Home Sales Hit a Record-Setting Rebound

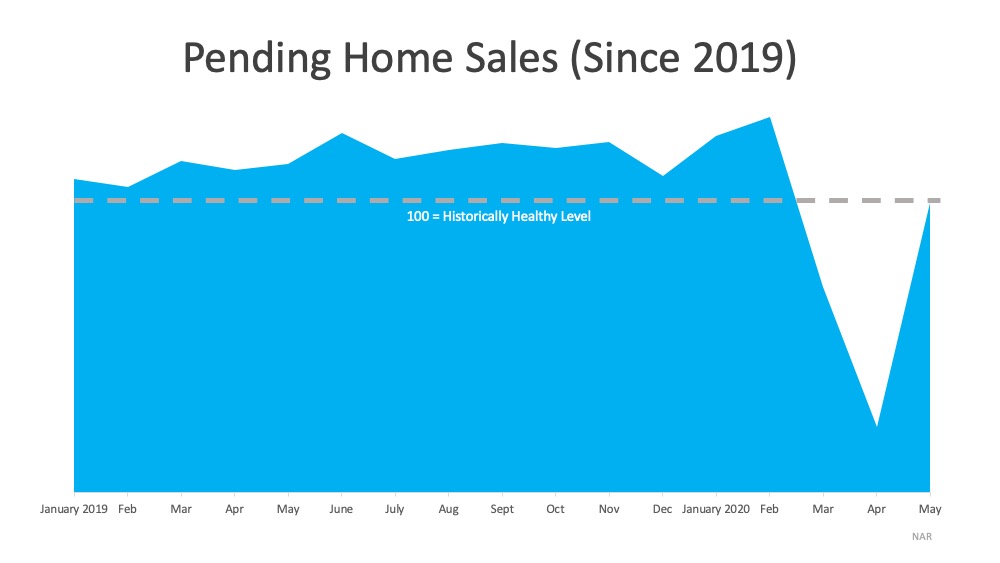

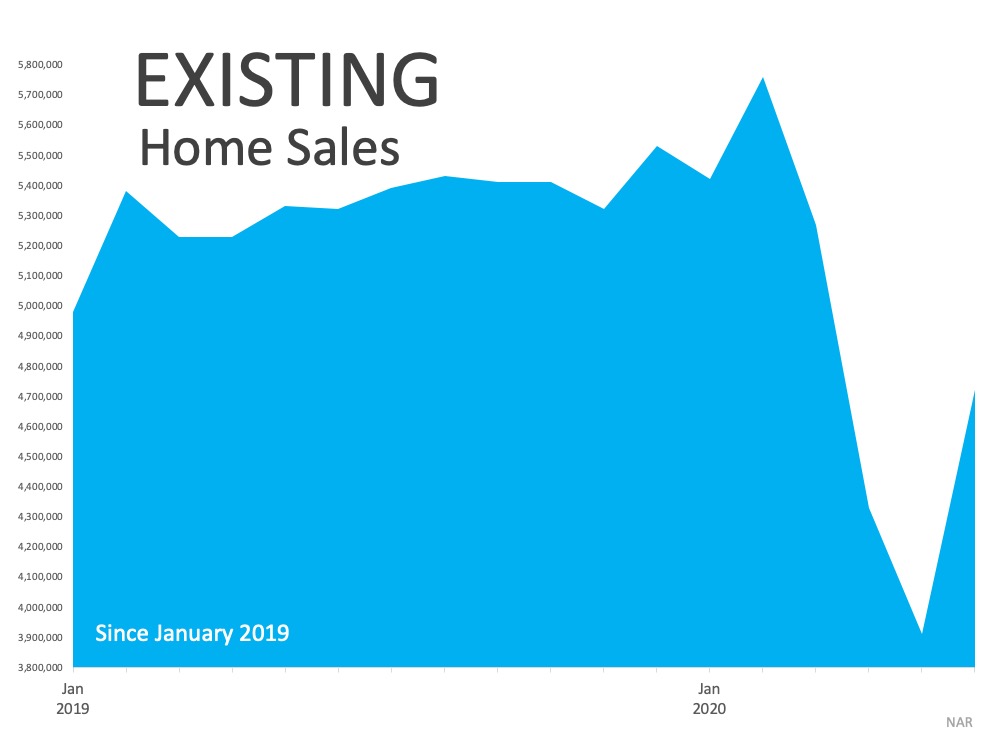

With a worldwide health crisis that drove a pause in the economy this year, the housing market was greatly impacted. Many have been eagerly awaiting some bright signs of a recovery. Based on the latest Existing Home Sales Report from the National Association of Realtors (NAR), June hit a much-anticipated record-setting rebound to ignite that spark.

According to NAR, home sales jumped 20.7% from May to a seasonally-adjusted annual rate of 4.72 million in June:

“Existing-home sales rebounded at a record pace in June, showing strong signs of a market turnaround after three straight months of sales declines caused by the ongoing pandemic…Each of the four major regions achieved month-over-month growth.”

This significant rebound is a major boost for the housing market and the U.S. economy. According to Lawrence Yun, Chief Economist for NAR, the momentum has the potential to continue on, too:

This significant rebound is a major boost for the housing market and the U.S. economy. According to Lawrence Yun, Chief Economist for NAR, the momentum has the potential to continue on, too:

“The sales recovery is strong, as buyers were eager to purchase homes and properties that they had been eyeing during the shutdown…This revitalization looks to be sustainable for many months ahead as long as mortgage rates remain low and job gains continue.”

With mortgage rates hitting an all-time low, dropping below 3% for the first time last week, potential homebuyers are poised to continue taking advantage of this historic opportunity to buy. This fierce competition among buyers is contributing to home price increases as well, as more buyers are finding themselves in bidding wars in this environment. The report also notes:

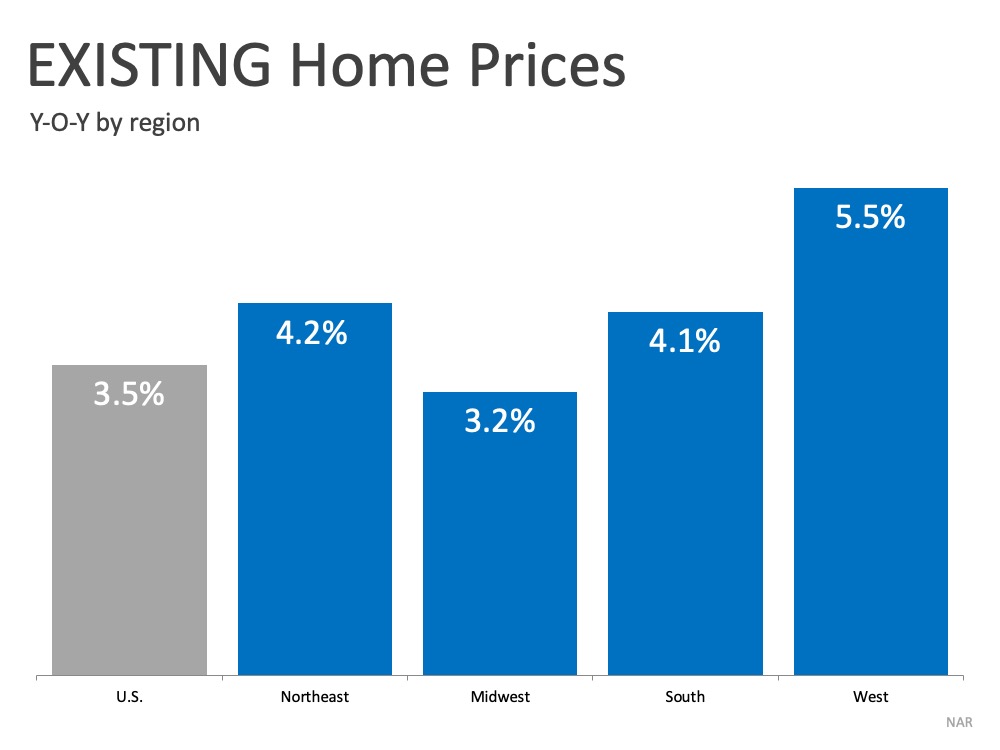

“The median existing-home price for all housing types in June was $295,300, up 3.5% from June 2019 ($285,400), as prices rose in every region. June’s national price increase marks 100 straight months of year-over-year gains.”

The graph below shows home price increases by region, powered by low-interest rates, pent-up demand, and a decline in inventory on the market: Yun also indicates:

Yun also indicates:

“Home prices rose during the lockdown and could rise even further due to heavy buyer competition and a significant shortage of supply.”

Bottom Line

Buyers returning to the market are a great sign for the economy, as housing is still leading the way toward recovery. If you’re ready to buy a home this year, let’s connect to make sure you have the best possible guide with you each step of the way.

What Are Experts Saying about Home Prices?

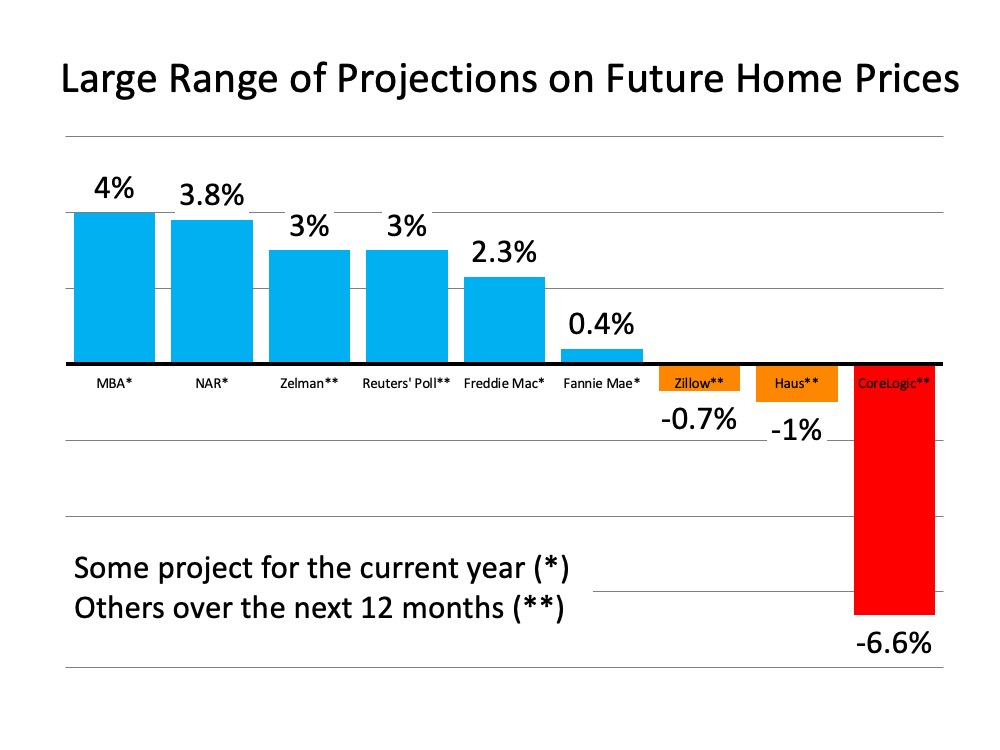

Last week, a very well-respected real estate analytics firm surprised many with their home price projection for the next twelve months. CoreLogic, in their latest Home Price Index, said:

“The economic downturn that started in March 2020 is predicted to cause a 6.6% drop in the HPI by May 2021, which would be the first decrease in annual home prices in over 9 years.”

The forecast was surprising as it was strikingly different than any other projection by major analysts. Six of the other eight forecasts call for appreciation, and the two who project depreciation indicate it will be one percent or less.

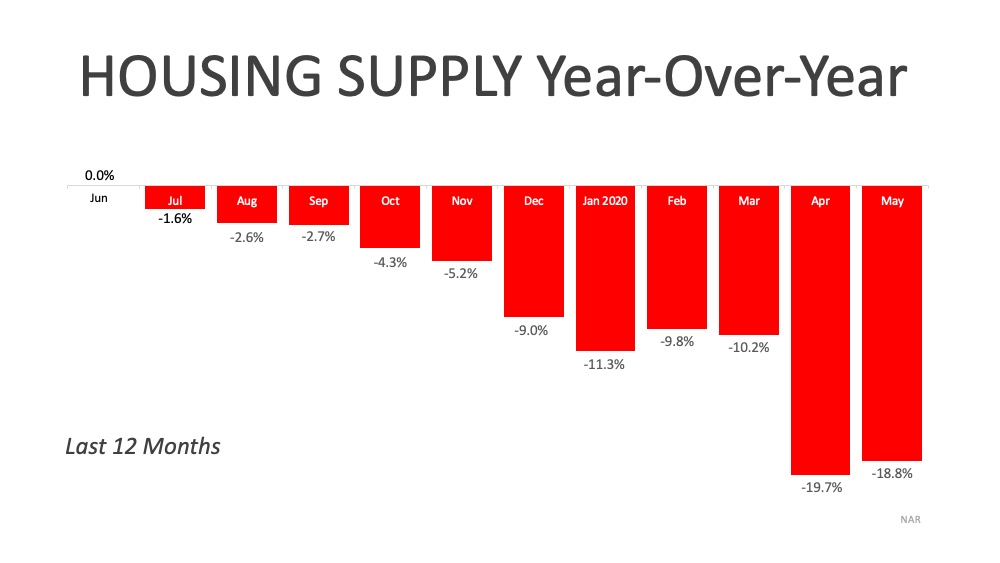

Here is a graph showing all of the projections: There’s a simple formula to determine the future price of any item: calculate the supply of that item in ratio to the demand for that item. In housing right now, demand far exceeds supply. Last week mortgage applications to buy a home were 33% higher than they were at the same time last year. The available inventory of homes for sale is 31% lower than it was last year. Normally, these numbers should call for homes to continue to appreciate.

There’s a simple formula to determine the future price of any item: calculate the supply of that item in ratio to the demand for that item. In housing right now, demand far exceeds supply. Last week mortgage applications to buy a home were 33% higher than they were at the same time last year. The available inventory of homes for sale is 31% lower than it was last year. Normally, these numbers should call for homes to continue to appreciate.

Bottom Line

Because of the uncertainty with the pandemic, any economic prediction is extremely difficult. However, looking at the limited supply of homes for sale and the tremendous demand for housing, it is difficult to disagree with the majority of analysts who are calling for price appreciation.

Latest Unemployment Report: Great News…for the Most Part

The Bureau of Labor Statistics (BLS) released their latest Employment Situation Summary last Thursday, and it again beat analysts’ expectations in a big way. The consensus was for 3,074,000 jobs to be added in June. The report revealed that 4,800,000 jobs were added. The unemployment rate fell to 11.1% from 13.3% last month. Again, excellent news as the unemployment rate fell for the second consecutive month. However, there’s still a long way to go before the economy fully recovers as 17.8 million Americans remain unemployed.

Here are two interesting insights on the report:

What about a supposed misclassification?

The BLS addressed this at length in a blog post last week, and concluded by saying:

“Regardless of the assumptions we might make about misclassification, the trend in the unemployment rate over the period in question is the same; the rate increased in March & April and eased in May.”

They specifically noted the issue in the latest report by explaining that if they adjusted the rate for the potential miscalculation, it would increase from 11.1% to 12.1% (which is lower than the adjusted rate of 16.4% last month). They went on to say:

“However, this represents the upper bound of our estimate of misclassification and probably overstates the size of the misclassification error.”

Does the shutdown of parts of the economy skew the unemployment numbers?

Because the uniqueness of 2020 impacts the employment situation in so many ways, each jobs report is now examined with a microscope to make sure the headlines generated by the report accurately convey what’s happening in the job market.

One such analysis is done by Jed Kolko, Chief Economist at Indeed. He believes the extraordinary number of people in the “temporary” unemployed category confuses the broader issue of how many people have permanently lost their job. He adjusts for this when calculating his “core unemployment rate” (which subtracts temporary layoffs and adds unemployed who didn’t search for a job recently).

The bad news is that his analysis reveals that the number of permanently unemployed is still rising (from 4.6% in April to 5.9% last month). The good news, however, is when you use his methodology to look back at the Great Recession, today’s “core unemployment rate” is significantly lower (5.9% versus 10.5% in April 2010).

Bottom Line

Last week’s jobs report was much better than most expected. However, we should remain cautious in our optimism. As the Wall Street Journal explained in their analysis of the jobs report:

“U.S. job growth surged last month, underscoring the economy’s capacity for a quick rebound if businesses continue to reopen and consumers regain confidence. A recent coronavirus spike, however, could undermine trends captured in the latest jobs report.”

Are New Homes Going to Be Available to Buy This Year?

In today’s economy, everyone seems to be searching for signs that a recovery is coming soon. Many experts agree that it may actually already be in motion or will be starting by the 3rd quarter of this year. With the housing market positioned to lead the way out of this recession, builder confidence might be a bright spark that gets the recovery fire started. The construction of new homes coming right around the corner is a huge part of that effort, and it may drive your opportunity to make a move this year.

According to the National Association of Home Builders (NAHB):

“New home sales jumped in May, as housing demand was supported by low interest rates, a renewed household focus on housing, and rising demand in lower-density markets. Census and HUD estimated new home sales in May at a 676,000 seasonally adjusted annual pace, a 17% gain over April.”

In addition, builder confidence is also rising, opening up opportunities for newly constructed homes in the market. The NAHB also notes:

“In a sign that housing stands poised to lead a post-pandemic economic recovery, builder confidence in the market for newly-built single-family homes jumped 21 points to 58 in June, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI). Any reading above 50 indicates a positive market.”

As noted above, this upward trend is supported by builders reporting an increase in demand for single-family homes in suburban neighborhoods with lower-density populations, a result of the COVID-19 health crisis.

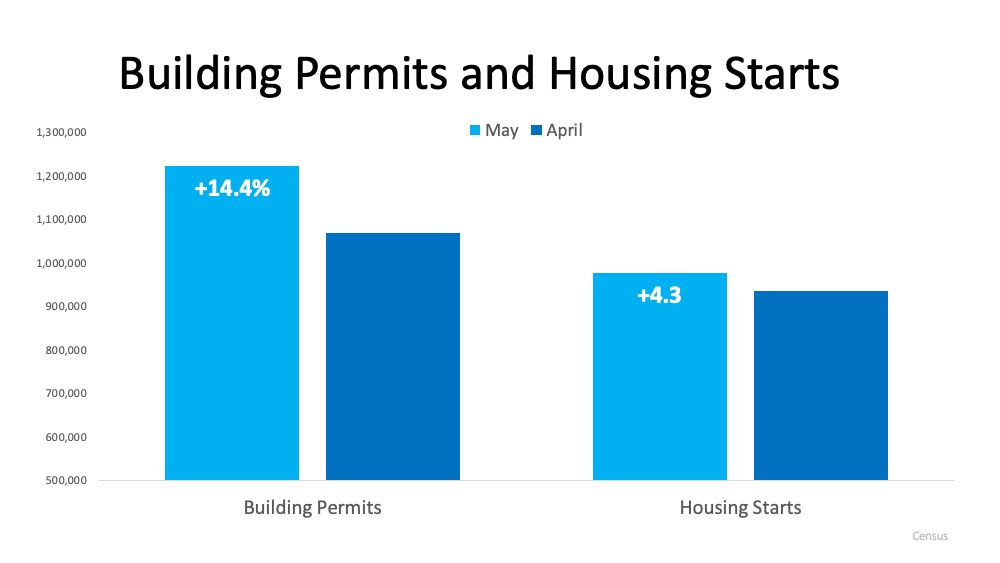

Moreover, the most recent Monthly New Residential Construction Report from the U.S. Census indicates that authorized building permits for new residential construction increased by 14.4% month-over-month from April to May, and housing starts were also up 4.3% over the same time period. (See graph below): Although housing permits and starts are both considerably lower than they were at this time last year, indicating the new construction market is still working on building its way back up, the trends are moving in the right direction when it comes to having an impact on the U.S. economy. They’re also poised to create the much-needed new homes for Americans to purchase in a time when inventory is so scarce.

Although housing permits and starts are both considerably lower than they were at this time last year, indicating the new construction market is still working on building its way back up, the trends are moving in the right direction when it comes to having an impact on the U.S. economy. They’re also poised to create the much-needed new homes for Americans to purchase in a time when inventory is so scarce.

Dean Mon, Chairman of the NAHB notes:

“As the nation reopens, housing is well-positioned to lead the economy forward…Inventory is tight, mortgage applications are increasing, interest rates are low and confidence is rising. And buyer traffic more than doubled in one month even as builders report growing online and phone inquiries stemming from the outbreak.”

The gap between homes to buy and the high demand from purchasers may be narrowed by new construction, and the data shows that these homes are on their way into the housing market.

So, if you’ve debated whether or not to sell your house this year because you’re not sure where to move, a newly-built home – designed to your specific liking – may be your answer.

Bottom Line

With new residential construction right around the corner, you can feel confident about selling your house and having a place to move into. Maybe it’s time to finally design the home you’ve always wanted. Let’s connect today to discuss selling your house while demand from eager buyers is high.

Is the Economic Recovery Already Underway?

The Wall Street Journal just released its latest monthly Survey of Economists. In an article on the findings, they reported:

“The U.S. economy will be in recovery by the third quarter of this year, economists said in a survey that also concluded the labor market will fare better than previously expected following the effects of the coronavirus pandemic.”

Clearly, the latest jobs report from the U.S. Bureau of Labor Statistics confirmed the labor market is outperforming expectations, as it revealed that 2.5 million jobs were added. Directly before the release, experts forecasted that we would lose over 8 million jobs.

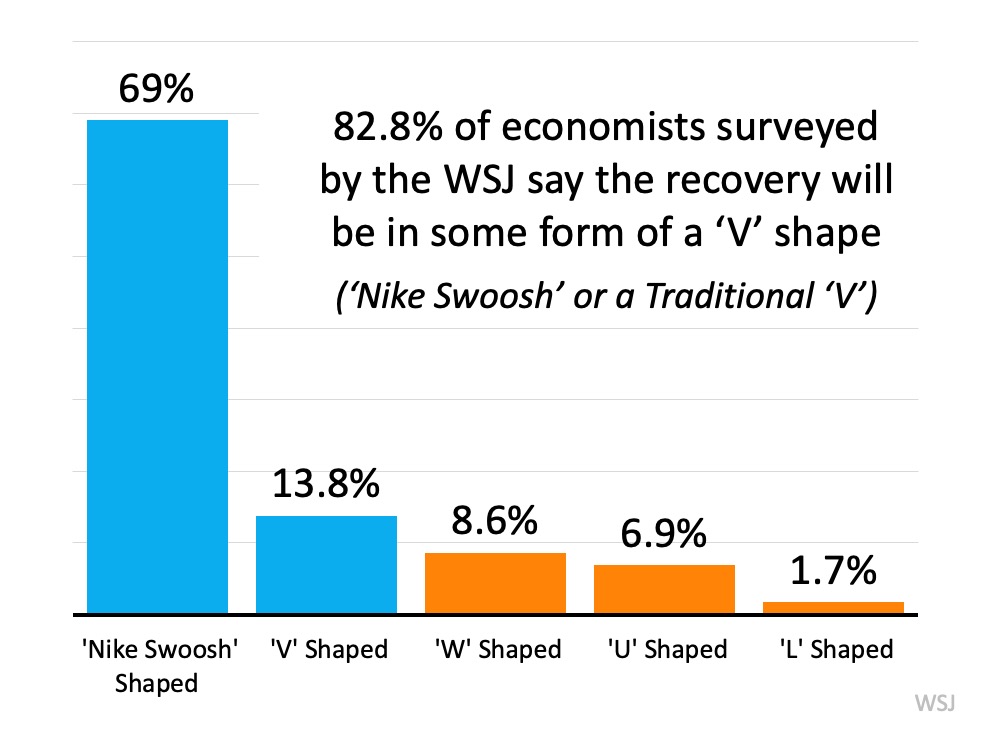

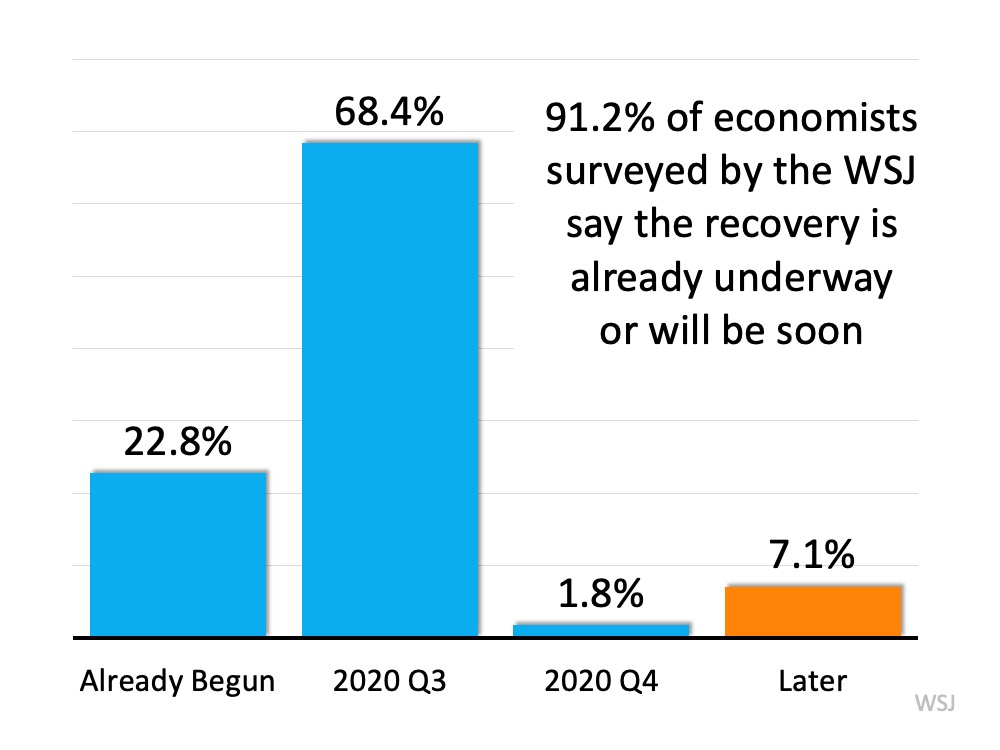

A second revelation indicating the economy is already about to turn around was also somewhat unexpected. More than 9 out of 10 economists surveyed believe the recovery has already begun this quarter or will begin in the third quarter. Here are the results of the survey question asking when the recovery will begin: The survey also asked what type of recovery the economists expect.

The survey also asked what type of recovery the economists expect.

More than 8 out of 10 believe it will be a form of a ‘V’ recovery:

- A true ‘V’ with a sharp drop and a sharp rebound

- A ‘Nike Swoosh’ with a sharp drop and a more gradual recovery, coined after the company’s logo

Some experts, possibly concerned about a second wave of COVID-19, call for a ‘W’ recovery – a double-dip recession.

Others call for a ‘U’ with a prolonged bottom.

A very small percentage project the dreaded ‘L’ recovery, which is no recovery at all for the foreseeable future (think of the Great Recession).

Bottom Line

Though we still have a long and difficult journey ahead, it appears the worst for both the economy and the unemployment situation may be in our rearview mirror.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

![2020 Homebuyer Preferences [INFOGRAPHIC] | MyKCM](https://desireestanley.com/files/2020/08/20200807-MEM-1046x1789.jpg)

![2020 Homebuyer Preferences [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/08/06112131/20200807-MEM-1046x1789.jpg)