Do You Need to Know More about Forbearance and Mortgage Relief Options?

Earlier this year when the nation pressed pause on the economy and unemployment rates jumped up significantly, many homeowners were immediately concerned about being able to pay their mortgages, and understandably so. To assist in this challenging time, two protection plans were put into place to help support those in need.

First, there was a pause placed on initiating foreclosures for government-backed loans. This plan started on March 18, 2020, and it extends at least through December 31, 2020. Second, homeowners were able to obtain forbearance for up to 180 days, followed by a potential extension for up to another 180 days. This way, there is a relief period in which homeowners have the opportunity to halt payments on their mortgages for up to one year.

Not Everyone Understands Their Options

The challenge, according to Matt Hulstein, Staff Attorney at non-profit Chicago Volunteer Legal Services, is, “A lot of homeowners aren’t aware of this option.”

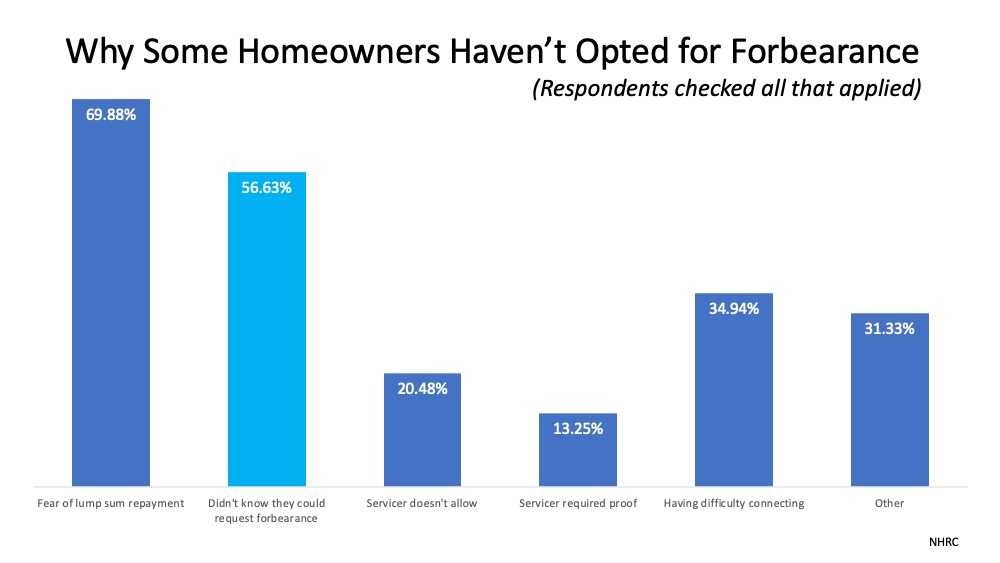

There’s definitely traction behind this statement. In a recent survey by The National Housing Resource Center, housing counselors from across the country noted that many homeowners really don’t know that there is help available. The following graph indicates the reasons why people who are in this challenging situation are not choosing to enter forbearance: The Urban Institute explained:

The Urban Institute explained:

“530,000 homeowners who became delinquent after the pandemic began did not take advantage of forbearance, despite being eligible to ask for the plan…These responses reflect a need to provide better information to all homeowners. (Lump-sum payment is not the only repayment option.)

Additionally, 205,000 homeowners who did not extend their forbearance after its term ended in June or July became delinquent on their loans. We need to examine who these people are and why are they not extending their option.”

Clearly, a more focused effort on education about forbearance and relief programs may make a big difference for many people, and a clear understanding of their options is mission-critical. Some communities, however, have been impacted by the economic challenges of the pandemic more so than others, further confirming the need to deliver education more widely. The Urban Institute also indicates:

“Black and Hispanic homeowners have been hit harder than white homeowners…nearly 21 percent of both Black and Hispanic homeowners missed or deferred the previous month’s mortgage payment, compared with 10 percent of white homeowners and about 13 percent of all homeowners with payments due.”

Options Available

It’s important to note that any homeowner experiencing financial hardship has the right to request forbearance. If you’re unfamiliar with the plans available, contact your mortgage provider (the company you send your mortgage payment to each month) to discuss your options. It is a necessary next step, as you may qualify for mortgage relief options or forbearance.

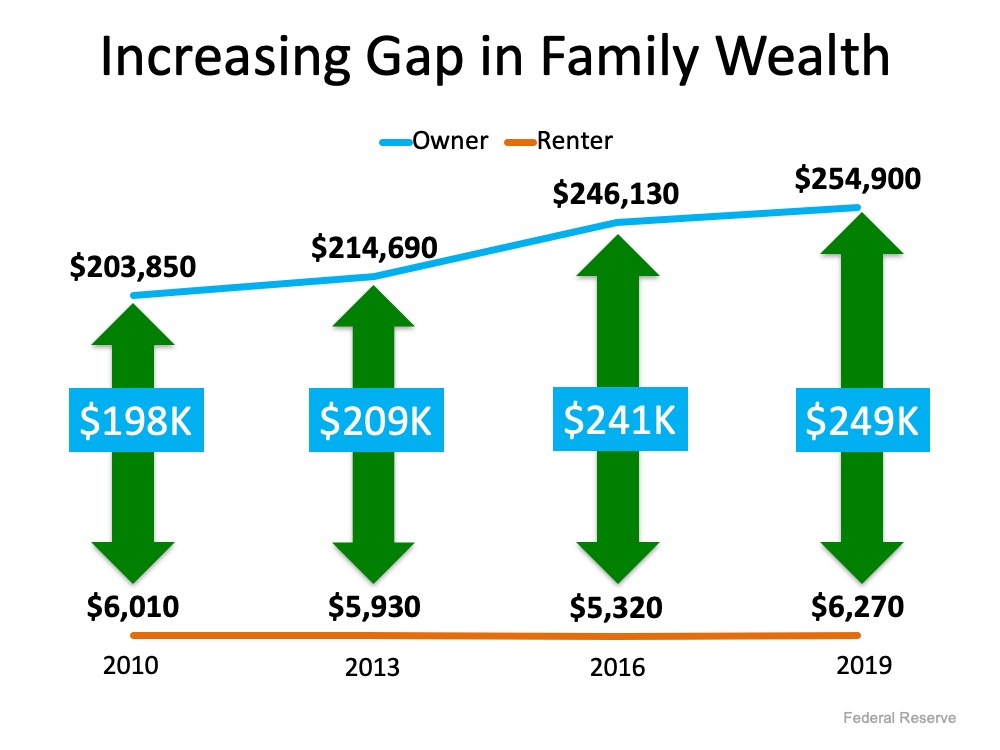

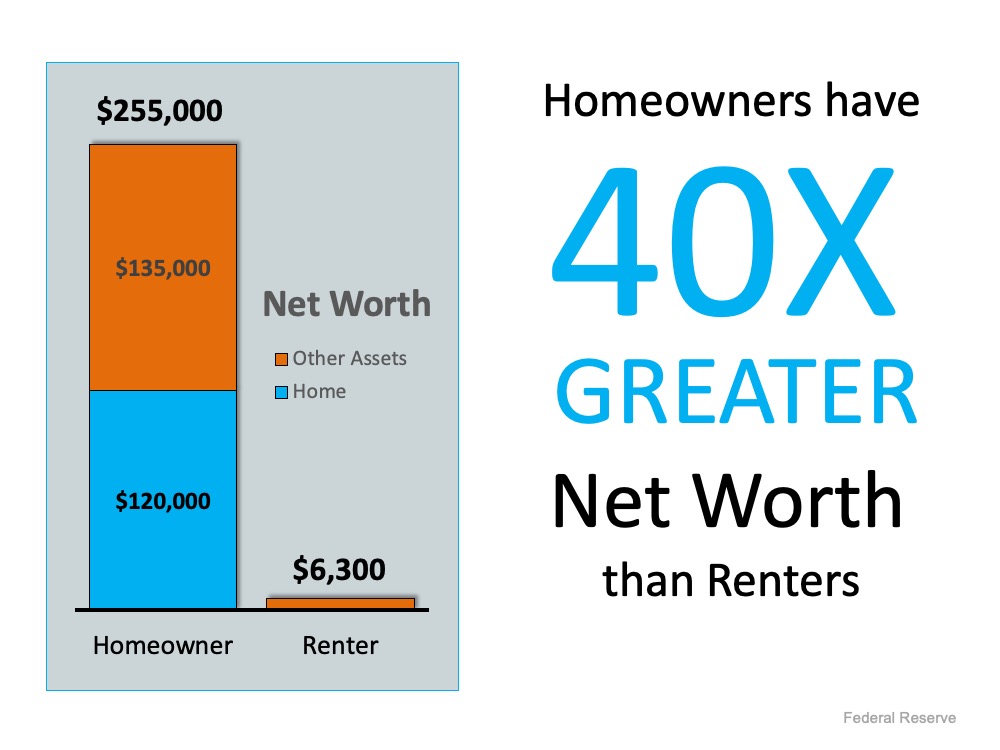

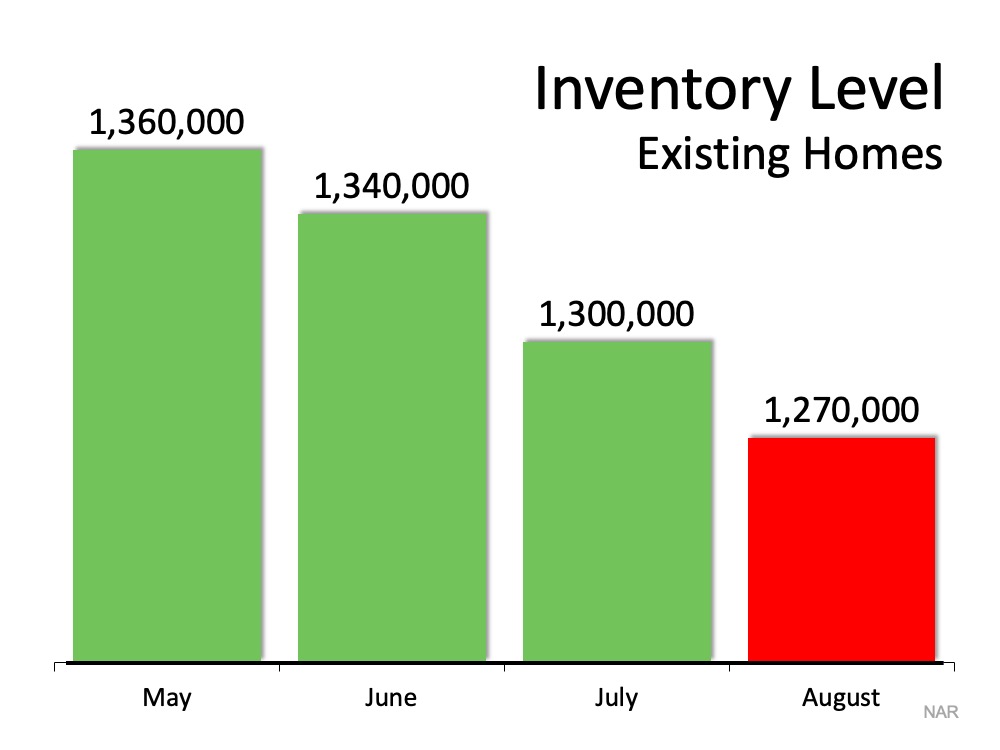

One option many homeowners may not realize they have is the ability to sell their house in this time of need. With the growing equity that homeowners have available today, making a move might be the best option to protect your financial future.

Bottom Line

If you need additional information on your options, you can review the Protect Your Investment guide from the National Association of Realtors (NAR) and the Homeowner’s Guide to Success from the Consumer Financial Protection Bureau (CFPB). For the majority of people, our home is the most important asset we have, and you should use all the help available right now to be able to preserve your investment.

6 Reasons You’ll Win by Selling with a Real Estate Agent This Fall

There are many benefits to working with a real estate professional when selling your house. During challenging times, like what we face today, it becomes even more important to have an expert you trust to help guide you through the process. If you’re considering selling on your own, known in the industry as a For Sale by Owner (FSBO), it’s critical to consider the following:

1. Your Safety Is a Priority

Your family’s safety should always come first, and that’s more crucial than ever given the current health situation in our country. When you FSBO, it is incredibly difficult to control entry into your home. A real estate professional will have the proper protocols in place to protect not only your belongings but your family’s health and well-being too. From regulating the number of people in your home at one time to ensuring proper sanitization during and after a showing, and even facilitating virtual tours for buyers, real estate professionals are equipped to follow the latest industry standards recommended by the National Association of Realtors (NAR) to help protect you and your family.

2. A Powerful Online Strategy Is a Must to Attract a Buyer

Recent studies from NAR have shown that, even before COVID-19, the first step 44% of all buyers took when looking for a home was to search online. Throughout the process, that number jumps to 93%. Today, those numbers have grown exponentially. Most real estate agents have developed a strong Internet and social media strategy to promote the sale of your house. Have you?

3. There Are Too Many Negotiations

Here are just a few of the people you’ll need to negotiate with if you decide to FSBO:

- The buyer, who wants the best deal possible

- The buyer’s agent, who solely represents the best interest of the buyer

- The inspection companies, which work for the buyer and will almost always find challenges with the house

- The appraiser, if there is a question of value

As part of their training, agents are taught how to negotiate every aspect of the real estate transaction and how to mediate the emotions felt by buyers looking to make what is probably the largest purchase of their lives.

4. You Won’t Know if Your Purchaser Is Qualified for a Mortgage

Having a buyer who wants to purchase your house is the first step. Making sure they can afford to buy it is just as important. As a FSBO, it’s almost impossible to be involved in the mortgage process of your buyer. A real estate professional is trained to ask the appropriate questions and, in most cases, will be intimately aware of the progress being made toward a purchaser’s mortgage commitment.

Further complicating the situation is how the current mortgage market is rapidly evolving because of the number of families out of work and in mortgage forbearance. A loan program that was available yesterday could be gone tomorrow. You need someone who is working with lenders every day to guarantee your buyer makes it to the closing table.

5. FSBOing Has Become More Difficult from a Legal Standpoint

The documentation involved in the selling process has increased dramatically as more and more disclosures and regulations have become mandatory. In an increasingly litigious society, the agent acts as a third-party to help the seller avoid legal jeopardy. This is one of the major reasons why the percentage of people FSBOing has dropped from 19% to 8% over the last 20+ years.

6. You Net More Money When Using an Agent

Many homeowners believe they’ll save the real estate commission by selling on their own. Realize that the main reason buyers look at FSBOs is because they also believe they can save the real estate agent’s commission. The seller and buyer can’t both save on the commission.

A study by Collateral Analytics revealed that FSBOs don’t actually save anything by forgoing the help of an agent. In some cases, the seller may even net less money from the sale. The study found the difference in price between a FSBO and an agent-listed home was an average of 6%. One of the main reasons for the price difference is effective exposure:

“Properties listed with a broker that is a member of the local MLS will be listed online with all other participating broker websites, marketing the home to a much larger buyer population. And those MLS properties generally offer compensation to agents who represent buyers, incentivizing them to show and sell the property and again potentially enlarging the buyer pool.”

The more buyers that view a home, the greater the chance a bidding war will take place.

Bottom Line

Listing on your own leaves you to manage the entire transaction by yourself. Why do that when you can hire an agent and still net the same amount of money? Before you decide to take on the challenge of selling your house alone, let’s connect to discuss your options.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

![Selling Your House Is the Right Move, Right Now [INFOGRAPHIC] | MyKCM](https://desireestanley.com/files/2020/10/20201023-MEM-1046x1750-2.png)

![Selling Your House Is the Right Move, Right Now [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/10/22151542/20201023-MEM-1046x1750.png)

![How to Prepare for a Bidding War [INFOGRAPHIC] | MyKCM](https://desireestanley.com/files/2020/10/20201016-MEM-1046x2827-2.png)

![How to Prepare for a Bidding War [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/10/15140756/20201016-MEM-1046x2827.png)

![Thinking of Moving? [INFOGRAPHIC] | MyKCM](https://desireestanley.com/files/2020/10/20201009-MEM-1046x2570-2.png)

![Thinking of Moving? [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/10/08125237/20201009-MEM-1046x2570.png)