The #1 Reason It Is Difficult to Find Your Dream Home

The headlines in real estate today all revolve around one major point: there is a shortage of homes available for sale. Price appreciation is accelerating again because there is a shortage of homes available for sale. First-time buyers are taking longer to purchase a home because there is a shortage of homes available for sale in the lower price points. Boomers are staying in their current homes longer because there is a shortage of homes available for sale to which they would move. In certain markets, affordability is becoming more challenging because there is a shortage of homes available for sale.

What’s the major reason for this lack of housing inventory?

The issue was examined in a recent article by the National Home Builders Association (NAHB). In the article, Robert Dietz, Chief Economist for NAHB, explained:

“Home building in the 2010s was a story of the Long Recovery. After the Great Recession, the number of home builders declined significantly, and housing production was unable to meet buyer demand…Years of population and household formation growth, combined with relatively reduced levels of home building, have left the market with a critical supply shortage.”

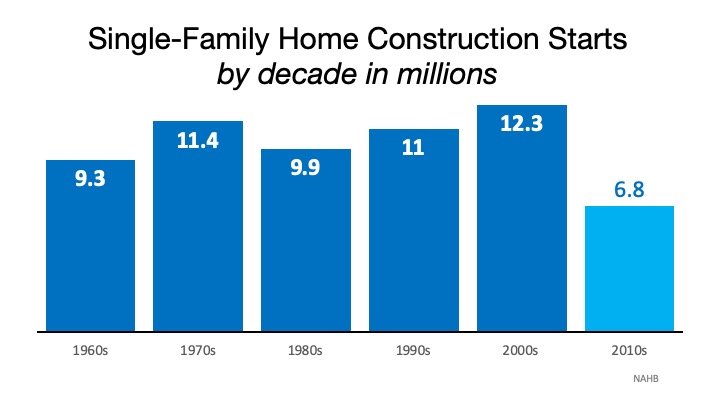

Here are the single-family home construction starts by decade for the last six decades: Obviously, there’s a current shortage of homes for sale because not enough houses were built over the last ten years. To add to the challenge, the U.S. population expanded by more than 20 million people during the 2010s.

Obviously, there’s a current shortage of homes for sale because not enough houses were built over the last ten years. To add to the challenge, the U.S. population expanded by more than 20 million people during the 2010s.

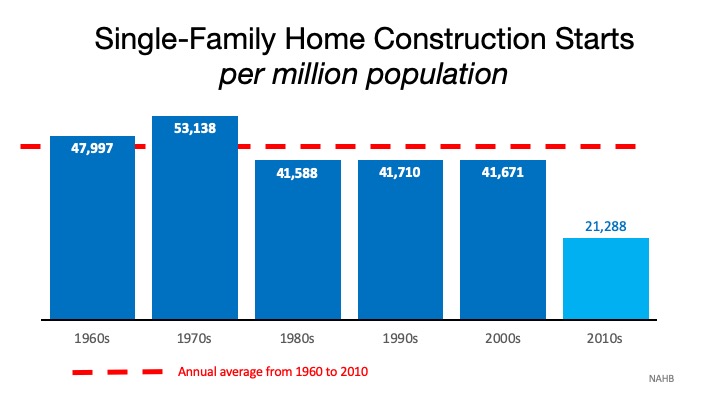

Below is a graph showing the number of starts per million in population. The last decade shows that starts per population were less than half the average of the previous five decades.

There’s good news coming!

The NAHB article explains that there is light at the end of the tunnel.

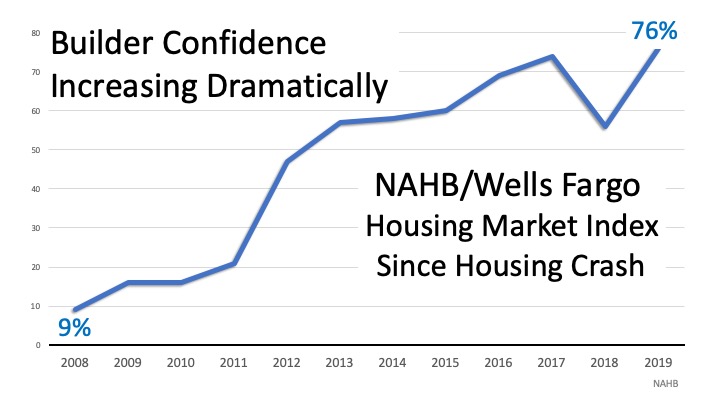

How confident home builders are in the housing market is a great indicator of how much building is about to get started. The NAHB/Wells Fargo Housing Market Index (HMI) gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair,” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average,” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as “good” than “poor.”

Here are the HMI readings going back to 2008: The 2019 confidence reading of 76 was the highest since 1999. The January 2020 index came in at one point lower at 75. These readings indicate we should see an increase in new residential construction in 2020. Just last week, NAHB Chairman Greg Ugalde stated:

The 2019 confidence reading of 76 was the highest since 1999. The January 2020 index came in at one point lower at 75. These readings indicate we should see an increase in new residential construction in 2020. Just last week, NAHB Chairman Greg Ugalde stated:

“Low interest rates and a healthy labor market combined with a need for additional inventory are setting the stage for further home building gains in 2020.”

The increase in housing starts has already begun. According to the January report from the U.S. Census Bureau and the U.S. Department of Housing and Urban Development, single‐family housing starts were up 11.2% and attained the highest level in thirteen years.

Bottom Line

Whether you’re a first-time buyer or a seller thinking of moving up or down, 2020 could be your year with more new construction homes coming to market.

How Buyers Can Win By Downsizing in 2020

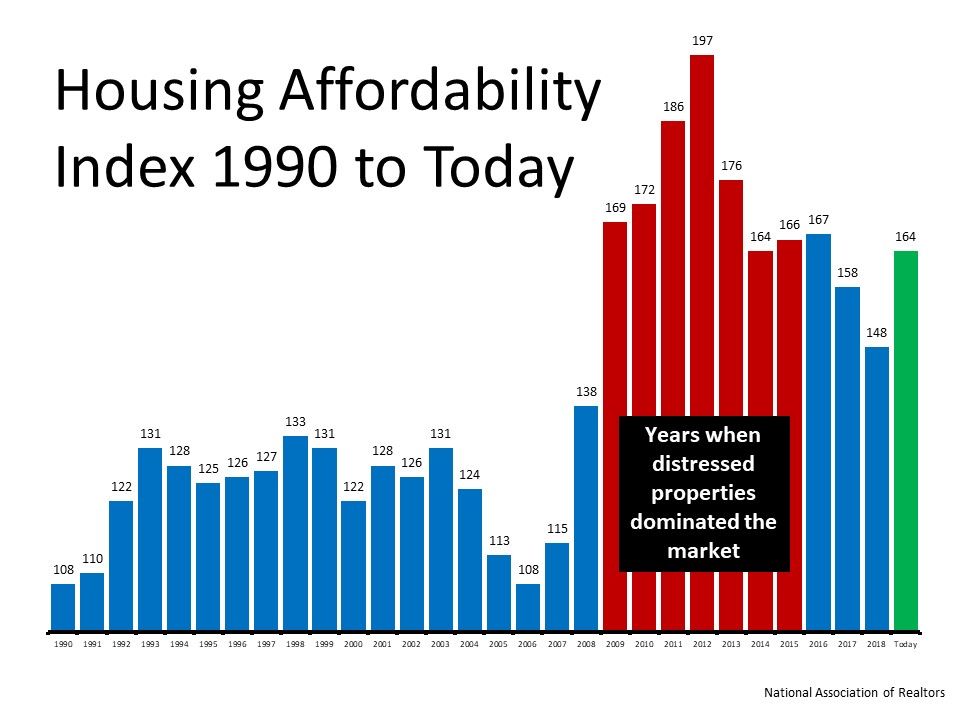

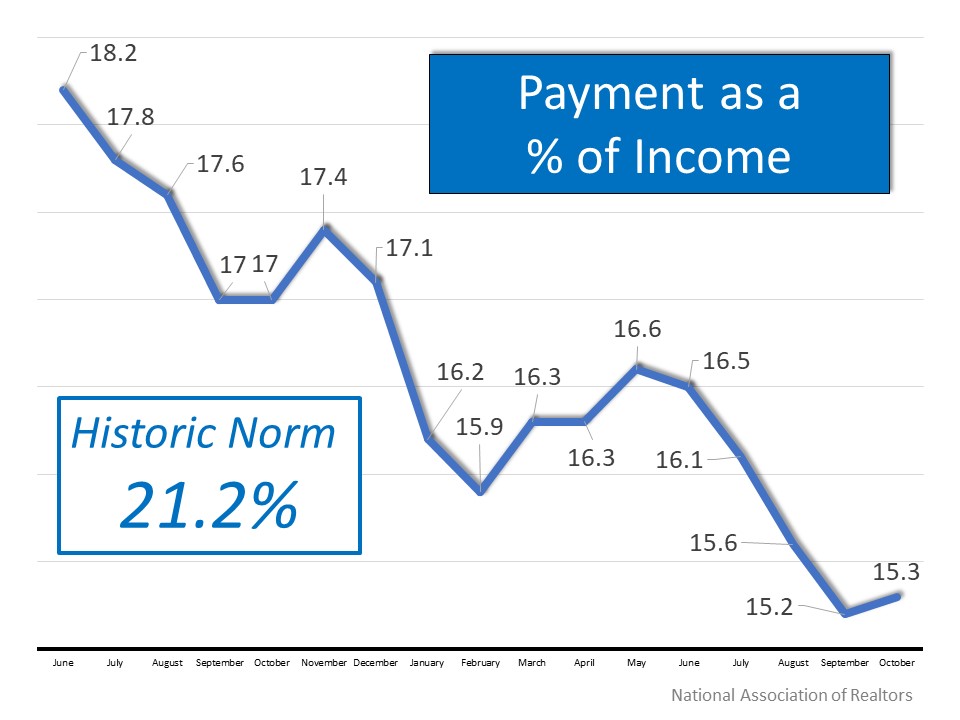

Home values have been increasing for 93 consecutive months, according to the National Association of Realtors. If you’re a homeowner, particularly one looking to downsize your living space, that’s great news, as you’ve likely built significant equity in your home.

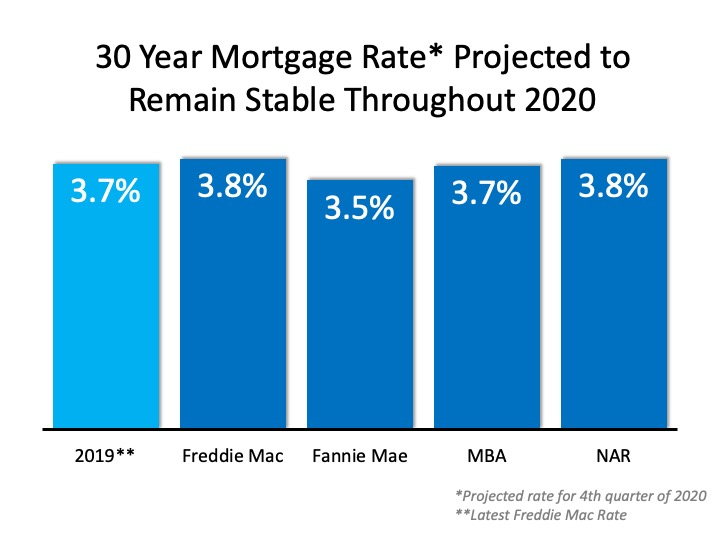

Here’s some more good news: mortgage rates are expected to remain low throughout 2020 at an average of 3.8% for a 30-year fixed-rate loan.

The combination of leveraging your growing equity and capitalizing on low rates could make a big difference in your housing plans this year.

How to Use Your Home Equity

For move-up buyers, the typical pattern for building financial stability and wealth through homeownership works this way: you buy a house and gain equity over several years of mortgage payments and price appreciation. You then take that equity from the sale of your house to make a down payment on your next home and repeat the process.

For homeowners ready to downsize, home equity can work in a slightly different way. What you choose to do depends in part upon your goals.

According to HousingWire.com, for some, the desire to downsize may be related to retirement plans or children aging out of the home. Others may be choosing to live in a smaller home to save money or simplify their lifestyle in a space that’s easier to clean and declutter. The reasons can vary greatly and by generation.

Those who choose to put their equity toward a new home have the opportunity to make a substantial down payment or maybe even to buy their next home in cash. This is incredibly valuable if your goal is to have a minimal mortgage payment or none at all.

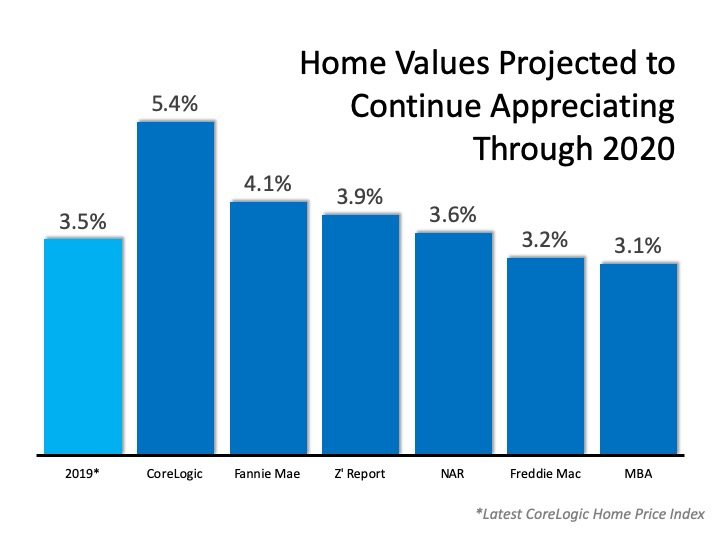

A local real estate professional can help you evaluate your equity and how to use it wisely. If you’re planning to downsize, keep in mind that home prices are anticipated to continue rising in 2020, which could influence your choices.

The Impact of Low Mortgage Rates

Low mortgage rates can offset price hikes, so locking in while rates are low will be key. For many downsizing homeowners, a loan with a shorter term is ideal, so the balance can be reduced more quickly.

Interest rates on 10, 15, and 20-year loans are lower than the rates on a 30-year fixed-rate loan. If you’re downsizing your housing costs, you may prefer a shorter-term loan to pay off your home faster. This way, you can save thousands in interest payments over time.

Bottom Line

If you’re planning a transition into a smaller home, the twin trends of low mortgage rates and rising home equity can kickstart or boost your plans, especially if you’re anticipating retirement soon or just want to live in a smaller home that’s easier to maintain. Let’s get together today to explore your options.

Housing Inventory Vanishing: What Is the Impact on You?

The real estate market is expected to do very well this year as mortgage rates remain at historic lows. One challenge to the housing industry is the lack of homes available for sale. Last week, move.com released a report showing that 2020 is beginning with the lowest available housing inventory in two years. The report explains:

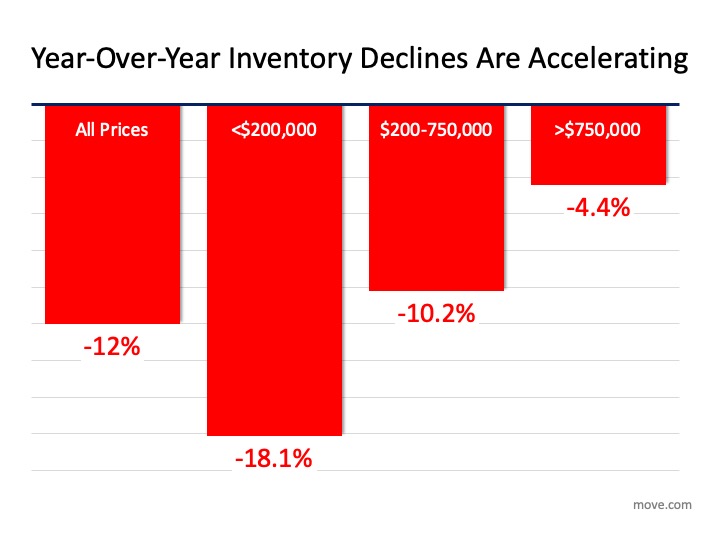

“Last month saw the largest year-over-year decline of housing inventory in almost three years with a dramatic 12 percent decline, pushing the number of homes for sale in the U.S. to the lowest level since January 2018.”

The report also revealed that the decline in inventory stretches across all price points, as shown in the following graph: George Ratiu, Senior Economist at realtor.com, explains how this drop in available homes for sale comes at a time when more buyers are expected to enter the market:

George Ratiu, Senior Economist at realtor.com, explains how this drop in available homes for sale comes at a time when more buyers are expected to enter the market:

“The market is struggling with a large housing undersupply just as 4.8 million millennials are reaching 30-years of age in 2020, a prime age for many to purchase their first home. The significant inventory drop…is a harbinger of the continuing imbalance expected to plague this year’s markets, as the number of homes for sale are poised to reach historically low levels.”

The question is: What does this mean to you?

If You’re a Buyer…

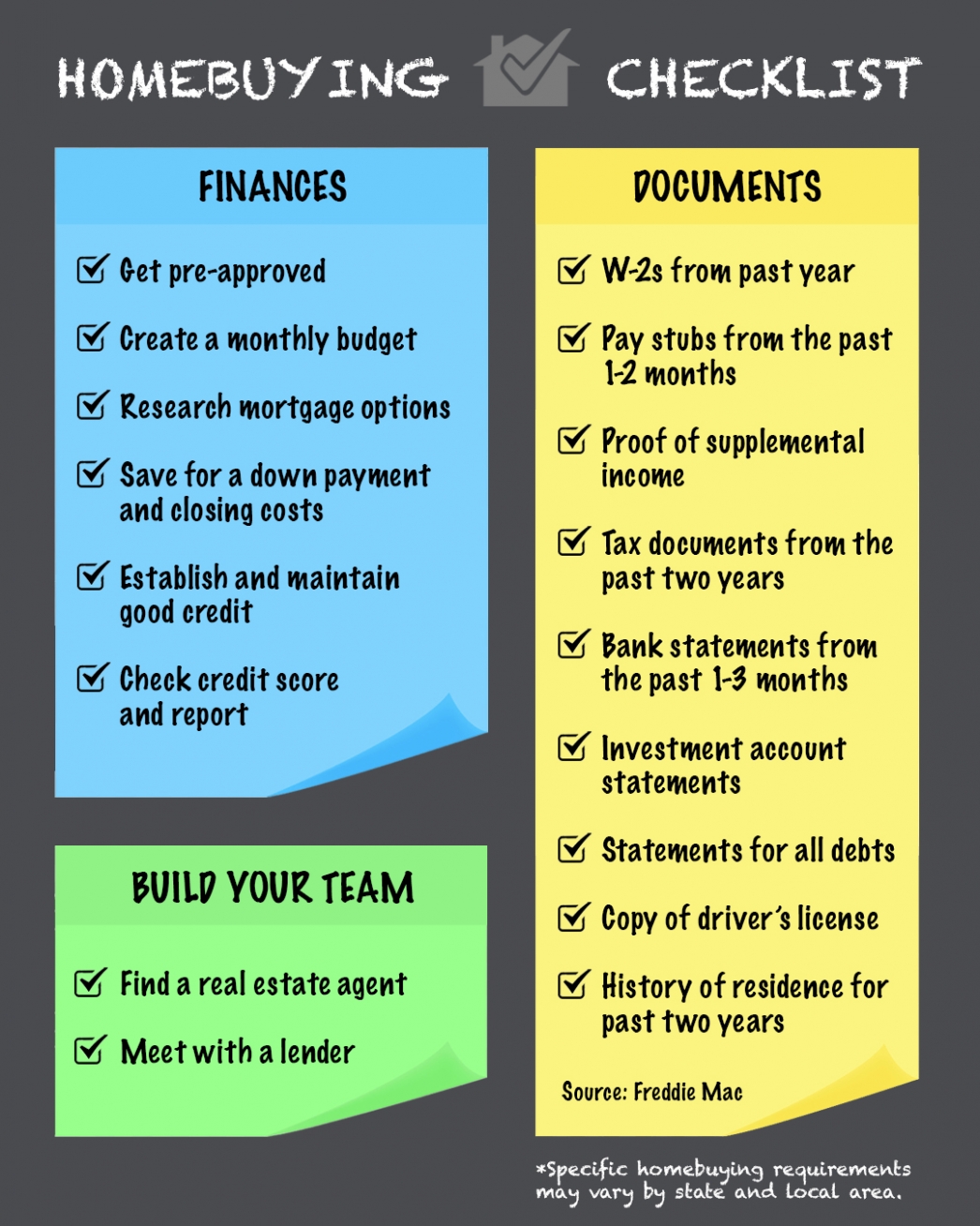

Be patient during your home search. It may take time to find a home you love. Once you do, however, be ready to move forward quickly. Get pre-approved for a mortgage, be ready to make a competitive offer from the start, and understand that a shortage in inventory could lead to the resurgence of bidding wars. Calculate just how far you’re willing to go to secure a home if you truly love it.

If You’re a Seller…

Realize that, in some ways, you’re in the driver’s seat. When there is a shortage of an item at the same time there is a strong demand for that item, the seller of that item is in a good position to negotiate. Whether it is the price, moving date, possible repairs, or anything else, you’ll be able to demand more from a potential purchaser at a time like this – especially if you have multiple interested buyers. Don’t be unreasonable, but understand you probably have the upper hand.

Bottom Line

The housing market will remain strong throughout 2020. Understand what that means to you, whether you’re buying, selling, or doing both.

Tips to sell your home faster

When selling your house, there are a few key things you can prioritize to have the greatest impact for a faster sale:

1. Make Buyers Feel at Home

Declutter your home! Pack away all personal items like pictures, awards, and sentimental belongings. Make buyers feel like they belong in the house. According to the 2019 Profile of Home Staging by the National Association of Realtors, “83% of buyers’ agents said staging a home made it easier for a buyer to visualize the property as a future home.”

Not only will your house spend less time on the market, but the same report mentioned that, “One-quarter of buyers’ agents said that staging a home increased the dollar value offered between 1 – 5%, compared to other similar homes on the market that were not staged.”

2. Keep It Organized

Since you took the time to declutter, keep it organized. Before buyers arrive, pick up toys, make the bed, and put away clean dishes. According to the same report, the kitchen is one of the most important rooms to stage in order to attract more buyers. Put out a scented candle or some cookies fresh from the oven. Buyers will remember the smell of your home.

3. Price It Right

More inventory coming into the market guarantees there will be some competition. You want to make sure your home is noticed. A key to selling your house is ensuring it is Priced to Sell Immediately (PTSI). This means you’ll be driving more traffic to your property, and ultimately creating more interest in your home.

4. Give Buyers Full Access

One of the top four elements when selling your home is access. If your home is available anytime, that opens up more opportunity to find a buyer right away. Some buyers, especially those relocating, don’t have much time available. If they cannot get into the house, they will move on to the next one.

Bottom Line

If you want to sell your home in the least amount of time at the best price with as little hassle as possible, a local real estate professional is a useful guide. Let’s connect today to determine what you need to do to sell your home as quickly as possible.

You Need More Than a Guide. You Need a Sherpa.

In a normal housing market, whether you’re buying or selling a home, you need an experienced guide to help you navigate the process. You need someone you can turn to who will tell you how to price your home correctly right from the start. You need someone who can help you determine what to offer on your dream home without paying too much or offending the seller with a low-ball offer.

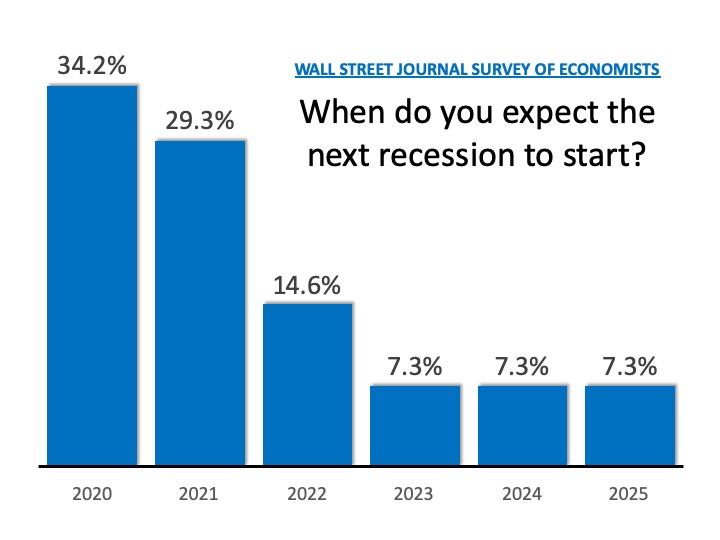

We are, however, in anything but a “normal market” right now. The media is full of stories about an impending recession, a trade war with China, and constant political upheaval. Each of these potential situations could dramatically impact the real estate market. To successfully navigate the landscape today, you need more than an experienced guide. You need a ‘Real Estate Sherpa.’

A Sherpa is a “member of a Himalayan people living on the borders of Nepal and Tibet, renowned for their skill in mountaineering.” Sherpas are skilled in leading their parties through the extreme altitudes of the peaks and passes in the region – some of the most treacherous trails in the world. They take pride in their hardiness, expertise, and experience at very high altitudes.

They are much more than just guides.

This is much more than a normal real estate market.

The average guide just won’t do. You need a ‘Sherpa.’ You need an expert who understands what is happening in the market and why it is happening. You need someone who can simply and effectively explain it to you and your family. You need an expert who will guarantee you make the right decision, even in these challenging times.

Dave Ramsey, the financial guru, advises:

“When getting help with money, whether it’s insurance, real estate or investments, you should always look for someone with the heart of a teacher, not the heart of a salesman.”

Bottom Line

Hiring an agent who has a finger on the pulse of the market will make your buying or selling experience an educated one.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link