Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

Is A Bigger House Within Your Budget?

At this time of year, many families come together to celebrate the season. It’s also the time when many realize their homes are just not quite big enough to host all of their guests and loved ones. Are you one of those homeowners dreaming for a larger space to call home?

You may have enough equity in your current home to move up.

According to the Q3 2019 U.S. Home Equity & Underwater Report by ATTOM Data Solutions,

“14.4 million residential properties in the United States were considered equity rich, meaning that the combined estimated amount of loans secured by those properties was 50 percent or less of their estimated market value.”

This means that one in four of the 54 million mortgaged homes in the U.S. has at least 50% equity. If these homeowners decide to sell, they can use their equity to put toward the purchase of a new home. Maybe you’ll be one of them.

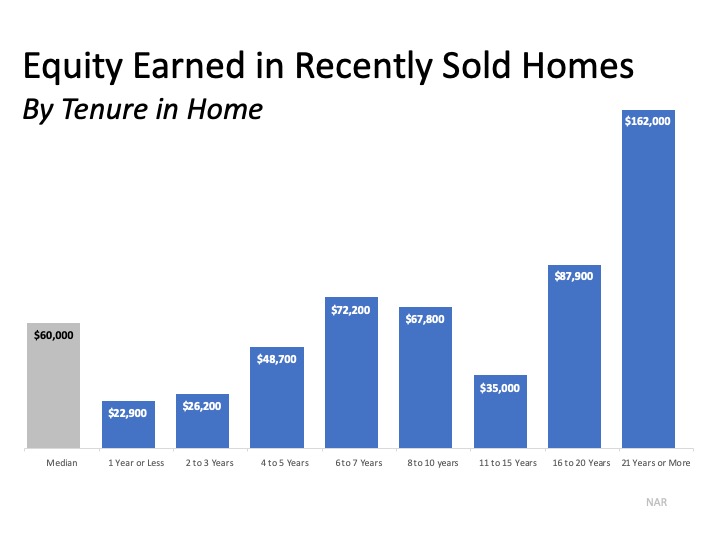

NAR recently released their 2019 Profile of Home Buyers and Sellers showing that,

“This year, home sellers cited that they sold their homes for a median of $60,000 more than they purchased it, up from $55,500 the year prior. This accounted for a 31 percent price gain, up from 29 percent the year before.”

Here’s the equity gain breakdown based on the number of years these sellers lived in their homes

Bottom Line

If you’re one of the many homeowners with big dreams of owning a larger home, let’s get together. Working with a trusted advisor to find out how much equity you have is a great first step in putting your move-up plan in motion.

It’s ‘National Roof Over Your Head’ Day!

Did you know that each year in the United States, we celebrate “National Roof Over Your Head Day” on December 3rd?

As noted on the National Calendar, it was “created as a day to be thankful for what you have, starting with the roof over your head. There are many things that we have that we take for granted and do not stop to appreciate how fortunate we are for having them.”

From bungalows to cottages, and farmhouses to treehouses, today we show our appreciation and gratitude for the places we call home. Owning the roof that shelters us is something many renters still aspire to, knowing there are so many financial and non-financial benefits to homeownership.

According to the 2019 State of the Nation’s Housing from the Joint Center for Housing Studies of Harvard University,

“Cost-burdened renters now outnumber cost-burdened homeowners by more than 3.0 million. In addition, renters make up 10.8 million of the 18.2 million severely burdened households that pay more than half their incomes for housing.”

Homeownership drives many benefits, including providing families with a place to feel secure. It also helps promote confidence that they are investing proactively in themselves and their communities. That is why there are 77.7 million owner-occupied housing units in the United States.

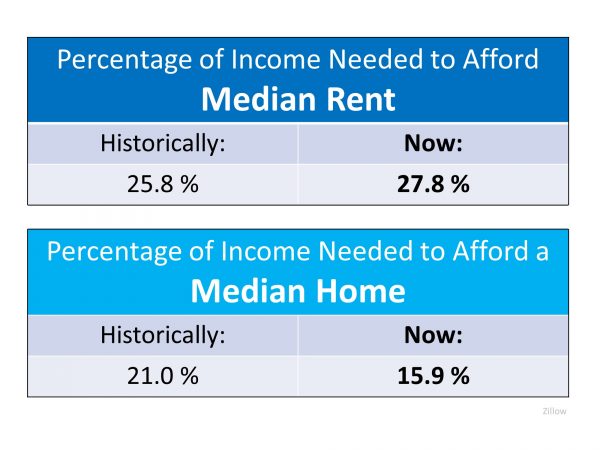

Many, however, fear it is too expensive to own a home. In reality, however, it’s actually more expensive to rent. Here’s the breakdown as a percentage of income necessary for both – affording median rent and owning a home:

Bottom Line

Today we pause to appreciate the places we call home, and all of the other reasons we have to be truly thankful. For those who don’t own yet and would like to, it’s a wonderful time to start identifying the steps to take toward homeownership. Let’s connect today to begin creating your plan.

7 Reasons to List Your House This Holiday Season

Around this time each year, many homeowners decide to wait until after the holidays to list their houses. Similarly, others who already have their homes on the market remove their listings until the spring. Let’s unpack the top reasons why listing your house now or keeping it on the market this winter may be the best choice you can make.

Here are seven great reasons not to wait:

- Relocation buyers are out there now. Many companies are still hiring throughout the holidays, and they need their new employees to start as soon as possible.

- Purchasers who are looking for homes during the holidays are serious buyers and are ready to buy now.

- You can restrict the showings on your home to days and times that are most convenient for you. You will remain in control.

- Homes show better when decorated for the holidays.

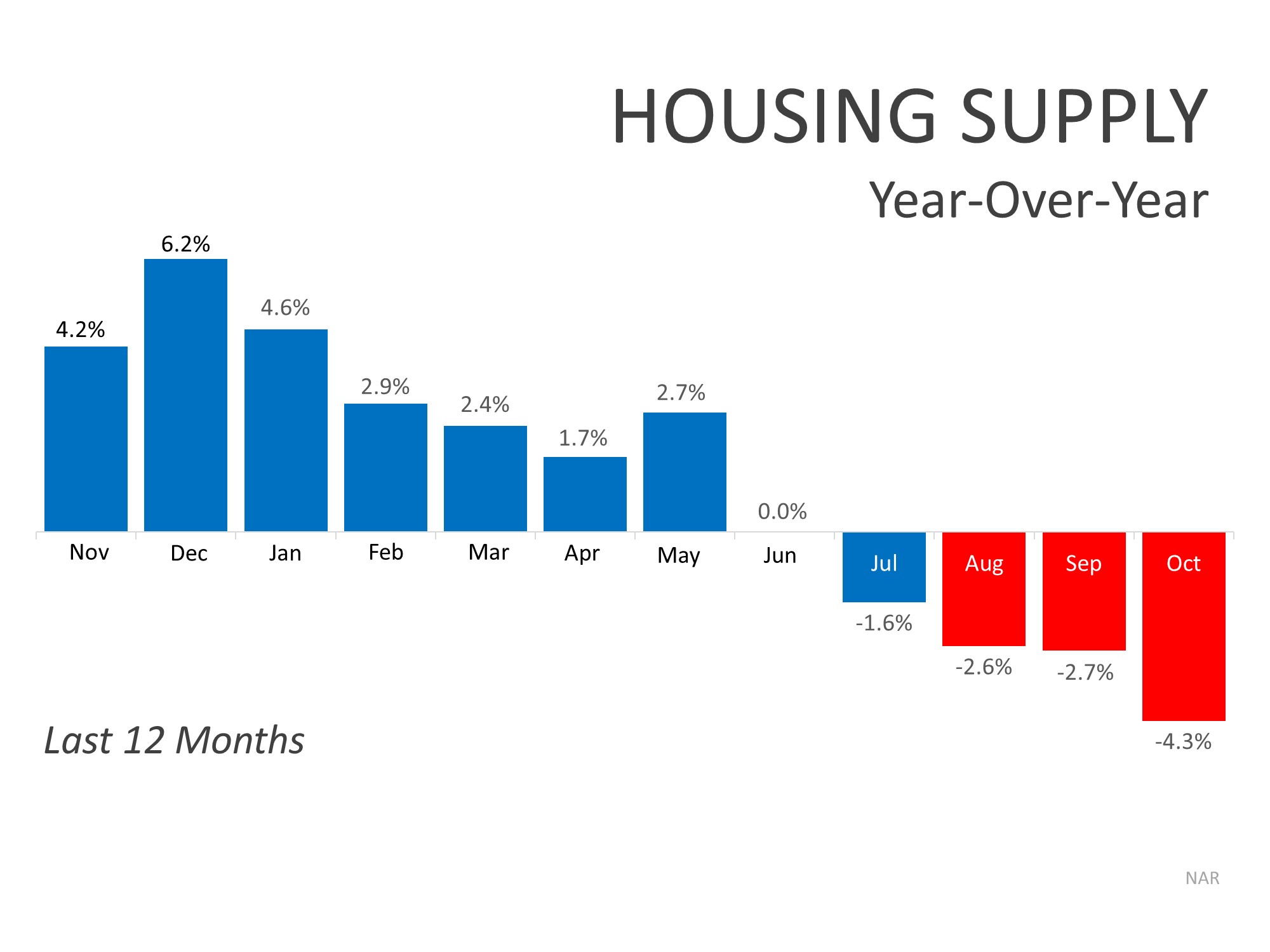

- There is minimal competition for you as a seller right now. Over the past few months we’ve seen the supply of homes for sale decreasing year-over-year, as shown in the graph below:

- The desire to own a home doesn’t stop during the holidays. Buyers who were unable to find their dream homes during the busy spring and summer months are still searching, and your home may be the answer.

- Late fall and early winter make up the “sweet spot” for sellers. The supply of listings increases substantially after the holidays. Also, in many parts of the country, new construction will continue to surge and reach new heights in 2020, which will lessen the demand for your house next year.

Bottom Line

It may make the most sense to list your home this holiday season. Let’s get together to determine if selling now is your best move.

How Long Can This Economic Recovery Last?

The economy is currently experiencing the longest recovery in our nation’s history. The stock market has hit record highs, while unemployment rates are at record lows. Home price appreciation is beginning to reaccelerate. This begs the question: How long can this economic recovery last?

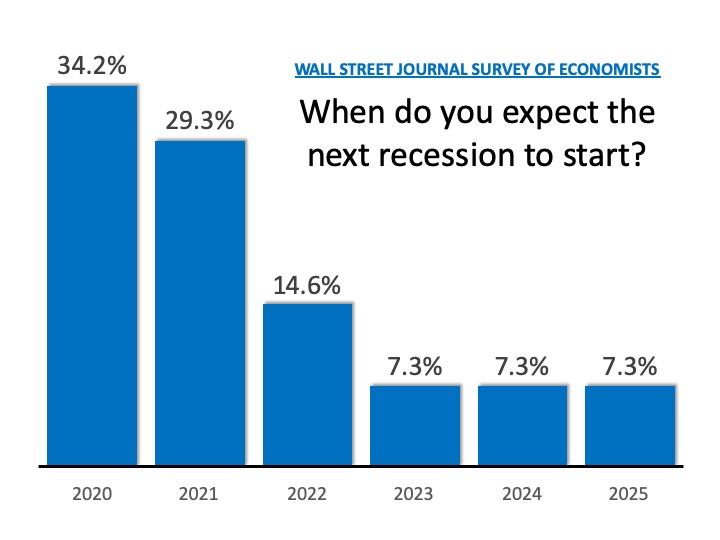

The Wall Street Journal (WSJ) Survey of Economists recently called for an economic slowdown (recession) in the near future. The most recent survey, however, now shows the economists are pushing that timetable back. When asked when they expect a recession to start, 42.5% of the economists in the previous survey projected between now and the end of 2020. The most recent survey showed that percentage drop to 34.2%. Here are the most current results: Like the economists surveyed by the WSJ, most experts are still predicting a recession will likely occur sometime in the next few years. However, many are pushing back the date for the economic slowdown.

Like the economists surveyed by the WSJ, most experts are still predicting a recession will likely occur sometime in the next few years. However, many are pushing back the date for the economic slowdown.

Bottom Line

Real estate is impacted by the economy (and the consumer’s belief in the strength of the economy). The fact that most economic experts are calling for the recovery to continue through 2020 means the housing market will also remain strong for the foreseeable future.

2 Myths Holding Back Home Buyers

In a recent article, First American shared how millennials are not really any different from previous generations when it comes to the goal of homeownership; it is still a huge part of their American Dream. The piece, however, also reveals,

“Saving for a down payment is one of the biggest obstacles faced by first-time home buyers. Dispelling the 20 percent down payment myth could open the path to homeownership for many more.”

Myth #1: “I Need a 20% Down Payment”

Buyers often overestimate how much they need to qualify for a home loan. According to the same article:

“Americans still overestimate the qualifications needed to get a mortgage, resulting in qualified potential buyers not even considering homeownership. Indeed, the Urban Institute report revealed that 16 percent of consumers believed that the minimum down payment required by lenders is 20 percent or more, and another 40 percent didn’t know at all.”

While many potential buyers still think they need to put at least 20% down for the home of their dreams, they often don’t realize how many assistance programs are available with as little as 3% down. With a little research, many renters may actually be able to enter the housing market sooner than they ever imagined.

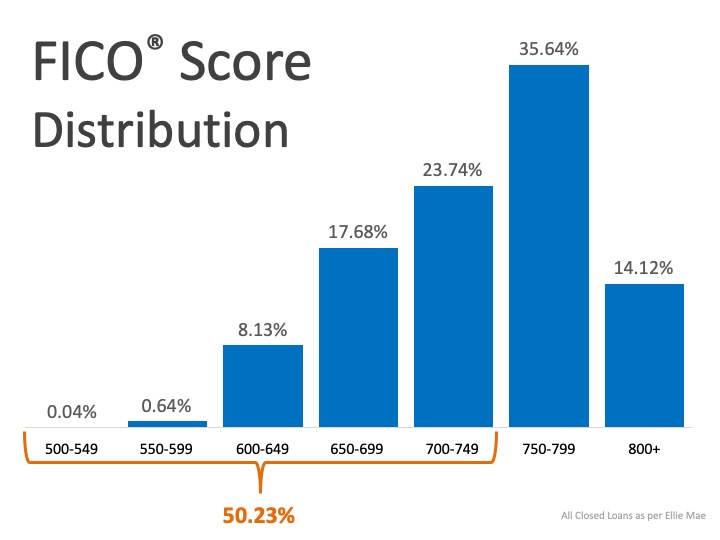

Myth #2: “I Need a 780 FICO® Score or Higher”

In addition to down payments, buyers are also often confused about the FICO® score it takes to qualify for a mortgage, believing a ‘good’ credit score is 780 or higher.

To debunk this myth, let’s take a look at Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved) loans. As indicated in the chart above, 50.23% of approved mortgages had a credit score of 500-749.

As indicated in the chart above, 50.23% of approved mortgages had a credit score of 500-749.

Bottom Line

Whether buying your first home or moving up to your dream home, knowing your options will make the mortgage process easier. Believe it or not – your dream home may already be within your reach.

What is Important to Boomers when Selling their House?

If you are a “baby boomer” (born between 1946 and 1964), you may be thinking about selling your current home. Your children may have finally moved out. Your large, four-bedroom house with three bathrooms no longer fits the bill. Taxes are too high. Utilities are too expensive. Cleaning and repair are too difficult. You may be ready to move into a home that better fits your current lifestyle. Many fellow boomers have already made the move you may be considering.

The National Association of Realtors recently released its 2019 Home Buyer and Seller Generational Report. The report revealed many interesting tidbits about both categories of baby boomers: younger boomers (ages 54 to 63) and older boomers (64 to72). Here are a few of the more interesting topics.

Percentage of Buyers who Looked Online First

- All Buyers: 44%

- Younger Boomers: 46%

- Older Boomers: 44%

Where Boomers Found the Home They Purchased

The two major ways buyers found the home they purchased:

- All buyers: 50% on the internet, 28% through a real estate agent

- Younger Boomers: 46% on the internet, 33% through a real estate agent

- Older Boomers: 36% on the internet, 35% through a real estate agent

Distance Seller Moved

The distance between the home they purchased and the home they recently sold was much greater for boomers than the average seller.

- All sellers: 20 miles

- Younger Boomers: 27 miles

- Older Boomers: 50 miles

Tenure in Previous Home of Seller

The percentage of older boomers who lived in their previous home for more than 20 years was almost twice the amount of the average seller.

- All sellers: 16%

- Younger Boomers: 20%

- Older Boomers: 31%

Primary Reason to Sell their Previous Home

- Want to move closer to friends or family

- Home too large

- Retirement

View of Homeownership as a Financial Investment

- 83% of Younger Boomers see homeownership as a good investment

- 82% of Older Boomers see homeownership as a good investment

Bottom Line

If you are a boomer and thinking about selling, now might be the time to contact an agent to help determine your options.

75 Years of VA Home Loan Benefits

Today, on Veterans Day, we salute those who have served our country in war or peace, and we thank them for their sacrifice.

This year marks the 75th anniversary of VA Home Loan Benefit offerings through the Servicemen’s Readjustment Act, also known as the GI Bill. Since 1944, this law has created opportunities for those who have served our country, ranging from vocational training to home loans.

Facts About VA Home Loans:

- Nearly 24 million home loans have been guaranteed by the Veterans Administration.

- Nearly 82% of VA home loans are made with no down payment.

- The VA also provides grants to help seriously disabled Veterans purchase, modify, or construct a home to meet their needs. Last year the VA provided 2,000 grants totaling $104 million.

Benefits of a VA Home Loan:

- No down payment

- No Private Mortgage Insurance*

- Lower credit score requirements

- Limitation on closing costs

- Lower average interest rates

*More information on VA Home Loan Fees

Bottom Line

The best thing you can do today to celebrate Veterans Day is to share this information with those who can benefit from these opportunities. For more information, or to find out how to qualify to use a VA Home Loan Benefit, let’s get together to navigate through the process. Thank you for your service!

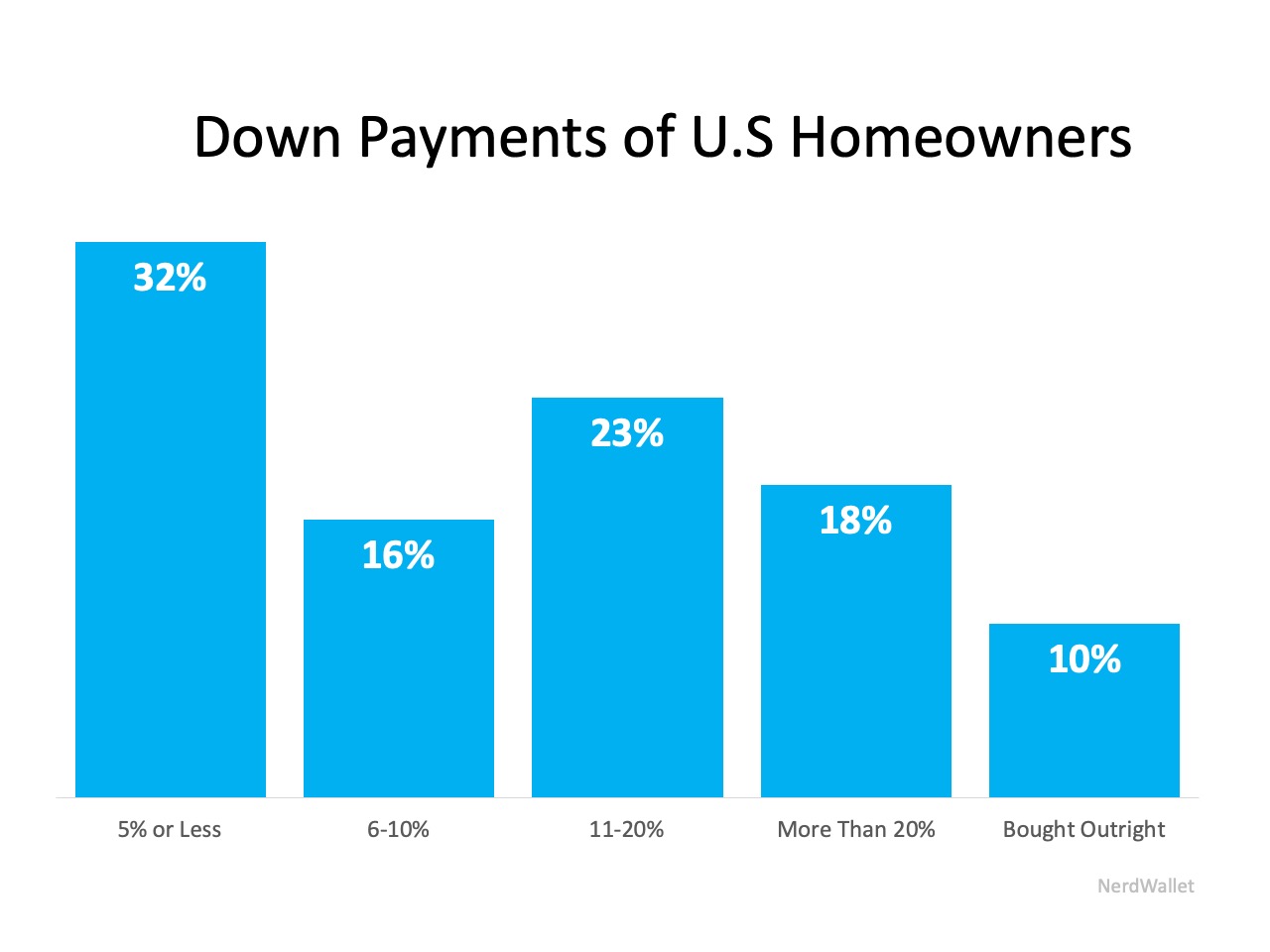

62% of Buyers Are Wrong About Down Payment Needs

According to the ‘2019 Home Buyer Report’ conducted by Nerdwallet, many first-time buyers still believe they need a 20% down payment to buy a home in today’s market:

“More than 6 in 10 (62%) Americans believe you must put at least 20% down in order to purchase a home.”

When potential homebuyers think they need a 20% down payment to enter the market, they also tend to think they’ll have to wait several years (in some markets) to come up with the necessary funds to buy their dream homes. The report continues to say,

“The truth: 32% of current U.S. homeowners put 5% or less down on their home, according to census data.” (as shown below):

The lack of knowledge about the home-buying process is, unfortunately, keeping many motivated buyers on the sidelines.

The lack of knowledge about the home-buying process is, unfortunately, keeping many motivated buyers on the sidelines.

Bottom Line

Don’t let a lack of understanding keep you and your family out of the housing market. Let’s get together to discuss your options today.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link