Why Selling this Fall May Be Your Best Move

If you’re thinking about moving, selling your house this fall might be the way to go. Here are four highlights in the housing market that may make your decision to sell this fall an easy one.

1. Buyers Are Actively in the Market

ShowingTime, a leading real estate showing software and market stat service provider, just reported that buyer traffic jumped 60.7% compared to this time last year. That’s a huge increase.

It’s clear that buyers are ready, willing, and able to purchase – and they’re in the market right now. In many regions of the country, multiple buyers are entering bidding wars to compete for the home they want. Take advantage of the buyer activity currently in the market so you can sell your house in the most favorable terms.

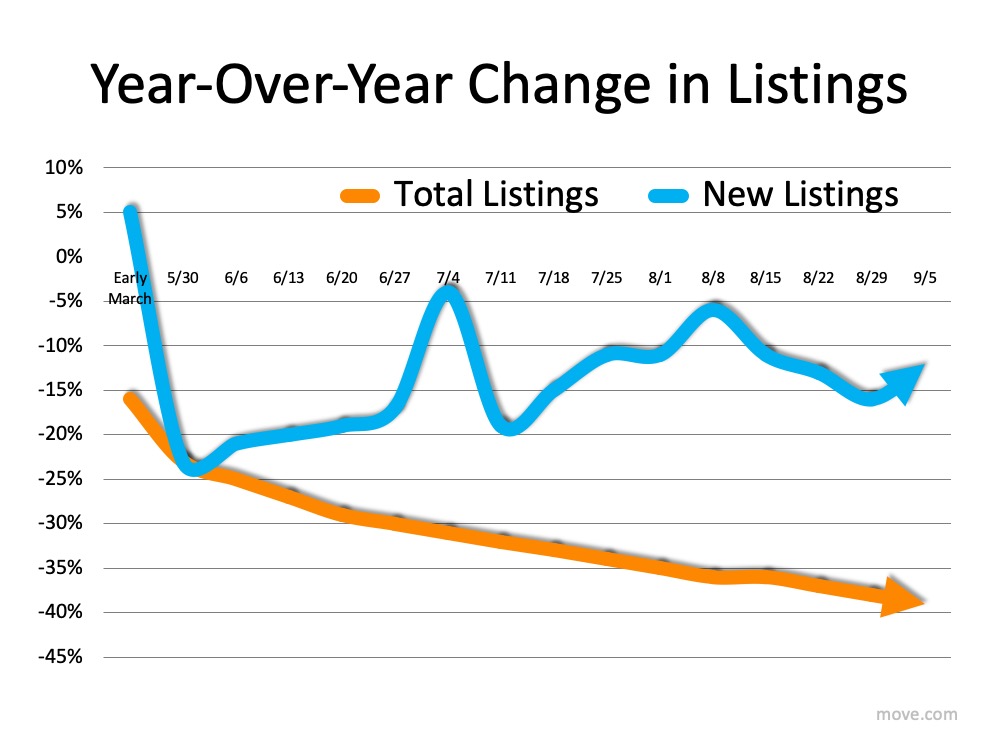

2. There Are Not Enough Homes for Sale

In the latest Existing Home Sales Report, the National Association of Realtors (NAR) announced that there were only 1.49 million units available for sale. That number was down 18.6% from one year ago. This means in the majority of the country, there aren’t enough homes for sale to satisfy the number of buyers.

Due to the health crisis, many homeowners were reluctant to list their homes earlier this year. That will change as the economy continues to recover. The choices buyers have will increase going into the new year. Don’t wait until additional sellers come to market before you decide to make a move.

3. The Process Is Going Quickly

Today’s ultra-competitive environment has forced buyers to do all they can to stand out from the crowd, including getting pre-approved for their mortgage financing. This makes the entire selling process much faster and simpler, as buyers know exactly what they can afford before shopping for a home. According to the latest Origination Insights Report from Ellie Mae, the time needed to close a loan is just 49 days.

4. There May Never Be a More Important Time to Move

You’ve likely spent much of the last six months in your current home. Perhaps you now realize how small it is, and you need more space. If you’re working from home, your children are doing virtual school, or you just need more space, your current floor plan may not work for your family’s changing needs.

Homebuilders are beginning to build houses again, so you can choose the exact floor plan to match what your family needs, and you can make sure the outdoor space is what you want too.

Bottom Line

The housing market is prime for sellers right now, so let’s connect to get the process started this fall. If the timing is right for you and your family, the market is calling your name.

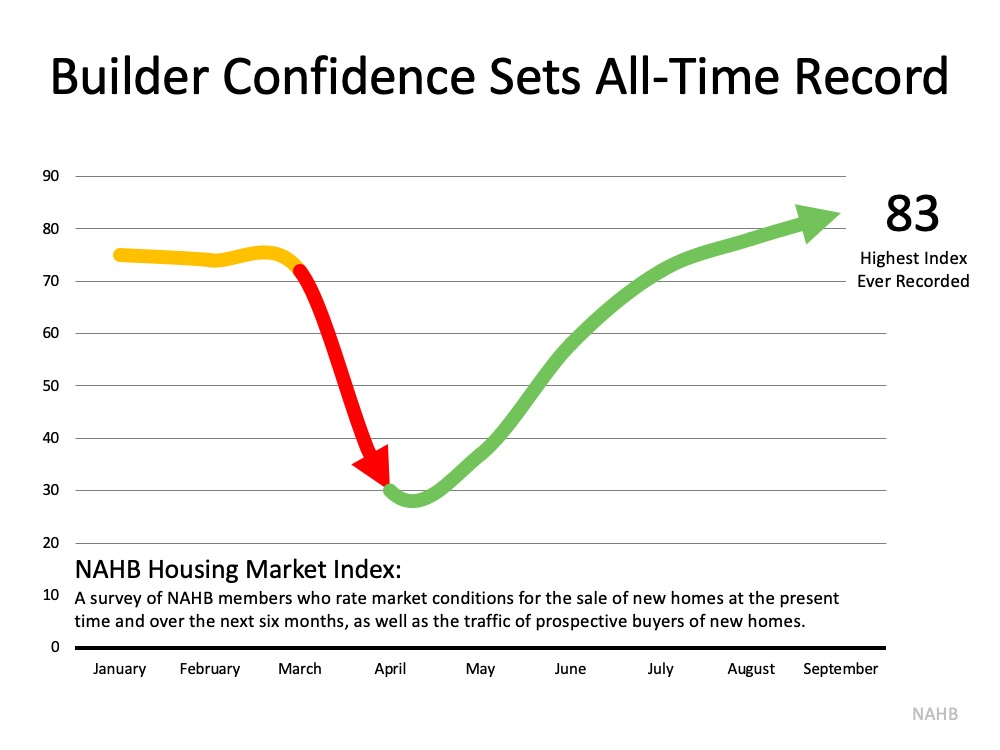

Home Builder Confidence Hits All-Time Record

Last week, the National Association of Home Builders (NAHB) reported their Housing Market Index (HMI) hit an all-time high in the 35-year history of the series with a score of 83. The index gauges builder perceptions of current single-family home sales and sale expectations for the next six months, as well as the traffic of prospective buyers of new homes.

As the following chart shows, confidence dropped dramatically when stay-in-place orders were originally mandated earlier this year. Since then, it has soared back. Looking at the three-month moving averages for HMI scores, confidence increased in every region of the country:

Looking at the three-month moving averages for HMI scores, confidence increased in every region of the country:

- The Northeast increased 11 points to 76

- The Midwest jumped 9 points to 72

- The South rose 8 points to 79

- The West increased 7 points to 85

Confidence Is Validated by the Numbers

This confidence is definitely warranted. According to a recent NAHB report, single-family housing starts increased 4.1% to a 1.02 million annual rate, and single-family permits increased 6% to a 1.04 million unit rate, meaning newly constructed homes are on the rise.

A separate report from the Mortgage Bankers Association (MBA) shows mortgage applications for new home purchases increased by 33.3% compared to a year ago. Joel Kan, Associate Vice President of Economic and Industry Forecasting at MBA, commented on the numbers:

“The housing market continued to exceed expectations in August, as housing demand for new homes stayed strong and the job market continued to recover…The new home market has maintained its path of recovery throughout the summer, and record-low mortgage rates and households seeking more space will likely continue to drive demand into the fall.”

Bottom Line

If you’re thinking about putting your house on the market but are afraid you may not find a home to buy, let’s connect to discuss new construction opportunities in our area.

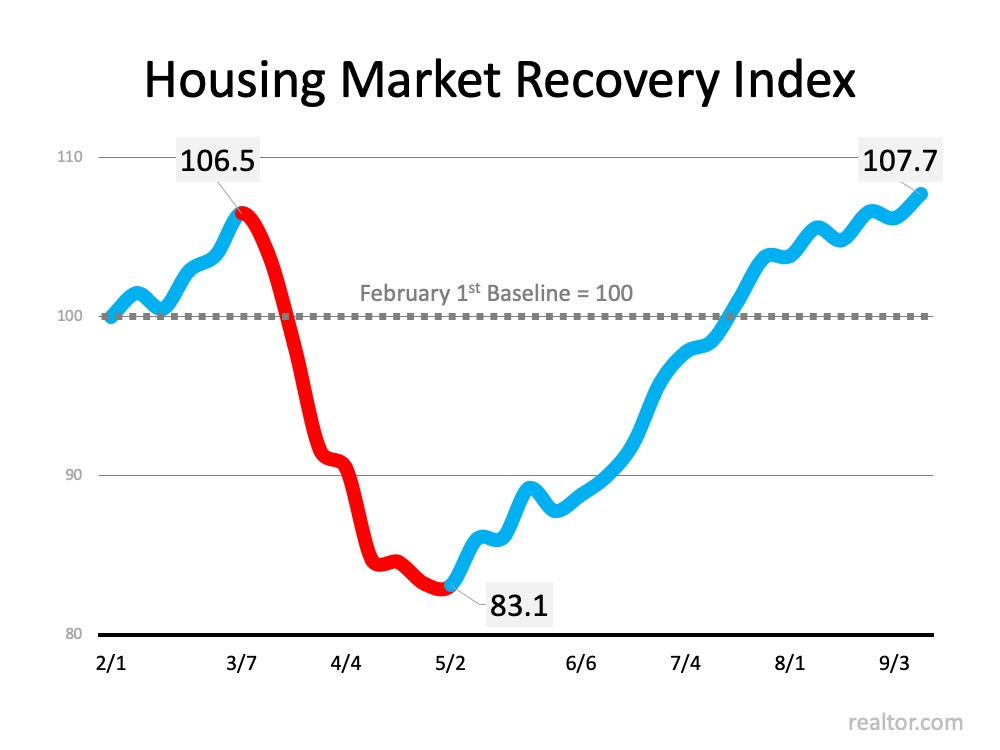

The Surging Real Estate Market Continues to Climb

Earlier this year, realtor.com announced the release of the Housing Recovery Index, a weekly guide showing how the pandemic has impacted the residential real estate market. The index leverages a weighted average of four key components of the housing industry by tracking each of the following:

- Housing Demand – Growth in online search activity

- Home Price – Growth in asking prices

- Housing Supply – Growth of new listings

- Pace of Sales – Difference in time-on-market

The index compares the current status “to the January 2020 market trend, as a baseline for pre-COVID market growth. The overall index is set to 100 in this baseline period. The higher a market’s index value, the higher its recovery and vice versa.”

The graph below charts the index by showing how the real estate market started out strong in early 2020, and then dropped dramatically at the beginning of March when the pandemic paused the economy. It also shows the strength of the recovery since the beginning of May. Today, the index stands at its highest point all year, including the time prior to the economic shutdown.

Today, the index stands at its highest point all year, including the time prior to the economic shutdown.

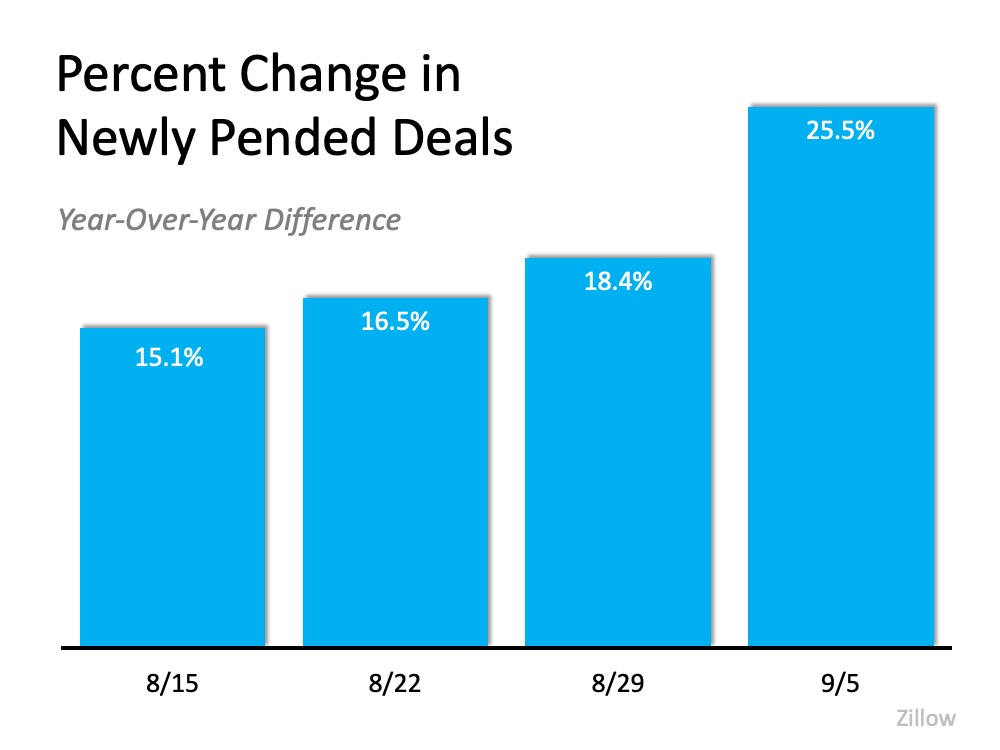

The Momentum Is Still Building

Though there is some evidence that the overall economic recovery may be slowing, the housing market is still gaining momentum. Zillow tracks the number of homes that are put into contract on a weekly basis. Their latest report confirms that buyer demand is continuing to dramatically outpace this same time last year, and the percent increase over last year is growing. Clearly, the housing market is not only outperforming the grim forecasts from earlier this year, but it is also eclipsing the actual success of last year.

Clearly, the housing market is not only outperforming the grim forecasts from earlier this year, but it is also eclipsing the actual success of last year.

Frank Martell, President and CEO of CoreLogic, explains it best:

“On an aggregated level, the housing economy remains rock solid despite the shock and awe of the pandemic.”

Bottom Line

Whether you’re considering buying or selling, staying on top of the real estate market over the coming months will be essential to your success.

Is Now a Good Time to Move?

How long have you lived in your current home? If it’s been a while, you may be thinking about moving. According to the latest Profile of Home Buyers and Sellers by the National Association of Realtors (NAR), in 2019, homeowners were living in their homes for an average of 10 years. That’s a long time to time to be in one place, considering the average length of time homeowners used to stay put hovered closer to 6 years.

With today’s changing homebuyer needs, especially given how the current health crisis has altered our daily lifestyles, many homeowners are reconsidering where they’re at and thinking about moving to a home with more space for their families. Here’s why it might be a great time to make that happen.

The real estate market has changed in many ways over the past 10 years, and current homeowners are earning much more equity today than they used to have. According to CoreLogic, in the first quarter of 2020 alone, the average homeowner gained approximately $9,600 in equity. If you’re considering selling your house right now, you may have accumulated more equity to put toward a move than you realize.

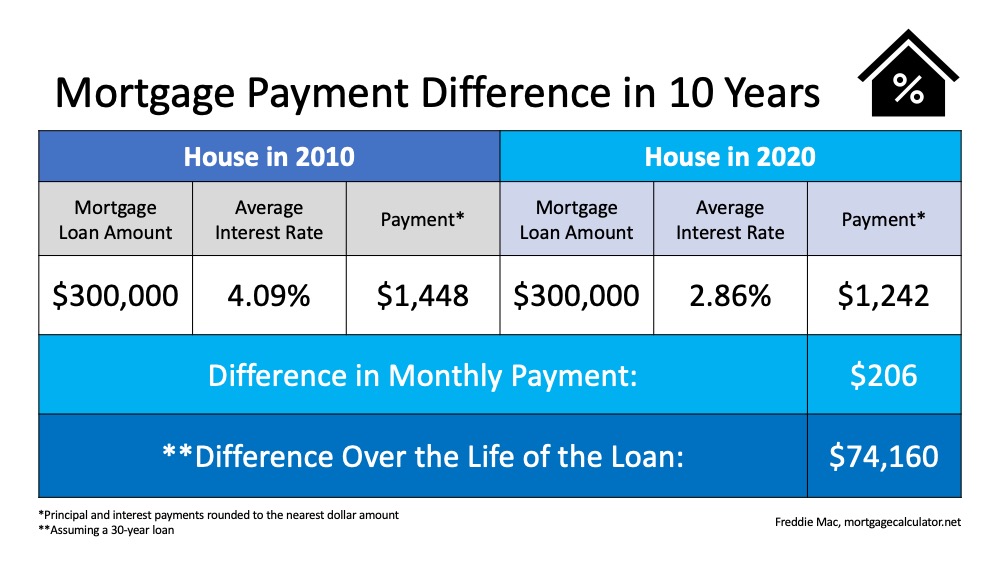

Dialing back 10 years, many homeowners also locked in a fairly low mortgage rate. In 2010, the average rate was only 4.09%. This motivated homeowners to stay in their houses longer than usual to keep their rate low, rather than moving. Just last Thursday, however, average mortgage rates hit a new historic low at 2.86%. Sam Khater, Chief Economist at Freddie Mac explains:

“Mortgage rates have hit another record low due to a late summer slowdown in the economic recovery…These low rates have ignited robust purchase demand activity, which is up twenty-five percent from a year ago and has been growing at double digit rates for four consecutive months.”

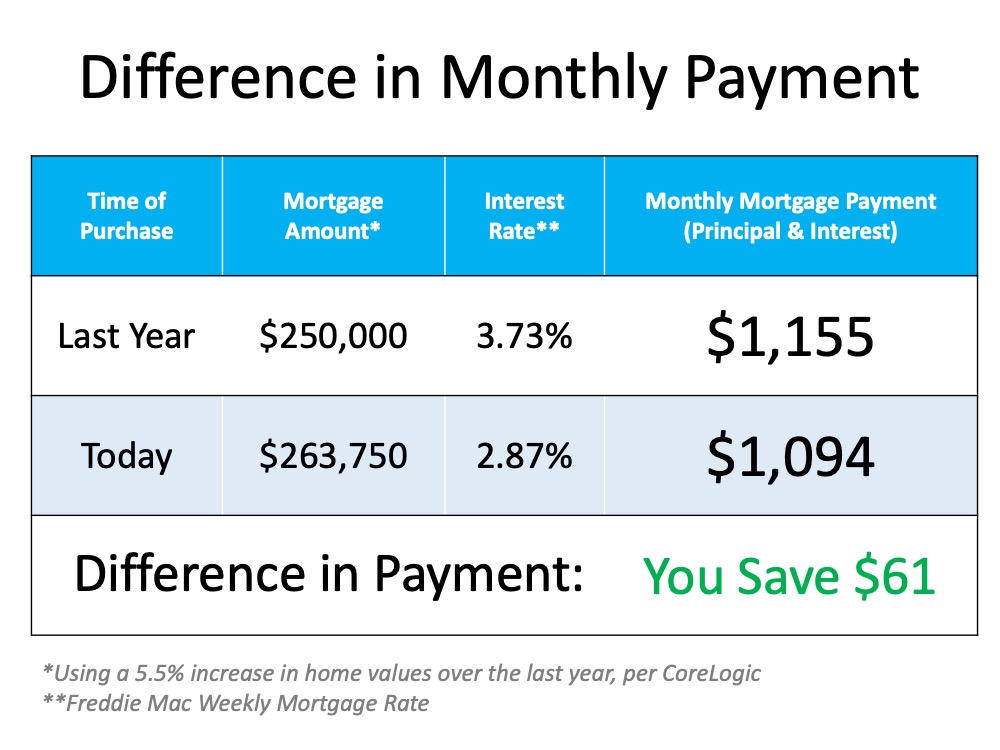

Ten years ago, we couldn’t have imagined a mortgage rate under 3%. Looking at the math today, making a move into a new home and locking in a significantly lower rate than you have now could save you greatly on a monthly basis, and over the life of your loan (See chart below): As the example shows, you can save a substantial amount every month if you qualify for today’s low mortgage rate, and the savings can really add up over the life of a 30-year fixed-rate loan.

As the example shows, you can save a substantial amount every month if you qualify for today’s low mortgage rate, and the savings can really add up over the life of a 30-year fixed-rate loan.

Bottom Line

As a homeowner, you have a huge opportunity to move up right now. Whether you want to save more each month or get more home for your money based on your family’s changing needs, it’s a great time to connect to discuss the market in our area. Buyers are actively looking for more homes to buy, and you can win big by making a move if the time is right for you.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

![Rising Home Equity Can Power Your Next Move [INFOGRAPHIC] | MyKCM](https://desireestanley.com/files/2020/10/20201002-MEM-1046x2104-2.jpg)

![Rising Home Equity Can Power Your Next Move [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/10/01135342/20201002-MEM-1046x2104.jpg)

![Why Pricing Your Home Right Matters This Fall [INFOGRAPHIC] | MyKCM](https://desireestanley.com/files/2020/09/20200925-MEM-1046x588-2.jpg)

![Why Pricing Your Home Right Matters This Fall [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/09/24122226/20200925-MEM-1046x588.jpg)

![Homes Across the Country Are Selling Fast [INFOGRAPHIC] | My KCM](https://desireestanley.com/files/2020/09/20200918-MEM-1046x1575-2.jpg)

![Homes Across the Country Are Selling Fast [INFOGRAPHIC] | My KCM](https://files.mykcm.com/2020/09/17125830/20200918-MEM-1046x1575.jpg)