4 Reasons to Buy a Home This Fall

Here are four great reasons to consider buying a home today, instead of waiting.

1. Prices Will Continue to Rise

CoreLogic’s latest Home Price Insights Report shows that home prices have appreciated by 3.6% over the last 12 months. The same report predicts prices will continue to increase at a rate of 5.8% over the next year.

The bottom in home prices has come and gone. Home values will continue to appreciate for years. Waiting no longer makes sense.

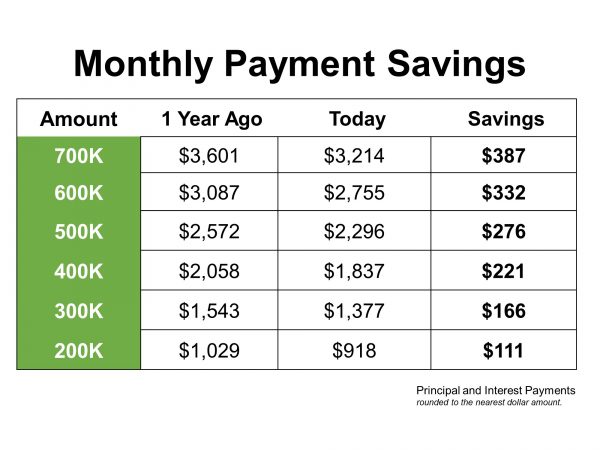

2. Mortgage Interest Rates Are Projected to Increase Next Year

The Primary Mortgage Market Survey from Freddie Mac indicates that interest rates for a 30-year mortgage have recently hovered just above 3.5%. This is great news for buyers in the market right now, because low-interest rates increase your purchasing power – but don’t wait! Most experts predict rates will rise over the next 12 months. The Mortgage Bankers Association, Fannie Mae, Freddie Mac, and the National Association of Realtors are in unison, projecting that rates will increase by this time next year.

An increase in rates will impact your monthly mortgage payment. A year from now, your housing expense will increase if a mortgage is needed to buy your next home.

3. Either Way, You Are Paying a Mortgage

There are some renters who haven’t purchased a home yet because they’re uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you’re living rent-free with your parents, you are paying a mortgage – either yours or that of your landlord.

As an owner, your mortgage payment is a form of ‘forced savings’ that allows you to have equity in your home you can tap into later in life. As a renter, you guarantee your landlord is the person with that equity.

Are you ready to put your housing costs to work for you?

4. It’s Time to Move on With Your Life

The ‘cost’ of a home is determined by two major components: the price of the home and the current mortgage rate. It appears both are on the rise.

But what if they weren’t? Would you wait?

Look at the actual reason you’re buying and decide if it is worth waiting. Whether you want to have a great place for your children to grow up, you want your family to be safer, or you just want to have control over custom renovations, maybe now is the time to buy.

Bottom Line

Buying a home sooner rather than later could lead to substantial savings. Let’s get together to determine if homeownership is the right choice for you and your family this fall.

3 Powerful Reasons to Buy a Home Now

Whether you are a first-time buyer or looking to move up to the home of your dreams, now is a great time to purchase a home. Here are three major reasons to buy today.

1. Affordability

Many people focus solely on price when talking about home affordability. Since home prices have appreciated throughout the past year, they assume homes are less affordable. However, affordability is determined by three components:

- Price

- Wages

- Mortgage Interest Rate

Prices are up, but so are wages – and interest rates have recently dropped dramatically (see #2 below). As a result, the National Association of Realtors’ (NAR) latest Affordability Index report revealed that homes are MORE affordable throughout the country today than they were a year ago.

“All four regions saw an increase in affordability from a year ago. The South had the biggest gain in affordability of 6.9%, followed by the West with a gain of 6.0%. The Midwest had an increase of 5.8%, followed by the Northeast with the smallest gain of 1.8%.”

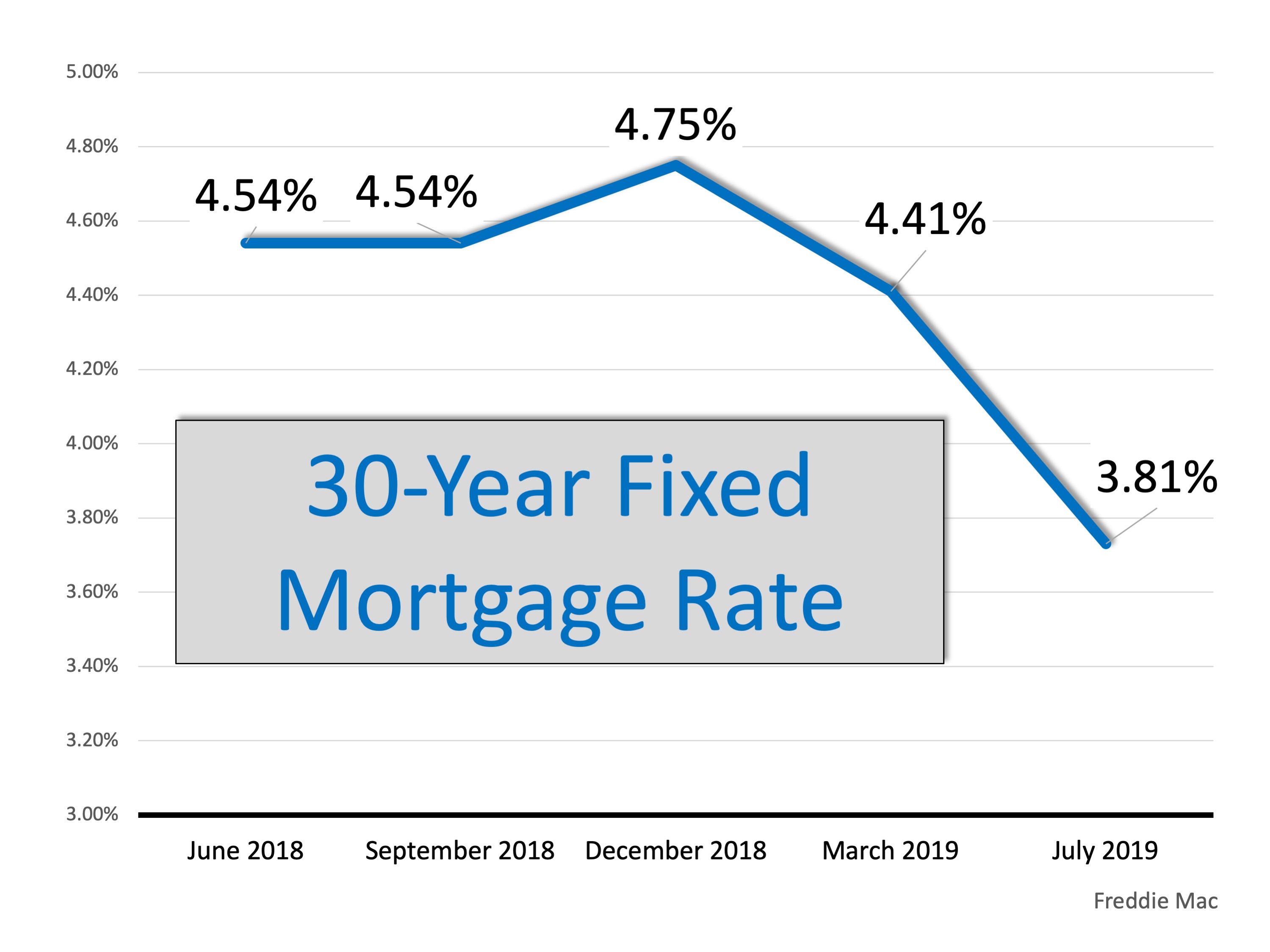

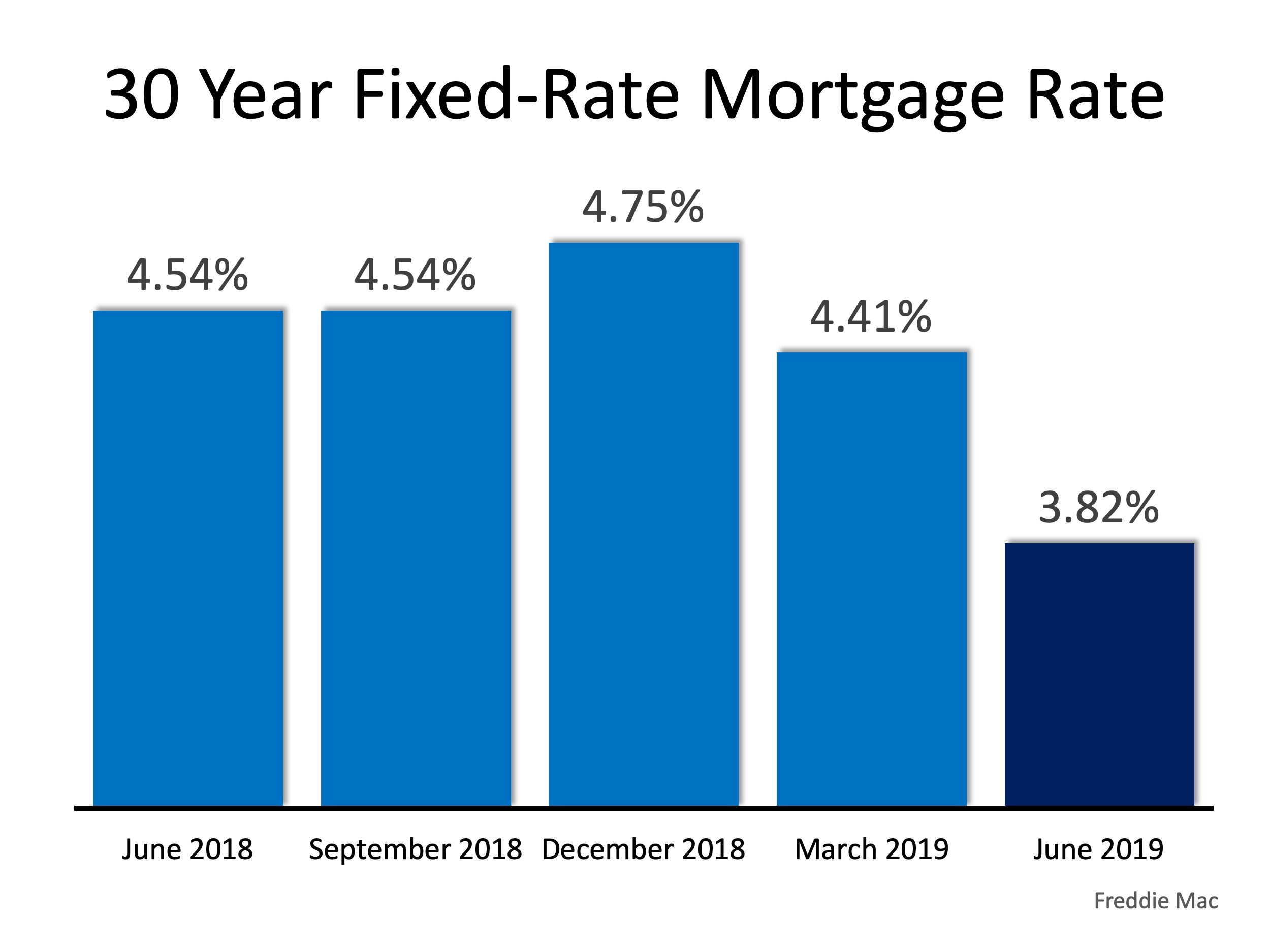

2. Mortgage Interest Rates

Mortgage rates have dropped almost a full point after heading toward 5% last fall and early winter. Currently, they are below 4%.

Additionally, Fannie Mae recently predicted the average rate for a 30-year fixed mortgage will be 3.7% in the second half of 2019. That compares to a 4.4% average rate in the first quarter and 4% in the second quarter.

Additionally, Fannie Mae recently predicted the average rate for a 30-year fixed mortgage will be 3.7% in the second half of 2019. That compares to a 4.4% average rate in the first quarter and 4% in the second quarter.

With mortgage rates remaining near historic lows, Fannie Mae and others have increased their forecasts for housing appreciation for the rest of the year. If home price gains are about to re-accelerate, buying now rather than later makes financial sense.

3. Increase Family Wealth

Homeownership has always been recognized as a sensational way to build long-term family wealth. A new report by ATTOM Data Solutions reveals:

“U.S. homeowners who sold in the second quarter of 2019 realized an average home price gain since purchase of $67,500, up from an average gain of $57,706 in Q1 2019 and up from an average gain of $60,100 in Q2 2018. The average home seller gain of $67,500 in Q2 2019 represented an average 33.9 percent return as a percentage of original purchase price.”

The longer you delay purchasing a home, the longer you are waiting to put the power of home equity to work for you.

Bottom Line

With affordability increasing, mortgage rates decreasing, and home values about to re-accelerate, it may be time to make a move. Let’s get together to determine if buying now makes sense for your family.

Why Is So Much Paperwork Required to Get a Mortgage?

When buying a home today, why is there so much paperwork mandated by the lenders for a mortgage loan application? It seems like they need to know everything about you. Furthermore, it requires three separate sources to validate each and every entry on the application form. Many buyers are being told by friends and family that the process was a hundred times easier when they bought their home ten to twenty years ago.

There are two very good reasons that the loan process is much more onerous on today’s buyer than perhaps any other time in history.

1. The government has set new guidelines that now demand that the bank proves beyond any doubt that you are indeed capable of paying the mortgage.

During the run-up to the housing crisis, many people ‘qualified’ for mortgages that they could never pay back. This led to millions of families losing their home. The government wants to make sure this can’t happen again.

2. The banks don’t want to be in the real estate business.

Over the last several years, banks were forced to take on the responsibility of liquidating millions of foreclosures and negotiating an additional million plus short sales. Just like the government, they don’t want more foreclosures. For that reason, they have to double (maybe even triple) check everything on the application.

However, there is some good news in this situation.

The housing crash that mandated that banks be extremely strict on paperwork requirements also allowed you to get a low mortgage interest rate.

The friends and family who bought homes ten or twenty years ago experienced a simpler mortgage application process, but also paid a higher interest rate (the average 30-year fixed rate mortgage was 8.12% in the 1990s and 6.29% in the 2000s).

If you went to the bank and offered to pay 7% instead of around 4%, they would probably bend over backward to make the process much easier.

Bottom Line

Instead of concentrating on the additional paperwork required, let’s be thankful that we are able to buy a home at historically low rates.

3 Things to Know in the Housing Market Today!

A lot is happening in the world, and it’s having a direct impact on the housing market. The reality is this: some of it is positive and some of it may be negative. Some we just don’t know yet.

The following three areas of the housing market are critical to understand: interest rates, building materials, and the outlook for an economic slowdown.

1. Interest Rates

One of the most important things to consider when buying a home is the interest rate you will be charged to borrow the money. In our recent post we posed the question, “Are Low Interest Rates Here To Stay?” The latest information from Freddie Mac makes it appear they are. We are currently at a 21-month low in interest rates.

2. Building Materials

Talk of tariffs could also affect the housing market. According to a recent article, the National Association of Home Builders reports that as much as $10 billion in goods imported from China are used in homebuilding. Depending on the outcome of the tariff and trade discussions between several countries, there could be as much as a 25% boost in the cost of building materials.

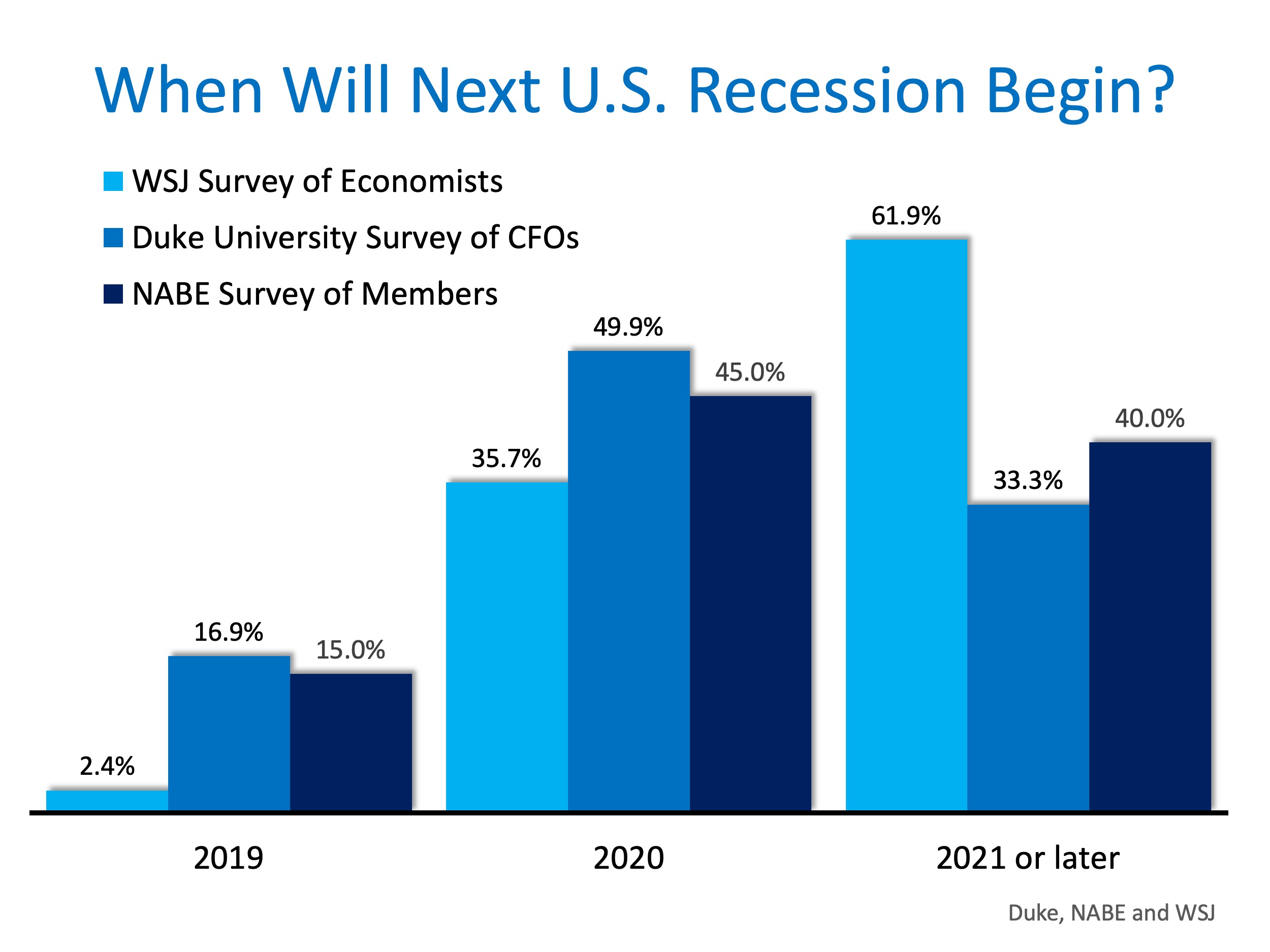

3. Economic Slowdown

In a prior blog post on this topic, we began the year with many economic leaders thinking we could expect a recession in late 2019 or early 2020. As spring approached, we reported that economists had started to push that projection past 2020. Now, three leading surveys indicate that it may begin in the next eighteen months.

Bottom Line

We are in a strong housing market. Wages are increasing, home prices are appreciating, and mortgage rates are the lowest they have been in 21 months. Whether you are thinking of buying or selling, it’s a great time to be in the market.

New survey shows mortgage rates declining

Wondering about the mortgage rates? Heard that they’re going up? Worried about buying right now because rates are high? You might be surprised then to hear that the mortgage rates are actually declining according to this recent survey by Freddie Mac.

News Facts

- 30-year fixed-rate mortgage (FRM) averaged 4.14 percent with an average 0.5 point for the week ending May 2, 2019, down from last week when it averaged 4.20 percent. A year ago at this time, the 30-year FRM averaged 4.55 percent.

- 15-year FRM this week averaged 3.60 percent with an average 0.4 point, down from last week when it averaged 3.64 percent. A year ago at this time, the 15-year FRM averaged 4.03 percent.

- 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.68 percent with an average 0.4 point, down from last week when it averaged 3.77 percent. A year ago at this time, the 5-year ARM averaged 3.69 percent.

Call me @ 408-465-9290 if you’ve got questions about how you can get into the home of your dreams.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

![Where is the Housing Market Headed in 2020? [INFOGRAPHIC] | MyKCM](https://desireestanley.com/files/2019/12/20191220-MEM-1046x1552.jpg)

![Where is the Housing Market Headed in 2020? [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/12/19070953/20191220-MEM-1046x1552.jpg)