INTERO INTRODUCES PINNACLE HOME SERVICES PROGRAM FOR SELLERS

Official Press Release:

CUPERTINO, Calif.–(BUSINESS WIRE)–Intero, a Berkshire Hathaway affiliate and a wholly-owned subsidiary of HomeServices of America, Inc., is proud to announce the introduction of PINNACLE, a premium designer-curated home preparation service with zero out-of-pocket cost to sellers until their home closes escrow.

Available for clients working with an Intero agent, PINNACLE provides vast, customized home-preparation options, including, but not limited to, cosmetic updates, general repairs, professional staging services, window treatments, landscaping, decluttering and moving and packing services.

Sellers who opt into Intero’s PINNACLE program will interface with their own project coordinator. These project coordinators do the work of assessing what needs to be done and coordinate the job from start to finish with local contractors. The program also stands out for providing tailored relocation services to seniors who need additional support when moving.

“We’re proud to bring the PINNACLE program to the market,” said Brian Crane, Chief Executive Officer of Intero. “The PINNACLE program gives Intero agents and clients a progressive and effective tool to enhance the condition of the home prior to going to the market, without the upfront out-of-pocket expense. This PINNACLE program is a true differentiator in the marketplace for Intero and will add to Intero’s ability to help seller clients achieve the best results.”

The PINNACLE program is available today for any seller with a signed listing agreement with an Intero sales associate. To get more information, please visit www.interopinnacle.com or call me at 408.465.9290 to learn how you can take advantage of this fantastic option when you’re ready to sell!

Millennials Are on the Move as First-Time Homebuyers [INFOGRAPHIC]

![Is Your First Home Now Within Your Grasp? [INFOGRAPHIC] | MyKCM](https://desireestanley.com/files/2019/12/20191206-MEM-1046x1477.jpg)

![Is Your First Home Now Within Your Grasp? [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/12/05064901/20191206-MEM-1046x1477.jpg)

Some Highlights:

- According to NAR’s latest Profile of Home Buyers & Sellers, the median age of all first-time homebuyers is 32.

- With more millennials entering a homebuying phase of life, they are driving a large portion of the buyer’s appetite in the market, keeping buyer activity strong.

- More and more “old millennials” (ages 25-36) are realizing that homeownership is now within their grasp, and they’re actively dominating the first-time homebuyer market!

Tips to sell your home faster

When selling your house, there are a few key things you can prioritize to have the greatest impact for a faster sale:

1. Make Buyers Feel at Home

Declutter your home! Pack away all personal items like pictures, awards, and sentimental belongings. Make buyers feel like they belong in the house. According to the 2019 Profile of Home Staging by the National Association of Realtors, “83% of buyers’ agents said staging a home made it easier for a buyer to visualize the property as a future home.”

Not only will your house spend less time on the market, but the same report mentioned that, “One-quarter of buyers’ agents said that staging a home increased the dollar value offered between 1 – 5%, compared to other similar homes on the market that were not staged.”

2. Keep It Organized

Since you took the time to declutter, keep it organized. Before buyers arrive, pick up toys, make the bed, and put away clean dishes. According to the same report, the kitchen is one of the most important rooms to stage in order to attract more buyers. Put out a scented candle or some cookies fresh from the oven. Buyers will remember the smell of your home.

3. Price It Right

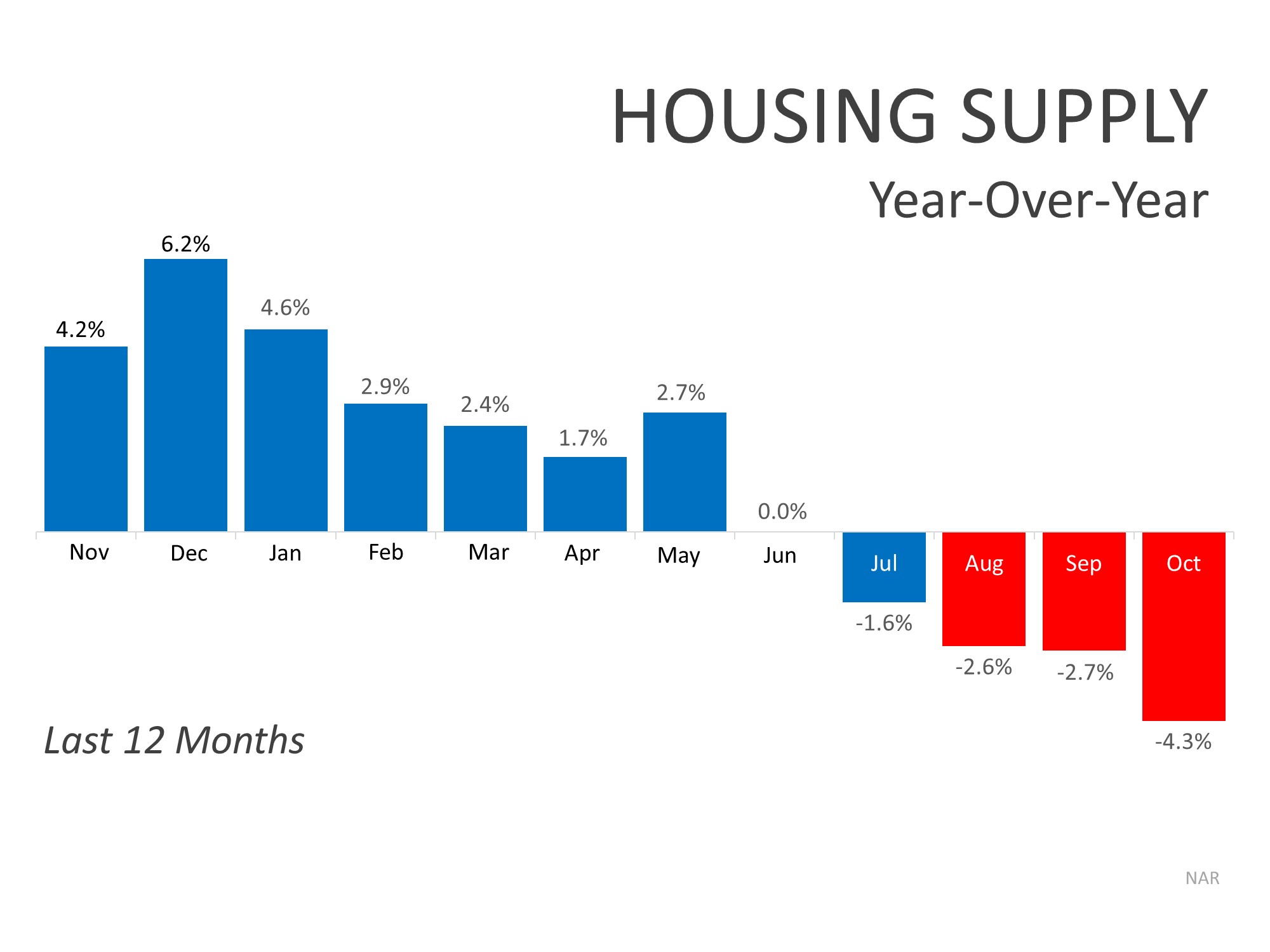

More inventory coming into the market guarantees there will be some competition. You want to make sure your home is noticed. A key to selling your house is ensuring it is Priced to Sell Immediately (PTSI). This means you’ll be driving more traffic to your property, and ultimately creating more interest in your home.

4. Give Buyers Full Access

One of the top four elements when selling your home is access. If your home is available anytime, that opens up more opportunity to find a buyer right away. Some buyers, especially those relocating, don’t have much time available. If they cannot get into the house, they will move on to the next one.

Bottom Line

If you want to sell your home in the least amount of time at the best price with as little hassle as possible, a local real estate professional is a useful guide. Let’s connect today to determine what you need to do to sell your home as quickly as possible.

Planning on Buying a Home? Be Sure You Know Your Options.

When you’re ready to buy, you’ll need to determine if you prefer the charm of an existing home or the look and feel of a newer build. With limited existing home inventory available today, especially in the starter and middle-level markets, many buyers are considering a new home that’s recently been constructed, or they’re building the home of their dreams.

According to Robert Dietz, Chief Economist at the National Association of Home Builders (NAHB),

“The second half of 2019 has seen steady gains in single-family construction, and this is mirrored by the gradual uptick in builder sentiment over the past few months.”

This is great news for homebuyers because it means there is additional inventory coming to the market, giving buyers more choices. The most recent data from NAHB shows,

“The inventory of new homes for sale was 321,000 in September, representing a 5.5 months’ supply. The median sales price was $299,400. The median price of a new home sale a year earlier was $328,300.”

Another added bonus is that builders are very aware of buyer demand in this segment, so they’re now building in a price range where there are more interested buyers ($299,400 instead of $328,300). With a reduced sales price and low-interest rates, today’s buyers have strong purchasing power.

Bottom Line

If you’re thinking of buying a home, you may want to consider a new build to meet your family’s needs. Let’s get together to discuss the process and review what’s available in our area.

4 Reasons to Buy a Home This Fall

Here are four great reasons to consider buying a home today, instead of waiting.

1. Prices Will Continue to Rise

CoreLogic’s latest Home Price Insights Report shows that home prices have appreciated by 3.6% over the last 12 months. The same report predicts prices will continue to increase at a rate of 5.8% over the next year.

The bottom in home prices has come and gone. Home values will continue to appreciate for years. Waiting no longer makes sense.

2. Mortgage Interest Rates Are Projected to Increase Next Year

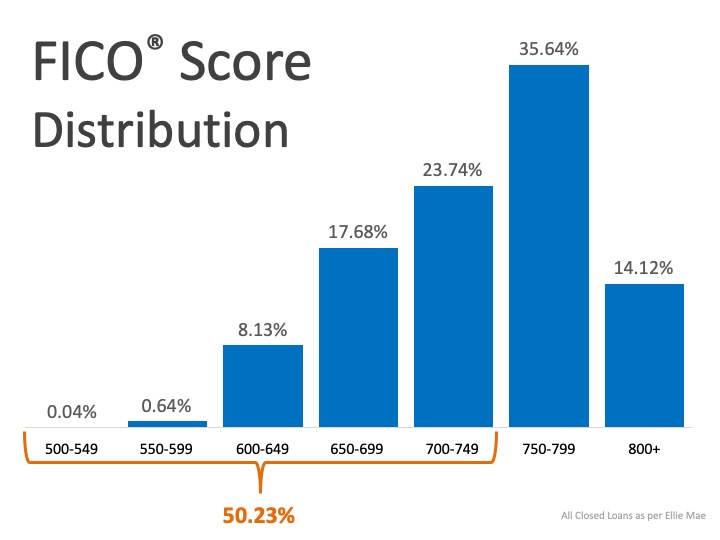

The Primary Mortgage Market Survey from Freddie Mac indicates that interest rates for a 30-year mortgage have recently hovered just above 3.5%. This is great news for buyers in the market right now, because low-interest rates increase your purchasing power – but don’t wait! Most experts predict rates will rise over the next 12 months. The Mortgage Bankers Association, Fannie Mae, Freddie Mac, and the National Association of Realtors are in unison, projecting that rates will increase by this time next year.

An increase in rates will impact your monthly mortgage payment. A year from now, your housing expense will increase if a mortgage is needed to buy your next home.

3. Either Way, You Are Paying a Mortgage

There are some renters who haven’t purchased a home yet because they’re uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you’re living rent-free with your parents, you are paying a mortgage – either yours or that of your landlord.

As an owner, your mortgage payment is a form of ‘forced savings’ that allows you to have equity in your home you can tap into later in life. As a renter, you guarantee your landlord is the person with that equity.

Are you ready to put your housing costs to work for you?

4. It’s Time to Move on With Your Life

The ‘cost’ of a home is determined by two major components: the price of the home and the current mortgage rate. It appears both are on the rise.

But what if they weren’t? Would you wait?

Look at the actual reason you’re buying and decide if it is worth waiting. Whether you want to have a great place for your children to grow up, you want your family to be safer, or you just want to have control over custom renovations, maybe now is the time to buy.

Bottom Line

Buying a home sooner rather than later could lead to substantial savings. Let’s get together to determine if homeownership is the right choice for you and your family this fall.

You Need More Than a Guide. You Need a Sherpa.

In a normal housing market, whether you’re buying or selling a home, you need an experienced guide to help you navigate the process. You need someone you can turn to who will tell you how to price your home correctly right from the start. You need someone who can help you determine what to offer on your dream home without paying too much or offending the seller with a low-ball offer.

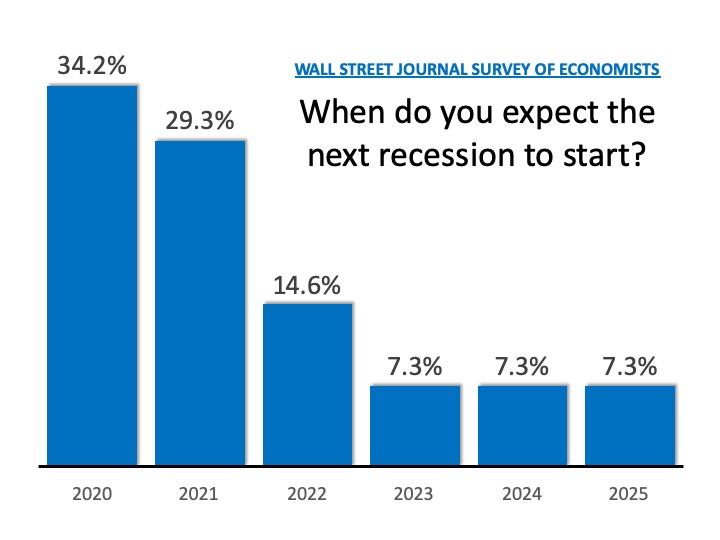

We are, however, in anything but a “normal market” right now. The media is full of stories about an impending recession, a trade war with China, and constant political upheaval. Each of these potential situations could dramatically impact the real estate market. To successfully navigate the landscape today, you need more than an experienced guide. You need a ‘Real Estate Sherpa.’

A Sherpa is a “member of a Himalayan people living on the borders of Nepal and Tibet, renowned for their skill in mountaineering.” Sherpas are skilled in leading their parties through the extreme altitudes of the peaks and passes in the region – some of the most treacherous trails in the world. They take pride in their hardiness, expertise, and experience at very high altitudes.

They are much more than just guides.

This is much more than a normal real estate market.

The average guide just won’t do. You need a ‘Sherpa.’ You need an expert who understands what is happening in the market and why it is happening. You need someone who can simply and effectively explain it to you and your family. You need an expert who will guarantee you make the right decision, even in these challenging times.

Dave Ramsey, the financial guru, advises:

“When getting help with money, whether it’s insurance, real estate or investments, you should always look for someone with the heart of a teacher, not the heart of a salesman.”

Bottom Line

Hiring an agent who has a finger on the pulse of the market will make your buying or selling experience an educated one.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link