Is the Economic Recovery Beating All Projections?

Earlier this year, many economists and market analysts were predicting an apocalyptic financial downturn that would potentially rattle the U.S. economy for years to come. They immediately started to compare it to the Great Depression of a century ago. Six months later, the economy is still trying to stabilize, but it is evident that the country will not face the total devastation projected by some. As we continue to battle the pandemic, forecasts are now being revised upward. The Wall Street Journal (WSJ) just reported:

“The U.S. economy and labor market are recovering from the coronavirus-related downturn more quickly than previously expected, economists said in a monthly survey.

Business and academic economists polled by The Wall Street Journal expect gross domestic product to increase at an annualized rate of 23.9% in the third quarter. That is up sharply from an expectation of an 18.3% growth rate in the previous survey.”

What Shape Will the Recovery Take?

Economists have historically cast economic recoveries in the form of one of four letters – V, U, W, or L.

A V-shaped recovery is all about the speed of the recovery. This quick recovery is treated as the best-case scenario for any economy that enters a recession. NOTE: Economists are now also using a new term for this type of recovery called the “Nike Swoosh.” It is a form of the V-shape that may take several months to recover, thus resembling the Nike Swoosh logo.

A U-shaped recovery is when the economy experiences a sharp fall into a recession, like the V-shaped scenario. In this case, however, the economy remains depressed for a longer period of time, possibly several years, before growth starts to pick back up again.

A W-shaped recovery can look like an economy is undergoing a V-shaped recovery until it plunges into a second, often smaller, contraction before fully recovering to pre-recession levels.

An L-shaped recovery is seen as the worst-case scenario. Although the economy returns to growth, it is at a much lower base than pre-recession levels, which means it takes significantly longer to fully recover.

Many experts predicted that this would be a dreaded L-shaped recovery, like the 2008 recession that followed the housing market collapse. Fortunately, that does not seem to be the case.

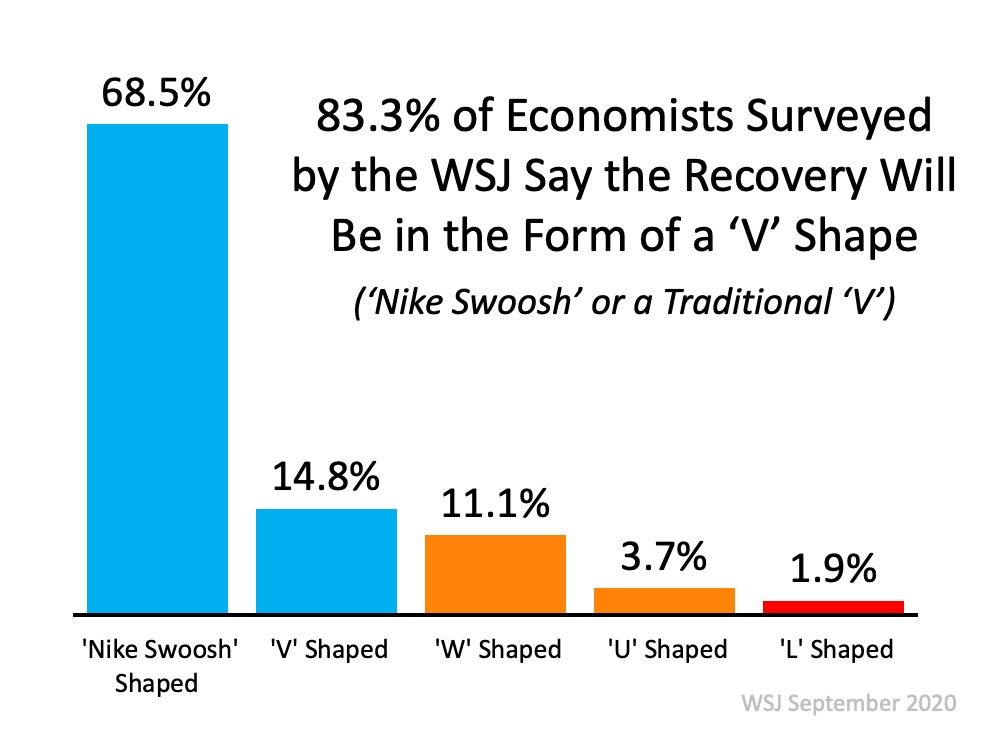

The same WSJ survey mentioned above asked the economists which letter this recovery will most resemble. Here are the results:

What About the Unemployment Numbers?

It’s difficult to speak positively about a jobs report that shows millions of Americans are still out of work. However, when we compare it to many forecasts from earlier this year, the numbers are much better than most experts expected. There was talk of numbers that would rival the Great Depression when the nation suffered through four consecutive years of unemployment over 20%.

The first report after the 2020 shutdown did show a 14.7% unemployment rate, but much to the surprise of many analysts, the rate has decreased each of the last three months and is now in the single digits (8.4%).

Economist Jason Furman, Professor at Harvard University‘s John F. Kennedy School of Government and the Chair of the Council of Economic Advisers during the previous administration, recently put it into context:

“An unemployment rate of 8.4% is much lower than most anyone would have thought it a few months ago. It is still a bad recession but not a historically unprecedented event or one we need to go back to the Great Depression for comparison.”

The economists surveyed by the WSJ also forecasted unemployment rates going forward:

- 2021: 6.3%

- 2022: 5.2%

- 2023: 4.9%

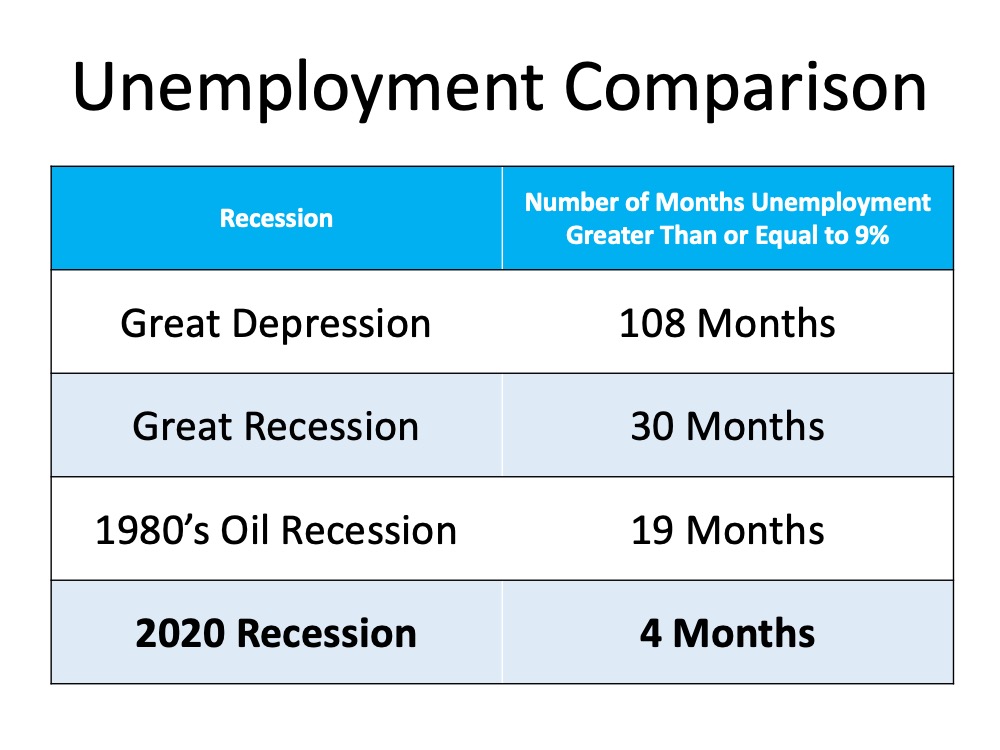

The following table shows how the current employment situation compares to other major disruptions in our economy:

Bottom Line

The economic recovery still has a long way to go. So far, we are doing much better than most thought would be possible.

The Latest Unemployment Rate Fell to 8.4%

Last Friday, the Bureau for Labor Statistics released their Employment Report for August 2020. The big surprise was that the unemployment rate fell to 8.4%, a full percent lower than what many analysts had forecasted earlier in the week. Though it is tough to look at this as great news when millions of Americans are still without work, the number of unemployed is currently much lower than most experts had projected it would be just a few months ago.

Not Like the Great Depression or even the Great Recession

Jason Furman, Professor of Practice at Harvard explained:

“An unemployment rate of 8.4% is much lower than most anyone would have thought it a few months ago. It is still a bad recession but not a historically unprecedented event or one we need to go back to the Great Depression for comparison.”

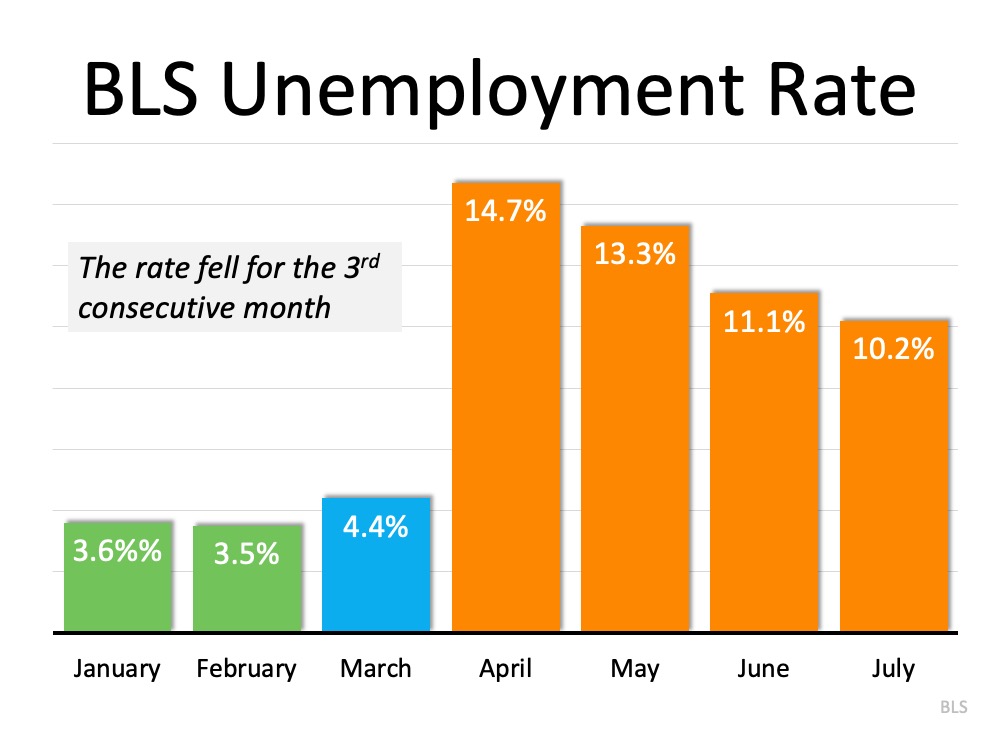

During the Great Depression, the unemployment rate was over 20% for four consecutive years (1932 – 1935). This April, the rate jumped to 14.7%, but has fallen each month since.

During and after the Great Recession (2007-2009), the unemployment rate was at 9% or greater for thirty consecutive months (April 2009 – October 2011). Most economists believe the current rate will continue to fall monthly as the economy regains its strength.

What Happens Going Forward?

The outcome will be determined by how quickly we can contain the virus. In their last Economic Forecasting Survey, the Wall Street Journal reported the economists surveyed believe the annual unemployment rates will be 6.6% in 2021 and 5.5% in 2022. Though that will still be greater than the 3.5% rate that we saw earlier this year, it is lower than the annual rate reported in 2011 (8.5%), 2012 (7.9%), and 2013 (6.7%).

Bottom Line

There are still millions of Americans struggling through this economic downturn. There is, however, a light at the end of the tunnel. The unemployment situation did not get as bad as many had predicted, and the recovery is taking place faster than most thought would happen.

The Latest Unemployment Report: Slow and Steady Improvement

Last Friday, the Bureau of Labor Statistics (BLS) released its latest Employment Situation Summary. Going into the release, the expert consensus was for 1.58 million jobs to be added in July, and for the unemployment rate to fall to 10.5%.

When the official report came out, it revealed that 1.8 million jobs were added, and the unemployment rate fell to 10.2% (from 11.1% last month). Once again, this is excellent news as this was the third consecutive month the unemployment rate decreased. There is, however, still a long way to go before the job market fully recovers. The Wall Street Journal (WSJ) put a potential date on that recovery:

There is, however, still a long way to go before the job market fully recovers. The Wall Street Journal (WSJ) put a potential date on that recovery:

“July’s payroll growth, at 1.8 million, still leaves total payrolls 12.9 million lower than in February. And yet if job gains continued at July’s pace, that deficit will be erased by March 2021. If payrolls reclaim their last peak in 13 months, that would be remarkably fast. It took more than six years after the last recession.”

Permanent vs. Temporary Unemployment

During a pandemic, it’s important to differentiate those who have lost their jobs on a temporary basis from those who have lost them on a permanent basis. Morgan Stanley economists noted in the same WSJ article:

“The rate of churn in the labor market remains incredibly high, but a notable positive detail in this month’s report was the downtick in the rate of new permanent layoffs.”

To address this, the core unemployment rate becomes increasingly important. It identifies the number of people who have permanently lost their jobs. This measure subtracts temporary layoffs and adds unemployed who did not search for a job recently. Jed Kolko, Chief Economist at Indeed and the founder of the index reported:

“Core unemployment fell in July for the first time in the pandemic. That’s the good news I was hoping for.”

What about the housing market?

The housing market has continued to show tremendous resilience during the pandemic. Commenting on the labor report, Robert Dietz, Chief Economist for the National Association of Home Builders (NAHB), tweeted:

“Housing continues to rebound in another positive labor market report. Home builder and remodeler job gains of 24K for July. Residential construction employment down just 56.4K compared to a year ago. Total residential construction employment at 2.85 million.”

Bottom Line

We should remain cautious in our optimism, as the recovery is ultimately tied to our future success in mitigating the ongoing health crisis. However, as Mike Fratantoni, Chief Economist for the Mortgage Bankers Association reminds us: “The pace of job growth slowed in July, but the gains over the past three months represent an impressive rebound during the ongoing economic challenges brought forth by the pandemic.”

Guidance and Support Are Key When Buying Your First Home

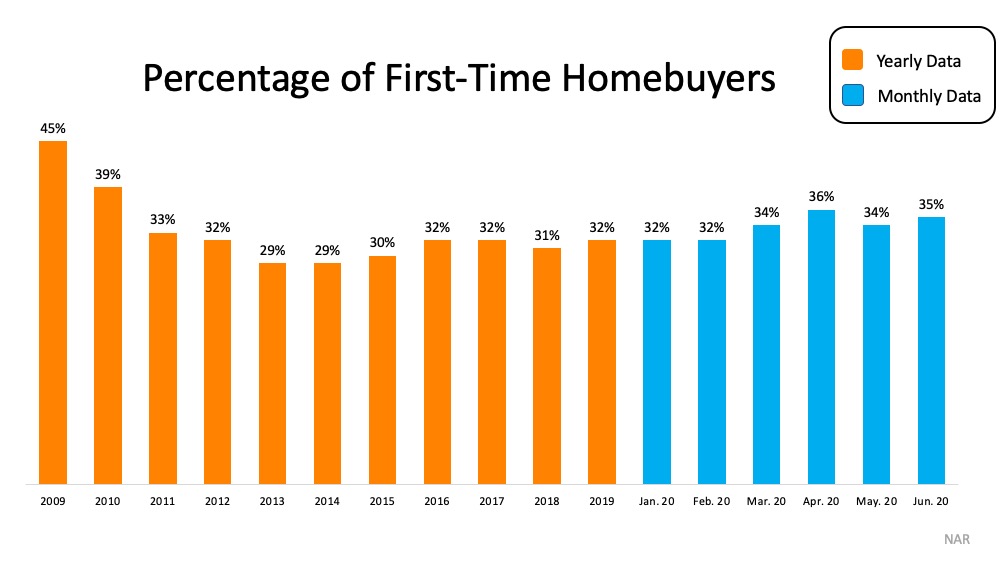

In June, the number of first-time homebuyers accounted for 35% of the existing homes sold, a trend that’s been building steadily throughout the year. According to the National Association of Realtors (NAR):

“The share of first-time buyers increased in March through June—right into the heart of the pandemic period and the surge in unemployment—and is now trending higher than the 29% to 32% average in past years since 2012.” (See graph below):

Why the rise in first-time homebuying?

NAR continues to say:

“The major factor is, arguably, low mortgage rates. As of the week ended July 16, the 30-year fixed mortgage rate dropped to 2.98%. With rates so low that are locked in under a 30-year mortgage, the typical mortgage payment, estimated at $1,036, has fallen below the median rent, at $1,045. For potential home buyers who were thinking of purchasing a home anyway before the pandemic outbreak and who are likely to remain employed, the low mortgage rate may be the clincher.”

Clearly, historically low mortgage rates are encouraging many to buy. With the average mortgage payment now estimated at a lower monthly cost than renting, it’s a great time for first-time homebuyers to enter the market. According to the Q2 2020 Housing Trends Report from the National Association of Homebuilders (NAHB):

“Eighty-four percent of Gen Z’s planning to buy a home are first timers, compared to 68% of Millennials, 52% of Gen X’s, and 21% of Boomers. Looking at results by region shows that over 60% of prospective buyers in the Northeast and South are buying a home for the first time. The share is above 55% in the Midwest and West.”

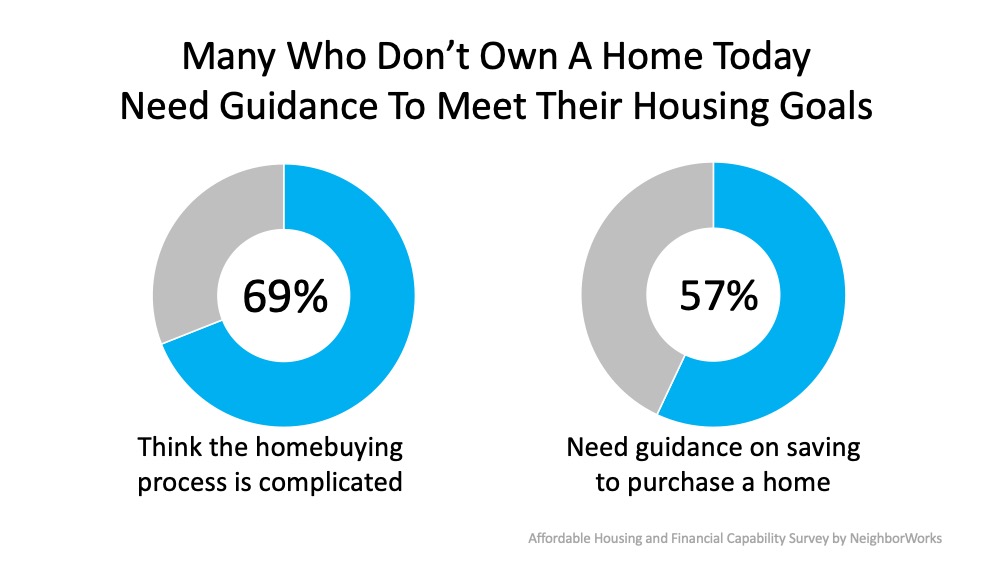

There are, however, challenges for first-time buyers. A recent survey conducted by NeighborWorks America also notes that understanding the homebuying process may be the most significant barrier for many hopeful homeowners:

“Homeownership is a particular challenge for many, despite high levels of interest. Americans believe there are many benefits to homeownership and half of non-owners will seek information about the process in the next few years…a large share of non-owners say the process is too challenging and only a minority know where to find advice if they wanted it. And although many would seek the guidance of community and non-profit programs, only one in three non-owners are aware of such services.”

If you’re among the first-time homebuyers who feel the process is complicated, you’re not alone. If you’re not sure where to begin or you simply want help in figuring out how to save for a home, finding a trusted real estate advisor to work with is a critical step toward your success. A real estate professional can help you understand the process, review your current situation, and guide you with a plan to help you to feel confident when buying a home.

If you’re among the first-time homebuyers who feel the process is complicated, you’re not alone. If you’re not sure where to begin or you simply want help in figuring out how to save for a home, finding a trusted real estate advisor to work with is a critical step toward your success. A real estate professional can help you understand the process, review your current situation, and guide you with a plan to help you to feel confident when buying a home.

Bottom Line

If you’re interested in purchasing a home and need help getting started, let’s connect today so you can take advantage of the support available to guide you through each step of the way.

Latest Unemployment Report: Great News…for the Most Part

The Bureau of Labor Statistics (BLS) released their latest Employment Situation Summary last Thursday, and it again beat analysts’ expectations in a big way. The consensus was for 3,074,000 jobs to be added in June. The report revealed that 4,800,000 jobs were added. The unemployment rate fell to 11.1% from 13.3% last month. Again, excellent news as the unemployment rate fell for the second consecutive month. However, there’s still a long way to go before the economy fully recovers as 17.8 million Americans remain unemployed.

Here are two interesting insights on the report:

What about a supposed misclassification?

The BLS addressed this at length in a blog post last week, and concluded by saying:

“Regardless of the assumptions we might make about misclassification, the trend in the unemployment rate over the period in question is the same; the rate increased in March & April and eased in May.”

They specifically noted the issue in the latest report by explaining that if they adjusted the rate for the potential miscalculation, it would increase from 11.1% to 12.1% (which is lower than the adjusted rate of 16.4% last month). They went on to say:

“However, this represents the upper bound of our estimate of misclassification and probably overstates the size of the misclassification error.”

Does the shutdown of parts of the economy skew the unemployment numbers?

Because the uniqueness of 2020 impacts the employment situation in so many ways, each jobs report is now examined with a microscope to make sure the headlines generated by the report accurately convey what’s happening in the job market.

One such analysis is done by Jed Kolko, Chief Economist at Indeed. He believes the extraordinary number of people in the “temporary” unemployed category confuses the broader issue of how many people have permanently lost their job. He adjusts for this when calculating his “core unemployment rate” (which subtracts temporary layoffs and adds unemployed who didn’t search for a job recently).

The bad news is that his analysis reveals that the number of permanently unemployed is still rising (from 4.6% in April to 5.9% last month). The good news, however, is when you use his methodology to look back at the Great Recession, today’s “core unemployment rate” is significantly lower (5.9% versus 10.5% in April 2010).

Bottom Line

Last week’s jobs report was much better than most expected. However, we should remain cautious in our optimism. As the Wall Street Journal explained in their analysis of the jobs report:

“U.S. job growth surged last month, underscoring the economy’s capacity for a quick rebound if businesses continue to reopen and consumers regain confidence. A recent coronavirus spike, however, could undermine trends captured in the latest jobs report.”

Is the Economic Recovery Already Underway?

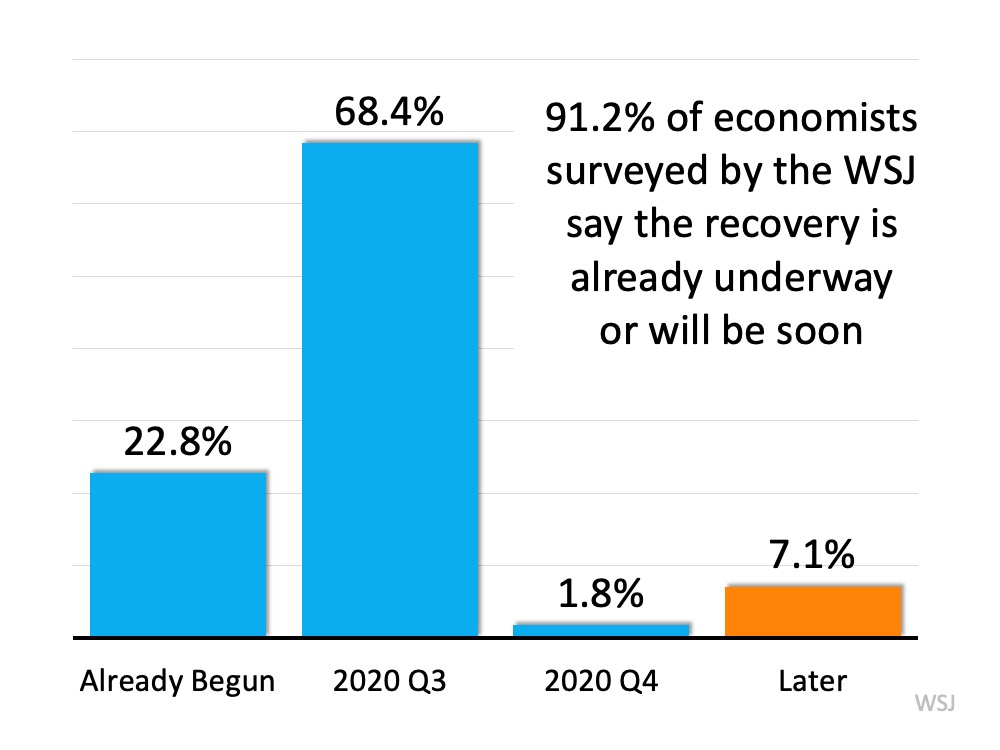

The Wall Street Journal just released its latest monthly Survey of Economists. In an article on the findings, they reported:

“The U.S. economy will be in recovery by the third quarter of this year, economists said in a survey that also concluded the labor market will fare better than previously expected following the effects of the coronavirus pandemic.”

Clearly, the latest jobs report from the U.S. Bureau of Labor Statistics confirmed the labor market is outperforming expectations, as it revealed that 2.5 million jobs were added. Directly before the release, experts forecasted that we would lose over 8 million jobs.

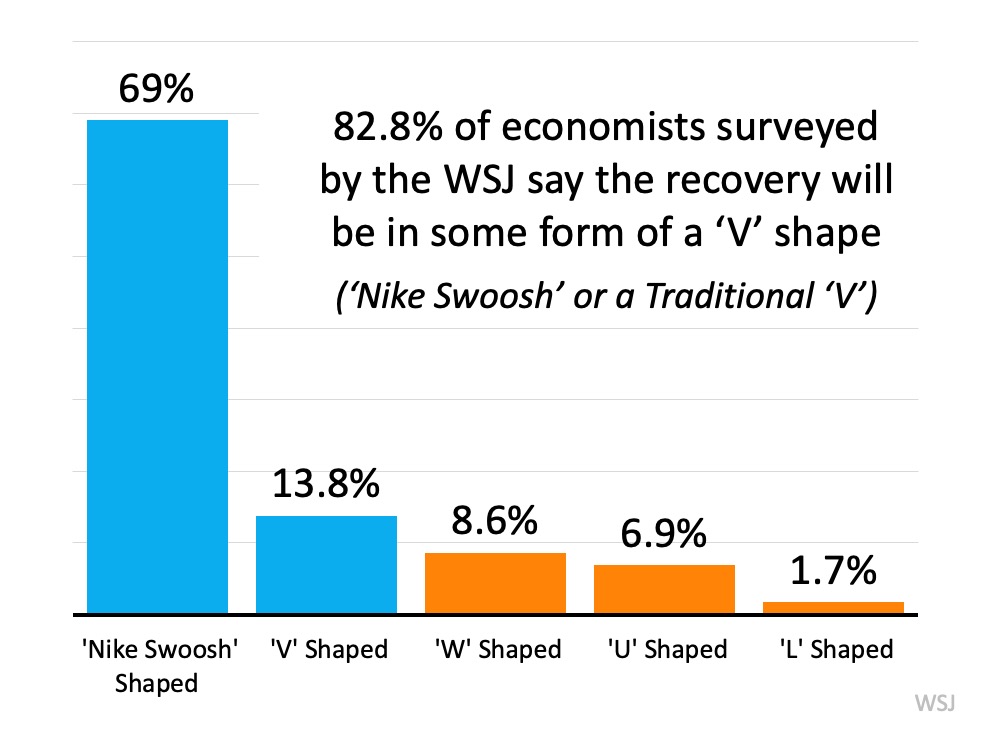

A second revelation indicating the economy is already about to turn around was also somewhat unexpected. More than 9 out of 10 economists surveyed believe the recovery has already begun this quarter or will begin in the third quarter. Here are the results of the survey question asking when the recovery will begin: The survey also asked what type of recovery the economists expect.

The survey also asked what type of recovery the economists expect.

More than 8 out of 10 believe it will be a form of a ‘V’ recovery:

- A true ‘V’ with a sharp drop and a sharp rebound

- A ‘Nike Swoosh’ with a sharp drop and a more gradual recovery, coined after the company’s logo

Some experts, possibly concerned about a second wave of COVID-19, call for a ‘W’ recovery – a double-dip recession.

Others call for a ‘U’ with a prolonged bottom.

A very small percentage project the dreaded ‘L’ recovery, which is no recovery at all for the foreseeable future (think of the Great Recession).

Bottom Line

Though we still have a long and difficult journey ahead, it appears the worst for both the economy and the unemployment situation may be in our rearview mirror.

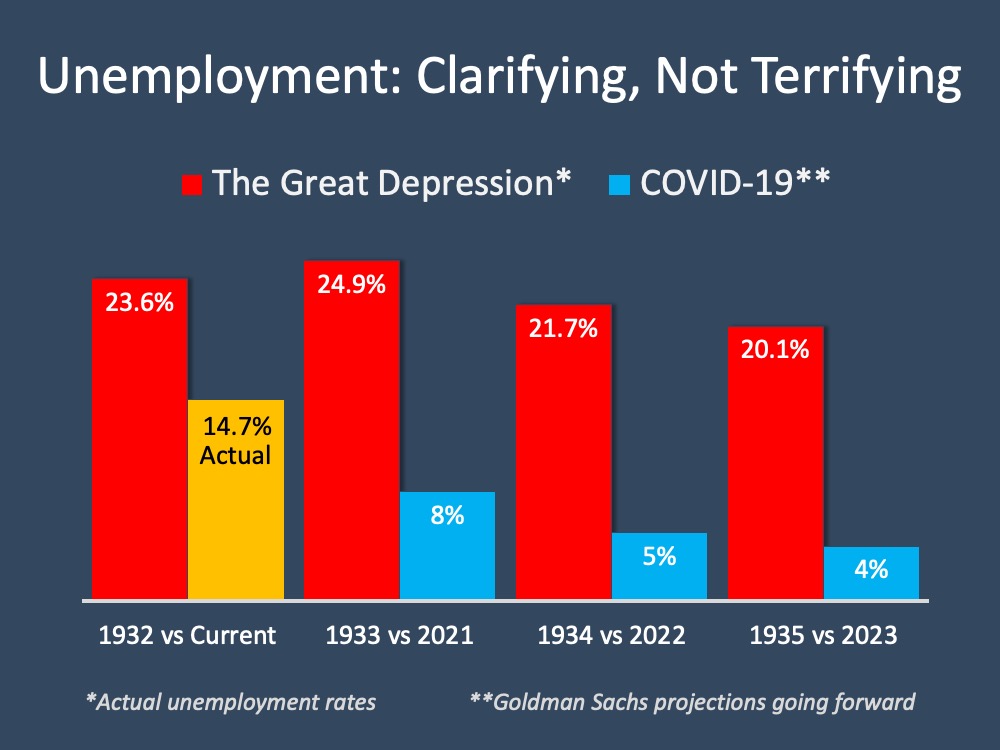

Unemployment Report: No Need to Be Terrified

Last Friday, the Bureau of Labor Statistics (BLS) released its latest jobs report. It revealed that the economic shutdown made necessary by COVID-19 caused the unemployment rate to jump to 14.7%. Many anticipate that next month the percentage could be even higher. These numbers represent the extreme hardship so many families are experiencing right now. That pain should not be understated.

However, the long-term toll the pandemic will cause should not be overstated either. There have been numerous headlines claiming the current disruption in the economy is akin to the Great Depression, and many of those articles are calling for total Armageddon. Some experts are stepping up to refute those claims.

In a Wall Street Journal (WSJ) article this past weekend, Josh Zumbrun, a national economics correspondent for the Journal explained:

“News stories often describe the coronavirus-induced global economic downturn as the worst since the Great Depression…the comparison does more to terrify than clarify.”

Zumbrun goes on to explain:

“From 1929 to 1933, the economy shrank for 43 consecutive months, according to contemporaneous estimates. Unemployment climbed to nearly 25% before slowly beginning its descent, but it remained above 10% for an entire decade…This time, many economists believe a rebound could begin this year or early next year.”

Here is a graph comparing current unemployment numbers (actual and projected) to those during the Great Depression: Clearly, the two unemployment situations do not compare.

Clearly, the two unemployment situations do not compare.

What makes this time so different?

This was not a structural collapse of the economy, but instead a planned shutdown to help mitigate the virus. Once the virus is contained, the economy will immediately begin to recover. This is nothing like what happened in the 1930s. In the same WSJ article mentioned above, former Federal Reserve Chairman Ben Bernanke, who has done extensive research on the depression in the 1930s, explained:

“The breakdown of the financial system was a major reason for both the Great Depression and the 2007-09 recession.” He went on to say that today – “the banks are stronger and much better capitalized.”

What about the families and small businesses that are suffering right now?

The nation’s collective heart goes out to all. The BLS report, however, showed that ninety percent of the job losses are temporary. In addition, many are getting help surviving this pause in their employment status. During the Great Depression, there were no government-sponsored unemployment insurance or large government subsidies as there are this time.

Today, many families are receiving unemployment benefits and an additional $600 a week. The stimulus package is helping many companies weather the storm. Is there still pain? Of course. The assistance, however, is providing much relief until most can go back to work.

Bottom Line

We should look at the current situation for what it is – a predetermined pause placed on the economy. The country will recover once the pandemic ends. Comparisons to any other downturn make little sense. Bernanke put it best:

“I don’t find comparing the current downturn with the Great Depression to be very helpful. The expected duration is much less, and the causes are very different.”

Unemployment: Hope on the Horizon

Today, the unemployment rate for April 2020 will be released by the U.S. Bureau of Labor Statistics. It will hit a peak this country has never seen before, with data representing real families and lives affected by this economic slowdown. The numbers will alarm us. There will be headlines and doomsday scenarios in the media. There is hope, though, that as businesses reopen, most people will become employed again soon.

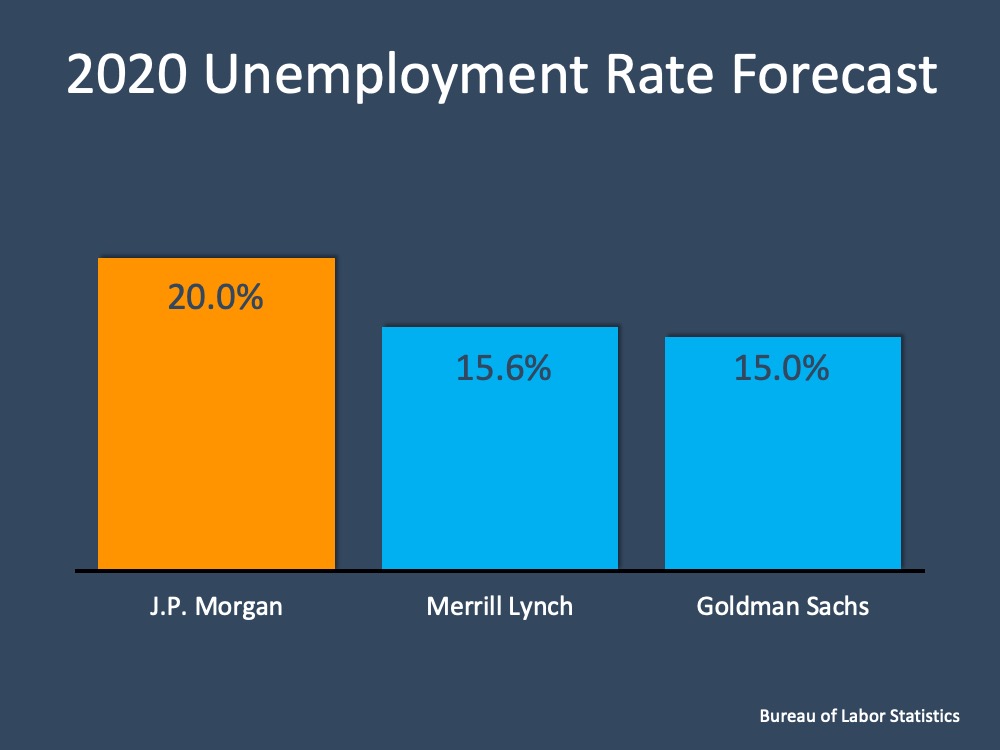

Last month’s report indicated we initially lost over 700,000 jobs in this country, and the unemployment rate quickly rose to 4.4%. With the release of the new data, that number will climb even higher. Experts forecast this report will show somewhere between a 15% – 20% national unemployment rate, and some anticipate that number to be even greater (see graph below):

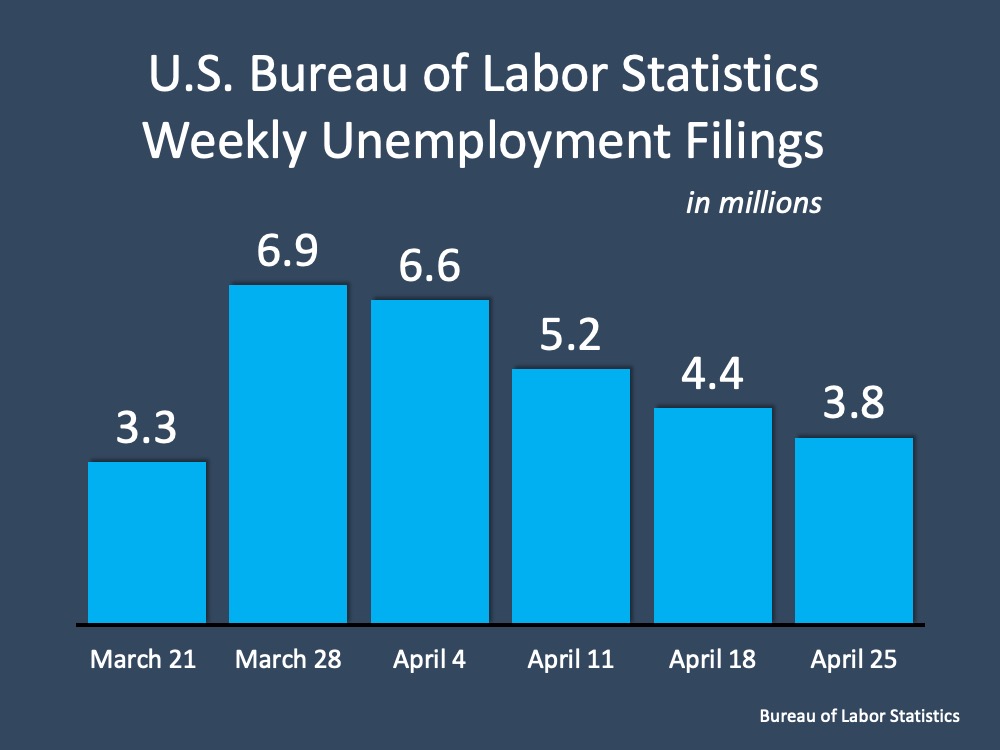

What’s happened over the last several weeks?

Here’s a breakdown of this spring’s weekly unemployment filings: The good news shown here indicates the number of additional unemployment claims has decreased week over week since the beginning of April. Carlos Rodriguez, CEO of Automatic Data Processing (ADP) says based on what he’s seeing:

The good news shown here indicates the number of additional unemployment claims has decreased week over week since the beginning of April. Carlos Rodriguez, CEO of Automatic Data Processing (ADP) says based on what he’s seeing:

“It’s possible that companies are already anticipating some kind of normalization, opening in certain states and starting to post jobs.”

He goes on to say that this doesn’t mean all companies are hiring, but it could mean they are at the point where they’re not cutting jobs anymore. Let’s hope this trend continues.

What will the future bring?

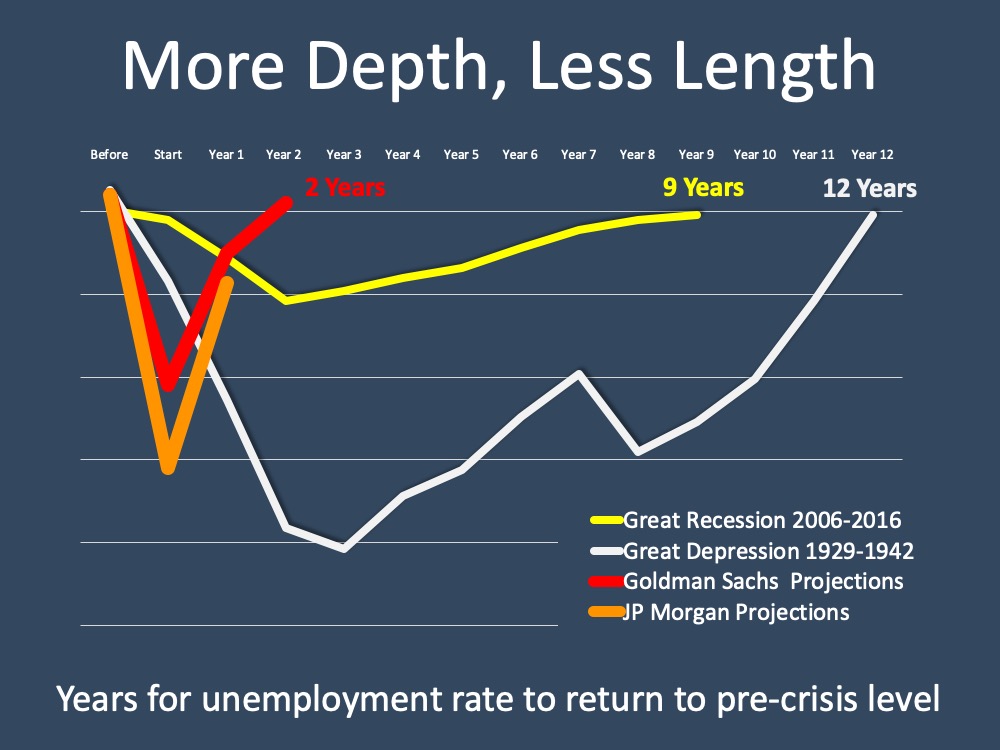

Most experts predict that while unemployment is high right now, it won’t be that way for long. The length of unemployment during this crisis is projected to be significantly shorter than the duration seen in the Great Recession and the Great Depression. While forecasts may be high, the numbers are trending down and the length of time isn’t expected to last forever.

While forecasts may be high, the numbers are trending down and the length of time isn’t expected to last forever.

Bottom Line

Don’t let the headlines rattle you. There’s hope coming as we start to safely reopen businesses throughout the country. Unemployment affects our families, our businesses, and our country. Our job is to rally around those impacted and do our part to support them through this time.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link