Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

Real Estate Is Soaring, But Not Like 2008

Unlike last year, the residential real estate market kicked off 2020 with a bang! In their latest Monthly Mortgage Monitor, Black Knight proclaimed:

“The housing market is heating entering 2020 and recent rate declines could continue that trend, a sharp contrast to the strong cooling that was seen at this same time last year.”

Zillow revealed they’re also seeing a robust beginning to the year. Jeff Tucker, Zillow Economist, said:

“Our first look at 2020 data suggests that we could see the most competitive home shopping season in years, as buyers are already competing over…homes for sale.”

Buying demand is very strong. The latest Showing Index from ShowingTime reported a 20.2% year-over-year increase in purchaser traffic across the country, the sixth consecutive month of nationwide growth, and the largest increase in the history of the index.

The even better news is that buyers are not just looking. The latest Existing Home Sales Report from the National Association of Realtors (NAR) showed that closed sales increased 9.6% from a year ago.

This increase in overall activity has caused Zelman & Associates to increase their projection for home price appreciation in 2020 from 3.7% to 4.7%.

Are we headed for another housing crash like we had last decade?

Whenever price appreciation begins to accelerate, the fear of the last housing boom and bust creeps into the minds of the American population. The pain felt during the last housing crash scarred us deeply, and understandably so. The crash led us into the Great Recession of 2008.

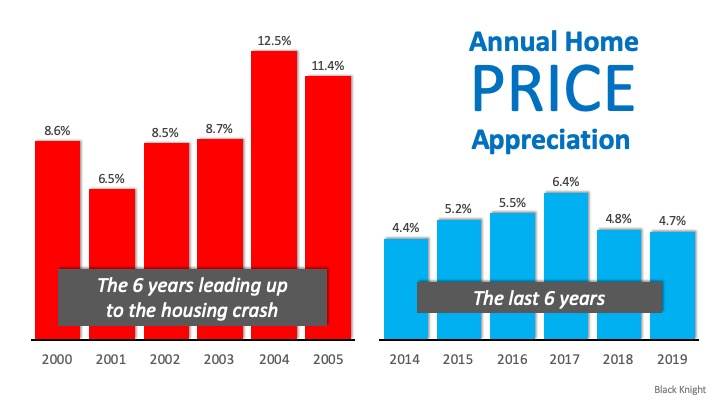

If we take a closer look, however, we can see the current situation is nothing like it was in the last decade. As an example, let’s look at price appreciation for the six years prior to the last boom (2006) and compare it to the last six years: There’s a stark difference between these two periods of time. Normal appreciation is 3.6%, so while current appreciation is higher than the historic norm, it’s certainly not accelerating beyond control as it did leading up to the housing crash.

There’s a stark difference between these two periods of time. Normal appreciation is 3.6%, so while current appreciation is higher than the historic norm, it’s certainly not accelerating beyond control as it did leading up to the housing crash.

Today, the strength of the housing market is actually helping prevent a setback in the overall economy. In a recent post, Odeta Kushi, Deputy Chief Economist for First American explained:

“While the housing crisis is still fresh on the minds of many, and was the catalyst of the Great Recession, the U.S. housing market has weathered all other recessions since 1980. With the exception of the Great Recession, house price appreciation hardly skipped a beat and year-over-year existing-home sales growth barely declined in all the other previous recessions in the last 40 years…In 2020, we argue the housing market is more likely poised to help stave off recession than fall victim to it.”

Bottom Line

The year has started off very nicely for the residential housing market. If you’re thinking of buying or selling, now may be the time to get together to discuss your options.

10 Steps to Buying a Home [INFOGRAPHIC]

![10 Steps to Buying a Home [INFOGRAPHIC] | MyKCM](https://desireestanley.com/files/2020/03/20200228-MEM-EN-1046x837.jpg)

![10 Steps to Buying a Home [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/02/25113646/20200228-MEM-EN-1046x837.jpg)

Some Highlights:

- If you’re thinking of buying a home and you’re not sure where to start, you’re not alone.

- Here’s a guide with 10 simple steps to follow in the homebuying process.

- Be sure to work with a trusted real estate professional to find out the specifics of what to do in your local area.

The Many Benefits of Aging in a Community

There’s comfort in being around people who share common interests, goals, and challenges. That comfort in a community doesn’t wane with age – it actually deepens. Whether it’s proudly talking about grandchildren or lamenting the fact that our eyes aren’t as good as they used to be, it helps to be around people who not only understand what we’re saying but actually feel the same joys and concerns as well.

That’s why many boomers are deciding to move into an active adult community. In the latest 55places National Housing Survey, they were described by one out of three seniors as an “outgoing, social community of likeminded people.”

Bill Ness, Chief Executive Officer and Founder of 55places.com, explains:

“Baby boomers are now reaching the age when moving to an active adult community is the ideal opportunity for them…Many boomers now want to downsize, experience a maintenance-free lifestyle, and pursue more social opportunities. It’s exciting that there are so many choices for baby boomers.”

There’s still a desire, however, among many seniors to “age-in-place.” According to the Senior Resource Guide, aging-in-place means:

“…that you will be remaining in your own home for the later years of your life; not moving into a smaller home, assisted living, or a retirement community etcetera.”

The challenge is, many seniors live in suburban or rural areas, and that often necessitates driving significant distances to see friends or attend other social engagements. A recent report from the Joint Center for Housing Studies of Harvard University (JCHS) titled Housing America’s Older Adults addressed this exact concern:

“The growing concentration of older households in outlying communities presents major challenges for residents and service providers alike. Single-family homes make up most of the housing stock in low-density areas, and residents typically need to be able to drive to do errands, see doctors, and socialize.”

The Kiplinger report also chimed in on this subject:

“While most seniors say they want to age in place, a much smaller percentage of them actually manage to accomplish it, studies show. Transportation is often a problem; when you can no longer drive, you can’t get to medical appointments or to other outings.”

Driving may not be a challenge right now, but think about what it may be like to drive 10, 20, or 30 years down the road.

There are also health challenges brought on by a possible lack of socialization when living at home versus a community of seniors. Sarah J. Stevenson is an author who writes about seniors. In a recent blog post for A Place for Mom, she explains:

“Social contacts tend to decrease as we age for reasons such as retirement, the death of friends and family, or lack of mobility.”

Thankfully, research from the same article suggests if you’re spending time with others in a community, thus reducing the impact of loneliness and isolation, there’s less of a risk of developing high blood pressure, obesity, heart disease, a weakened immune system, depression, anxiety, cognitive decline, Alzheimer’s disease, and early death.

Though the familiarity of our current home may bring a feeling of warmth, comfort, and convenience, it’s important to understand that staying there may mean missing out on crucial socialization opportunities. Living with adult children, joining a retirement community, or moving to an assisted living facility can help us continue to be with people we enjoy every day.

Bottom Line

“Aging-in-place” definitely has its advantages, but it could mean getting “stuck-in-place” too. There are many health benefits derived from socialization with a community of people that shares common interests. It’s important to take the need for human interaction into consideration when making a decision about where to spend the later years in life.

How the Housing Market Benefits with Uncertainty in the World

It’s hard to listen to today’s news without hearing about the uncertainty surrounding global markets, the spread of the coronavirus, and tensions in the Middle East, just to name a few. These concerns have caused some to question their investment plans going forward. As an example, in Vanguard’s Global Outlook for 2020, the fund explains,

“Slowing global growth and elevated uncertainty create a fragile backdrop for markets in 2020 and beyond.”

Is there a silver lining to this cloud of doubt?

Some worry this could cause concern for the U.S. housing market. The uncertainty, however, may actually mean good news for real estate.

Mark Fleming, Chief Economist at First American, discussed the situation in a recent report,

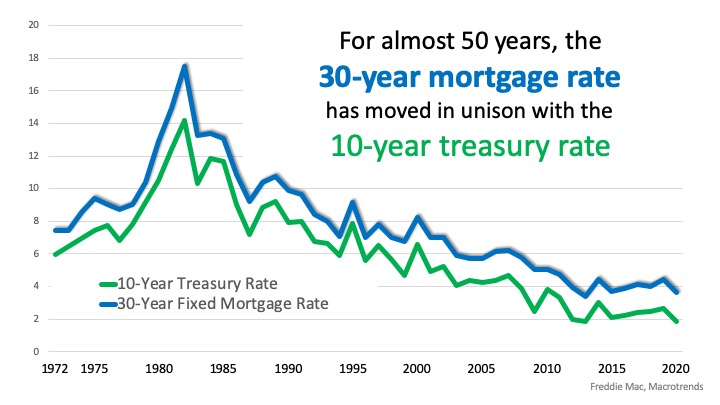

“Global events and uncertainty…impact the U.S. economy, and more specifically, the U.S. housing market…U.S. bonds, backed by the full faith and credit of the U.S. government, are widely considered the safest investments in the world. When global investors sense increased uncertainty, there is a ‘flight to safety’ in U.S. Treasury bonds, which causes their price to go up, and their yield to go down.”

Last week, in a HousingWire article, Kathleen Howley reaffirmed Fleming’s point,

“The death toll from the coronavirus already has passed Severe Acute Respiratory Syndrome, or SARS, that bruised the world’s economy in 2003…That’s making investors around the world anxious, and when they get anxious, they tend to sell off stocks and seek the safe haven of U.S. bonds. An increase in competition for bonds means investors, including the people who buy mortgage-backed bonds, have to take lower yields. That translates into lower mortgage rates.”

The yield from treasury bonds is the rate investors receive when they purchase the bond. Historically, when the treasury rate moves up or down, the 30-year mortgage rate follows. Here’s a powerful graph showing the relationship between the two over the last 48 years: How might concerns about global challenges impact the housing market in 2020? Fleming explains,

How might concerns about global challenges impact the housing market in 2020? Fleming explains,

“Even a small change in the 10-year Treasury due to increased uncertainty, let’s say a slight drop to 1.6 percent, would imply a 30-year, fixed mortgage rate as low as 3.3 percent. Assuming no change in household income, that would mean a house-buying power gain of $21,000, a five percent increase.”

Bottom Line

For a multitude of reasons, 2020 could be a challenging year. It seems, however, real estate will do just fine. As Fleming concluded in his report:

“Amid uncertainty, the house-buying power of U.S. consumers can benefit significantly.”

The #1 Misconception in the Homebuying Process

After over a year of moderating home prices, it appears home value appreciation is about to reaccelerate. Skylar Olsen, Director of Economic Research at Zillow, explained in a recent article:

“A year ago, a combination of a government shutdown, stock market slump and mortgage rate spike caused a long-anticipated inventory rise. That supposed boom turned out to be a short-lived mirage as buyers came back into the market and more than erased the inventory gains. As a natural reaction, the recent slowdown in home values looks like it’s set to reverse back.”

CoreLogic, in their January 2020 Market Pulse Report, agrees with Olsen, projecting home value appreciation in all fifty states this year. Here’s the breakdown:

- 21 states appreciating 5% or more

- 26 states appreciating between 3-5%

- Only 3 states appreciating less than 3%

The Misconception

Many believe when real estate values are increasing, owning a home becomes less affordable. That misconception is not necessarily true.

In most cases, homes are purchased with a mortgage. The current mortgage rate is a major component of the affordability equation. Mortgage rates have fallen by almost a full percentage point since this time last year.

Another major piece of the equation is a buyer’s income. The median family income has risen by 5% over the last year, contributing to the affordability factor.

Black Knight, in their latest Mortgage Monitor, addressed this exact issue:

“Despite the average home price increasing by nearly $13,000 from just over a year ago, the monthly mortgage payment required to buy that same home has actually dropped by 10% over that same span due to falling interest rates…

Put another way, prospective homebuyers can now purchase a $48K more expensive home than a year ago while still paying the same in principal and interest, a 16% increase in buying power.”

Bottom Line

If you’re thinking about purchasing a home, realize that homes are still affordable even though prices are increasing. As the Black Knight report concluded:

“Even with home price growth accelerating, today’s low-interest-rate environment has made home affordability the best it’s been since early 2018.”

The Overlooked Financial Advantages of Homeownership

There are many clear financial benefits to owning a home: increasing equity, building net worth, growing appreciation, and more. If you’re a renter, it’s never too early to make a plan for how homeownership can propel you toward a stronger future. Here’s a dive into three often-overlooked financial benefits of homeownership and how preparing for them now can steer you in the direction of greater stability, savings, and predictability.

1. You Won’t Always Have a Monthly Housing Payment

According to a recent article by the National Association of Realtors (NAR):

“If you’ve been a lifelong renter, this may sound like a foreign concept, but believe it or not, one day you won’t have a monthly housing payment. Unlike renting, you will eventually pay off your mortgage and your monthly payments will be funding other (possibly more fun) things.”

As a homeowner, someday you can eliminate the monthly payment you make on your house. That’s a huge win and a big factor in how homeownership can drive stability and savings in your life. As soon as you buy a home, your monthly housing costs will begin to work for you as forced savings, coming in the form of equity. As you build equity and grow your net worth, you can continue to reinvest those savings into your future, maybe even by buying that next dream home. The possibilities are truly endless.

2. Homeownership Is a Tax Break

One thing people who have never owned a home don’t always think about are the tax advantages of homeownership. The same piece states:

“Both the interest and property tax portion of your mortgage is a tax deduction. As long as the balance of your mortgage is less than the total price of your home, the interest is 100% deductible on your tax return.”

Whether you’re living in your first home or your fifth, it’s a huge financial advantage to have some tax relief tied to the interest you pay each year. It’s one thing you definitely don’t get when you’re renting. Be sure to work with a tax professional to get the best possible benefits on your annual return.

3. Monthly Housing Costs Are Predictable

A third item noted in the article is how monthly costs become more predictable with homeownership:

“As a homeowner, your monthly costs are most likely based on a fixed-rate mortgage, which allows you to budget your finances over a long period of time, unlike the unpredictability of renting.”

With a mortgage, you can keep your monthly housing costs steady and predictable. Rental prices have been skyrocketing since 2012, and with today’s low mortgage rates, it’s a great time to get more for your money when purchasing a home. If you want to lock-in your monthly payment at a low rate and have a solid understanding of what you’re going to spend in your mortgage payment each month, buying a home may be your best bet.

Bottom Line

If you’re ready to start feeling the benefits of stability, savings, and predictability that come with owning a home, let’s get together to determine if buying a home sooner rather than later is right for you.

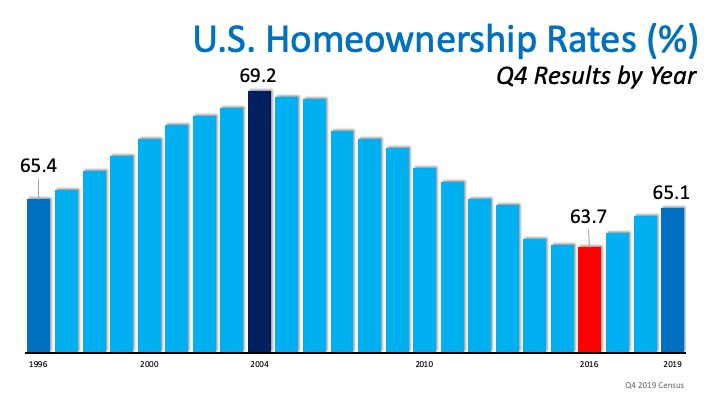

Homeownership Rate on the Rise to a 6-Year High

Regardless of the lack of inventory on the market, the U.S. homeownership rate has climbed to a 6-year high. The United States Census Bureau reported that it increased to 65.1% in the fourth quarter of 2019, representing the highest level in the past six years. See the graph below: This increase does not come as a surprise. According to realtor.com,

This increase does not come as a surprise. According to realtor.com,

“The largest cohort of the millennial generation turns 30-years-old in 2020 and they are hitting the housing market in full force. At the end of the fourth quarter of 2019, millennials made up the largest generational segment of homebuyers, growing their share of home purchase mortgages to 48 percent.”

With so many Millennials entering a homebuying phase of life and getting into the market, the Millennial Report also explains,

“Homeownership is an even bigger goal for younger generations. Of those with savings, 41 percent of Gen Z and 40 percent of younger millennials are saving to buy a home.”

Today’s low interest rates are providing a break to new homeowners too, regardless of generation, making homeownership more desirable and achievable at the same time. Freddie Mac explains,

“The combination of very low mortgage rates, a strong economy and more positive financial market sentiment all point to home purchase demand continuing to rise over the next few months.”

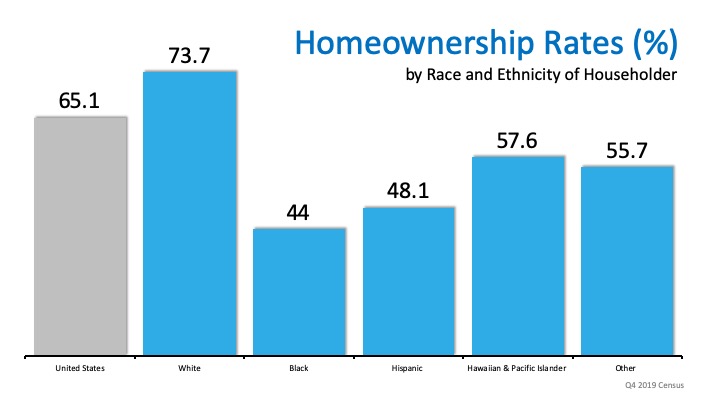

The increase in homeownership rate was also represented by race and ethnicity of the householders. HousingWire explains,

“The homeownership rate for black Americans in 2019’s fourth quarter rose to 44%, a seven-year high, increasing from the record low it reached in 2019’s second quarter. The rate for Hispanic Americans was 48.1%, a two-year high, the Census data showed…The rate for white Americans was 73.7%, an eight-year high.”

Bottom Line

If you’re considering buying a home this year, let’s get together to set a plan that will help you get one step closer to achieving your dream.

Where Homebuyers Are Heading By Generation [INFOGRAPHIC]

![Where Homebuyers Are Heading By Generation [INFOGRAPHIC] | MyKCM](https://desireestanley.com/files/2020/01/20200117-MEM-1-1046x2841.jpg)

![Where Homebuyers Are Heading By Generation [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/01/17060847/20200117-MEM-1-1046x2841.jpg)

Some Highlights:

- Whether capitalizing on job opportunities, affordability, or warm-weather places to retire, Americans are making moves to these top cities to take advantage of the strength in the current housing market.

- A strong economy and lower mortgage rates have made it easier for many would-be buyers to get into the market. According to realtor.com, it just depends on which market.

- To find the top market in our area, let’s get together.

The 2 Surprising Things Homebuyers Really Want

In a market where current inventory is low, it’s normal to think buyers might be willing to give up a few desirable features in their home search in order to make finding a house a little easier. Don’t be fooled, though – there’s still an interest in the market for some key upgrades. Here’s a look at the two surprising things buyers seem to be searching for in today’s market, and how they’re impacting new home builds.

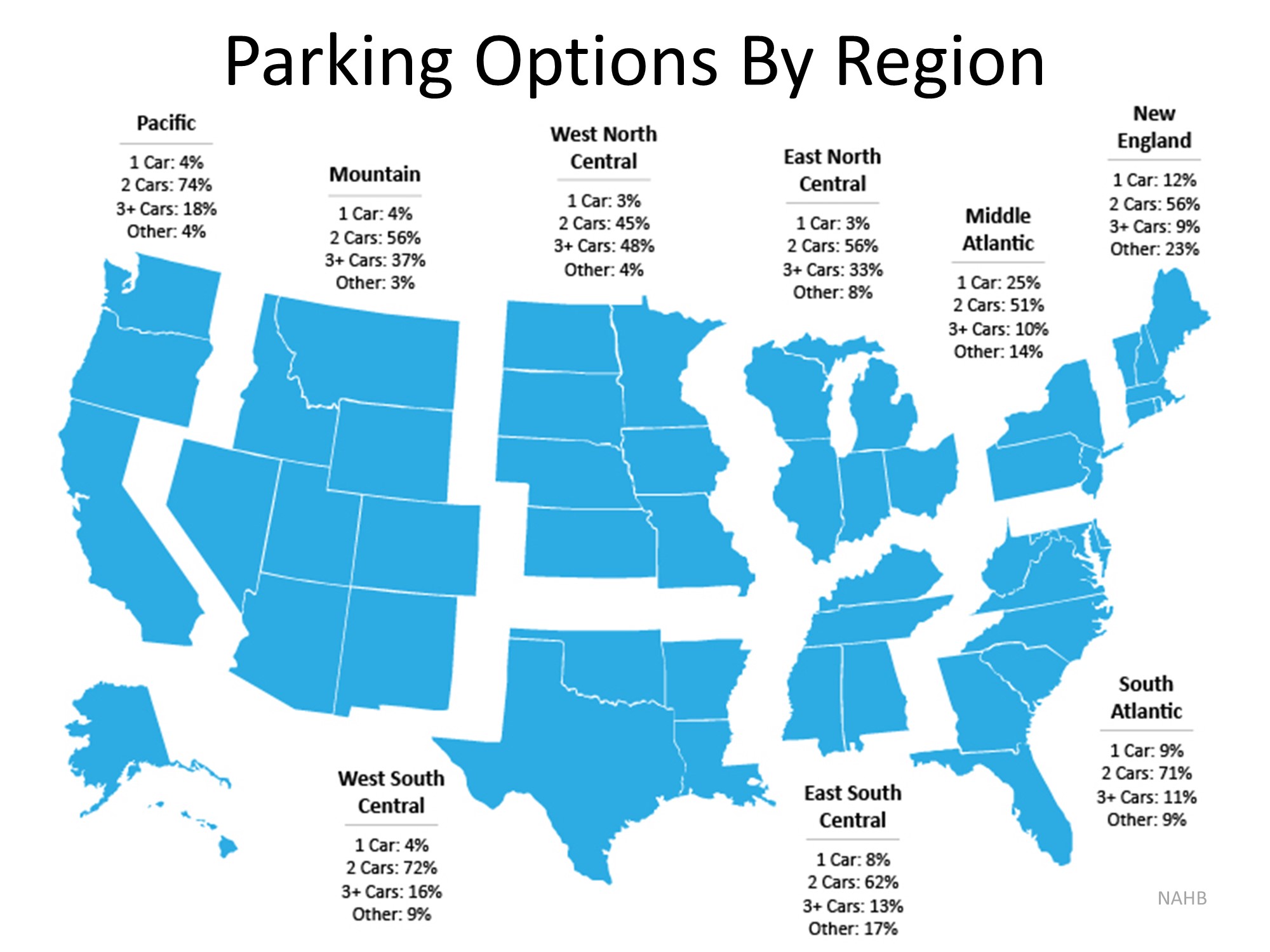

Homebuyers Are Not Giving Up Their Garages

The National Association of Home Builders (NAHB) recently released an article showing the percentage of new single-family homes completed in 2018. The data reveals,

- 64% of new homes offer a 2-car garage

- 21% have a garage large enough to hold 3 or more cars

- 7% have a 1-car garage

- 7% do not include a garage or carport

- 1% have a carport

The following map represents this breakdown by region: Evidently, a garage is something homebuyers are looking for in their searches, but that’s not all.

Evidently, a garage is something homebuyers are looking for in their searches, but that’s not all.

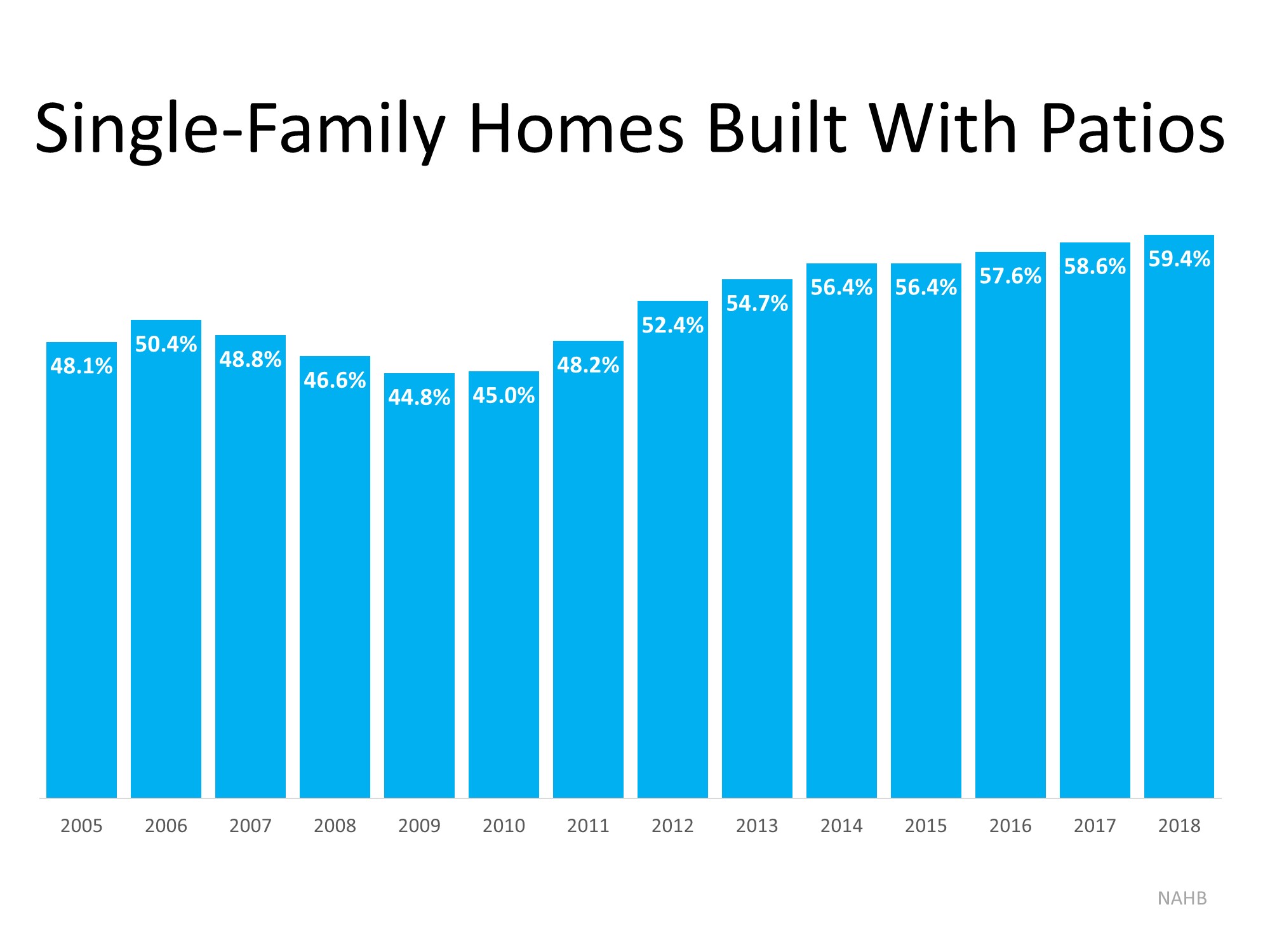

Homebuyers Are Not Giving Up Their Patios

Patios are on the radar for buyers as well. Community areas are often common amenities in new neighborhoods, but as it turns out, private outdoor spaces are quite desirable too. NAHB also found that,

“Of the roughly 876,000 single-family homes started in 2018, 59.4% came with patios…This is the highest the number has been since NAHB began tracking the series in 2005.”

As shown in the graph below, the number of new homes built with patios has been increasing for the past 9 years. Clearly, they’re a desirable feature for new homeowners too.

Bottom Line

Homebuyers are looking for garage space and outdoor patio living. If you’re a homeowner thinking of selling a house with these amenities, it appears buyers are willing to spring for those key features. Let’s get together today to determine the current value and demand for your home.

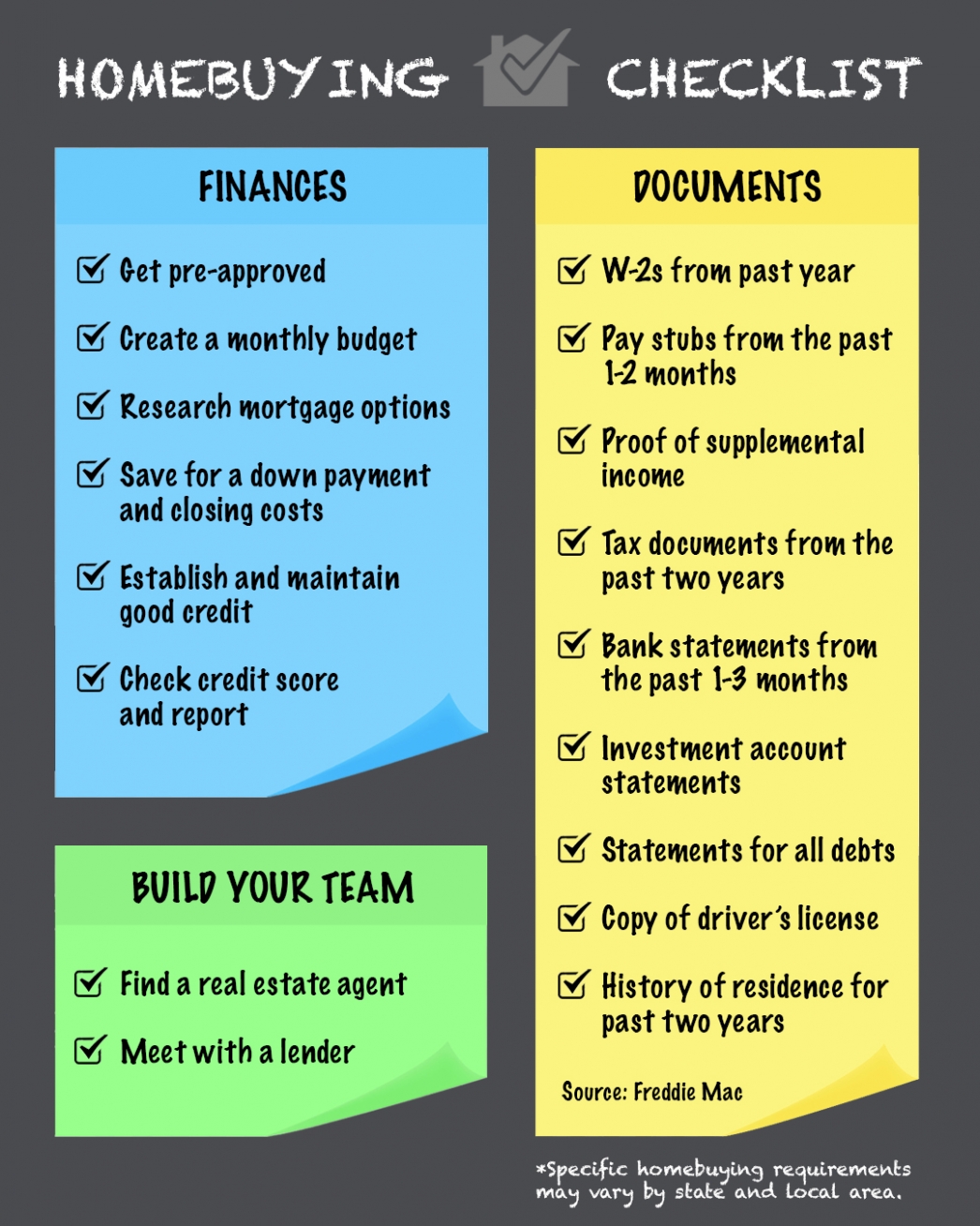

2020 Home buying Checklist

Some Highlights:

- If you’re thinking of buying a home, plan ahead and stay on the right track, starting with pre-approval.

- Being proactive about the home buying process will help set you up for success in each step.

- Make sure to work with a trusted real estate professional along the way, to help guide you through the homebuying steps specific to your area.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link