Housing Inventory Vanishing: What Is the Impact on You?

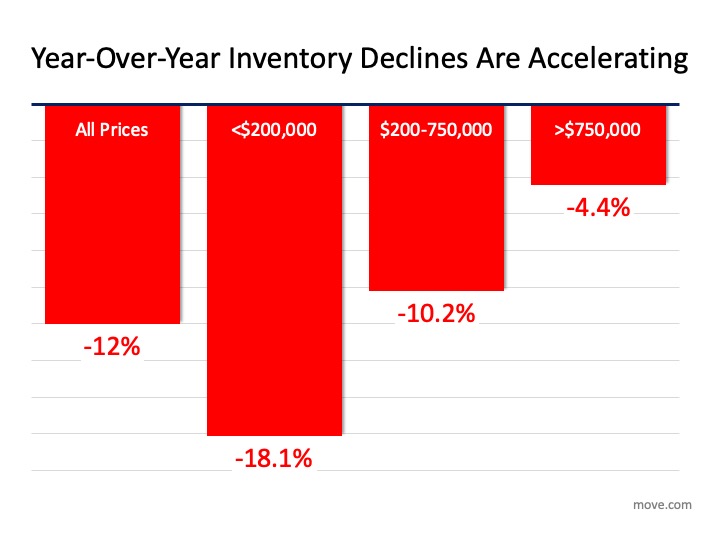

The real estate market is expected to do very well this year as mortgage rates remain at historic lows. One challenge to the housing industry is the lack of homes available for sale. Last week, move.com released a report showing that 2020 is beginning with the lowest available housing inventory in two years. The report explains:

“Last month saw the largest year-over-year decline of housing inventory in almost three years with a dramatic 12 percent decline, pushing the number of homes for sale in the U.S. to the lowest level since January 2018.”

The report also revealed that the decline in inventory stretches across all price points, as shown in the following graph: George Ratiu, Senior Economist at realtor.com, explains how this drop in available homes for sale comes at a time when more buyers are expected to enter the market:

George Ratiu, Senior Economist at realtor.com, explains how this drop in available homes for sale comes at a time when more buyers are expected to enter the market:

“The market is struggling with a large housing undersupply just as 4.8 million millennials are reaching 30-years of age in 2020, a prime age for many to purchase their first home. The significant inventory drop…is a harbinger of the continuing imbalance expected to plague this year’s markets, as the number of homes for sale are poised to reach historically low levels.”

The question is: What does this mean to you?

If You’re a Buyer…

Be patient during your home search. It may take time to find a home you love. Once you do, however, be ready to move forward quickly. Get pre-approved for a mortgage, be ready to make a competitive offer from the start, and understand that a shortage in inventory could lead to the resurgence of bidding wars. Calculate just how far you’re willing to go to secure a home if you truly love it.

If You’re a Seller…

Realize that, in some ways, you’re in the driver’s seat. When there is a shortage of an item at the same time there is a strong demand for that item, the seller of that item is in a good position to negotiate. Whether it is the price, moving date, possible repairs, or anything else, you’ll be able to demand more from a potential purchaser at a time like this – especially if you have multiple interested buyers. Don’t be unreasonable, but understand you probably have the upper hand.

Bottom Line

The housing market will remain strong throughout 2020. Understand what that means to you, whether you’re buying, selling, or doing both.

4 Reasons to Buy a Home This Fall

Here are four great reasons to consider buying a home today, instead of waiting.

1. Prices Will Continue to Rise

CoreLogic’s latest Home Price Insights Report shows that home prices have appreciated by 3.6% over the last 12 months. The same report predicts prices will continue to increase at a rate of 5.8% over the next year.

The bottom in home prices has come and gone. Home values will continue to appreciate for years. Waiting no longer makes sense.

2. Mortgage Interest Rates Are Projected to Increase Next Year

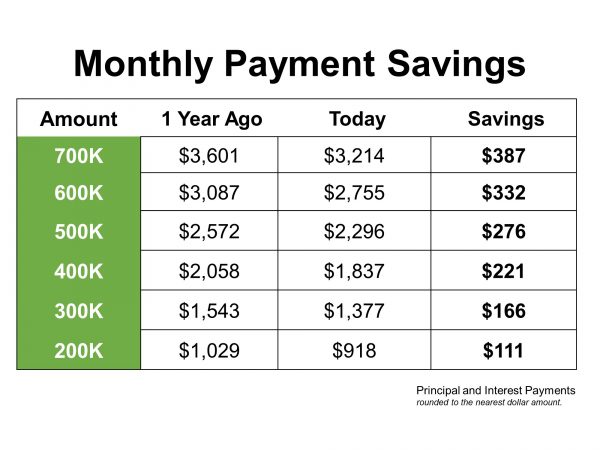

The Primary Mortgage Market Survey from Freddie Mac indicates that interest rates for a 30-year mortgage have recently hovered just above 3.5%. This is great news for buyers in the market right now, because low-interest rates increase your purchasing power – but don’t wait! Most experts predict rates will rise over the next 12 months. The Mortgage Bankers Association, Fannie Mae, Freddie Mac, and the National Association of Realtors are in unison, projecting that rates will increase by this time next year.

An increase in rates will impact your monthly mortgage payment. A year from now, your housing expense will increase if a mortgage is needed to buy your next home.

3. Either Way, You Are Paying a Mortgage

There are some renters who haven’t purchased a home yet because they’re uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you’re living rent-free with your parents, you are paying a mortgage – either yours or that of your landlord.

As an owner, your mortgage payment is a form of ‘forced savings’ that allows you to have equity in your home you can tap into later in life. As a renter, you guarantee your landlord is the person with that equity.

Are you ready to put your housing costs to work for you?

4. It’s Time to Move on With Your Life

The ‘cost’ of a home is determined by two major components: the price of the home and the current mortgage rate. It appears both are on the rise.

But what if they weren’t? Would you wait?

Look at the actual reason you’re buying and decide if it is worth waiting. Whether you want to have a great place for your children to grow up, you want your family to be safer, or you just want to have control over custom renovations, maybe now is the time to buy.

Bottom Line

Buying a home sooner rather than later could lead to substantial savings. Let’s get together to determine if homeownership is the right choice for you and your family this fall.

Things to Avoid After Applying for a Mortgage

Congratulations! You’ve found a home to buy and have applied for a mortgage! You’re undoubtedly excited about the opportunity to decorate your new home, but before you make any large purchases, move your money around, or make any big-time life changes, consult your loan officer – someone who will be able to tell you how your decisions will impact your home loan.

Below is a list of Things You Shouldn’t Do After Applying for a Mortgage. Some may seem obvious, but some may not.

1. Don’t Change Jobs or the Way You Are Paid at Your Job. Your loan officer must be able to track the source and amount of your annual income. If possible, you’ll want to avoid changing from salary to commission or becoming self-employed during this time as well.

2. Don’t Deposit Cash into Your Bank Accounts. Lenders need to source your money, and cash is not really traceable. Before you deposit any amount of cash into your accounts, discuss the proper way to document your transactions with your loan officer.

3. Don’t Make Any Large Purchases Like a New Car or Furniture for Your New Home. New debt comes with it, including new monthly obligations. New obligations create new qualifications. People with new debt have a higher debt to income ratios…higher ratios make for riskier loans…and sometimes qualified borrowers no longer qualify.

4. Don’t Co-Sign Other Loans for Anyone. When you co-sign, you are obligated. As we mentioned, with that obligation comes higher ratios as well. Even if you swear you will not be the one making the payments, your lender will have to count the payments against you.

5. Don’t Change Bank Accounts. Remember, lenders need to source and track assets. That task is significantly easier when there is consistency among your accounts. Before you even transfer any money, talk to your loan officer.

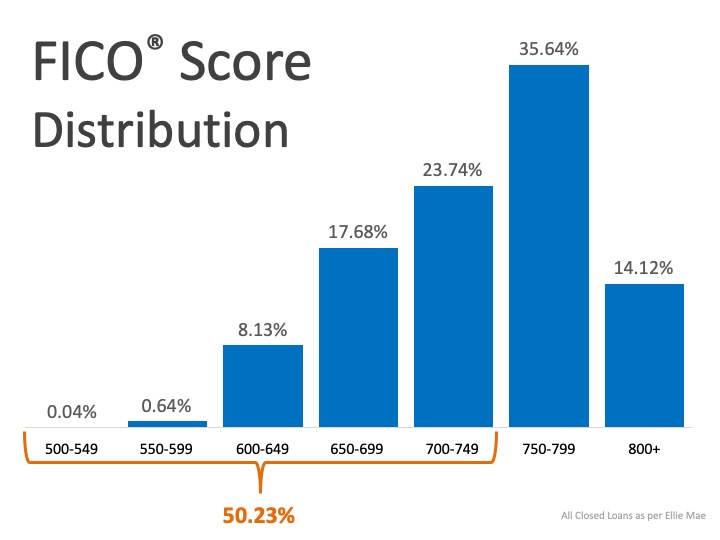

6. Don’t Apply for New Credit. It doesn’t matter whether it’s a new credit card or a new car. When you have your credit report run by organizations in multiple financial channels (mortgage, credit card, auto, etc.), your FICO® score will be affected. Lower credit scores can determine your interest rate and maybe even your eligibility for approval.

7. Don’t Close Any Credit Accounts. Many clients erroneously believe that having less available credit makes them less risky and more likely to be approved. Wrong. A major component of your score is your length and depth of credit history (as opposed to just your payment history) and your total usage of credit as a percentage of available credit. Closing accounts has a negative impact on both of those determinants in your score.

Bottom Line

Any blip in income, assets, or credit should be reviewed and executed in a way that ensures your home loan can still be approved. The best advice is to fully disclose and discuss your plans with your loan officer before you do anything financial in nature. They are there to guide you through the process.

Busting the Myth About a Housing Affordability Crisis

It seems you can’t find a headline with the term “housing affordability” without the word “crisis” attached to it. That’s because some only consider the fact that residential real estate prices have continued to appreciate. However, we must realize it’s not just the price of a home that matters, but the price relative to a purchaser’s buying power.

Homes, in most cases, are purchased with a mortgage. The current mortgage rate is a major component of the affordability equation. Mortgage rates have fallen by over a full percentage point since December 2018. Another major piece of the affordability equation is a buyer’s income. The median family income has risen by 3.5% over the last year.

Let’s look at three different reports issued recently that reveal how homes are very affordable in comparison to historic numbers, and how they have become even more affordable over the past several months.

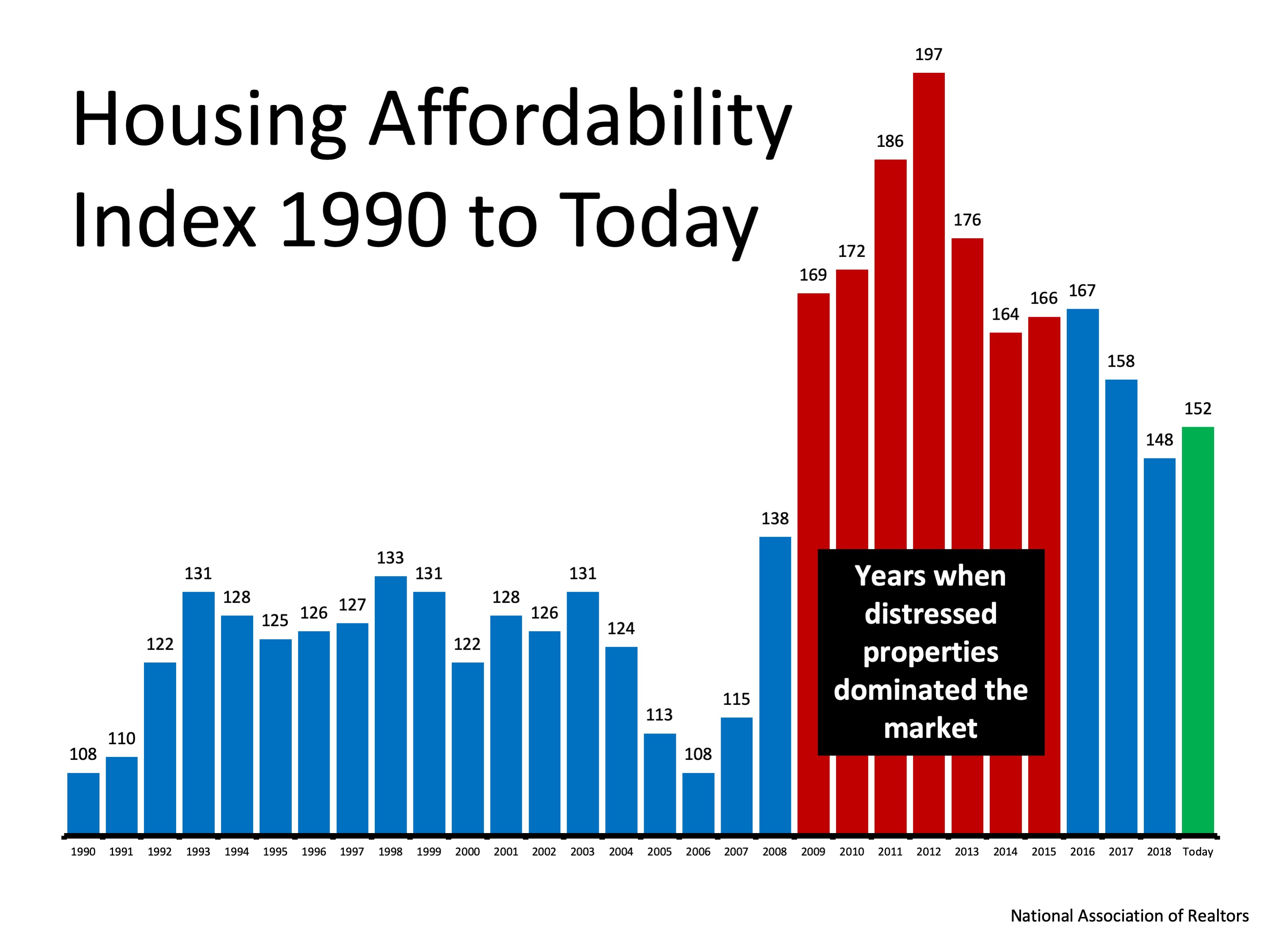

1. National Association of Realtors’ (NAR) Housing Affordability Index:

Here is a graph showing the index going all the way back to 1990. The higher the column, the more affordable homes are: We can see that homes are less affordable today (the green bar) than they were during the housing crash (the red bars). This was when distressed properties like foreclosures and short sales saturated the market and sold for massive discounts. However, homes are more affordable today than at any time from 1990 to 2008.

We can see that homes are less affordable today (the green bar) than they were during the housing crash (the red bars). This was when distressed properties like foreclosures and short sales saturated the market and sold for massive discounts. However, homes are more affordable today than at any time from 1990 to 2008.

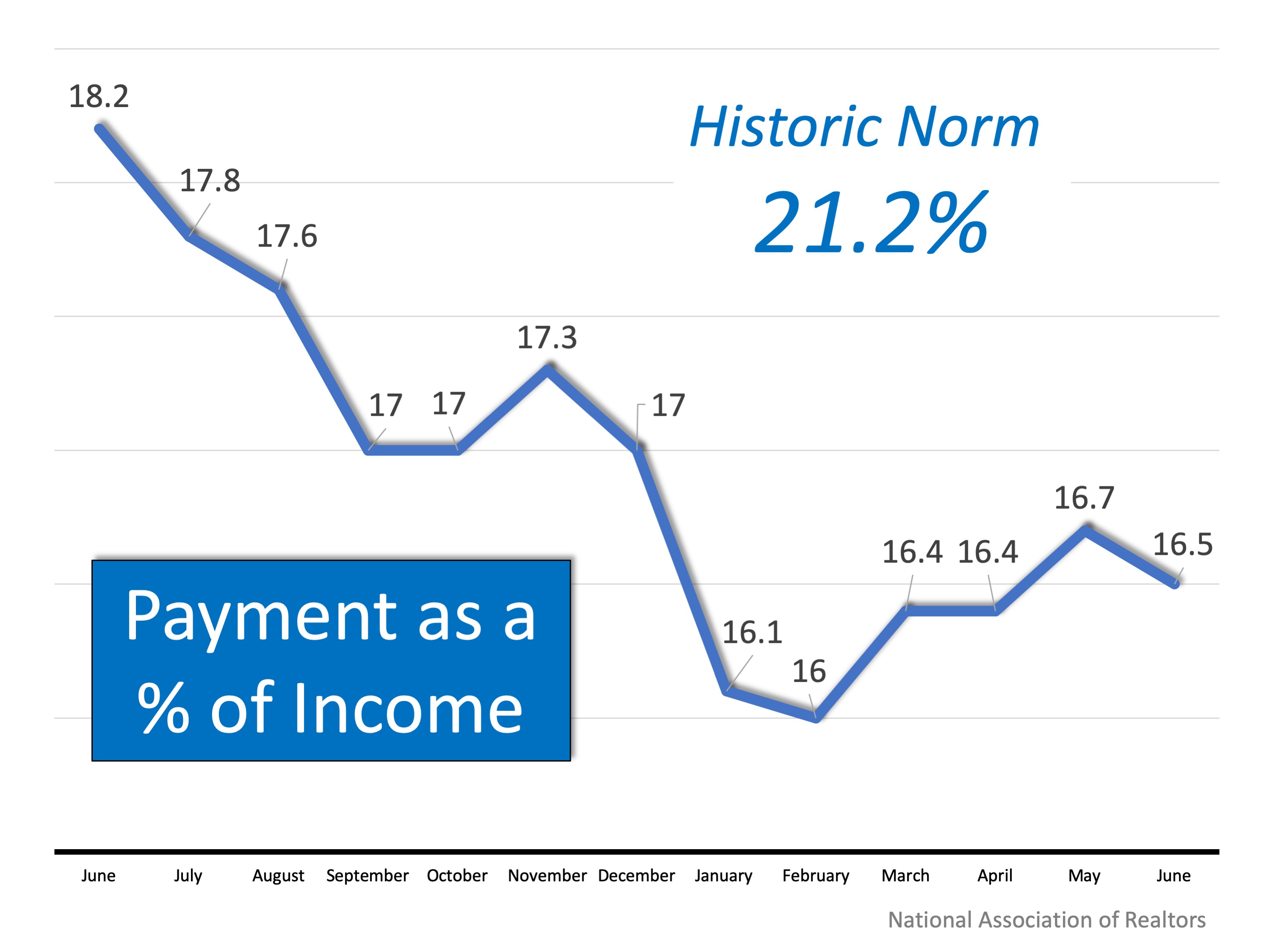

NAR’s report on the index also shows that the percentage of a family’s income needed for a mortgage payment (16.5%) is dramatically lower than last year and is well below the historic norm of 21.2%.

2. Black Knight’s Mortgage Monitor:

This report reveals that as a result of falling interest rates and slowing home price appreciation, affordability is the best it has been in 18 months. Black Knight Data & Analytics President Ben Graboske explains:

“For much of the past year and a half, affordability pressures have put a damper on home price appreciation. Indeed, the rate of annual home price growth has declined for 15 consecutive months. More recently, declining 30-year fixed interest rates have helped to ease some of those pressures, improving the affordability outlook considerably…And despite the average home price rising by more than $12K since November, today’s lower fixed interest rates have worked out to a $108 lower monthly payment…Lower rates have also increased the buying power for prospective homebuyers looking to purchase the average-priced home by the equivalent of 15%.”

3. First American’s Real House Price Index:

While affordability has increased recently, Mark Fleming, First American’s Chief Economist explains:

“If the 30-year, fixed-rate mortgage declines just a fraction more, consumer house-buying power would reach its highest level in almost 20 years.”

Fleming goes on to say that the gains in affordability are about mortgage rates and the increase in family incomes:

“Average nominal household incomes are nearly 57 percent higher today than in January 2000. Record income levels combined with mortgage rates near historic lows mean consumer house-buying power is more than 150 percent greater today than it was in January 2000.”

Bottom Line

If you’ve put off the purchase of a first home or a move-up home because of affordability concerns, you should take another look at your ability to purchase in today’s market. You may be pleasantly surprised!

Americans Rank Real Estate Best Investment for 6 Years Running! [INFOGRAPHIC]

![Americans Rank Real Estate Best Investment For 6 Years Running! [INFOGRAPHIC] | MyKCM](https://desireestanley.com/files/2019/07/20190628-MEM.jpg)

![Americans Rank Real Estate Best Investment For 6 Years Running! [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/06/04055442/20190628-MEM-1046x1063.jpg)

Some Highlights:

- Real estate has outranked stocks/mutual funds, gold, savings accounts/CDs, and bonds as the best long-term investment among Americans for the last 6 years.

- Stock owners are more positive about real estate than stocks as an investment.

- Of the 4 listed, real estate is the only investment you can also live in!

Why Is So Much Paperwork Required to Get a Mortgage?

When buying a home today, why is there so much paperwork mandated by the lenders for a mortgage loan application? It seems like they need to know everything about you. Furthermore, it requires three separate sources to validate each and every entry on the application form. Many buyers are being told by friends and family that the process was a hundred times easier when they bought their home ten to twenty years ago.

There are two very good reasons that the loan process is much more onerous on today’s buyer than perhaps any other time in history.

1. The government has set new guidelines that now demand that the bank proves beyond any doubt that you are indeed capable of paying the mortgage.

During the run-up to the housing crisis, many people ‘qualified’ for mortgages that they could never pay back. This led to millions of families losing their home. The government wants to make sure this can’t happen again.

2. The banks don’t want to be in the real estate business.

Over the last several years, banks were forced to take on the responsibility of liquidating millions of foreclosures and negotiating an additional million plus short sales. Just like the government, they don’t want more foreclosures. For that reason, they have to double (maybe even triple) check everything on the application.

However, there is some good news in this situation.

The housing crash that mandated that banks be extremely strict on paperwork requirements also allowed you to get a low mortgage interest rate.

The friends and family who bought homes ten or twenty years ago experienced a simpler mortgage application process, but also paid a higher interest rate (the average 30-year fixed rate mortgage was 8.12% in the 1990s and 6.29% in the 2000s).

If you went to the bank and offered to pay 7% instead of around 4%, they would probably bend over backward to make the process much easier.

Bottom Line

Instead of concentrating on the additional paperwork required, let’s be thankful that we are able to buy a home at historically low rates.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link