due to a late summer slowdown in the economic recovery…These low rates have ignited robust purchase demand activity…However, heading into the fall it will be difficult to sustain the growth momentum in purchases because the lack of supply is already exhibiting a constraint on sales activity.”

According to the National Association of Realtors (NAR), right now, unsold inventory sits at a 3.1-month supply at the current sales pace. To have a balanced market where there are enough homes for sale to meet buyer demand, the market needs inventory for 6 months. Today, we’re nowhere near where that number needs to be. If the trend continues, it will get even harder to find homes to purchase this fall, and that may slow down potential buyers. Danielle Hale, Chief Economist at realtor.com, notes:

“The overall lack of sustained new listings growth could put a dent in fall home sales despite high interest from home shoppers, because new listings are key to home sales.”

The realtor.com Weekly Recovery Report keeps an eye on the number of listings coming into the market (houses available for sale) and the total number of listings staying in the market compared to the previous year (See graph below): Buyers are clearly scooping up homes faster than they’re being put up for sale. The number of total listings (the orange line) continues to decline even as new listings (the blue line) are coming to the market. Why? Javier Vivas, Director of Economic Research at realtor.com, notes:

Buyers are clearly scooping up homes faster than they’re being put up for sale. The number of total listings (the orange line) continues to decline even as new listings (the blue line) are coming to the market. Why? Javier Vivas, Director of Economic Research at realtor.com, notes:

“The post-pandemic period has brought a record number of homebuyers back into the market, but it’s also failed to bring a consistent number of sellers back. Homes are selling faster, and sales are still on an upward trend, but rapidly disappearing inventory also means more home shoppers are being priced out. If we don’t see material improvement to supply in the next few weeks, we could see the number of transactions begin to dwindle again even as the lineup of buyers continues to grow.”

Does this mean it’s a good time to sell?

Yes. If you’re thinking about selling your house, this fall is a great time to make it happen. There are plenty of buyers looking for homes to purchase because they want to take advantage of low-interest rates. Realtors are also reporting an average of 3 offers per house and an increase in bidding wars, meaning the demand is there and the opportunity to sell for the most favorable terms is in your favor as a seller.

Bottom Line

If you’re considering selling your house, this is the perfect time to connect so we can talk about how you can benefit from the market trends in our local area.

Have You Ever Seen a Housing Market Like This?

The year 2020 will certainly be one to remember, with new realities and norms that changed the way we live. This year’s real estate market is certainly no exception to that shift, with historic highlights continuing to break records and challenge what many thought possible in the housing market. Here’s a look at four key areas that are fundamentally defining the market this year.

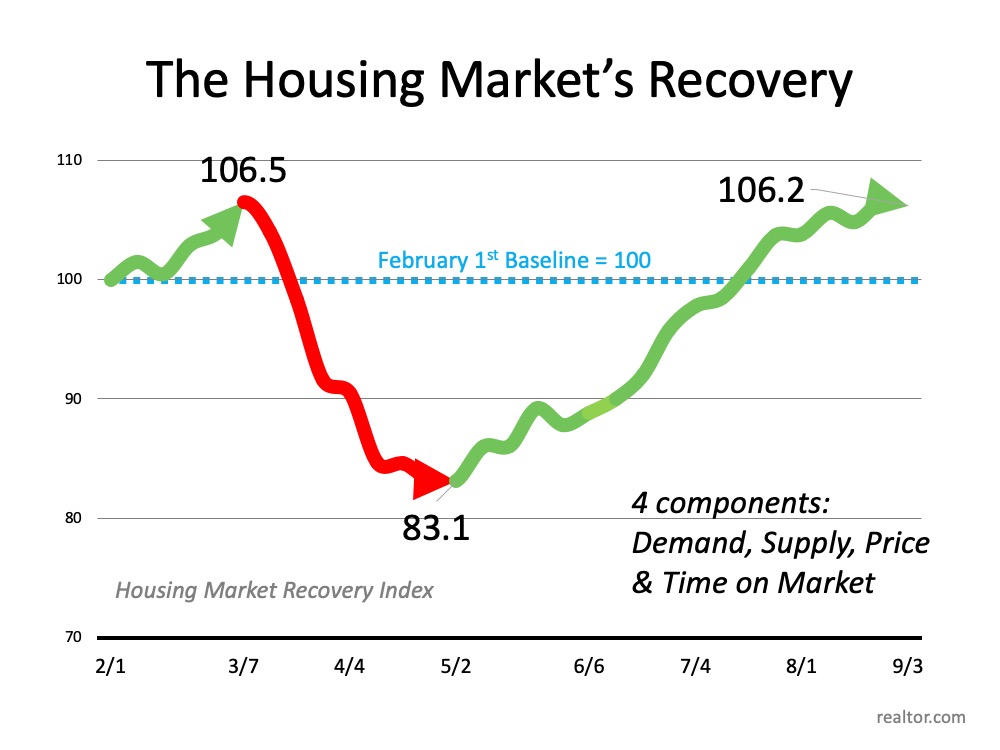

Housing Market Recovery

The economy was intentionally put on pause this spring in response to the COVID-19 health crisis. Many aspects of the common real estate transaction were placed on hold at the same time. Thankfully, technology and innovation helped the industry power forward, and business gradually ramped back up as shelter-in-place orders were lifted.

The result? Total transformation of the market from rock-bottom lows to exceptional highs. Today, the housing recovery is being called truly remarkable by many experts and is far exceeding expectations. From pending home sales to purchase applications, buyers are back in business and homes are selling – fast.

According to the Housing Market Recovery Index by realtor.com, the market has surpassed pre-pandemic levels, and has regained the strength we remember from February of this year (See graph below):

Record-Breaking Mortgage Rates

Historically low mortgage rates are another 2020 game-changer. Today’s low rate is one of the big motivating factors bringing buyers back into the market. The average rate reached an all-time low on multiple occasions this year, and it continues to hover in the record-low territory.

When rates are this low, buyers have a huge opportunity to get more for their money when purchasing a home, something many are eager to find while continuing to spend more time than expected at home this year, and likely beyond.

Continued Home Price Appreciation

One of the key drivers of home price appreciation this year is historically low inventory. Inventory was low going into the pandemic, and it is still sitting well below the level needed for a normal market. Although sellers are slowly making their way back into the game, buyers are scooping up homes faster than they’re coming up for sale.

This is a classic supply and demand scenario, forcing home prices to rise. Selling something when there is a higher demand for what is available naturally bumps up the price. If you’re ready to sell your house today, this may be the optimal time to make your move. As Bill Banfield, EVP of Capital Markets at Quicken Loans, notes:

“The pandemic has not stopped the consistent home price growth we have witnessed in recent years.”

Increasing Affordability

Even as home prices continue to rise, affordability is working in favor of today’s homebuyers. According to many experts, rates this low are off-setting rising home prices, which increases buyer purchasing power – an opportunity not to be missed, especially if your family’s needs have changed. If you now need space for a home office, gym, virtual classroom, and more, it may be time to reconsider your current house.

According to Mortgage News Daily:

“Those shopping for a home can afford 10 percent more home than they could have one year ago while keeping their monthly payment unchanged. This translates into nearly $32,000 more buying power.”

Bottom Line

With mortgage rates hitting historic lows, home prices appreciating, affordability rising, and the market recovering like no other, 2020 has been quite a year for real estate – perhaps one we’ve never seen before and may never see again. Let’s connect today if you’re ready to take advantage of this year’s record-breaking opportunities.

The 2020 Home buyer Wish List [INFOGRAPHIC]

![The 2020 Homebuyer Wish List [INFOGRAPHIC] | MyKCM](https://desireestanley.com/files/2020/09/20200904-MEM-1046x1536.jpg)

![The 2020 Homebuyer Wish List [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/09/03121217/20200904-MEM-1046x1536.jpg)

Some Highlights

- The word “home” is taking on a whole new meaning this year, and buyers are starting to look for new features as they re-think their needs and what’s truly possible.

- From more outdoor space to virtual classrooms for their children, buyers have a growing list of what they’d like to see in their homes.

- Let’s connect today if your needs have changed and your wish list is expanding too.

How Will the Presidential Election Impact Real Estate?

The year 2020 will be remembered as one of the most challenging times of our lives. A worldwide pandemic, a recession causing historic unemployment, and a level of social unrest perhaps never seen before have all changed the way we live. Only the real estate market seems to be unaffected, as a new forecast projects there may be more homes purchased this year than last year.

As we come to the end of this tumultuous year, we’re preparing for perhaps the most contentious presidential election of the century. Today, it’s important to look at the impact past presidential election years have had on the real estate market.

Is there a drop-off in home sales during a presidential election year?

BTIG, a research and analysis company, looked at new home sales from 1963 through 2019 in their report titled One House, Two House, Red House, Blue House. They noted that in non-presidential years, there is a -9.8% decrease in November compared to October. This is the normal seasonality of the market, with a slowdown in activity that’s usually seen in fall and winter.

However, it also revealed that in presidential election years, the typical drop increases to -15%. The report explains why:

“This may indicate that potential homebuyers may become more cautious in the face of national election uncertainty.”

Are those sales lost forever?

No. BTIG determined:

“This caution is temporary, and ultimately results in deferred sales, as the economy, jobs, interest rates and consumer confidence all have far more meaningful roles in the home purchase decision than a Presidential election result in the months that follow.”

In a separate study done by Meyers Research & Zonda, Ali Wolf, Chief Economist, agrees that those purchases are just delayed until after the election:

“History suggests that the slowdown is largely concentrated in the month of November. In fact, the year after a presidential election is the best of the four-year cycle. This suggests that demand for new housing is not lost because of election uncertainty, rather it gets pushed out to the following year.”

Will it matter who is elected?

To some degree, but not in the overall number of home sales. As mentioned above, consumer confidence plays a significant role in a family’s desire to buy a home. How may consumer confidence impact the housing market post-election? The BTIG report covered that as well:

“A change in administration might benefit trailing blue county housing dynamics. The re-election of President Trump could continue to propel red county outperformance.”

Again, overall sales should not be impacted in a significant way.

Bottom Line

If mortgage rates remain near all-time lows, the economy continues to recover, and unemployment continues to decrease, the real estate market should remain strong up to and past the election.

It’s Not Just About the Price of the Home

When most of us begin searching for a home, we naturally start by looking at the price. It’s important, however, to closely consider what else impacts the purchase. It’s not just the price of the house that matters, but the overall cost in the long run. Today, that’s largely impacted by low mortgage rates. Low rates are actually making homes more affordable now than at any time since 2016, and here’s why.

Today’s low rates are off-setting rising home prices because it’s less expensive to borrow money. In essence, purchasing a home while mortgage rates are this low may save you significantly over the life of your home loan.

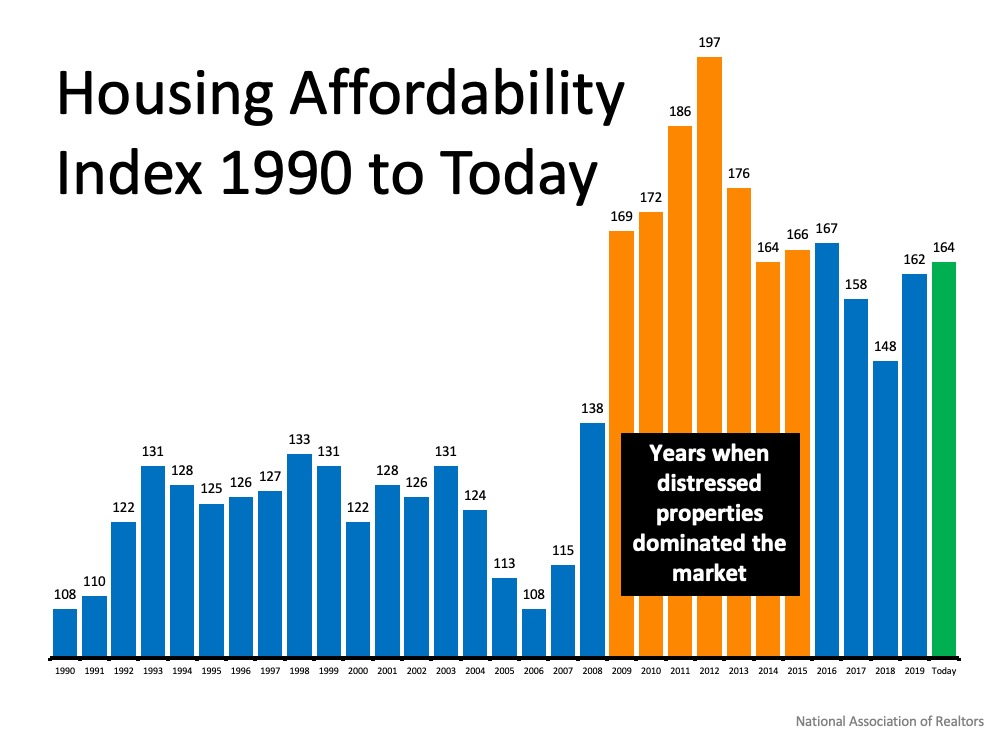

Taking a look at the graph below with data sourced from the National Association of Realtors (NAR), the higher the bars rise, the more affordable homes are. The orange bars represent the period of time when homes were most affordable, but that’s also reflective of when the housing bubble burst. At that time, distressed properties, like foreclosures and short sales, dominated the market. That’s a drastically different environment than what we have in the housing market now.

The green bar represents today’s market. It shows that homes truly are more affordable than they have been in years, and much more so than they were in the normal market that led up to the housing crash. Low mortgage rates are a big differentiator driving this affordability.

What are the experts saying about affordability?

Experts agree that this unique moment in time is making homes incredibly affordable for buyers.

Lawrence Yun, Chief Economist, NAR:

“Although housing prices have consistently moved higher, when the favorable mortgage rates are factored in, an overall home purchase was more affordable in 2020’s second quarter compared to one year ago.”

Bill Banfield, EVP of Capital Markets, Quicken Loans:

“No matter what you’re looking for, this is a great time to buy since the current low interest rates can stretch your spending power.”

“Those shopping for a home can afford 10 percent more home than they could have one year ago while keeping their monthly payment unchanged. This translates into nearly $32,000 more buying power.”

“Homeowners are the clear winners. Low mortgage rates mean the cost of owning is at historically low levels and who gains all the benefits of strong house price appreciation? Homeowners.”

Bottom Line

When purchasing a home, it’s important to think about the overall cost, not just the price of the house. Homes on your wish list may be more affordable today than you think. Let’s connect to discuss how affordability plays a role in our local market, and your long-term homeownership goals.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link