Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

Home buyer Traffic Is on the Rise

One of the biggest surprises of 2020 is the resilience of the residential real estate market. Lawrence Yun, Chief Economist of the National Association of Realtors (NAR), is now forecasting that more homes will sell this year than last year. He’s also predicting home sales to increase by 8-12% next year. There’s strong evidence that he will be right.

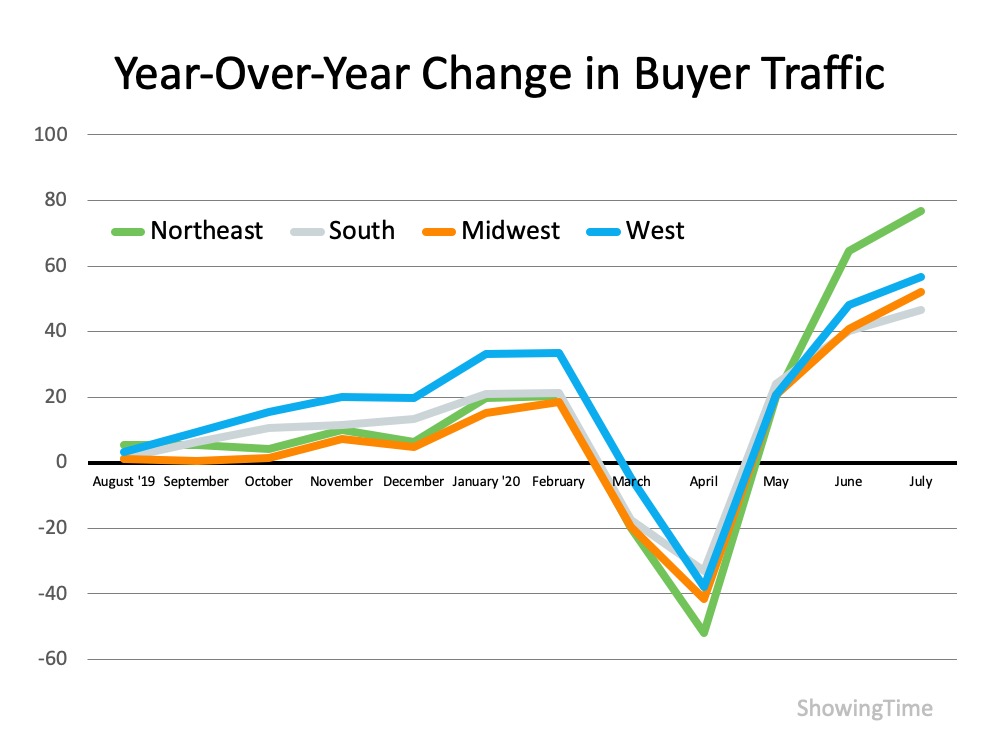

ShowingTime, a leading showing software and market stat service provider for the residential real estate industry, just reported on their latest the ShowingTime Showing Index:

“Home buyer traffic jumped again in July, recording a 60.7 percent year-over-year increase in nationwide showing activity.”

That means there are 60% more buyers setting appointments to see homes than there were at this same time last year. The number of potential purchasers was also up dramatically in every region of the country:

- The Northeast was up 76.6%

- The West was up 56.7%

- The Midwest was up 52.1%

- The South was up 46.7%

The Housing Market Is Showing a ‘V’ Type Recovery

ShowingTime also indicates the real estate market has already come back from the downturn earlier this year that was caused by shelter-in-place orders. Here are the year-over-year numbers for each region on a monthly basis (See graph below): We’re way ahead of where we were at this time last year. This data validates the thoughts of Frank Martell, President and CEO of CoreLogic, who recently noted:

We’re way ahead of where we were at this time last year. This data validates the thoughts of Frank Martell, President and CEO of CoreLogic, who recently noted:

“On an aggregated level, the housing economy remains rock solid despite the shock and awe of the pandemic.”

Bottom Line

If you’re thinking about selling your house, this may be a great time to get the best price and the most favorable terms.

Have You Ever Seen a Housing Market Like This?

The year 2020 will certainly be one to remember, with new realities and norms that changed the way we live. This year’s real estate market is certainly no exception to that shift, with historic highlights continuing to break records and challenge what many thought possible in the housing market. Here’s a look at four key areas that are fundamentally defining the market this year.

Housing Market Recovery

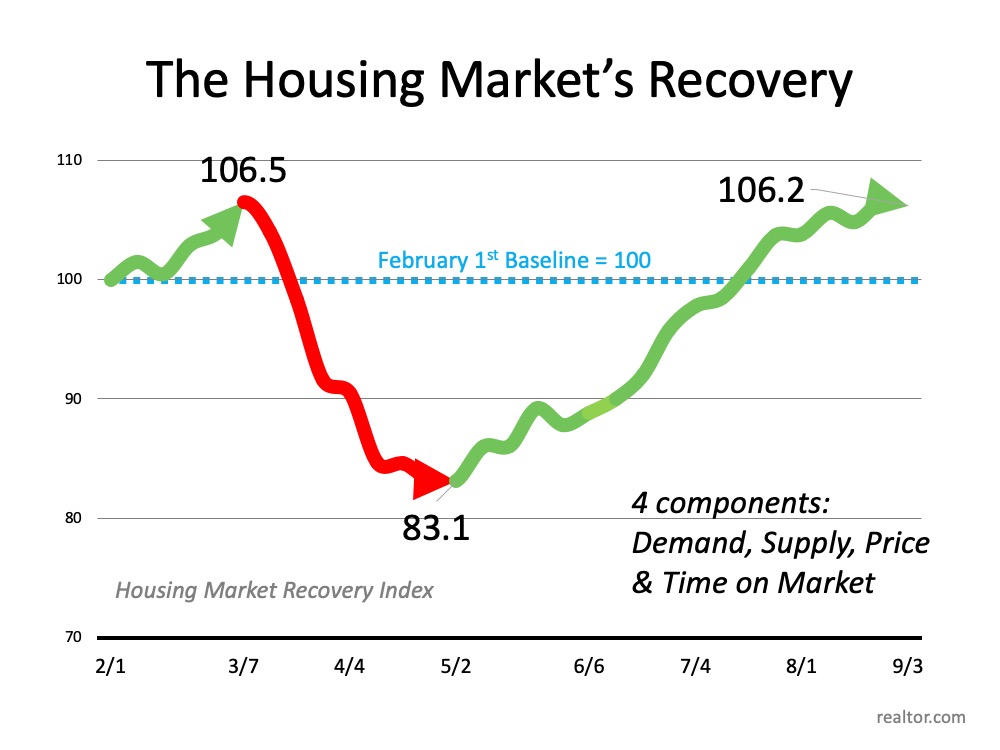

The economy was intentionally put on pause this spring in response to the COVID-19 health crisis. Many aspects of the common real estate transaction were placed on hold at the same time. Thankfully, technology and innovation helped the industry power forward, and business gradually ramped back up as shelter-in-place orders were lifted.

The result? Total transformation of the market from rock-bottom lows to exceptional highs. Today, the housing recovery is being called truly remarkable by many experts and is far exceeding expectations. From pending home sales to purchase applications, buyers are back in business and homes are selling – fast.

According to the Housing Market Recovery Index by realtor.com, the market has surpassed pre-pandemic levels, and has regained the strength we remember from February of this year (See graph below):

Record-Breaking Mortgage Rates

Historically low mortgage rates are another 2020 game-changer. Today’s low rate is one of the big motivating factors bringing buyers back into the market. The average rate reached an all-time low on multiple occasions this year, and it continues to hover in the record-low territory.

When rates are this low, buyers have a huge opportunity to get more for their money when purchasing a home, something many are eager to find while continuing to spend more time than expected at home this year, and likely beyond.

Continued Home Price Appreciation

One of the key drivers of home price appreciation this year is historically low inventory. Inventory was low going into the pandemic, and it is still sitting well below the level needed for a normal market. Although sellers are slowly making their way back into the game, buyers are scooping up homes faster than they’re coming up for sale.

This is a classic supply and demand scenario, forcing home prices to rise. Selling something when there is a higher demand for what is available naturally bumps up the price. If you’re ready to sell your house today, this may be the optimal time to make your move. As Bill Banfield, EVP of Capital Markets at Quicken Loans, notes:

“The pandemic has not stopped the consistent home price growth we have witnessed in recent years.”

Increasing Affordability

Even as home prices continue to rise, affordability is working in favor of today’s homebuyers. According to many experts, rates this low are off-setting rising home prices, which increases buyer purchasing power – an opportunity not to be missed, especially if your family’s needs have changed. If you now need space for a home office, gym, virtual classroom, and more, it may be time to reconsider your current house.

According to Mortgage News Daily:

“Those shopping for a home can afford 10 percent more home than they could have one year ago while keeping their monthly payment unchanged. This translates into nearly $32,000 more buying power.”

Bottom Line

With mortgage rates hitting historic lows, home prices appreciating, affordability rising, and the market recovering like no other, 2020 has been quite a year for real estate – perhaps one we’ve never seen before and may never see again. Let’s connect today if you’re ready to take advantage of this year’s record-breaking opportunities.

The 2020 Home buyer Wish List [INFOGRAPHIC]

![The 2020 Homebuyer Wish List [INFOGRAPHIC] | MyKCM](https://desireestanley.com/files/2020/09/20200904-MEM-1046x1536.jpg)

![The 2020 Homebuyer Wish List [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/09/03121217/20200904-MEM-1046x1536.jpg)

Some Highlights

- The word “home” is taking on a whole new meaning this year, and buyers are starting to look for new features as they re-think their needs and what’s truly possible.

- From more outdoor space to virtual classrooms for their children, buyers have a growing list of what they’d like to see in their homes.

- Let’s connect today if your needs have changed and your wish list is expanding too.

It’s Not Just About the Price of the Home

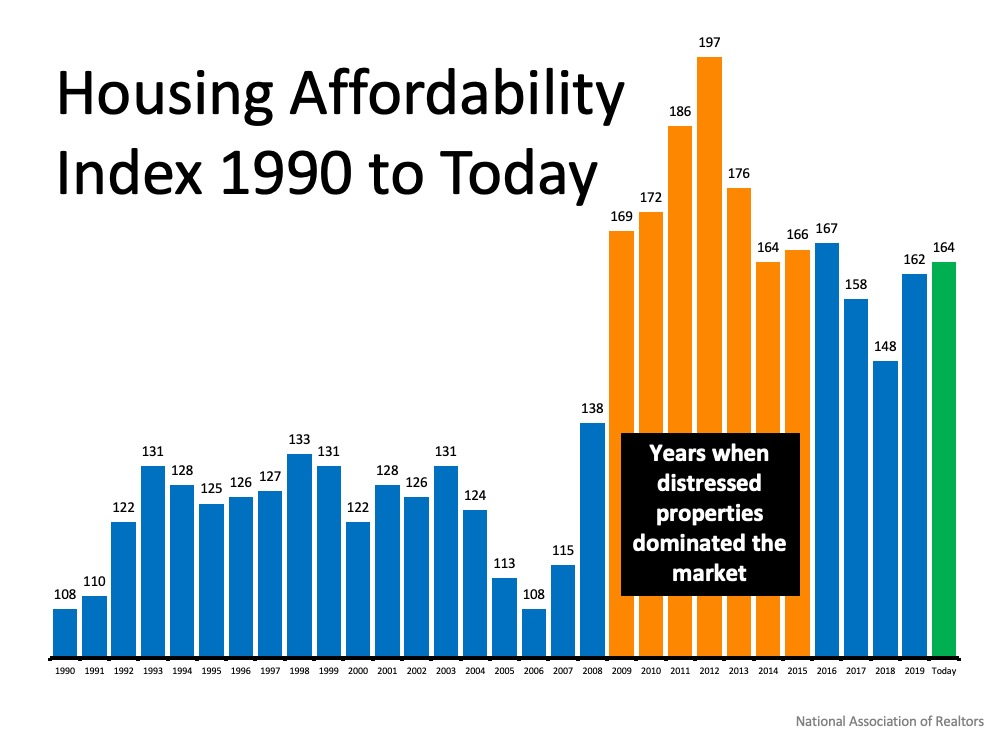

When most of us begin searching for a home, we naturally start by looking at the price. It’s important, however, to closely consider what else impacts the purchase. It’s not just the price of the house that matters, but the overall cost in the long run. Today, that’s largely impacted by low mortgage rates. Low rates are actually making homes more affordable now than at any time since 2016, and here’s why.

Today’s low rates are off-setting rising home prices because it’s less expensive to borrow money. In essence, purchasing a home while mortgage rates are this low may save you significantly over the life of your home loan.

Taking a look at the graph below with data sourced from the National Association of Realtors (NAR), the higher the bars rise, the more affordable homes are. The orange bars represent the period of time when homes were most affordable, but that’s also reflective of when the housing bubble burst. At that time, distressed properties, like foreclosures and short sales, dominated the market. That’s a drastically different environment than what we have in the housing market now.

The green bar represents today’s market. It shows that homes truly are more affordable than they have been in years, and much more so than they were in the normal market that led up to the housing crash. Low mortgage rates are a big differentiator driving this affordability.

What are the experts saying about affordability?

Experts agree that this unique moment in time is making homes incredibly affordable for buyers.

Lawrence Yun, Chief Economist, NAR:

“Although housing prices have consistently moved higher, when the favorable mortgage rates are factored in, an overall home purchase was more affordable in 2020’s second quarter compared to one year ago.”

Bill Banfield, EVP of Capital Markets, Quicken Loans:

“No matter what you’re looking for, this is a great time to buy since the current low interest rates can stretch your spending power.”

“Those shopping for a home can afford 10 percent more home than they could have one year ago while keeping their monthly payment unchanged. This translates into nearly $32,000 more buying power.”

“Homeowners are the clear winners. Low mortgage rates mean the cost of owning is at historically low levels and who gains all the benefits of strong house price appreciation? Homeowners.”

Bottom Line

When purchasing a home, it’s important to think about the overall cost, not just the price of the house. Homes on your wish list may be more affordable today than you think. Let’s connect to discuss how affordability plays a role in our local market, and your long-term homeownership goals.

Three Ways to Win in a Bidding War

With so few houses for sale today and low mortgage rates driving buyer activity, bidding wars are becoming more common. Multiple-offer scenarios are heating up, so it’s important to get pre-approved before you start your search. This way, you can put your best foot forward – quickly and efficiently – if you’re planning to buy a home this season.

Javier Vivas, Director of Economic Research at realtor.com, explains:

“COVID-19 has accelerated earlier trends, bringing even more buyers than the market can handle. In many markets, fierce competition, bidding wars, and multiple offer scenarios may be the common theme in the weeks to come.”

Here are three things you can do to make your offer a competitive one when you’re ready to make your move.

1. Be Ready

A recent survey shows that only 52% of active homebuyers obtained a pre-approval letter before they began their home search. That means about half of active buyers missed out on this key part of the process.

Buyers who are pre-approved are definitely a step ahead when it’s time to make an offer. Having a pre-approval letter indicating you’re a qualified buyer shows sellers you’re serious. It’s often a deciding factor that can tip the scale in your direction if there’s more than one offer on a home. It’s best to contact a mortgage professional to start your pre-approval process early, so you’re in the best position right from the start of your home search.

2. Present Your Best Offer

In a highly competitive market, it’s common for sellers to pick a date and time to review all offers on a house at one time. If this is the case, you may not have an opportunity to negotiate back and forth with the sellers. As a matter of fact, the National Association of Realtors (NAR) notes:

“Not only are properties selling quickly, but they are also getting more offers. On average, REALTORS® reported nearly three offers per sold property in July 2020.”

Make sure the offer you’re presenting is the best one the sellers receive. A real estate professional can help you make sure your offer is a fair and highly competitive one.

3. Act Fast

With existing homes going like hotcakes, there’s no time to waste in the process. NAR reports how the speed of home sales is ramping up:

“Properties typically remained on the market for 22 days in July, seasonally down from 24 days in June and from 29 days in July 2019. Sixty-eight percent of homes sold in July 2020 were on the market for less than a month.”

In addition, NAR notes:

“Total existing-home sales…jumped 24.7% from June to a seasonally adjusted annual rate of 5.86 million in July. The previous record monthly increase in sales was 20.7% in June of this year. Sales as a whole rose year-over-year, up 8.7% from a year ago (5.39 million in July 2019).”

As you can see, the market is gaining steam. For two consecutive months houses have sold very quickly. Essentially, you may not have time to sleep on it or shop around when you find a home you love. Chances are, someone else loves it too. If you take your time, it may not be available when you’re ready to commit.

Bottom Line

The housing market is very strong right now, and buyers are scooping up available homes faster than they’re coming to market. If you’re planning to purchase a home this year, let’s connect to discuss the trends in our current area, so you’re ready to compete – and win.

Why Is It so Important to Be Pre-Approved in the Home buying Process?

You may have heard that pre-approval is a great first step in the homebuying process. But why is it so important? When looking for a home, the temptation to fall in love with a house that’s outside your budget is very real. So, before you start shopping around, it’s helpful to know your price range, what you’re comfortable within a monthly mortgage payment, and ultimately how much money you can borrow for your loan. Pre-approval from a lender is the only way to do this.

According to a recent survey from realtor.com, many buyers are making the mistake of skipping the pre-approval step in the homebuying process:

“Of over 2,000 active home shoppers who plan to purchase a home in the next 12 months, only 52% obtained a pre-approval letter before beginning their home search, which means nearly half of home buyers are missing this crucial piece of paperwork.”

This paperwork (the pre-approval letter) shows sellers you’re a qualified buyer, something that can really help you stand out from the crowd in the current ultra-competitive market.

How competitive is today’s market? Extremely – especially among buyers.

With limited inventory, there are many more buyers than sellers right now, and that’s fueling the competition. According to the National Association of Realtors (NAR), homes are receiving an average of 2.9 offers for sellers to negotiate, so bidding wars are heating up.

Pre-approval shows homeowners you’re a serious buyer. It helps you stand out from the crowd if you get into a multiple-offer scenario, and these days, it’s likely. When a seller knows you’re qualified to buy the home, you’re in a better position to potentially win the bidding war and land the home of your dreams.

Danielle Hale, Chief Economist for realtor.com notes:

“For ‘a buyer in a competitive market, it’s typically essential to have pre-approval done in order to submit an offer, so getting it done before you even look at homes is a smart move that will enable a buyer to move fast to put an offer in on the right home.’”

In addition, today’s housing market is also changing from moment to moment. Interest rates are low, prices are going up, and lending institutions are regularly updating their standards. You’re going to need guidance to navigate these waters, so it’s important to have a team of professionals (a loan officer and a real estate agent) making sure you take the right steps along the way and can show your qualifications as a buyer at the time you find a home to purchase.

Bottom Line

In a competitive market with low inventory, a pre-approval letter is a game-changing piece of the homebuying process. If you’re ready to buy this year, let’s connect before you start searching for a home.

Should You Buy an Existing Home or New Construction?

Finding the right home to purchase today is one of the biggest challenges for potential buyers. With so few homes for sale and construction of newly built homes ramping up, you may be wondering if you should consider new construction in your search process. It’s a great question to ask, and one to look at from the pros and cons of what it means to buy a new home versus an existing one. Here are a few things to consider when making the best decision for your family.

New Construction

When buying a new home, you can often choose more energy-efficient options. New appliances, new windows, a new roof, etc. These can all help lower your energy costs, which can add up to significant savings over time. With programs like ENERGY STAR, your home also helps protect the environment and reduces your carbon footprint.

Lower maintenance that comes with a newer home is another great benefit. When you have a new home, you likely won’t have as many little repairs to tackle, like leaky faucets, shutters to paint, and other odd jobs around the house. With new construction, you’ll also have warranty options that may cover portions of your investment for the first few years.

Another solid benefit to new construction is customization. Do you want a mudroom, stainless steel appliances, granite countertops, hardwood floors, an office, or a multipurpose room to homeschool your children? These items can be customized to your specific needs during the design phase. With an existing home, you’re buying something that’s already completed, so if you want to make changes, you may need to hire a contractor to help get your home ready for your family.

Existing Home

When buying an existing home, you can negotiate with the current homeowner on price, which is something you generally don’t get to do with a builder. Builders know their material and construction costs, and they have a price set for the model you’re buying. So, if you want to negotiate, then maybe an existing home will be best.

For many families, having an established neighborhood is also important. Some buyers like to know the neighbors, if it’s family-friendly, and traffic patterns before making a commitment. When you buy new construction, you won’t have a full view of some of those details until the lots around you are sold.

Finally, timing comes into play. With an existing home, you can move in based on the timeline you agree to with the sellers. With new construction, you need to wait for the house to be built. Depending on the time of the year you’re buying and the region you’re in, the weather can also be a factor in the timeframe. This is something really important to keep in mind, especially if you need to move sooner rather than later. Over the past few months with COVID-19 and social distancing regulations, some areas for new construction have been delayed.

Bottom Line

Whether you want to buy a newly built home or one that’s already established, both are great options. They each have their pros and cons, and every family will have different circumstances driving their decision. If you have questions and want to know more about the options in our area, let’s connect today so you can feel confident making a decision about your next home.

Builders & Realtors Agree: Real Estate Is Back

When shelter-in-place orders brought the economy to a screeching halt earlier this year, many believed the residential housing market would follow suit. Countless analysts predicted buyer demand would disappear and home values would depreciate for the first time in almost a decade. That, however, didn’t happen. It appears the opposite is taking place.

After the bottom fell out of the real estate market immediately following the shutdown, it has come roaring back – and seems to still be gaining steam. Here’s a look at two recent reports – one from the National Association of Home Builders (NAHB) and one from the National Association of Realtors (NAR) – showing this growing strength.

Builder Confidence Hits All-Time High

Last week, it was reported that applications for new home purchases with home builders were 39% higher than in July of 2019. That has builder confidence soaring.

Each month, NAHB releases its Housing Market Index, a survey of NAHB members who rate market conditions for the sale of new homes at the present time and over the next six months, as well as prospective buyer traffic for new homes.

This month, they reported that builder confidence in the market for newly-built single-family homes increased to the highest reading in the 35-year history of the series. NAHB Chairman, Chuck Fowke, explained:

“The demand for new single-family homes continues to be strong, as low interest rates and a focus on the importance of housing has stoked buyer traffic to all-time highs…Housing has clearly been a bright spot during the pandemic and the sharp rebound in builder confidence over the summer has led NAHB to upgrade its forecast for single-family starts, which are now projected to show only a slight decline for 2020.”

The number of newly constructed homes being built will be almost at the same level as last year, even though the economic shutdown crushed home building earlier in the year.

Existing Homes Are Also Selling Like Hotcakes

Last Friday, NAR released its Existing Home Sales Report. The report revealed that month-over-month sales increased by 24.7%, setting another record for the category. The Wall Street Journal reported that the increase crushed expert forecasts:

“Economists surveyed by The Wall Street Journal expected a 14.2% monthly increase in sales of previously-owned homes, which make up most of the housing market.”

Home sales increased by 8.7% year-over-year.

Lawrence Yun, Chief Economist for NAR, explained how the resale market is just as hot as the new construction market:

“The housing market is well past the recovery phase and is now booming with higher home sales compared to the pre-pandemic days. With the sizable shift in remote work, current homeowners are looking for larger homes and this will lead to a secondary level of demand even into 2021.”

In addition, the Housing Market Recovery Index, which is released monthly by realtor.com, also showed the market is recovering nicely. The latest index reading was 104.8, which means the housing market is doing better than it was in January and February of this year. As a reference, the highest point in the index was a 106.5 in early March, just prior to the health crisis setting in.

Bottom Line

Both the newly constructed and existing home sale markets are posting numbers greater than a year ago. Real estate is back. If you’re thinking of buying or selling, let’s connect so you have the expert counsel you need along the way.

Ask a Pro About Buying a Home [INFOGRAPHIC]

![Ask a Pro About Buying a Home [INFOGRAPHIC] | MykCM](https://desireestanley.com/files/2020/08/20200821-MEM-1046x1226.jpg)

![Ask a Pro About Buying a Home [INFOGRAPHIC] | MykCM](https://files.mykcm.com/2020/08/20101011/20200821-MEM-1046x1226.jpg)

Some Highlights

- According to trending data, searches for key real estate topics are skyrocketing online.

- Clearly, lots of people have questions about buying a home, and other topics related to the process.

- Working with a trusted real estate professional will help you create the most personalized and helpful experience. Let’s connect so you have the guidance you need along the way.

Just How Strong Is the Housing Recovery?

The residential real estate market has definitely been the shining light in this country’s current economic situation. All-time low mortgage rates coupled with a new appreciation of what a home truly means has caused the housing market to push forward through this major health crisis. Let’s look at two measures that explain the resilience of the real estate market.

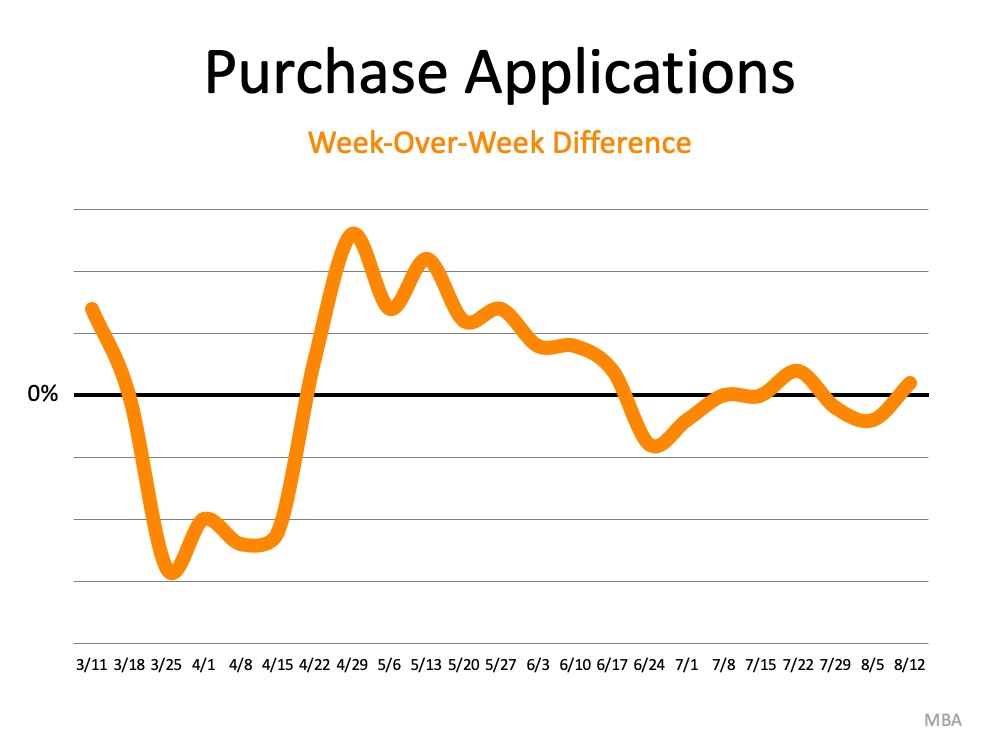

Purchase Mortgages

The number of buyers getting a mortgage to purchase a home is a strong indicator of the strength of a housing market. Below is a graph of the week-over-week percent change in that number, as reported by the Mortgage Bankers’ Association: The number dropped dramatically in March and mid-April when the economy was shut down in response to COVID. It increased substantially from later in April through the middle of June. The strong increase in May and June was the result of the pent-up demand from earlier in the spring along with the normal business that would have been done during that time.

The number dropped dramatically in March and mid-April when the economy was shut down in response to COVID. It increased substantially from later in April through the middle of June. The strong increase in May and June was the result of the pent-up demand from earlier in the spring along with the normal business that would have been done during that time.

Since July, the market has remained consistent on a weekly basis, but still reflects a double-digit increase from the levels one year ago. The August 12 report shows a whopping 22% increase over last year.

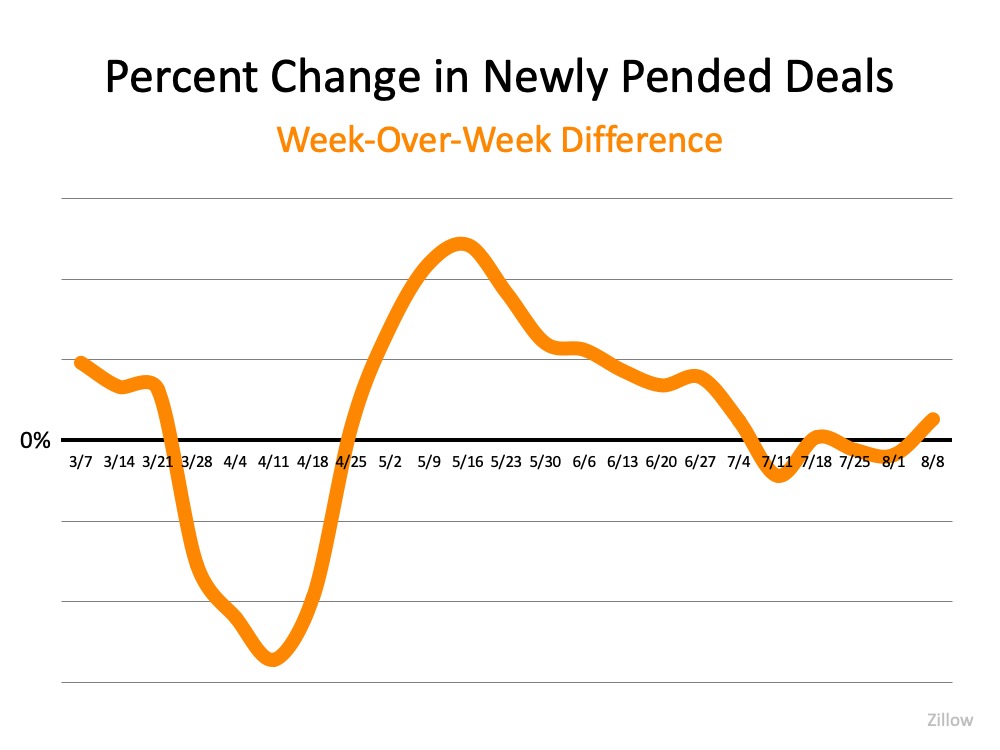

Pending Contracts

Like purchase mortgages, pending contracts are also a powerful indicator of the strength of the real estate market. Zillow reports each week on the percent change in the number of homes going into contract. Here’s a graph of their data: The graph mirrors the one above, showing a drop in early spring followed by a strong recovery in late spring and early summer. Then, in July, it settles into a consistent level of deals. That level, like the one for purchase mortgages, is well ahead of the level seen last year. The last report revealed that pending deals were 16.9% greater than the same time last year.

The graph mirrors the one above, showing a drop in early spring followed by a strong recovery in late spring and early summer. Then, in July, it settles into a consistent level of deals. That level, like the one for purchase mortgages, is well ahead of the level seen last year. The last report revealed that pending deals were 16.9% greater than the same time last year.

Bottom Line

Both indicators prove the housing market recovered quickly from the early setback caused by the shelter-in-home orders. They also show that Americans have realized the importance of their homes during this time and are buying more houses than they did prior to the pandemic.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link