Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

Two Important Impacts of Home Equity

Equity continues to rise, helping American homeowners secure a much more stable financial future. According to the most recent data from CoreLogic, the average homeowner gained $9,800 in equity over the past year. In addition, experts project 2020 home prices to continue rising. With prices going up, equity gains will also keep accelerating. Black Knight just reported:

“The annual percent change in the overall median existing single-family-home price has skyrocketed in the past several months, with recent numbers at three to five times higher than rates seen in the past several years.”

Jeff Tucker, Senior Economist at Zillow, just qualified recent price increases as “jaw-dropping” and “within a hair’s breadth of double-digit year-over-year appreciation.”

Knowing equity will help enable many homeowners to better survive the economic distress caused by the ongoing pandemic, it’s important to break down two key homeowner benefits of increasing equity.

1. Equity Increases a Homeowner’s Options to Buy a New Home

Aside from the financial damage of the last seven months, there has also been a tremendous emotional toll on many people. Shelter-in-place mandates, quarantine requirements, and virtual schooling have all made us re-evaluate the must-have requirements a home should deliver. Having equity in your current house gives you a better opportunity to move-up or build your perfect home from scratch.

Mark Fleming, Chief Economist at First American, recently explained:

“As homeowners gain equity in their homes, they are more likely to consider using that equity to purchase a larger or more attractive home – the wealth effect of rising equity.”

If you need to make a move, the equity in your current home can help make that possible – right now.

2. Equity Enables Homeowners to Help Future Generations

An increase in home equity grows overall wealth, which can transfer to future generations. The Federal Reserve, in an addendum to their recent Survey of Consumer Finances, explains:

“There are numerous ways families can transmit wealth and resources across generations. Families can directly transfer their wealth to the next generation in the form of a bequest. They can also provide the next generation with inter vivos transfers (gifts), for example, providing down payment support to enable a home purchase or a substantial wedding gift.”

The Federal Reserve also explains another way wealth (including the additional net worth generated by an increase in home equity) can benefit future generations:

“In addition to direct transfers or gifts, families can make investments in their children that indirectly increase their wealth. For example, families can invest in their children’s educational success by paying for college or private schools, which can in turn increase their children’s ability to accumulate wealth.”

Bottom Line

Equity can help a homeowner grow their confidence in a more stable financial future. It provides near-term move-up options and creates a positive impact for future generations. In many cases, the largest single investment a person has is their home. As that investment appreciates in value, financial options increase too.

Home Values Projected to Keep Rising

As we enter the final months of 2020 and continue to work through the challenges this year has brought, some of us wonder what impact continued economic uncertainty could have on home prices. Looking at the big picture, the rules of supply and demand will give us the clearest idea of what is to come.

Due to the undersupply of homes on the market today, there’s upward pressure on prices. Consider simple economics: when there is a high demand for an item and a low supply of it, consumers are willing to pay more for that item. That’s what’s happening in today’s real estate market. The housing supply shortage is also resulting in bidding wars, which will also drive price points higher in the home sale process.

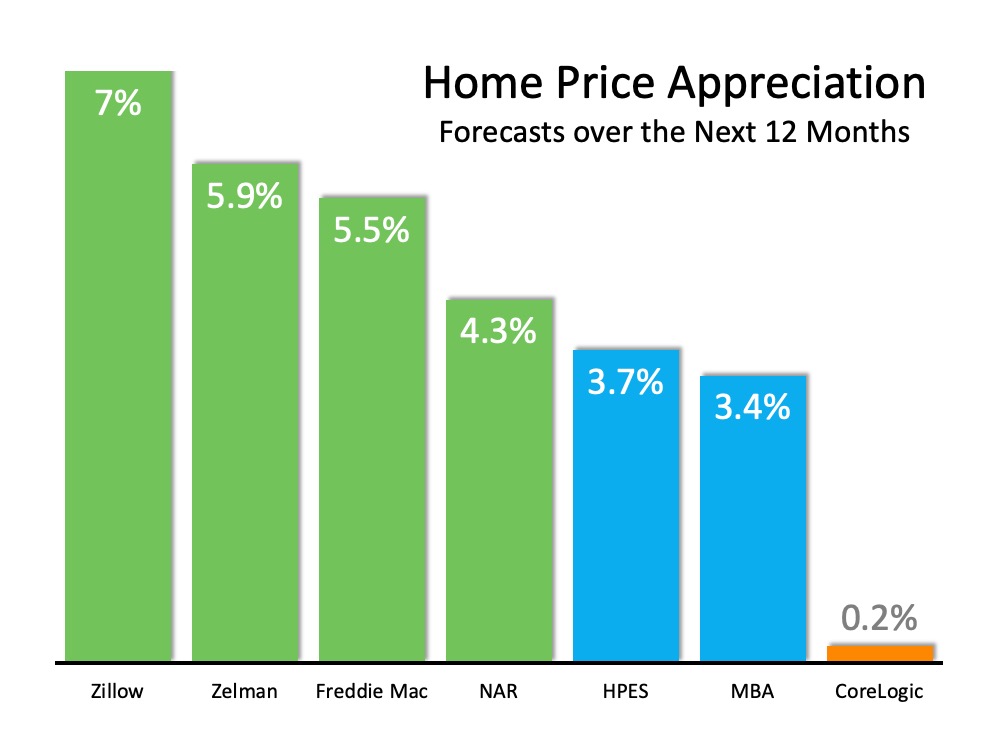

There’s no evidence that buyer demand will wane. As a result, experts project price appreciation will continue over the next twelve months. Here’s a graph of the major forecasts released in the last 60 days:

I hear many foreclosures might be coming to the market soon. Won’t that drive prices down?

Some are concerned that homeowners who entered a mortgage forbearance plan might face foreclosure once their plan ends. However, when you analyze the data on those in forbearance, it’s clear the actual level of risk is quite low.

Ivy Zelman, CEO of Zelman & Associates and a highly-regarded expert in housing and housing-related industries, was very firm in a podcast last week:

“The likelihood of us having a foreclosure crisis again is about zero percent.”

With demand high, supply low, and little risk of a foreclosure crisis, home prices will continue to appreciate.

Bottom Line

Originally, many thought home prices would depreciate in 2020 due to the economic slowdown from the coronavirus. Instead, prices appreciated substantially. Over the next year, we will likely see home values rise even higher given the continued lack of inventory of homes for sale.

Why Today’s Options Will Save Homeowners from Foreclosure

Many housing experts originally voiced concern that the mortgage forbearance program (which allows families impacted financially by COVID to delay mortgage payments to a later date) could lead to an increase in foreclosures when forbearances end.

Some originally forecasted that up to 30% of homeowners would choose to enter forbearance. Less than 10% actually did, and that percentage has been dropping steadily. Black Knight recently reported that the national forbearance rate has decreased to 5.6%, with active forbearances falling below 3 million for the first time since mid-April.

Many of those still in forbearance are actually making timely payments. Christopher Maloney of Bloomberg Wealth recently explained:

“Almost one quarter of all homeowners who have demanded forbearance are still current on their mortgages…according to the latest MBA data.”

However, since over two million homeowners are still in forbearance, some experts are concerned that this might lead to another wave of foreclosures like we saw a little over a decade ago during the Great Recession. Here is why this time is different.

There Will Be Very Few Strategic Defaults

During the housing crash twelve years ago, many homeowners owned a house that was worth less than the mortgage they had on that home (called negative equity or being underwater). Many decided they would just stop making their payments and walk away from the house, which then resulted in the bank foreclosing on the property. These foreclosures were known as strategic defaults. Today, the vast majority of homeowners have significant equity in their homes. This dramatically decreases the possibility of strategic defaults.

Aspen Grove Solutions, a business consulting firm, recently addressed the issue in a study titled Creating Positive Forbearance Outcomes:

“Unlike in 2008, strategic defaults have not emerged as a serious problem and seems unlikely to emerge given stronger expectations for property price increases, a record low inventory of homes, and stable residential underwriting standards leading up to the crisis which has reduced the number of owners who are underwater.”

There Are Other Options That Were Not Available the Last Time

A decade ago, there wasn’t a forbearance option, and most banks did not put in other programs, like modifications and short sales, until very late in the crisis.

Today, homeowners have several options because banks understand the three fundamental differences in today’s real estate market as compared to 2008:

1. Most homeowners have substantial equity in their homes.

2. The real estate market has a shortage of listings for sale. In 2008, homes for sale flooded the market.

3. Prices are appreciating. In 2008, prices were depreciating dramatically.

These differences allow banks to feel comfortable giving options to homeowners when exiting forbearance. Aspen Grove broke down some of these options in the study mentioned above:

- Refinance Repay: Capitalize forbearance amount – For borrowers who have strong credit, have good or improved equity in their homes, possibly had a higher interest rate on their original loan, have steady employment/no significant wage loss, and income.

- Repayment Plan: Pay it back in higher monthly payments – For people who cannot reinstate using savings, but have increased monthly income, and do not want to use a deferral program.

- Deferral Program: Shift payments to the end of the loan term – For borrowers who lost income temporarily and regained most or all of their income but are not in a position to refinance due to credit score, home equity, low total loan value relative to closing costs, or simple apathy.

- Modification: Flex modification or other mod – For households that permanently lost 20% to 30% of their income, but not all of their income, and want to remain in their home.

Each one of these programs enables the homeowner to remain in the home.

What about Those Who Don’t Qualify for These Programs?

Homeowners who can’t catch up on past payments and don’t qualify for the programs mentioned have two options: sell the house or let it go to foreclosure. Some experts think most will be forced to take the foreclosure route. However, an examination of the data shows that probably won’t be the case.

A decade ago, homeowners had very little equity in their homes. Therefore, selling was not an option unless they were willing to tap into limited savings to cover the cost of selling, like real estate commission, closing costs, and attorney fees. Without any other option, many just decided to stay in the house until they were served a foreclosure notice.

As mentioned above, today is different. Most homeowners now have a large amount of equity in their homes. They will most likely decide to sell their home and take that equity rather than wait for the bank to foreclose.

In a separate report, Black Knight highlighted this issue:

“In total, an estimated 172K loans are in forbearance, have missed three or more payments under their plans and have less than 10% equity in their homes.”

In other words, of the millions currently in a forbearance plan, there are few that likely will become a foreclosure.

Bottom Line

Some analysts are talking about future foreclosures reaching 500,000 to over 1 million. With the options today’s homeowners have, that doesn’t seem likely.

Americans Are Gaining Confidence in the Economy

The September Jobs Report issued by the Bureau of Labor Statistics reported that the unemployment rate dropped to 7.9%. Though that percentage is well below what experts projected earlier this year, it still means millions of people are without work. There’s no way to minimize the tremendous impact this pandemic-induced recession continues to have on many Americans.

However, the latest Home Purchase Sentiment Index from Fannie Mae shows how more and more Americans believe the worst is behind us, and their personal employment situation is good. The index revealed:

“The percentage of respondents who say they are not concerned about losing their job in the next 12 months increased from 78% to 83%, while the percentage who say they are concerned decreased from 22% to 16%. As a result, the net share of Americans who say they are not concerned about losing their job increased 11 percentage points.”

Americans Are Game-Changers Too

Americans are naturally optimistic and have always responded to challenges with both resiliency and resourcefulness. Today is no different. As an example, the Wall Street Journal (WSJ) just reported:

“Americans are starting new businesses at the fastest rate in more than a decade, according to government data, seizing on pent-up demand and new opportunities after the pandemic shut down and reshaped the economy.”

Why would someone start a business in the middle of an economic crisis? The WSJ explains:

“The jump may be one sign that the pandemic is speeding up ‘creative destruction,’ the concept…to describe how new, innovative businesses often displace older, less-efficient ones, buoying long-term prosperity.”

The WSJ also notes that these new businesses will have a positive impact on the overall employment situation, as new businesses “are a critical engine of job creation. Startups have historically accounted for around one-fifth of job creation.”

Bottom Line

For the millions of Americans still unemployed, we hope for a quick return to the workforce. We should, however, realize that over 90% of people are still employed, and some are venturing into new business start-ups. Perhaps the next big game-changing company is right around the corner.

Real Estate Continues to Show Unprecedented Strength This Year

The 2020 housing market has surpassed all expectations and continues to drive the nation’s economic recovery. The question is, will this positive trend continue throughout the rest of the year, especially given the uncertainty around the current health crisis, the upcoming election, and more?

Here’s a look at what several industry-leading experts have to say.

Lawrence Yun, Chief Economist, National Association of Realtors

“Home sales continue to amaze, and there are plenty of buyers in the pipeline ready to enter the market…Further gains in sales are likely for the remainder of the year, with mortgage rates hovering around 3% and with continued job recovery.”

Frank Martell, President, and CEO, CoreLogic

“Homeowners’ balance sheets continue to be bolstered by home price appreciation, which in turn mitigated foreclosure pressures…Although the exact contours of the economic recovery remain uncertain, we expect current equity gains, fueled by strong demand for available homes, will continue to support homeowners in the near term.”

“Zillow’s predictions for seasonally adjusted home prices and pending sales are more optimistic than previous forecasts because sales and prices have stayed strong through the summer months amid increasingly short inventory and high demand.

The pandemic also pushed the buying season further back in the year, adding to recent sales. Future sources of uncertainty including lapsed fiscal relief, the long-term fate of policies supporting the rental and mortgage market, and virus-specific factors, were incorporated into this outlook.”

Bottom Line

Many economists are in unison, indicating the housing market will continue to fuel the economy through the end of the year, maintaining this unprecedented strength.

Should You Buy a Retirement Home Sooner Rather than Later?

Every day in the U.S., roughly 10,000 people turn 65. Prior to the health crisis that swept the nation in 2020, most people had to wait until they retired to make a move to the beach, the golf course, or the senior living community they were looking to settle into for their later years in life. This year, however, the game changed.

Many of today’s workers who are nearing the end of their professional careers, but maybe aren’t quite ready to retire, have a new choice to make: should I move before I retire? If the sand and sun are calling your name and you have the opportunity to work remotely for the foreseeable future, now may be a great time to purchase that beach bungalow you’ve always dreamed of or the single-story home in the sprawling countryside that might be a little further out of town. Whether it’s a second home or a future retirement home, spending the next few years in a place that truly makes you smile every day might be the best way to round out a long and meaningful career.

Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

“The pandemic was unexpected, working from home was unexpected, but nonetheless many companies realized that workers can be just as productive working from home…We may begin to see a boost in people buying retirement homes before their retirement.”

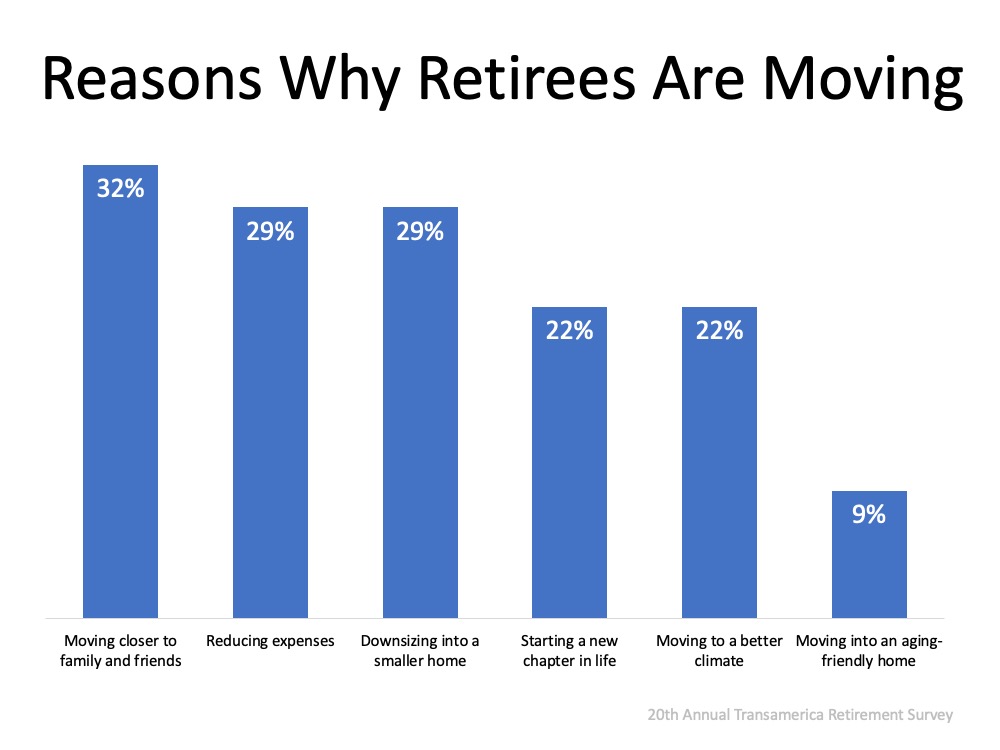

According to the 20th Annual Transamerica Retirement Survey, 3 out of 4 retirees (75%) own their homes, and only 23% have mortgage debt (including any equity loans or lines of credit). Since entering retirement, almost 4 in 10 retirees (38%) have moved into a new home. They’re making a profit by selling their current homes in today’s low inventory market and using their equity to purchase their future retirement homes. It’s a win-win.

Why These Homeowners Are Making Moves Now

The health crisis this year made us all more aware of the importance of our family and friends, and many of us have not seen our extended families since the pandemic started. It’s no surprise, therefore, to see in the same report that 32% of those surveyed cited the top reason they’re making a move is that they want to be closer to family and friends (See graph below): The survey also revealed that 73% percent of retirees currently live in single-family homes. With the overall number of homes for sale today hitting a historic low, and with the buyer demand for single-family homes skyrocketing, there’s never been a more ideal time to sell a single-family home and make a move toward retirement. Today’s market has the perfect combination of driving forces to make selling optimal, especially while buyers are looking to take advantage of low interest rates.

The survey also revealed that 73% percent of retirees currently live in single-family homes. With the overall number of homes for sale today hitting a historic low, and with the buyer demand for single-family homes skyrocketing, there’s never been a more ideal time to sell a single-family home and make a move toward retirement. Today’s market has the perfect combination of driving forces to make selling optimal, especially while buyers are looking to take advantage of low interest rates.

If you’re one of the 73% of retirees with a single-family home and want to move closer to your family, now is the time to put your house on the market. With the pace homes are selling today, you could essentially wrap up your move – start to finish – before the holidays.

Bottom Line

Whether you’re looking to fully retire or to buy a second home with the intent to use it as your retirement home in the future, the 2020 fall housing market may very well work in your favor. Let’s connect today to discuss your options in our local market.

Where Are Home Values Headed Over the Next 12 Months?

As shelter-in-place orders were implemented earlier this year, many questioned what the shutdown would mean to the real estate market. Specifically, there was concern about home values. After years of rising home prices, would 2020 be the year this appreciation trend would come to a screeching halt? Even worse, would home values begin to depreciate?

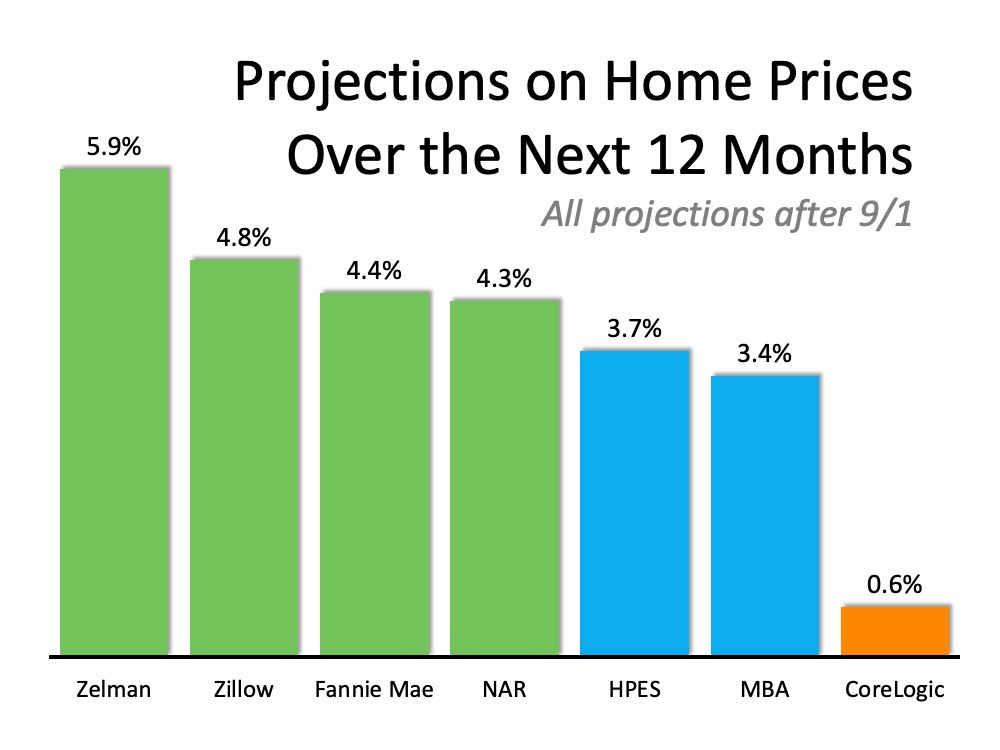

Original forecasts modeled this uncertainty, and they ranged anywhere from home values gaining 3% (Zelman & Associates) to home values depreciating by more than 6% (CoreLogic).

However, as the year unfolded, it became clear that there would be little negative impact on the housing market. As Mark Fleming, Chief Economist at First American, recently revealed:

“The only major industry to display immunity to the economic impacts of the coronavirus is the housing market.”

Have prices continued to appreciate so far this year?

Last week, the Federal Housing Finance Agency (FHFA) released its latest Home Price Index. The report showed home prices actually rose 6.5% from the same time last year. FHFA also noted that price appreciation accelerated to record levels over the summer months:

“Between May & July 2020, national prices increased by over 2%, which represents the largest two-month price increase observed since the start of the index in 1991.”

What are the experts forecasting for home prices going forward?

Below is a graph of home price projections for the next year. Since the market has changed dramatically over the last few months, this graph shows forecasts that have been published since September 1st.

Bottom Line

The numbers show that home values have weathered the storm of the pandemic. Let’s connect if you want to know what your home is currently worth and how that may enable you to make a move this year.

Housing Market on Track to Beat Last Year’s Success

Back in March, as the nation’s economy was shut down because of the coronavirus, many were predicting the real estate market would face a major collapse. Some forecasts called for a 15-20% decline in transactions. However, six months later, it seems as though the housing market has fully recovered.

Mark Fleming, Chief Economist at First American, announced last week:

“Since hitting a low point during the initial stages of the pandemic, the only major industry to display immunity to the economic impacts of the coronavirus is the housing market. Housing has experienced a strong V-shaped recovery and is now exceeding pre-pandemic levels.”

The Economic & Strategic Research Group at Fannie Mae upgraded its forecast for home sales last week:

“Housing data over the past month continued to show a strong V-shape rebound, helping drive the broader economy. Existing home sales jumped to a pace not seen since 2006…We have substantially upgraded our forecasts for both new and existing home sales. For 2020, total home sales are now expected to be 1.3% higher than in 2019.”

The National Association of Realtors (NAR) agrees. In their last Pending Sales Report, NAR shared projections from Chief Economist Lawrence Yun:

“Yun forecasts existing-home sales to ramp up to 5.8 million in the second half. That expected rebound would bring the full-year level of existing-home sales to 5.4 million, a 1.1% gain compared to 2019.”

Yun’s forecast for 2021 was even more optimistic, stating, “Home sales will ramp up again next year, increasing between 8% – 12%.”

Bottom Line

The housing market has come roaring back and looks as though it may even surpass last year’s success.

Frank Martell, President and CEO of CoreLogic, hit the nail on the head when he said, “On an aggregated level, the housing economy remains rock solid despite the shock and awe of the pandemic.”

Is the Economic Recovery Beating All Projections?

Earlier this year, many economists and market analysts were predicting an apocalyptic financial downturn that would potentially rattle the U.S. economy for years to come. They immediately started to compare it to the Great Depression of a century ago. Six months later, the economy is still trying to stabilize, but it is evident that the country will not face the total devastation projected by some. As we continue to battle the pandemic, forecasts are now being revised upward. The Wall Street Journal (WSJ) just reported:

“The U.S. economy and labor market are recovering from the coronavirus-related downturn more quickly than previously expected, economists said in a monthly survey.

Business and academic economists polled by The Wall Street Journal expect gross domestic product to increase at an annualized rate of 23.9% in the third quarter. That is up sharply from an expectation of an 18.3% growth rate in the previous survey.”

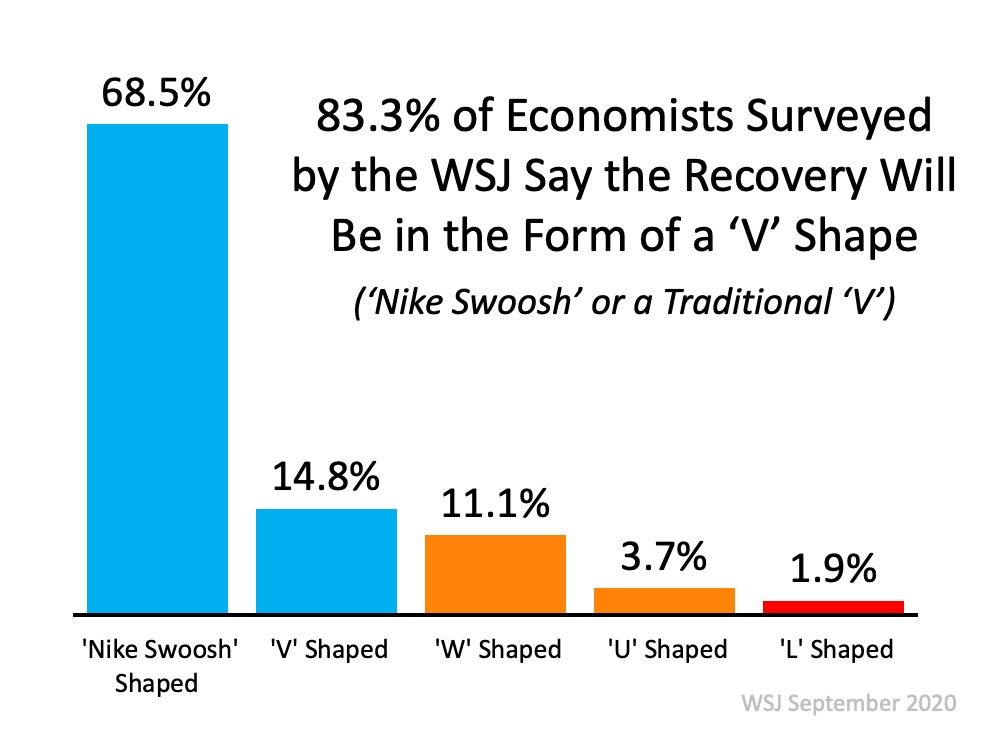

What Shape Will the Recovery Take?

Economists have historically cast economic recoveries in the form of one of four letters – V, U, W, or L.

A V-shaped recovery is all about the speed of the recovery. This quick recovery is treated as the best-case scenario for any economy that enters a recession. NOTE: Economists are now also using a new term for this type of recovery called the “Nike Swoosh.” It is a form of the V-shape that may take several months to recover, thus resembling the Nike Swoosh logo.

A U-shaped recovery is when the economy experiences a sharp fall into a recession, like the V-shaped scenario. In this case, however, the economy remains depressed for a longer period of time, possibly several years, before growth starts to pick back up again.

A W-shaped recovery can look like an economy is undergoing a V-shaped recovery until it plunges into a second, often smaller, contraction before fully recovering to pre-recession levels.

An L-shaped recovery is seen as the worst-case scenario. Although the economy returns to growth, it is at a much lower base than pre-recession levels, which means it takes significantly longer to fully recover.

Many experts predicted that this would be a dreaded L-shaped recovery, like the 2008 recession that followed the housing market collapse. Fortunately, that does not seem to be the case.

The same WSJ survey mentioned above asked the economists which letter this recovery will most resemble. Here are the results:

What About the Unemployment Numbers?

It’s difficult to speak positively about a jobs report that shows millions of Americans are still out of work. However, when we compare it to many forecasts from earlier this year, the numbers are much better than most experts expected. There was talk of numbers that would rival the Great Depression when the nation suffered through four consecutive years of unemployment over 20%.

The first report after the 2020 shutdown did show a 14.7% unemployment rate, but much to the surprise of many analysts, the rate has decreased each of the last three months and is now in the single digits (8.4%).

Economist Jason Furman, Professor at Harvard University‘s John F. Kennedy School of Government and the Chair of the Council of Economic Advisers during the previous administration, recently put it into context:

“An unemployment rate of 8.4% is much lower than most anyone would have thought it a few months ago. It is still a bad recession but not a historically unprecedented event or one we need to go back to the Great Depression for comparison.”

The economists surveyed by the WSJ also forecasted unemployment rates going forward:

- 2021: 6.3%

- 2022: 5.2%

- 2023: 4.9%

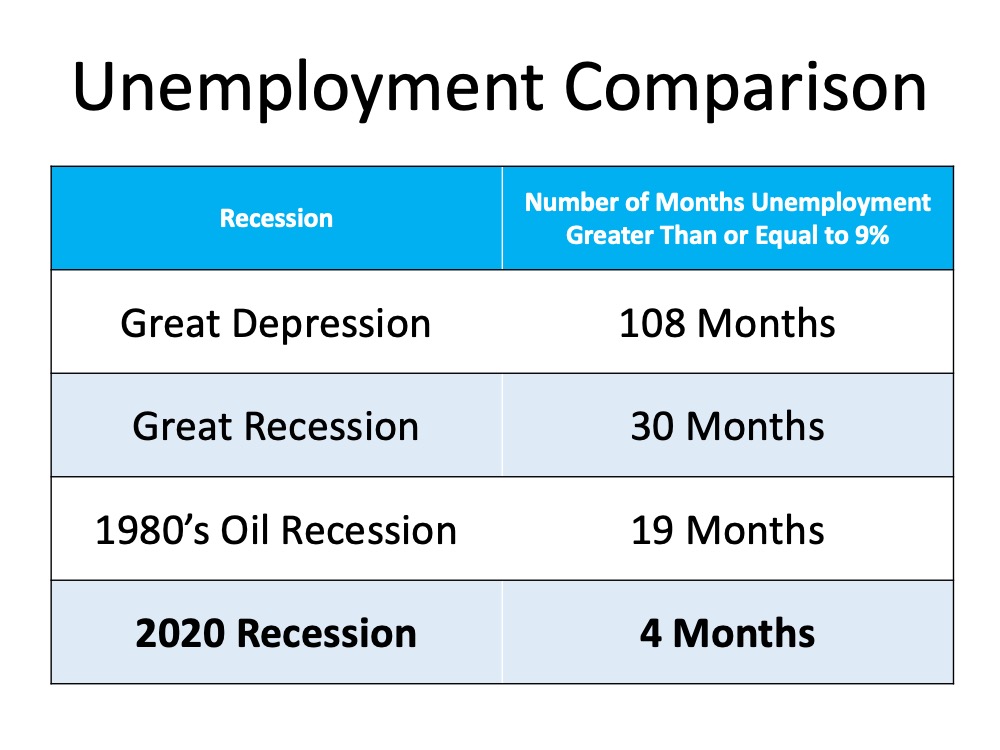

The following table shows how the current employment situation compares to other major disruptions in our economy:

Bottom Line

The economic recovery still has a long way to go. So far, we are doing much better than most thought would be possible.

How Low Inventory May Impact the Housing Market This Fall

Real estate continues to be called the ‘bright spot’ in the current economy, but there’s one thing that may hold the housing market back from achieving its full potential this year: the lack of homes for sale.

Buyers are actively searching for and purchasing homes, looking to capitalize on today’s historically low-interest rates, but there just aren’t enough houses for sale to meet that growing need. Sam Khater, Chief Economist at Freddie Mac, explains:

“Mortgage rates have hit another record low due to a late summer slowdown in the economic recovery…These low rates have ignited robust purchase demand activity…However, heading into the fall it will be difficult to sustain the growth momentum in purchases because the lack of supply is already exhibiting a constraint on sales activity.”

According to the National Association of Realtors (NAR), right now, unsold inventory sits at a 3.1-month supply at the current sales pace. To have a balanced market where there are enough homes for sale to meet buyer demand, the market needs inventory for 6 months. Today, we’re nowhere near where that number needs to be. If the trend continues, it will get even harder to find homes to purchase this fall, and that may slow down potential buyers. Danielle Hale, Chief Economist at realtor.com, notes:

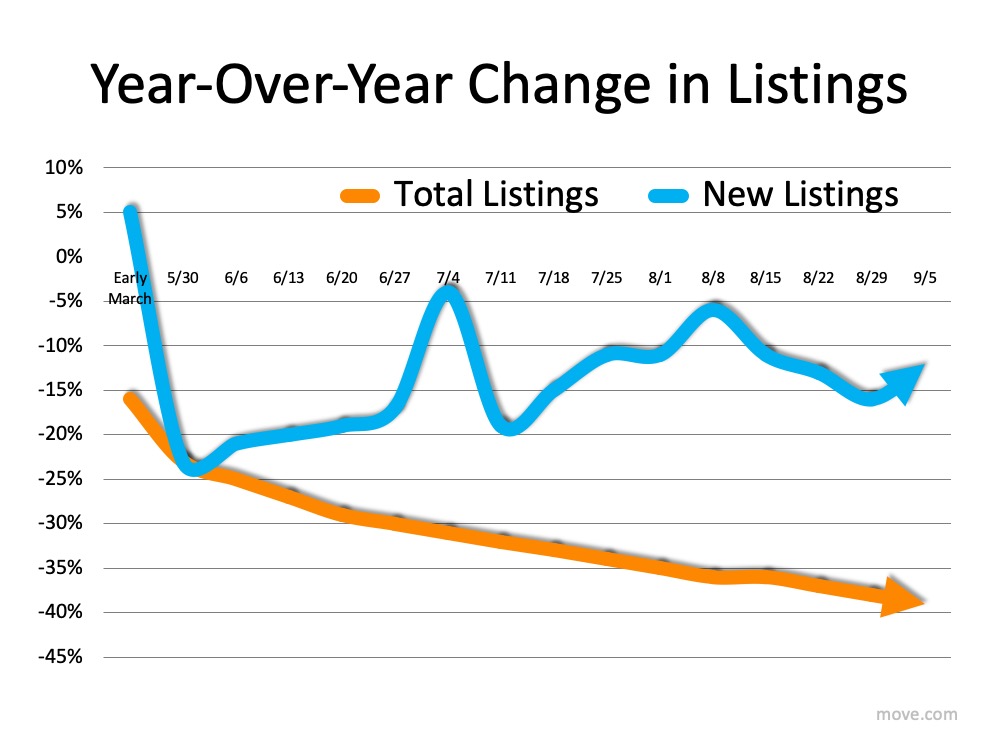

“The overall lack of sustained new listings growth could put a dent in fall home sales despite high interest from home shoppers, because new listings are key to home sales.”

The realtor.com Weekly Recovery Report keeps an eye on the number of listings coming into the market (houses available for sale) and the total number of listings staying in the market compared to the previous year (See graph below): Buyers are clearly scooping up homes faster than they’re being put up for sale. The number of total listings (the orange line) continues to decline even as new listings (the blue line) are coming to the market. Why? Javier Vivas, Director of Economic Research at realtor.com, notes:

Buyers are clearly scooping up homes faster than they’re being put up for sale. The number of total listings (the orange line) continues to decline even as new listings (the blue line) are coming to the market. Why? Javier Vivas, Director of Economic Research at realtor.com, notes:

“The post-pandemic period has brought a record number of homebuyers back into the market, but it’s also failed to bring a consistent number of sellers back. Homes are selling faster, and sales are still on an upward trend, but rapidly disappearing inventory also means more home shoppers are being priced out. If we don’t see material improvement to supply in the next few weeks, we could see the number of transactions begin to dwindle again even as the lineup of buyers continues to grow.”

Does this mean it’s a good time to sell?

Yes. If you’re thinking about selling your house, this fall is a great time to make it happen. There are plenty of buyers looking for homes to purchase because they want to take advantage of low-interest rates. Realtors are also reporting an average of 3 offers per house and an increase in bidding wars, meaning the demand is there and the opportunity to sell for the most favorable terms is in your favor as a seller.

Bottom Line

If you’re considering selling your house, this is the perfect time to connect so we can talk about how you can benefit from the market trends in our local area.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link