Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

Americans Rank Real Estate Best Investment for 7 Years Running [INFOGRAPHIC]

![Americans Rank Real Estate Best Investment for 7 Years Running [INFOGRAPHIC] | MyKCM](https://desireestanley.com/files/2020/07/20200710-MEM-1046x1067.jpg)

![Americans Rank Real Estate Best Investment for 7 Years Running [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/07/07133310/20200710-MEM-1046x1067.jpg)

Some Highlights

- Real estate has outranked stocks, savings accounts, and gold as the best long-term investment among Americans for the past 7 years.

- The belief in the stability of housing as a long-term investment remains strong, despite the many challenges our economy faces today.

- Of the four listed, real estate is also the only investment you can also live in. That’s a big win!

Buying a Home Early Can Significantly Increase Future Wealth

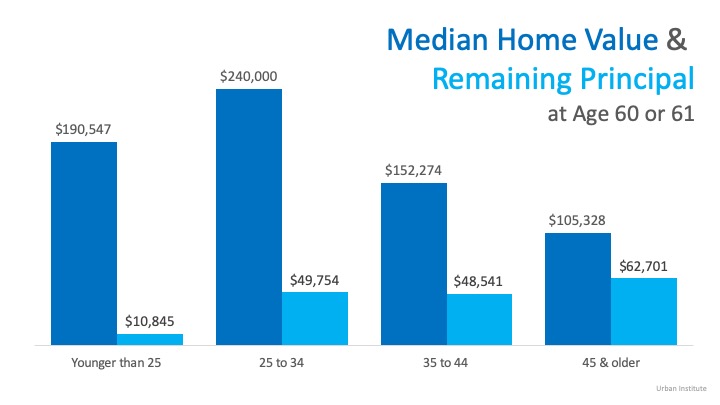

According to an Urban Institute study, homeowners who purchase a house before age 35 are better prepared for retirement at age 60.

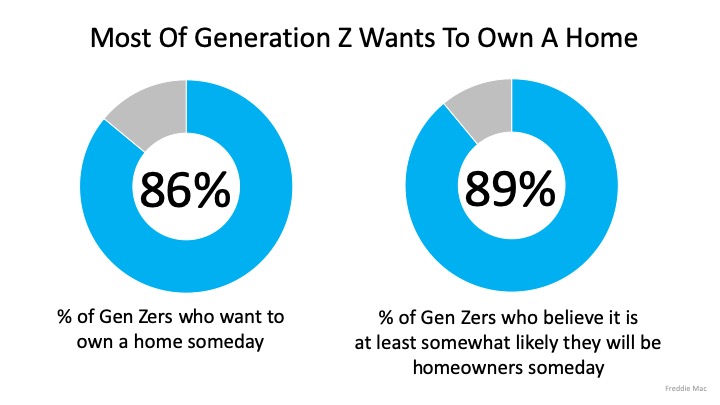

The good news is, our younger generations are strong believers in homeownership.

According to a Freddie Mac survey,

“The dream of homeownership is alive and well within “Generation Z,” the demographic cohort following Millennials.

Our survey…finds that Gen Z views homeownership as an important goal. They estimate that they will attain this goal by the time they turn 30 years old, three years younger than the current median homebuying age (33).”

If these aspiring homeowners purchase at an early age, the Urban Institute study shows the impact it can have.

If these aspiring homeowners purchase at an early age, the Urban Institute study shows the impact it can have.

Based on this data, those who purchased their first homes when they were younger than 25 had an average of $10,000 left on their mortgage at age 60. The 50% of buyers who purchased in their mid-20s and early-30s had close to $50,000 left but traditionally purchased more expensive homes. Although the vast majority of Gen Zers want to own a home and are somewhat confident in their future, “In terms of financial awareness, 65% of Gen Z respondents report that they are not confident in their knowledge of the mortgage process.”

Although the vast majority of Gen Zers want to own a home and are somewhat confident in their future, “In terms of financial awareness, 65% of Gen Z respondents report that they are not confident in their knowledge of the mortgage process.”

Bottom Line

As the numbers show, you’re not alone. If you want to buy this year but you’re not sure where to start the process, let’s get together to help you understand the best steps to take from here.

What is Important to Boomers when Selling their House?

If you are a “baby boomer” (born between 1946 and 1964), you may be thinking about selling your current home. Your children may have finally moved out. Your large, four-bedroom house with three bathrooms no longer fits the bill. Taxes are too high. Utilities are too expensive. Cleaning and repair are too difficult. You may be ready to move into a home that better fits your current lifestyle. Many fellow boomers have already made the move you may be considering.

The National Association of Realtors recently released its 2019 Home Buyer and Seller Generational Report. The report revealed many interesting tidbits about both categories of baby boomers: younger boomers (ages 54 to 63) and older boomers (64 to72). Here are a few of the more interesting topics.

Percentage of Buyers who Looked Online First

- All Buyers: 44%

- Younger Boomers: 46%

- Older Boomers: 44%

Where Boomers Found the Home They Purchased

The two major ways buyers found the home they purchased:

- All buyers: 50% on the internet, 28% through a real estate agent

- Younger Boomers: 46% on the internet, 33% through a real estate agent

- Older Boomers: 36% on the internet, 35% through a real estate agent

Distance Seller Moved

The distance between the home they purchased and the home they recently sold was much greater for boomers than the average seller.

- All sellers: 20 miles

- Younger Boomers: 27 miles

- Older Boomers: 50 miles

Tenure in Previous Home of Seller

The percentage of older boomers who lived in their previous home for more than 20 years was almost twice the amount of the average seller.

- All sellers: 16%

- Younger Boomers: 20%

- Older Boomers: 31%

Primary Reason to Sell their Previous Home

- Want to move closer to friends or family

- Home too large

- Retirement

View of Homeownership as a Financial Investment

- 83% of Younger Boomers see homeownership as a good investment

- 82% of Older Boomers see homeownership as a good investment

Bottom Line

If you are a boomer and thinking about selling, now might be the time to contact an agent to help determine your options.

75 Years of VA Home Loan Benefits

Today, on Veterans Day, we salute those who have served our country in war or peace, and we thank them for their sacrifice.

This year marks the 75th anniversary of VA Home Loan Benefit offerings through the Servicemen’s Readjustment Act, also known as the GI Bill. Since 1944, this law has created opportunities for those who have served our country, ranging from vocational training to home loans.

Facts About VA Home Loans:

- Nearly 24 million home loans have been guaranteed by the Veterans Administration.

- Nearly 82% of VA home loans are made with no down payment.

- The VA also provides grants to help seriously disabled Veterans purchase, modify, or construct a home to meet their needs. Last year the VA provided 2,000 grants totaling $104 million.

Benefits of a VA Home Loan:

- No down payment

- No Private Mortgage Insurance*

- Lower credit score requirements

- Limitation on closing costs

- Lower average interest rates

*More information on VA Home Loan Fees

Bottom Line

The best thing you can do today to celebrate Veterans Day is to share this information with those who can benefit from these opportunities. For more information, or to find out how to qualify to use a VA Home Loan Benefit, let’s get together to navigate through the process. Thank you for your service!

62% of Buyers Are Wrong About Down Payment Needs

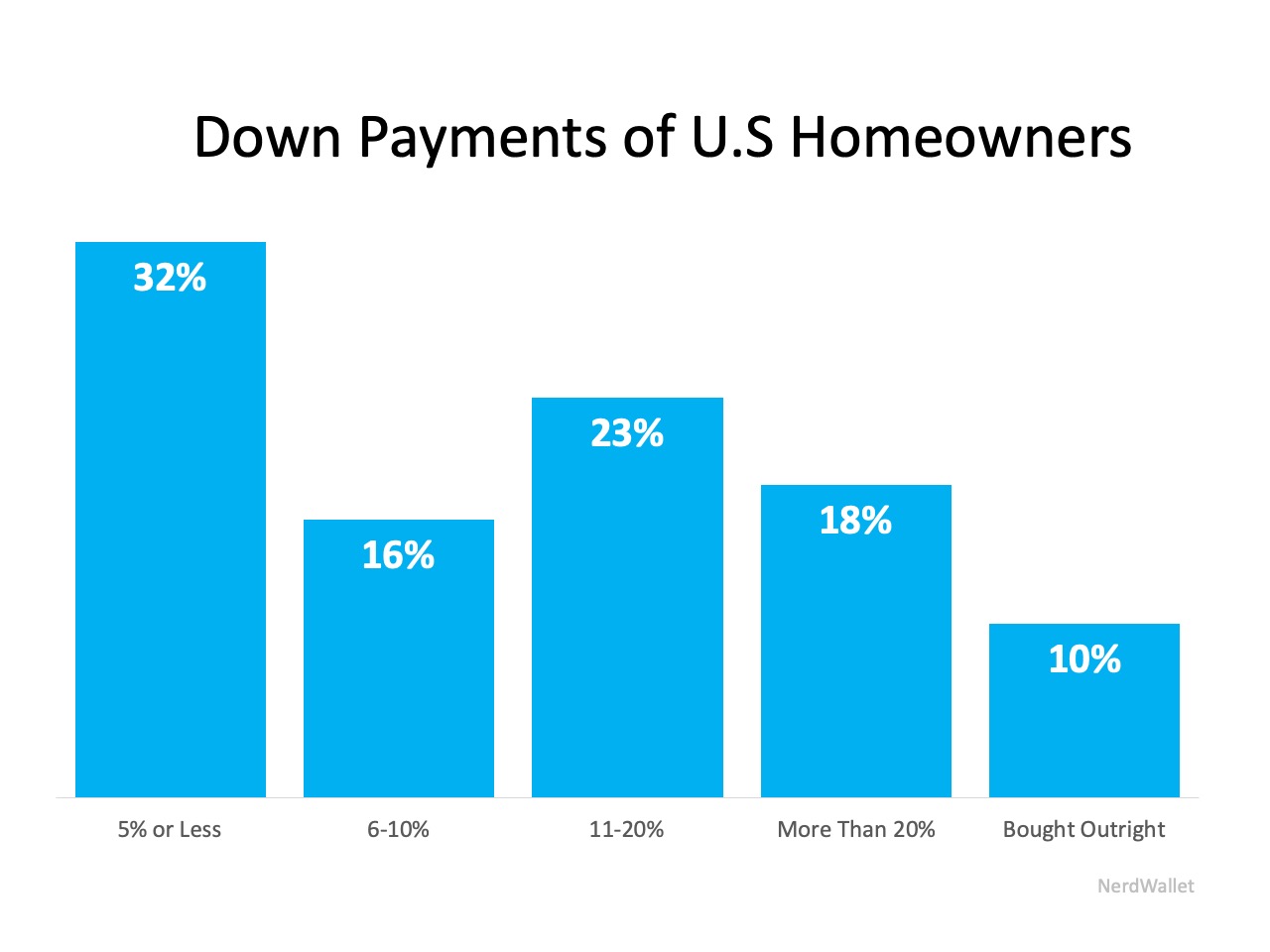

According to the ‘2019 Home Buyer Report’ conducted by Nerdwallet, many first-time buyers still believe they need a 20% down payment to buy a home in today’s market:

“More than 6 in 10 (62%) Americans believe you must put at least 20% down in order to purchase a home.”

When potential homebuyers think they need a 20% down payment to enter the market, they also tend to think they’ll have to wait several years (in some markets) to come up with the necessary funds to buy their dream homes. The report continues to say,

“The truth: 32% of current U.S. homeowners put 5% or less down on their home, according to census data.” (as shown below):

The lack of knowledge about the home-buying process is, unfortunately, keeping many motivated buyers on the sidelines.

The lack of knowledge about the home-buying process is, unfortunately, keeping many motivated buyers on the sidelines.

Bottom Line

Don’t let a lack of understanding keep you and your family out of the housing market. Let’s get together to discuss your options today.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link