The Latest Unemployment Rate Fell to 8.4%

Last Friday, the Bureau for Labor Statistics released their Employment Report for August 2020. The big surprise was that the unemployment rate fell to 8.4%, a full percent lower than what many analysts had forecasted earlier in the week. Though it is tough to look at this as great news when millions of Americans are still without work, the number of unemployed is currently much lower than most experts had projected it would be just a few months ago.

Not Like the Great Depression or even the Great Recession

Jason Furman, Professor of Practice at Harvard explained:

“An unemployment rate of 8.4% is much lower than most anyone would have thought it a few months ago. It is still a bad recession but not a historically unprecedented event or one we need to go back to the Great Depression for comparison.”

During the Great Depression, the unemployment rate was over 20% for four consecutive years (1932 – 1935). This April, the rate jumped to 14.7%, but has fallen each month since.

During and after the Great Recession (2007-2009), the unemployment rate was at 9% or greater for thirty consecutive months (April 2009 – October 2011). Most economists believe the current rate will continue to fall monthly as the economy regains its strength.

What Happens Going Forward?

The outcome will be determined by how quickly we can contain the virus. In their last Economic Forecasting Survey, the Wall Street Journal reported the economists surveyed believe the annual unemployment rates will be 6.6% in 2021 and 5.5% in 2022. Though that will still be greater than the 3.5% rate that we saw earlier this year, it is lower than the annual rate reported in 2011 (8.5%), 2012 (7.9%), and 2013 (6.7%).

Bottom Line

There are still millions of Americans struggling through this economic downturn. There is, however, a light at the end of the tunnel. The unemployment situation did not get as bad as many had predicted, and the recovery is taking place faster than most thought would happen.

Home buyer Demand Is Far Above Last Year’s Pace

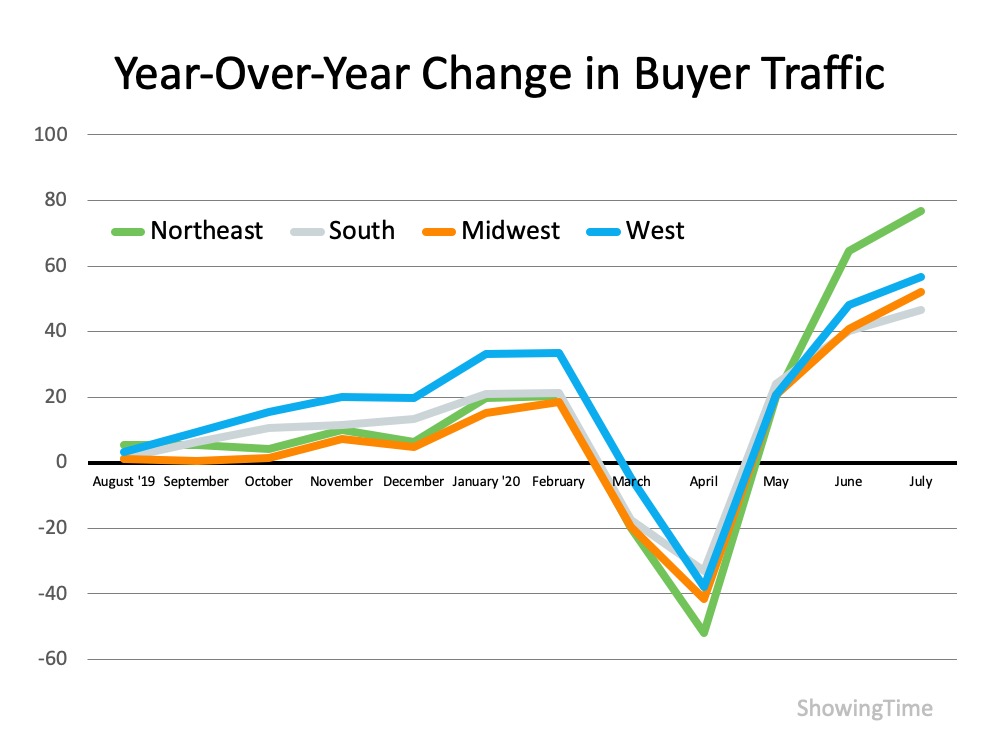

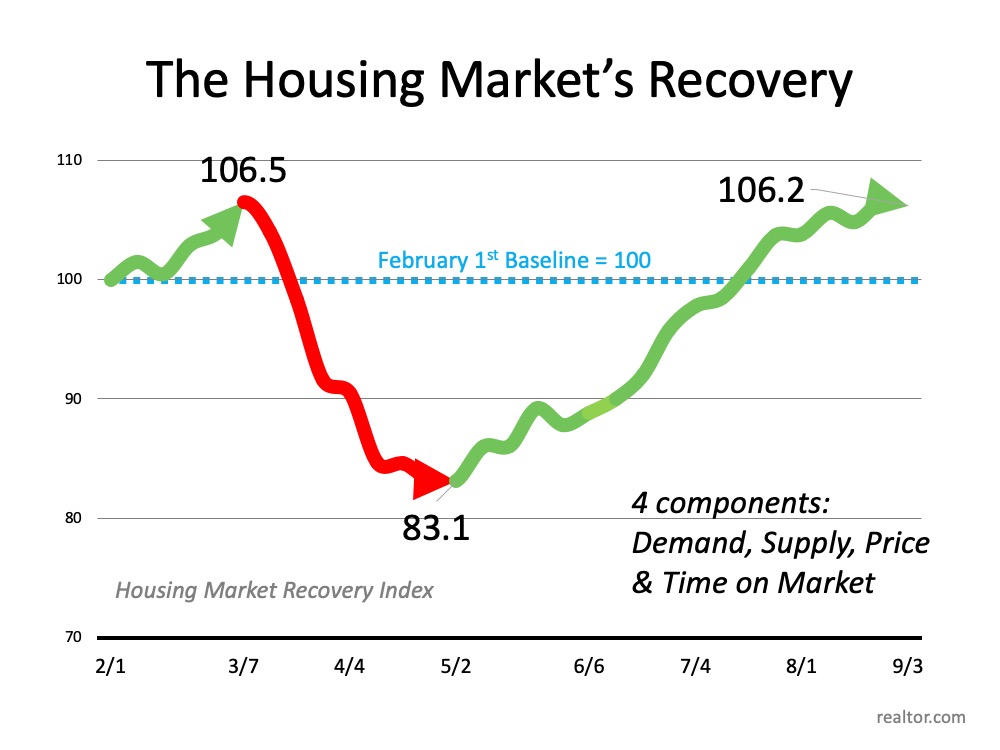

Homebuying has been on the rise over the past few months, with record-breaking sales powering through the market in June and July. Buyers are actively purchasing homes, and the momentum is continuing into the fall. It is, however, becoming harder for buyers to find homes to purchase. If you’ve been thinking about selling your house, the coming weeks might just be the timing you’ve been waiting for.

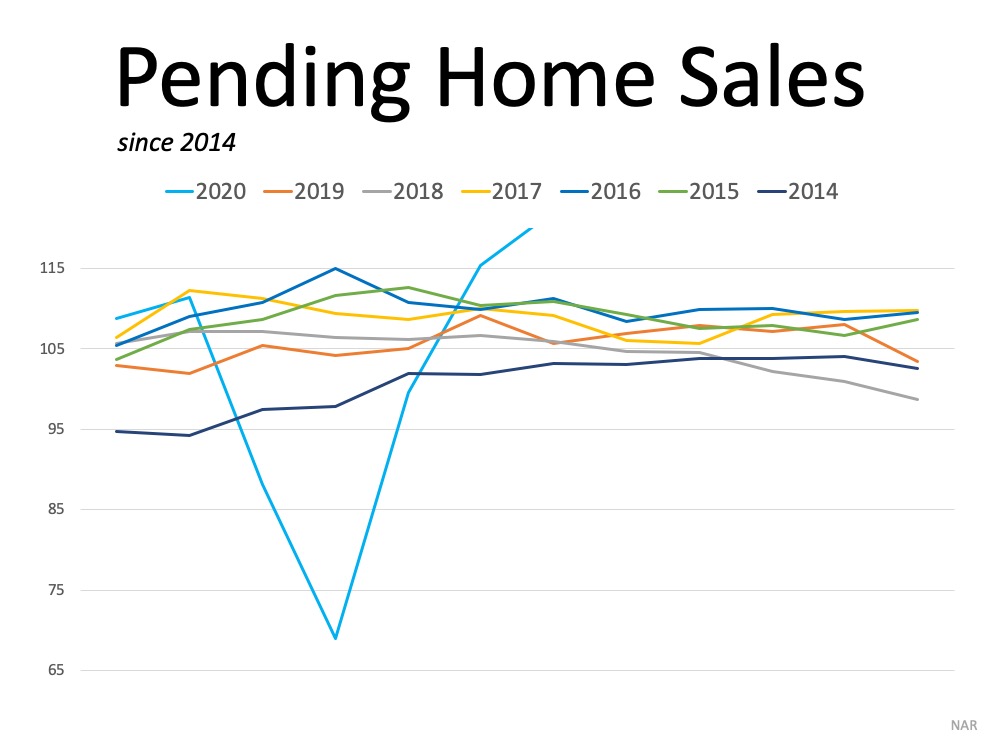

According to the Pending Home Sales Report from the National Association of Realtors (NAR):

“Pending home sales in July achieved another month of positive contract activity, marking three consecutive months of growth.

The Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, rose 5.9% to 122.1 in July. Year-over-year, contract signings rose 15.5%. An index of 100 is equal to the level of contract activity in 2001.”

This means that for the past several months, buyers have signed an increasing number of contracts to purchase homes – well above where the market was at this time last year. Lawrence Yun, Chief Economist at NAR notes:

“We are witnessing a true V-shaped sales recovery as homebuyers continue their strong return to the housing market…Home sellers are seeing their homes go under contract in record time, with nine new contracts for every 10 new listings.”

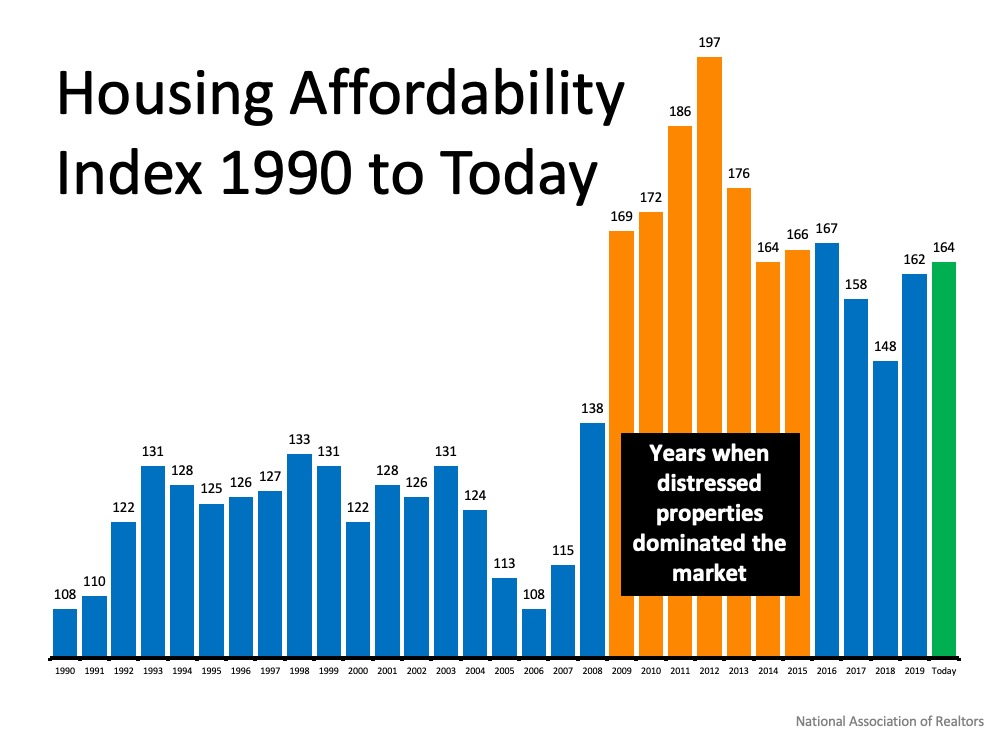

Below is a graph that shows the impressive recovery of homes sales compared to previous years. The deep blue v marks the slowdown from this spring that turned into an exponential jump in sales that followed through the summer, skyrocketing above years past:

What Does This Mean for Sellers?

If you were thinking about putting your house on the market in the spring, but decided to wait due to the health crisis, it may be time to make your move. Buyers are in the market right now. With so few homes available to purchase, homeowners today are experiencing more bidding wars, creating an optimal time to sell.

Is This Trend Going to Continue?

As CNBC notes, there are no signs of slowing buyer demand this fall:

“The usual summer slowdown in the housing market is not happening this year. Buyers continue to show strong demand, spurred by the new stay-at-home world of the coronavirus and by record low mortgage rates.”

Danielle Hale, Chief Economist at realtor.com, concurred:

“In a typical year in the housing market, buyer interest begins to wane before seller interest causing the usual seasonal slowdown as we move into the fall. Due to a delayed spring season and low mortgage rates, we could see buyer interest extend longer than usual into the typically quieter fall. Whether this means more home sales will depend on whether sellers participate or decide to stay on the sidelines.”

As Hale mentioned, homeowners who are willing to sell their houses right now will play a big role in whether the trend continues. The market needs more homes to satisfy ongoing buyer demand. Maybe it’s time to leverage your equity and move up while eager home shoppers are ready to purchase a house just like yours.

Bottom Line

If your current home doesn’t meet your family’s changing needs, let’s connect to help you sell your house and make the move you’ve been waiting for all year.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

![Virtual School Is Changing Homebuyer Needs [INFOGRAPHIC] | My KCM](https://desireestanley.com/files/2020/09/20200911-MEM-1046x1580-2.jpg)

![Virtual School Is Changing Homebuyer Needs [INFOGRAPHIC] | My KCM](https://files.mykcm.com/2020/09/10111103/20200911-MEM-1046x1580.jpg)

![The 2020 Homebuyer Wish List [INFOGRAPHIC] | MyKCM](https://desireestanley.com/files/2020/09/20200904-MEM-1046x1536.jpg)

![The 2020 Homebuyer Wish List [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/09/03121217/20200904-MEM-1046x1536.jpg)