Does Your Home Have What Buyers Are Looking For?

There’s a great opportunity for today’s homeowners to sell their houses and make a move, yet due to the impact of the ongoing health crisis, some sellers are taking their time coming back to the market. According to Javier Vivas, Director of Economic Research at realtor.com:

“Sellers continue returning to the market at a cautious pace and further improvement could be constrained by lingering coronavirus concerns, economic uncertainty, and civil unrest.”

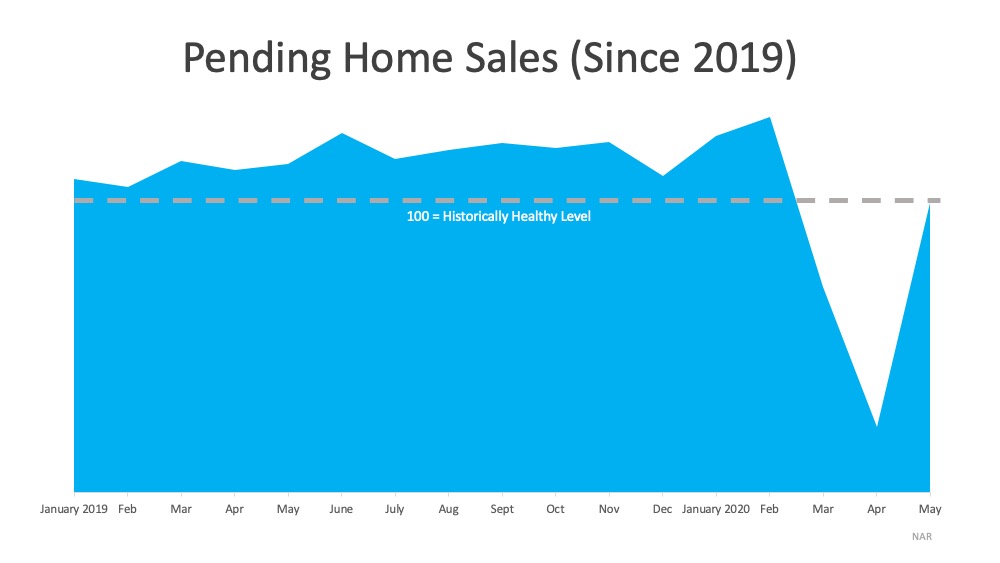

For homeowners who need a little nudge of motivation to get back in the game, it’s good to know that buyers are ready to purchase this season. After spending several months at home and re-evaluating what they truly want and need in their space, buyers are ready and they’re in the market now. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR) explains:

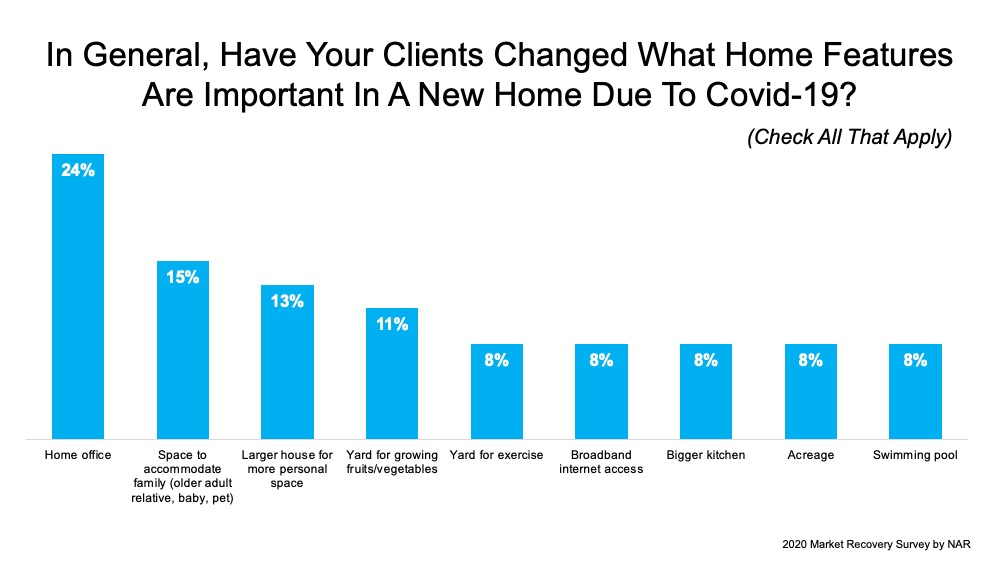

“A number of potential buyers noted stalled plans due to the pandemic and that has led to more urgency and a pent-up demand to buy…After being home for months on end – in a home they already wanted to leave – buyers are reminded how much their current home may lack certain desired features or amenities.”

The latest Market Recovery Survey from NAR shares some of the features and amenities buyers are looking for, especially since the health crisis has shifted many buyer priorities. The most common home features cited as increasingly important are home offices and space to accommodate family members new to the residence (See graph below): The survey results also show that among buyers who indicate they would now like to live in a different area due to COVID-19, 47% have an interest in purchasing in the suburbs, 39% cite rural areas, and 25% indicate a desire to be in small towns.

The survey results also show that among buyers who indicate they would now like to live in a different area due to COVID-19, 47% have an interest in purchasing in the suburbs, 39% cite rural areas, and 25% indicate a desire to be in small towns.

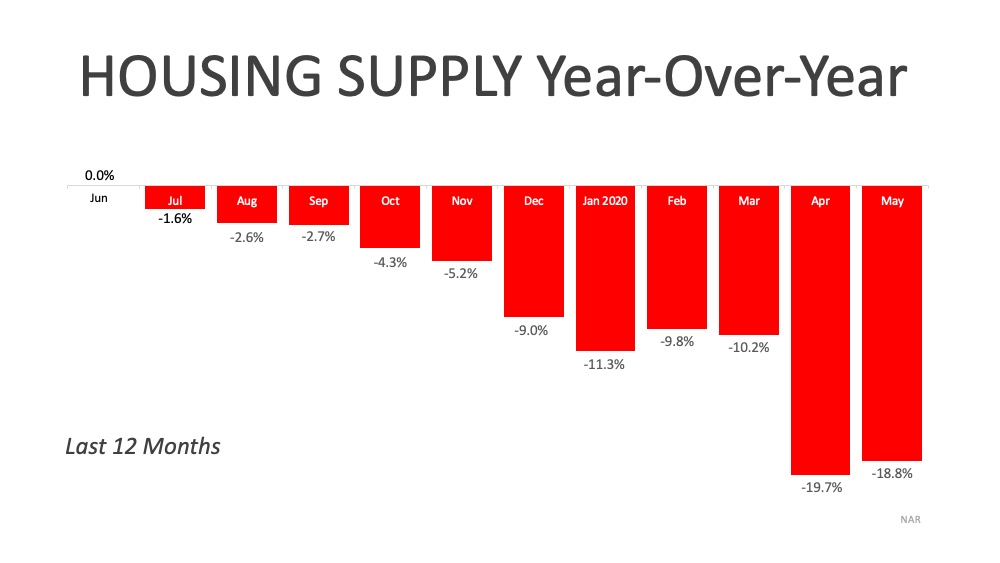

As we can see, buyers are eager to find a new home, but there’s a big challenge in the market: a lack of homes available to purchase. Danielle Hale, Chief Economist at realtor.com explains:

“The realtor.com June Housing Trends Report showed that buyers still outnumber sellers which is causing the gap in time on market to shrink, prices to grow at a faster pace than pre-COVID, and the number of homes available for sale to decrease by more than last month. These trends play out similarly in the most recent week’s data with the change in time on market being most notable. In the most recent week homes sat on the market just 7 days longer than last year whereas the rest of June saw homes sit 2 weeks or more longer than last year.”

In essence, home sales are picking up speed and buyers are purchasing them at a faster rate than they’re coming to the market. Hale continues to say:

“The housing market has plenty of buyers who would benefit from a few more sellers. If the virus can be contained and home prices continue to grow, this may help bring sellers back to the housing market.”

Bottom Line

If you’re considering selling and your current house has some of the features today’s buyers are looking for, let’s connect. You’ll likely be able to sell at the best price, in the least amount of time, and will be able to take advantage of the low-interest rates available right now when buying your new home.

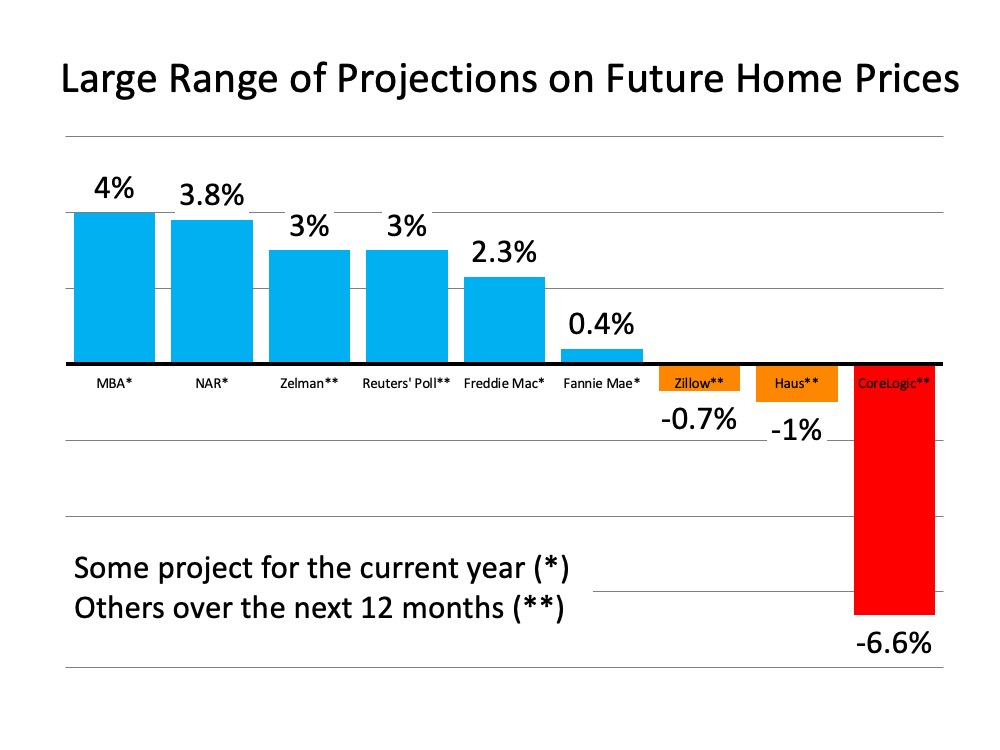

What Are Experts Saying about Home Prices?

Last week, a very well-respected real estate analytics firm surprised many with their home price projection for the next twelve months. CoreLogic, in their latest Home Price Index, said:

“The economic downturn that started in March 2020 is predicted to cause a 6.6% drop in the HPI by May 2021, which would be the first decrease in annual home prices in over 9 years.”

The forecast was surprising as it was strikingly different than any other projection by major analysts. Six of the other eight forecasts call for appreciation, and the two who project depreciation indicate it will be one percent or less.

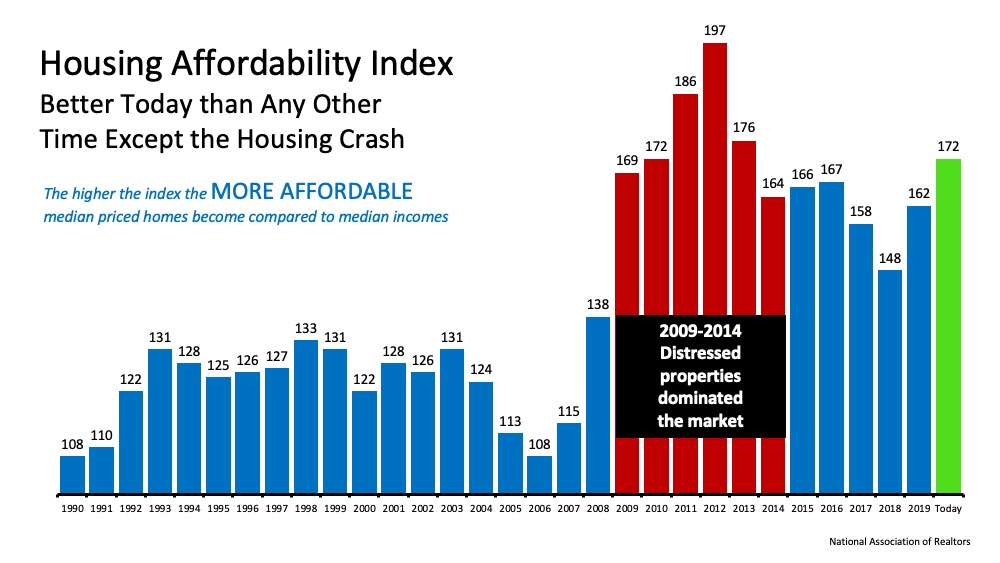

Here is a graph showing all of the projections: There’s a simple formula to determine the future price of any item: calculate the supply of that item in ratio to the demand for that item. In housing right now, demand far exceeds supply. Last week mortgage applications to buy a home were 33% higher than they were at the same time last year. The available inventory of homes for sale is 31% lower than it was last year. Normally, these numbers should call for homes to continue to appreciate.

There’s a simple formula to determine the future price of any item: calculate the supply of that item in ratio to the demand for that item. In housing right now, demand far exceeds supply. Last week mortgage applications to buy a home were 33% higher than they were at the same time last year. The available inventory of homes for sale is 31% lower than it was last year. Normally, these numbers should call for homes to continue to appreciate.

Bottom Line

Because of the uncertainty with the pandemic, any economic prediction is extremely difficult. However, looking at the limited supply of homes for sale and the tremendous demand for housing, it is difficult to disagree with the majority of analysts who are calling for price appreciation.

Americans Rank Real Estate Best Investment for 7 Years Running [INFOGRAPHIC]

![Americans Rank Real Estate Best Investment for 7 Years Running [INFOGRAPHIC] | MyKCM](https://desireestanley.com/files/2020/07/20200710-MEM-1046x1067.jpg)

![Americans Rank Real Estate Best Investment for 7 Years Running [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/07/07133310/20200710-MEM-1046x1067.jpg)

Some Highlights

- Real estate has outranked stocks, savings accounts, and gold as the best long-term investment among Americans for the past 7 years.

- The belief in the stability of housing as a long-term investment remains strong, despite the many challenges our economy faces today.

- Of the four listed, real estate is also the only investment you can also live in. That’s a big win!

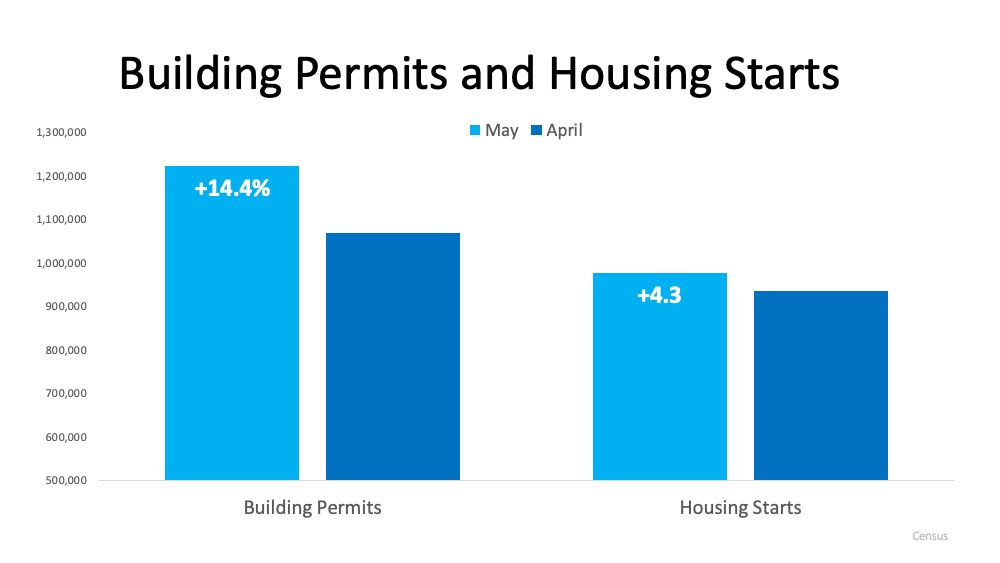

Are New Homes Going to Be Available to Buy This Year?

In today’s economy, everyone seems to be searching for signs that a recovery is coming soon. Many experts agree that it may actually already be in motion or will be starting by the 3rd quarter of this year. With the housing market positioned to lead the way out of this recession, builder confidence might be a bright spark that gets the recovery fire started. The construction of new homes coming right around the corner is a huge part of that effort, and it may drive your opportunity to make a move this year.

According to the National Association of Home Builders (NAHB):

“New home sales jumped in May, as housing demand was supported by low interest rates, a renewed household focus on housing, and rising demand in lower-density markets. Census and HUD estimated new home sales in May at a 676,000 seasonally adjusted annual pace, a 17% gain over April.”

In addition, builder confidence is also rising, opening up opportunities for newly constructed homes in the market. The NAHB also notes:

“In a sign that housing stands poised to lead a post-pandemic economic recovery, builder confidence in the market for newly-built single-family homes jumped 21 points to 58 in June, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI). Any reading above 50 indicates a positive market.”

As noted above, this upward trend is supported by builders reporting an increase in demand for single-family homes in suburban neighborhoods with lower-density populations, a result of the COVID-19 health crisis.

Moreover, the most recent Monthly New Residential Construction Report from the U.S. Census indicates that authorized building permits for new residential construction increased by 14.4% month-over-month from April to May, and housing starts were also up 4.3% over the same time period. (See graph below): Although housing permits and starts are both considerably lower than they were at this time last year, indicating the new construction market is still working on building its way back up, the trends are moving in the right direction when it comes to having an impact on the U.S. economy. They’re also poised to create the much-needed new homes for Americans to purchase in a time when inventory is so scarce.

Although housing permits and starts are both considerably lower than they were at this time last year, indicating the new construction market is still working on building its way back up, the trends are moving in the right direction when it comes to having an impact on the U.S. economy. They’re also poised to create the much-needed new homes for Americans to purchase in a time when inventory is so scarce.

Dean Mon, Chairman of the NAHB notes:

“As the nation reopens, housing is well-positioned to lead the economy forward…Inventory is tight, mortgage applications are increasing, interest rates are low and confidence is rising. And buyer traffic more than doubled in one month even as builders report growing online and phone inquiries stemming from the outbreak.”

The gap between homes to buy and the high demand from purchasers may be narrowed by new construction, and the data shows that these homes are on their way into the housing market.

So, if you’ve debated whether or not to sell your house this year because you’re not sure where to move, a newly-built home – designed to your specific liking – may be your answer.

Bottom Line

With new residential construction right around the corner, you can feel confident about selling your house and having a place to move into. Maybe it’s time to finally design the home you’ve always wanted. Let’s connect today to discuss selling your house while demand from eager buyers is high.

What Are the Experts Saying About Future Home Prices?

A worldwide pandemic and an economic recession have had a tremendous effect on the nation. The uncertainty brought about by both has made predicting consumer behavior nearly impossible. For that reason, forecasting home prices has become extremely difficult.

Normally, there’s a simple formula to determine the future price of any item: calculate the supply of that item in ratio to the demand for that item. In housing right now, demand far exceeds supply. Mortgage applications to buy a home just rose to the highest level in 11 years while the inventory of homes for sale is at (or near) an all-time low. That would usually indicate a strong appreciation for home values as we move throughout the year.

Some experts, however, are not convinced the current rush of purchasers is sustainable. Ralph McLaughlin, Chief Economist at Haus, explained in their June 2020 Hausing Market Forecast why there is a concern:

“The upswing that we’ll see this summer is a result of pent-up demand from homebuyers and supply-in-progress from homebuilders that has simply been pushed off a few months. However, after this pent-up demand goes away, the true economic scarring due to the pandemic will begin to affect the housing market as the tide of pent-up demand goes out.”

The virus and other challenges currently impacting the industry have created a wide range of thoughts regarding the future of home prices. Here’s a list of analysts and their projections, from the lowest depreciation to the highest appreciation:

- CoreLogic: Year-Over-Year decline of -1.5%

- Haus: Year-Over-Year decline of -1%

- Zillow: Year-Over-Year change is forecasted to bottom out at -0.7%.

- Home Price Expectation Survey: Decline of -0.3% in 2020

- Fannie Mae: Increase of 0.4% in 2020

- Freddie Mac: Increase of 2.3% in 2020

- Zelman & Associates: Increase of 3.0% in 2020

- National Association of Realtors: Increase of 3.8% in 2020

- Mortgage Bankers Association: Increase of 4.0% in 2020

We can garner two important points from this list:

- There is no real consensus among the experts.

- No one projects prices to crash like they did in 2008.

Bottom Line

Whether you’re thinking of buying a home or selling your house, know that home prices will not change dramatically this year, even with all of the uncertainty we’ve faced in 2020.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link