Make the Dream of Homeownership a Reality in 2020

In 1963, Martin Luther King, Jr. led and inspired a powerful movement with his famous “I Have a Dream” speech. Through his passion and determination, he sparked interest, ambition, and courage in his audience. Today, reflecting on his message encourages many of us to think about our own dreams, goals, beliefs, and aspirations. For many Americans, one of those common goals is owning a home: a piece of land, a roof over our heads, and a place where our families can grow and flourish.

If you’re dreaming of buying a home this year, the best way to start the process is to connect with a Real Estate professional to understand what goes into buying a home. Once you have that covered, then you can answer the questions below to make the best decision for you and your family.

1. How Can I Better Understand the Process, and How Much Can I Afford?

The process of buying a home is not one to enter into lightly. You need to decide on key things like how long you plan on living in an area, school districts you prefer, what kind of commute works for you, and how much you can afford to spend.

Keep in mind, before you start the process to purchase a home, you’ll also need to apply for a mortgage. Lenders will evaluate several factors connected to your financial track record, one of which is your credit history. They’ll want to see how well you’ve been able to minimize past debts, so make sure you’ve been paying your student loans, credit cards, and car loans on time. Most agents have loan officers they trust that they can refer you to.

According to ConsumerReports.org,

“Financial planners recommend limiting the amount you spend on housing to 25 percent of your monthly budget.”

2. How Much Do I Need for a Down Payment?

In addition to knowing how much you can afford on a monthly mortgage payment, understanding how much you’ll need for a down payment is another critical step. Thankfully, there are many different options and resources in the market to potentially reduce the amount you may think you need to put down upfront.

If you’re concerned about saving for a down payment, start small and be consistent. A little bit each month goes a long way. Jumpstart your savings by automatically adding a portion of your monthly paycheck into a separate savings account or house fund. AmericaSaves.org says,

“Over time, these automatic deposits add up. For example, $50 a month accumulates to $600 a year and $3,000 after five years, plus interest that has compounded.”

Before you know it, you’ll have enough for a down payment if you’re disciplined and thoughtful about your process.

3. Saving Takes Time: Practice Living on a Budget

As tempting as it is to settle in each morning with a fancy cup of coffee from your favorite local shop, putting that daily spend toward your down payment will help accelerate your path to homeownership. It’s the little things that count, so start trying to live on a slightly tighter budget if you aren’t doing so already. A budget will allow you to save more for your down payment and help you pay down other debts to improve your credit score. A survey of Millennial spending shows,

“70 percent of would-be first-time homebuyers will cut spending on spa days, shopping and going to the movies in exchange for purchasing a home within the next year.”

While you don’t need to cut all of the fun out of your current lifestyle, making smarter choices and limiting your spending in areas where you can slim down will make a big difference.

Bottom Line

If homeownership is on your dream list this year, take a good look at what you can prioritize to help you get there. Let’s get together today to discuss the best steps you can take to start the process.

The New Spring Real Estate Market is Here. Are You Ready?

Which month do you think most people who are considering buying a home actually start their search? If you’re like most of us, you probably think the surge happens in the spring, likely in April. Not anymore. According to new research, January 2019 was only 1% behind February for the most monthly views per listing on realtor.com.

So, what does that mean? The busiest season in real estate has just begun.

The same research indicates,

“Historically, April launched the kickoff of the home shopping season as buyers would come out of their winter hibernation looking for their new home. However, the spring shopping season now starts in January for many of the nation’s largest markets.”

With the reality of fewer homes on the market in the winter, and that supply naturally increases as we head to the spring market, waiting for more competition to list in your neighborhood this year might put you behind the curve. Perhaps now is the time to jump into the market.

George Ratiu, Senior Economist at realtor.com says,

“As shoppers modify their strategies for navigating a housing market that has become more competitive due to rising prices and low inventory, the search for a home is beginning earlier and earlier.”

There is a lot of speculation in the market about why the search for a home is shifting to an earlier start. The one thing we do know is if you’re thinking about buying or selling a home this year, the earlier you get started, the better.

Reminder: When should you sell something? When there is less of that item for sale and the greatest number of buyers are in the market. That’s exactly what is happening in real estate right now.

Bottom Line

The new spring market for real estate is underway. If you’re considering buying or selling, let’s connect, so you have the advantage in this competitive market.

Why You Shouldn’t “For Sale By Owner”

Rising home prices coupled with the current inventory in today’s market may cause some homeowners to consider selling their homes on their own (known in the industry as a For Sale By Owner). However, a FSBO might be hard to execute well for the vast majority of sellers.

Here are the top 5 reasons not to FSBO:

1. Online Strategy for Prospective Purchasers

Studies have shown that 93% of buyers search online for a home. That’s a pretty staggering number! Most real estate agents have an Internet strategy to promote the sale of your home. Do you?

2. Results Come from the Internet

According to NAR, here’s where buyers found the homes they actually purchased:

- 55% on the Internet

- 28% from a Real Estate Agent

- 10% Other

- 6% from a Yard Sign

- 1% from Newspapers

The days of selling your house by putting up a sign in your yard or placing an ad in the paper are long gone. Having a strong Internet strategy is crucial.

3. There Are Too Many People to Negotiate With

Here’s a list of some of the people with whom you must be prepared to negotiate if you decide to FSBO:

- The buyer, who wants the best deal possible

- The buyer’s agent, who solely represents the best interest of the buyer

- The buyer’s attorney (in some parts of the country)

- The home inspection companies, which work for the buyer and will almost always find some problems with the house

- The appraiser, if there is a question of value

4. FSBOing Has Become Increasingly Difficult

The paperwork involved in buying or selling a home has increased dramatically as industry disclosures and regulations have become mandatory. This is one of the reasons the percentage of people FSBOing has dropped from 19% to 8% over the last 20+ years.

5. You Net More Money When Using an Agent

Many homeowners believe they’ll save the real estate commission by selling on their own, but the seller and buyer can’t both save the commission.

A report by Zillow revealed that FSBOs are inclined to do so because they believe it will save money (46 percent cite this among their top three reasons), but they don’t actually save anything, and eventually end up listing with an agent.

The same report revealed that,

“While 36% of sellers that (at first) attempted to sell their homes on their own, only 11 percent of sellers—in other words, less than a third…actually sold without an agent.”

It appears working with a real estate professional is the best answer.

Bottom Line

Before you decide to take on the challenges of selling your house on your own, let’s get together to discuss your needs.

3 Mistakes to Avoid When Selling a Home in 2020

It’s exciting to put a house on the market and to think about making new memories in new spaces, but we can have deep sentimental attachments to the homes we’re leaving behind, too. Growing emotions can help or hinder a sale, depending on how we manage them.

When it comes to the bottom line, homeowners need to know what it takes to avoid costly mistakes. Being mindful of these things and prepared for the process can help you avoid some of the most common mishaps when selling your house.

1. Overpricing Your Home

When inventory is low, like it is in the current market, it’s common to think buyers will pay whatever we ask for when we price our homes. Believe it or not, that’s far from the truth. Don’t forget that the buyer’s bank will send an appraisal to determine the fair value for your home. The bank will not lend more than what the house is worth, so be mindful that you might need to renegotiate the price after the appraisal. A real estate professional will help you to set the true value of your home.

2. Letting Your Emotions Interfere with the Sale

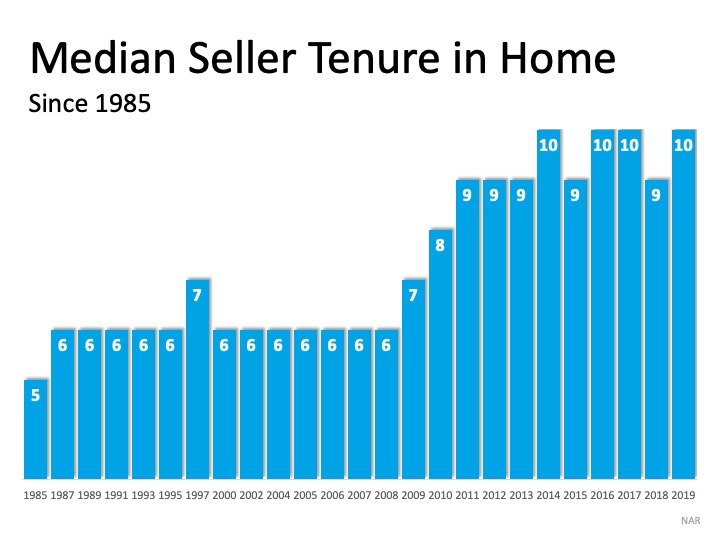

Today, most homeowners have been living in their houses for an average of 10 years (as shown in the graph below): This is several years longer than what used to be the norm since many homeowners have been recouping from negative equity situations over the past 10 years. The side effect, however, is when you live for so long in one place, you may get even more emotionally attached to your space. If it’s the first home you bought after you got married or the house where your children grew up, it very likely means something extra special to you. Every room has memories and it’s hard to detach from the sentimental value.

This is several years longer than what used to be the norm since many homeowners have been recouping from negative equity situations over the past 10 years. The side effect, however, is when you live for so long in one place, you may get even more emotionally attached to your space. If it’s the first home you bought after you got married or the house where your children grew up, it very likely means something extra special to you. Every room has memories and it’s hard to detach from the sentimental value.

For some homeowners, that makes it even harder to negotiate, separating the emotional value of the home from the fair market price. That’s why you need a real estate professional to help you with the negotiations in the process.

3. Not Staging Your Home

We’re generally quite proud of our décor and how we’ve customized our houses to make them our own personalized homes, but not all buyers will feel the same way about your design. That’s why it’s so important to make sure you stage your home with the buyer in mind. Buyers want to envision themselves in the space, so it truly feels like their own. They need to see themselves in the space with their furniture and keepsakes – not your pictures and decorations. Stage and declutter your home so they can visualize their own dreams as they walk through your house. A real estate professional can help you with tips to get your home ready to stage and sell.

Bottom Line

Today’s seller’s market might be your best chance to make a move. If you’re considering selling your house, let’s get together to help you navigate through the process while avoiding common seller mistakes.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

![Where is the Housing Market Headed in 2020? [INFOGRAPHIC] | MyKCM](https://desireestanley.com/files/2019/12/20191220-MEM-1046x1552.jpg)

![Where is the Housing Market Headed in 2020? [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/12/19070953/20191220-MEM-1046x1552.jpg)