Why Foreclosures Won’t Crush the Housing Market Next Year

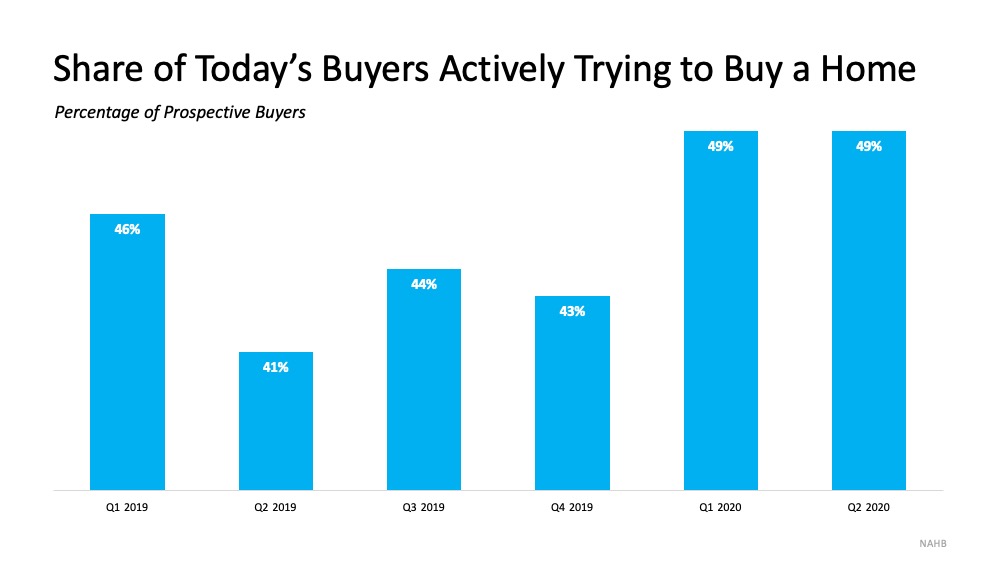

With the strength of the current housing market growing every day and more Americans returning to work, a faster-than-expected recovery in the housing sector is already well underway. Regardless, many are still asking the question: will we see a wave of foreclosures as a result of the current crisis? Thankfully, research shows the number of foreclosures is expected to be much lower than what this country experienced during the last recession. Here’s why.

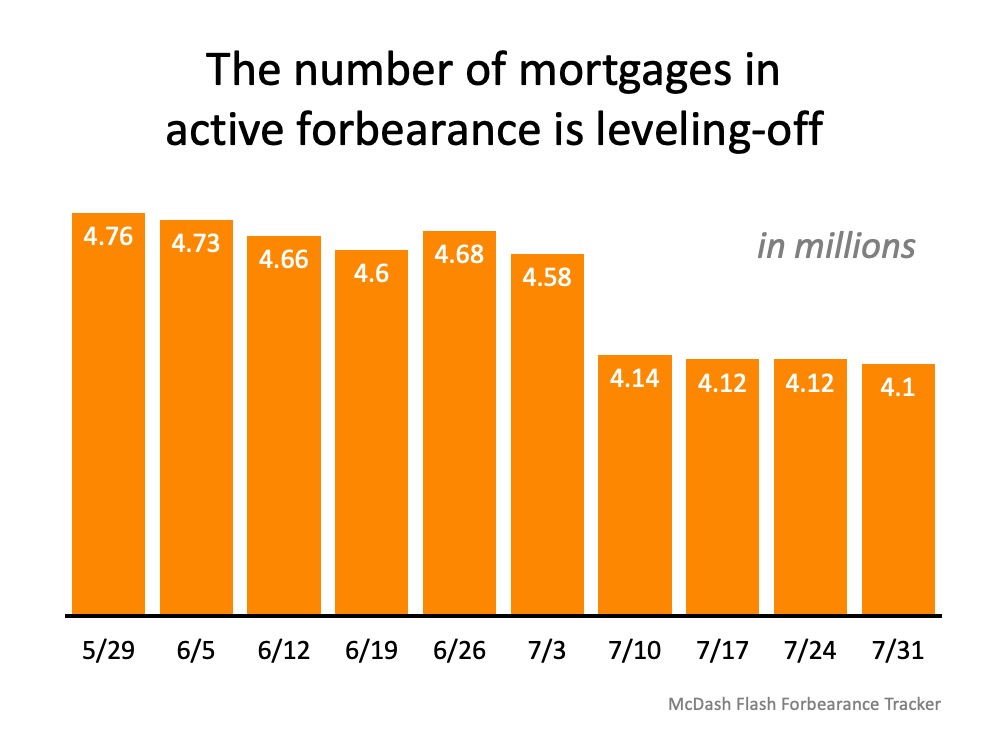

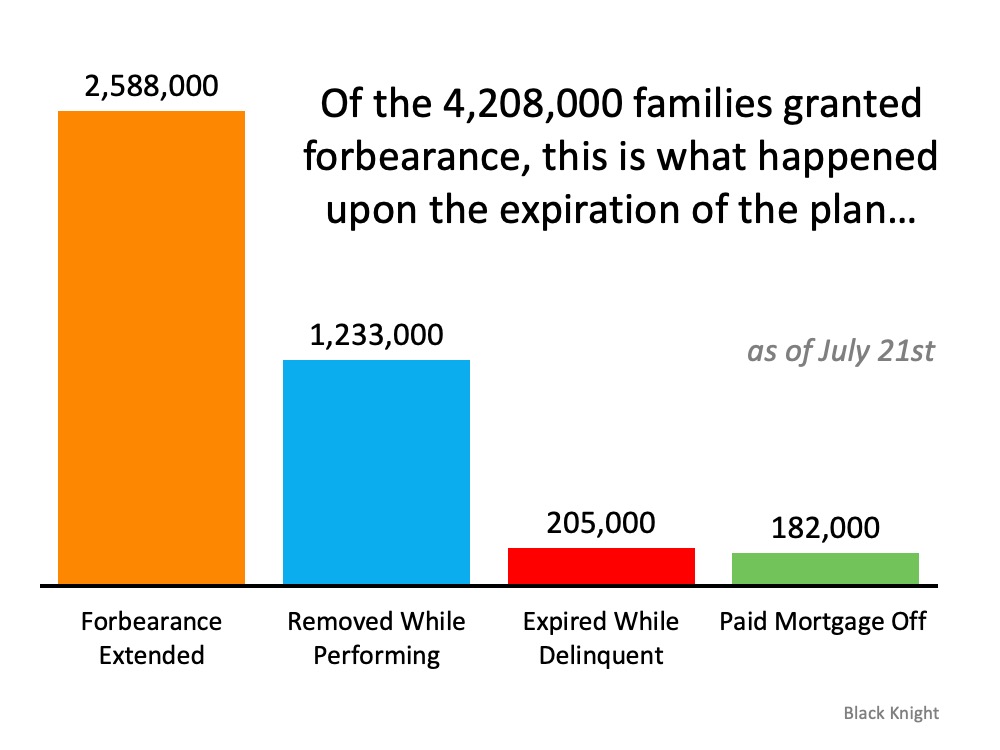

According to Black Knight Inc., the number of those in active forbearance has been leveling-off over the past month (see graph below): Black Knight Inc. also notes, of the original 4,208,000 families granted forbearance, only 2,588,000 of these homeowners got an extension. Many homeowners have once again started to pay their mortgages, paid off their homes, or never went delinquent on their payments in the first place. They may have applied for forbearance out of precaution, but never fully acted on it (see graph below):

Black Knight Inc. also notes, of the original 4,208,000 families granted forbearance, only 2,588,000 of these homeowners got an extension. Many homeowners have once again started to pay their mortgages, paid off their homes, or never went delinquent on their payments in the first place. They may have applied for forbearance out of precaution, but never fully acted on it (see graph below): The housing market, and homeowners, therefore, are in a much better position than many may think. Much of that has to do with the fact that today’s homeowners have more equity than most realize. According to John Burns Consulting, over 42% of homes are owned free and clear, meaning they are not tied to a mortgage. Of the remaining 58%, the average homeowner has $177,000 in equity. That number is keeping many homeowners afloat today and giving them options to avoid foreclosure.

The housing market, and homeowners, therefore, are in a much better position than many may think. Much of that has to do with the fact that today’s homeowners have more equity than most realize. According to John Burns Consulting, over 42% of homes are owned free and clear, meaning they are not tied to a mortgage. Of the remaining 58%, the average homeowner has $177,000 in equity. That number is keeping many homeowners afloat today and giving them options to avoid foreclosure.

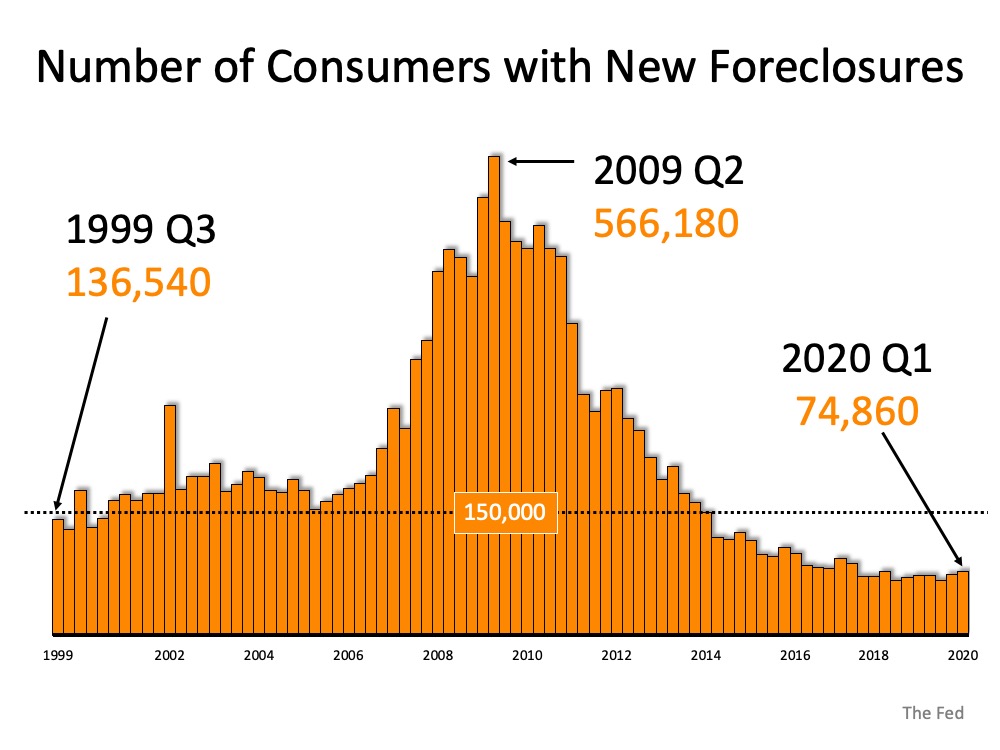

While ATTOM Data Solutions indicates that there is a potential for the number of foreclosures to increase throughout the country, it’s important to understand why they won’t rock the housing market this time around:

“The United States faces a possible foreclosure surge over the coming months that could more than double the number of households threatened with eviction for not paying their mortgages.”

That number may sound massive, but it is actually much smaller than it seems at first glance. Today’s actual quarterly active foreclosure number is 74,860. That’s over 7.5x lower than the number of foreclosures the country saw at the peak of the housing crash in 2009. When looking at the graph below, it’s clear that even if the number of quarterly foreclosures today doubles, as ATTOM Data Solutions indicates is a possibility (not a given), they will only reach what historically-speaking is a normalized range, far below what up-ended the housing market roughly 10 years ago. Equity is growing, jobs are returning, and the economy is slowly recovering, so the perfect storm for a wave of foreclosures is not realistically in the housing market forecast. As Odeta Kushi, Deputy Chief Economist for First American notes:

Equity is growing, jobs are returning, and the economy is slowly recovering, so the perfect storm for a wave of foreclosures is not realistically in the housing market forecast. As Odeta Kushi, Deputy Chief Economist for First American notes:

“Alone, economic hardship and a lack of equity are each necessary, but not sufficient to trigger a foreclosure. It is only when both conditions exist that a foreclosure becomes a likely outcome.”

While our hearts are with anyone who may end up in foreclosure as a result of this crisis, we do know that today’s homeowners have more options than they did 10 years ago. For some, it may mean selling their house and downsizing with that equity, which is a far better outcome than a foreclosure.

Bottom Line

Homeowners today have many options to avoid foreclosure, and equity is surely helping to keep many afloat. Even if today’s rate of foreclosures doubles, it will still only hit a mark that is more in line with a historically normalized range, a very good sign for homeowners and the housing market.

The Latest Unemployment Report: Slow and Steady Improvement

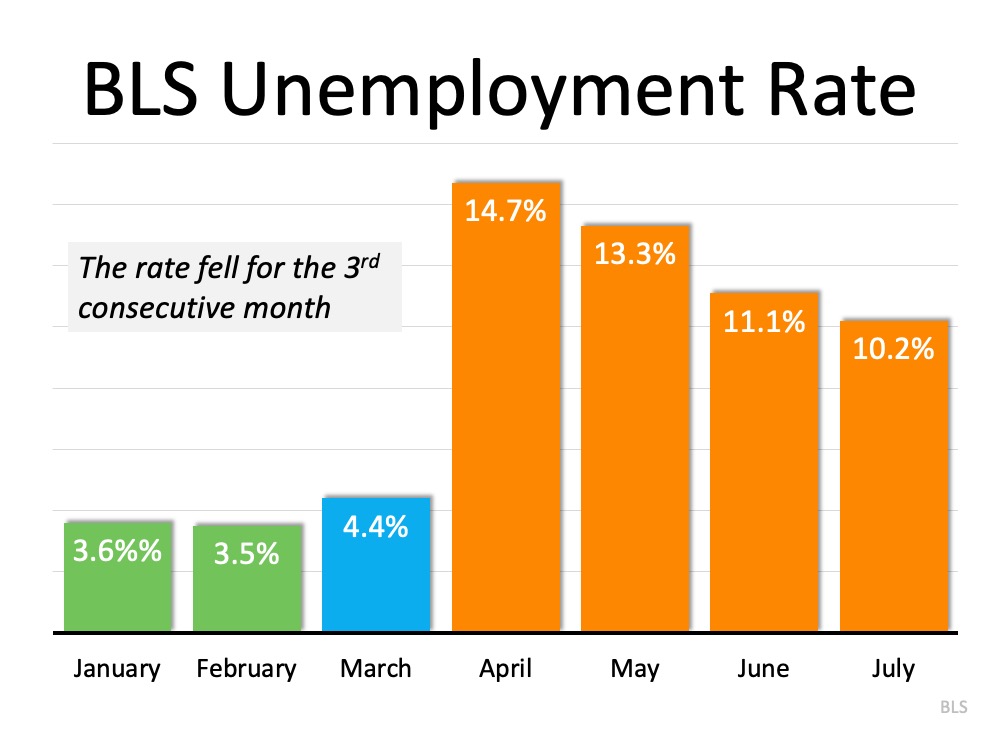

Last Friday, the Bureau of Labor Statistics (BLS) released its latest Employment Situation Summary. Going into the release, the expert consensus was for 1.58 million jobs to be added in July, and for the unemployment rate to fall to 10.5%.

When the official report came out, it revealed that 1.8 million jobs were added, and the unemployment rate fell to 10.2% (from 11.1% last month). Once again, this is excellent news as this was the third consecutive month the unemployment rate decreased. There is, however, still a long way to go before the job market fully recovers. The Wall Street Journal (WSJ) put a potential date on that recovery:

There is, however, still a long way to go before the job market fully recovers. The Wall Street Journal (WSJ) put a potential date on that recovery:

“July’s payroll growth, at 1.8 million, still leaves total payrolls 12.9 million lower than in February. And yet if job gains continued at July’s pace, that deficit will be erased by March 2021. If payrolls reclaim their last peak in 13 months, that would be remarkably fast. It took more than six years after the last recession.”

Permanent vs. Temporary Unemployment

During a pandemic, it’s important to differentiate those who have lost their jobs on a temporary basis from those who have lost them on a permanent basis. Morgan Stanley economists noted in the same WSJ article:

“The rate of churn in the labor market remains incredibly high, but a notable positive detail in this month’s report was the downtick in the rate of new permanent layoffs.”

To address this, the core unemployment rate becomes increasingly important. It identifies the number of people who have permanently lost their jobs. This measure subtracts temporary layoffs and adds unemployed who did not search for a job recently. Jed Kolko, Chief Economist at Indeed and the founder of the index reported:

“Core unemployment fell in July for the first time in the pandemic. That’s the good news I was hoping for.”

What about the housing market?

The housing market has continued to show tremendous resilience during the pandemic. Commenting on the labor report, Robert Dietz, Chief Economist for the National Association of Home Builders (NAHB), tweeted:

“Housing continues to rebound in another positive labor market report. Home builder and remodeler job gains of 24K for July. Residential construction employment down just 56.4K compared to a year ago. Total residential construction employment at 2.85 million.”

Bottom Line

We should remain cautious in our optimism, as the recovery is ultimately tied to our future success in mitigating the ongoing health crisis. However, as Mike Fratantoni, Chief Economist for the Mortgage Bankers Association reminds us: “The pace of job growth slowed in July, but the gains over the past three months represent an impressive rebound during the ongoing economic challenges brought forth by the pandemic.”

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

![Mortgage Rates & Payments by Decade [INFOGRAPHIC] | MyKCM](https://desireestanley.com/files/2020/08/20200814-MEM-1-1046x1306.jpg)

![Mortgage Rates & Payments by Decade [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/08/13150648/20200814-MEM-1-1046x1306.jpg)

![2020 Homebuyer Preferences [INFOGRAPHIC] | MyKCM](https://desireestanley.com/files/2020/08/20200807-MEM-1046x1789.jpg)

![2020 Homebuyer Preferences [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/08/06112131/20200807-MEM-1046x1789.jpg)