Economists Forecast Recovery to Begin in the Second Half of 2020

With the U.S. economy on everyone’s minds right now, questions about the country’s financial outlook continue to come up daily. The one that seems to keep rising to the top is: when will the economy begin to recover? While no one knows exactly how a rebound will play out, expert economists around the country are becoming more aligned on when the recovery will begin.

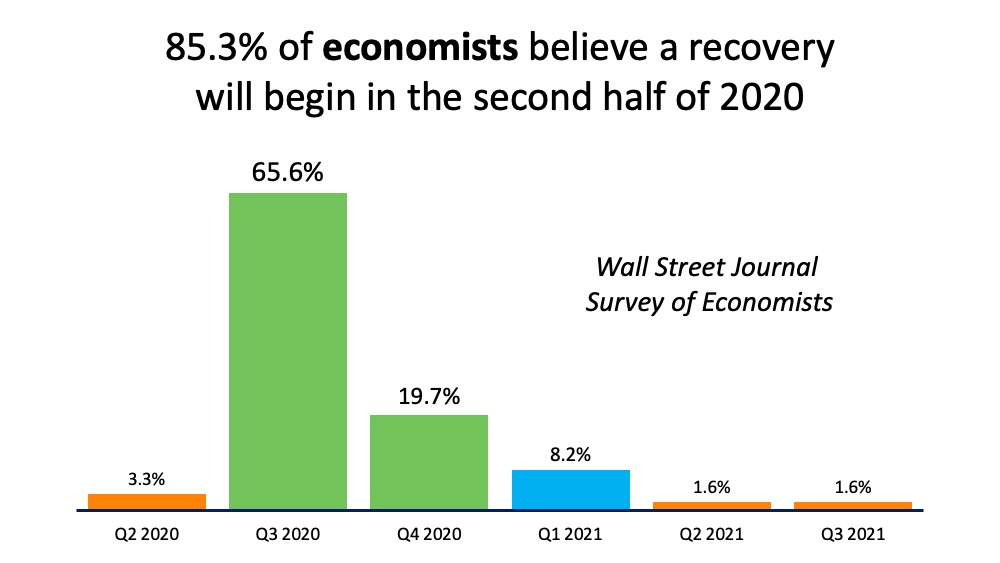

According to the latest Wall Street Journal Economic Forecasting Survey, which polls more than 60 economists on a monthly basis, 85.3% believe a recovery will begin in the second half of 2020 (see graph below): There seems to be a growing consensus among these experts that the second half of this year will be the start of a turnaround in this country.

There seems to be a growing consensus among these experts that the second half of this year will be the start of a turnaround in this country.

Chris Hyzy, Chief Investment Officer for Merrill notes:

“We fully expect the economy could begin to pick up in late June and July with a strong recovery in the fourth quarter.”

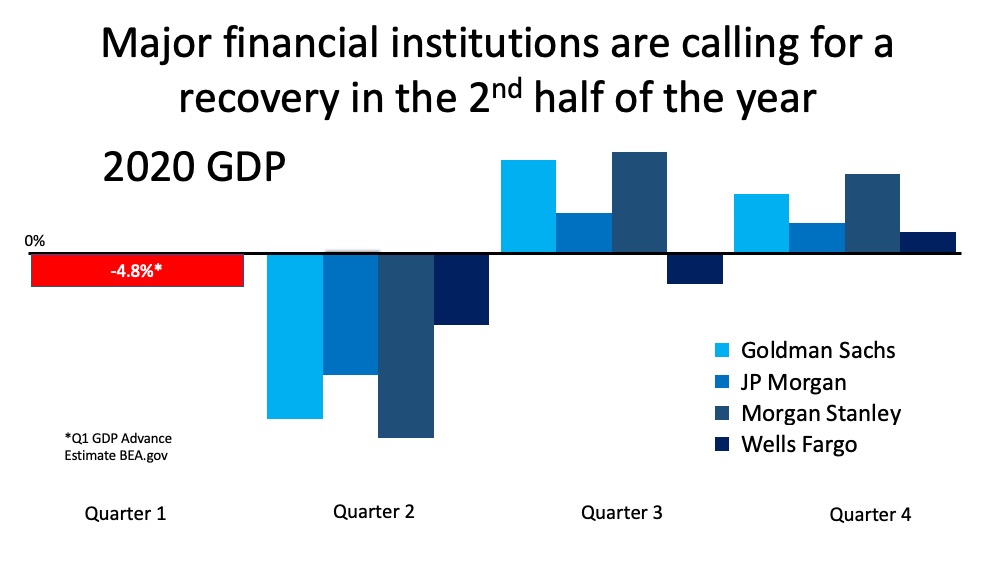

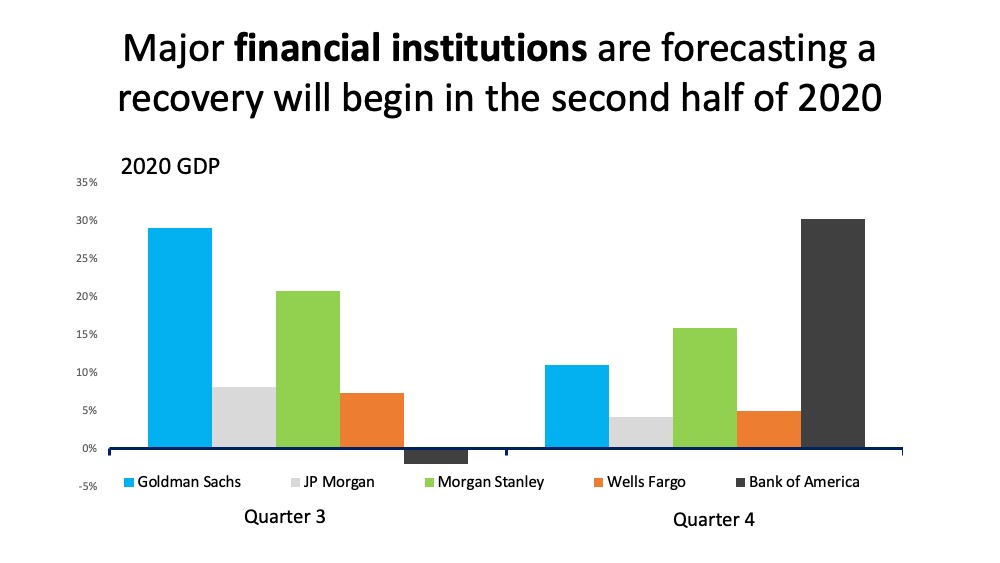

In addition, five of the major financial institutions are also forecasting positive GDP in the second half of the year. Today, four of the five expect a recovery to begin in the third quarter of 2020, and all five agree a recovery should start by the fourth quarter (see graph below):

Bottom Line

The vast majority of economists, analysts, and financial institutions are in unison, indicating an economic recovery should begin in the second half of 2020. Agreement among these leading experts is stronger than ever.

Unemployment Report: No Need to Be Terrified

Last Friday, the Bureau of Labor Statistics (BLS) released its latest jobs report. It revealed that the economic shutdown made necessary by COVID-19 caused the unemployment rate to jump to 14.7%. Many anticipate that next month the percentage could be even higher. These numbers represent the extreme hardship so many families are experiencing right now. That pain should not be understated.

However, the long-term toll the pandemic will cause should not be overstated either. There have been numerous headlines claiming the current disruption in the economy is akin to the Great Depression, and many of those articles are calling for total Armageddon. Some experts are stepping up to refute those claims.

In a Wall Street Journal (WSJ) article this past weekend, Josh Zumbrun, a national economics correspondent for the Journal explained:

“News stories often describe the coronavirus-induced global economic downturn as the worst since the Great Depression…the comparison does more to terrify than clarify.”

Zumbrun goes on to explain:

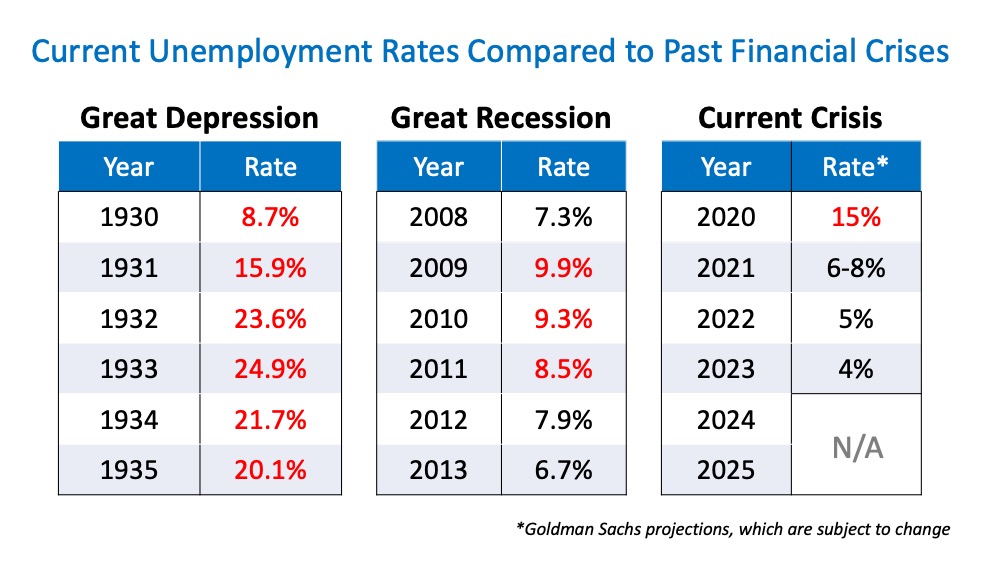

“From 1929 to 1933, the economy shrank for 43 consecutive months, according to contemporaneous estimates. Unemployment climbed to nearly 25% before slowly beginning its descent, but it remained above 10% for an entire decade…This time, many economists believe a rebound could begin this year or early next year.”

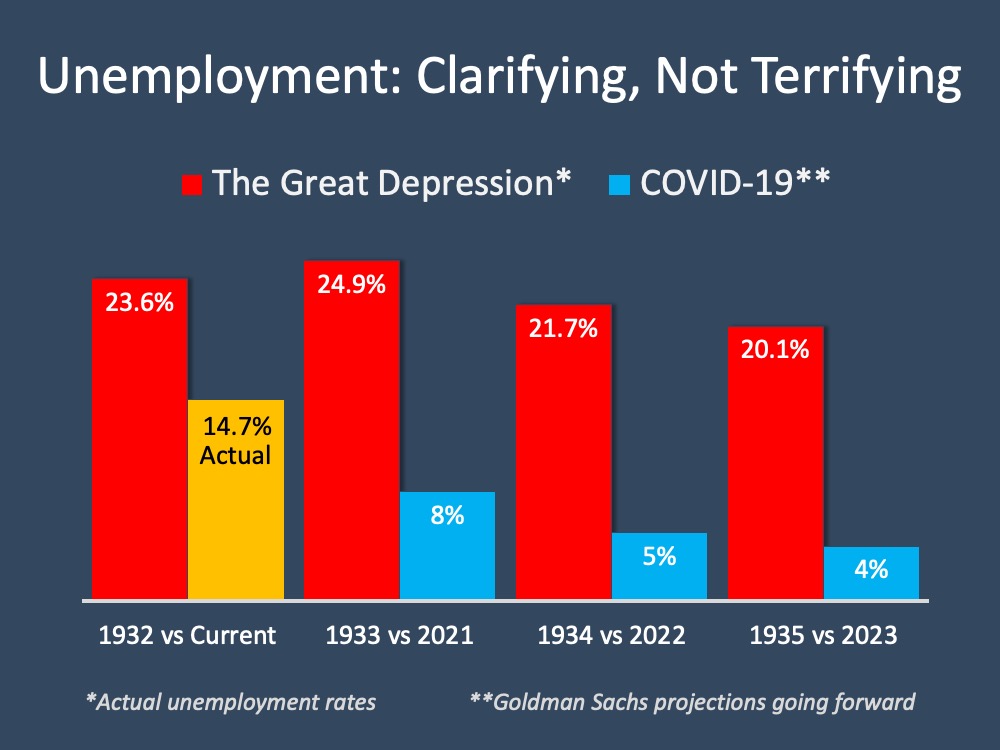

Here is a graph comparing current unemployment numbers (actual and projected) to those during the Great Depression: Clearly, the two unemployment situations do not compare.

Clearly, the two unemployment situations do not compare.

What makes this time so different?

This was not a structural collapse of the economy, but instead a planned shutdown to help mitigate the virus. Once the virus is contained, the economy will immediately begin to recover. This is nothing like what happened in the 1930s. In the same WSJ article mentioned above, former Federal Reserve Chairman Ben Bernanke, who has done extensive research on the depression in the 1930s, explained:

“The breakdown of the financial system was a major reason for both the Great Depression and the 2007-09 recession.” He went on to say that today – “the banks are stronger and much better capitalized.”

What about the families and small businesses that are suffering right now?

The nation’s collective heart goes out to all. The BLS report, however, showed that ninety percent of the job losses are temporary. In addition, many are getting help surviving this pause in their employment status. During the Great Depression, there were no government-sponsored unemployment insurance or large government subsidies as there are this time.

Today, many families are receiving unemployment benefits and an additional $600 a week. The stimulus package is helping many companies weather the storm. Is there still pain? Of course. The assistance, however, is providing much relief until most can go back to work.

Bottom Line

We should look at the current situation for what it is – a predetermined pause placed on the economy. The country will recover once the pandemic ends. Comparisons to any other downturn make little sense. Bernanke put it best:

“I don’t find comparing the current downturn with the Great Depression to be very helpful. The expected duration is much less, and the causes are very different.”

Will This Economic Crisis Have a V, U, or L-Shaped Recovery?

Many American businesses have been put on hold as the country deals with the worst pandemic in over one hundred years. As the states are deciding on the best strategy to slowly and safely reopen, the big question is: how long will it take the economy to fully recover?

Let’s look at the possibilities. Here are the three types of recoveries that follow most economic slowdowns (the definitions are from the financial glossary at Market Business News):

- V-shaped recovery: an economic period in which the economy experiences a sharp decline. However, it is also a brief period of decline. There is a clear bottom (called a trough by economists) which does not last long. Then there is a strong recovery.

- U-shaped recovery: when the decline is more gradual, i.e., less severe. The recovery that follows starts off moderately and then picks up speed. The recovery could last 12-24 months.

- L-shaped recovery: a steep economic decline followed by a long period with no growth. When an economy is in an L-shaped recovery, getting back to where it was before the decline will take years.

What type of recovery will we see this time?

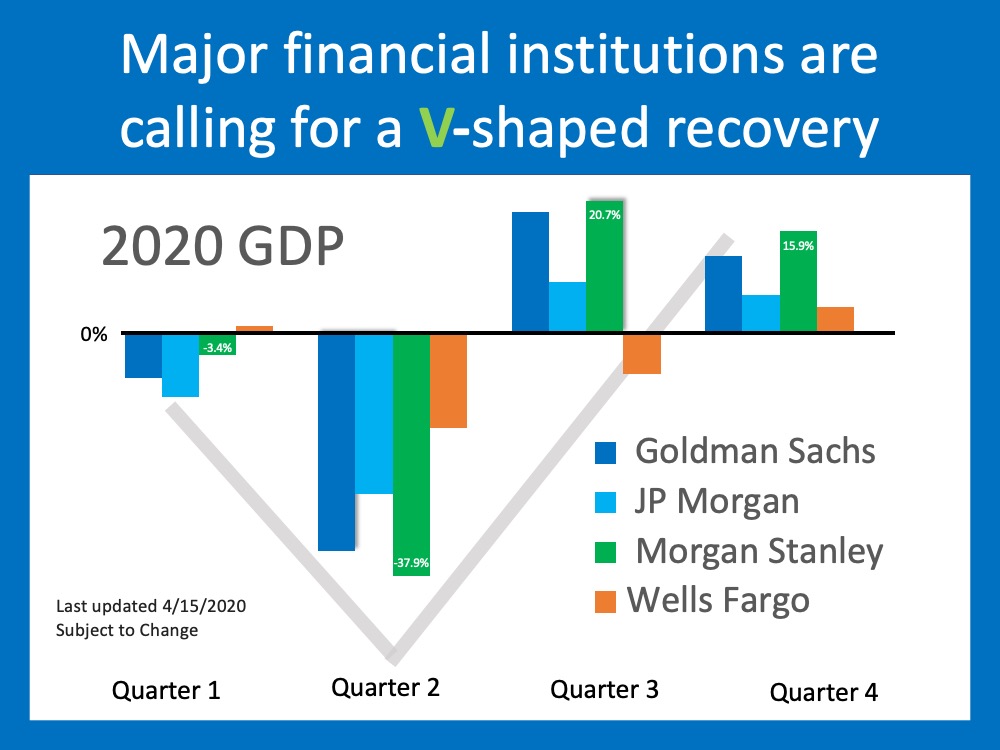

No one can answer this question with one hundred percent certainty. However, most top financial services firms are calling for a V-shaped recovery. Goldman Sachs, Morgan Stanley, Wells Fargo Securities, and JP Morgan have all recently come out with projections that call for GDP to take a deep dive in the first half of the year but have a strong comeback in the second half.

Is there any research on recovery following a pandemic?

There have been two extensive studies done that look at how an economy has recovered from a pandemic in the past. Here are the conclusions they reached:

1. John Burns Consulting:

“Historical analysis showed us that pandemics are usually V-shaped (sharp recessions that recover quickly enough to provide little damage to home prices), and some very cutting-edge search engine analysis by our Information Management team showed the current slowdown is playing out similarly thus far.”

2. Harvard Business Review:

“It’s worth looking back at history to place the potential impact path of Covid-19 empirically. In fact, V-shapes monopolize the empirical landscape of prior shocks, including epidemics such as SARS, the 1968 H3N2 (“Hong Kong”) flu, 1958 H2N2 (“Asian”) flu, and 1918 Spanish flu.”

The research says we should experience a V-shaped recovery.

Does everyone agree it will be a ‘V’?

No. Some are concerned that, even when businesses are fully operational, the American public may be reluctant to jump right back in.

As Market Business News explains:

“In a typical V-shaped recovery, there is a huge shift in economic activity after the downturn and the trough. Growing consumer demand and spending drive the massive shift in economic activity.”

If consumer demand and spending do not come back as quickly as most expect it will, we may be heading for a U-shaped recovery.

In a message last Thursday, Chris Hyzy, Chief Investment Officer for Merrill and Bank of America Private Bank, agrees with other analysts who are expecting a resurgence in the economy later this year:

“We’re forecasting real economic growth of 30% for the U.S. in the 4th quarter of this year and 6.1% in 2021.”

His projection, however, calls for a U-shaped recovery based on concerns that consumers may not rush back in:

“After the steep plunge and bottoming out, a ‘U-shaped’ recovery should begin as consumer confidence slowly returns.”

Bottom Line

The research indicates the recovery will be V-shaped, and most analysts agree. We will have to wait and see as the situation unfolds just how quickly Americans will get back to “normal” life.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link