3 Things to Know in the Housing Market Today!

A lot is happening in the world, and it’s having a direct impact on the housing market. The reality is this: some of it is positive and some of it may be negative. Some we just don’t know yet.

The following three areas of the housing market are critical to understand: interest rates, building materials, and the outlook for an economic slowdown.

1. Interest Rates

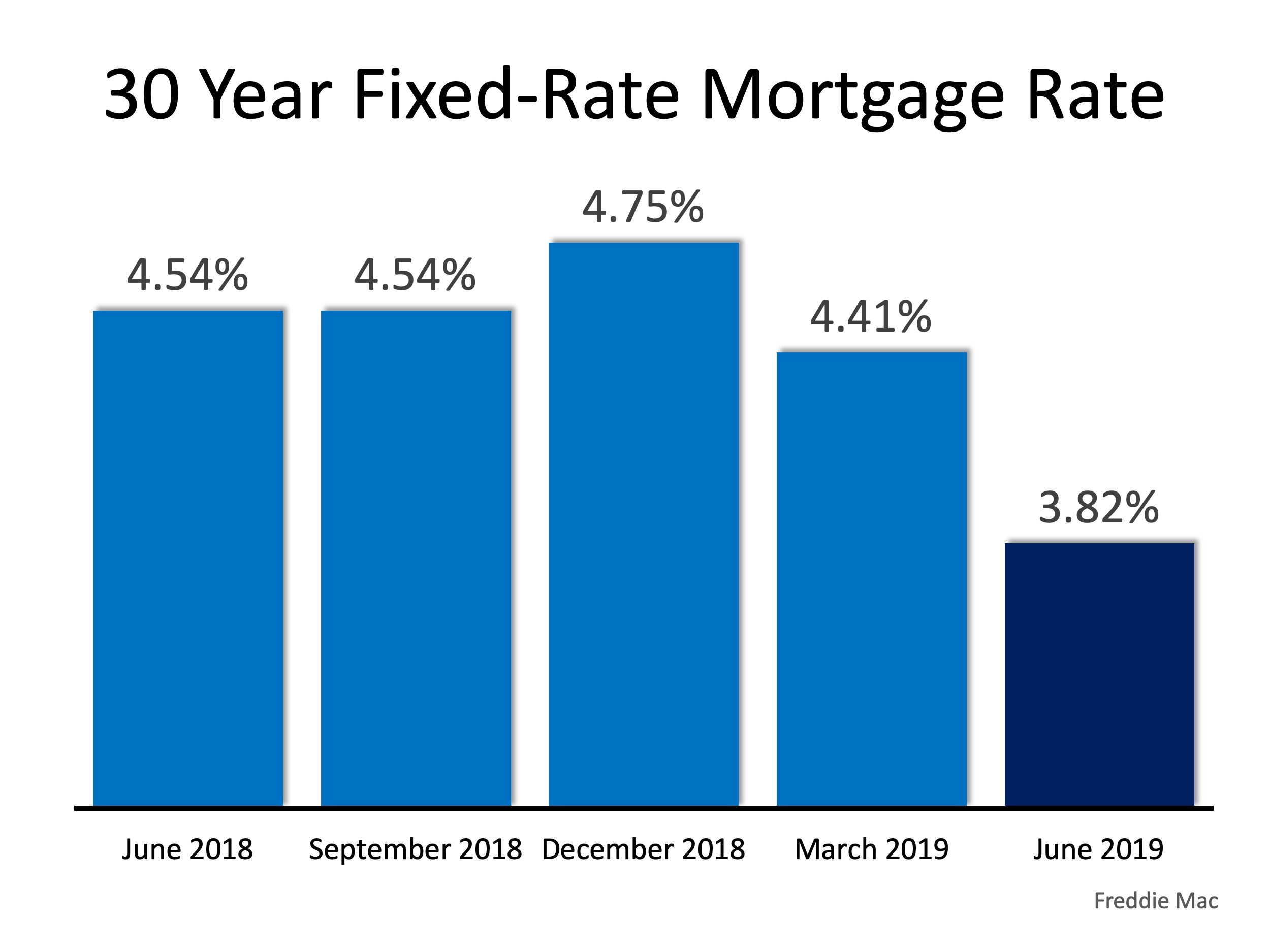

One of the most important things to consider when buying a home is the interest rate you will be charged to borrow the money. In our recent post we posed the question, “Are Low Interest Rates Here To Stay?” The latest information from Freddie Mac makes it appear they are. We are currently at a 21-month low in interest rates.

2. Building Materials

Talk of tariffs could also affect the housing market. According to a recent article, the National Association of Home Builders reports that as much as $10 billion in goods imported from China are used in homebuilding. Depending on the outcome of the tariff and trade discussions between several countries, there could be as much as a 25% boost in the cost of building materials.

3. Economic Slowdown

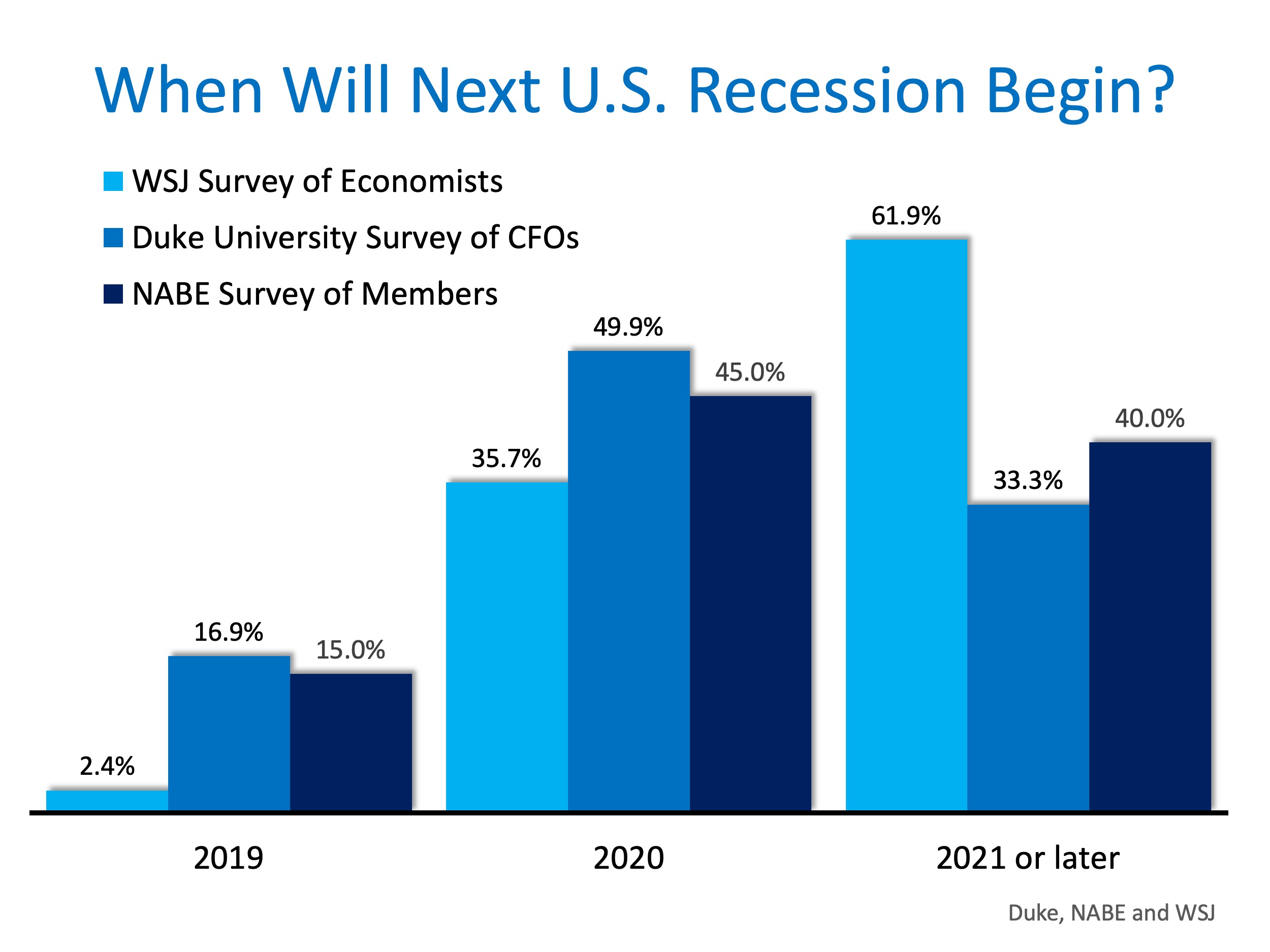

In a prior blog post on this topic, we began the year with many economic leaders thinking we could expect a recession in late 2019 or early 2020. As spring approached, we reported that economists had started to push that projection past 2020. Now, three leading surveys indicate that it may begin in the next eighteen months.

Bottom Line

We are in a strong housing market. Wages are increasing, home prices are appreciating, and mortgage rates are the lowest they have been in 21 months. Whether you are thinking of buying or selling, it’s a great time to be in the market.

Boomerang Buyers: Don’t Be Afraid to Buy a Home Again!

According to CoreLogic, from 2006 to 2014 “there were 7.3 million housing foreclosures and 1.9 million short sales.” The hesitation some Americans feel after experiencing a foreclosure brings to mind the old saying: “Fool me once- shame on you. Fool me twice- shame on me.”

According to the 2019 Home Buyer Report from NerdWallet,

“Thirteen percent of Americans have lost a home due to a financial event such as foreclosure in the past 10 years. More than 6 in 10 of them (61%) have not bought a home since, and 20% of those who haven’t repurchased say they never plan to again.”

This makes sense. They don’t want to go through the same pain again. As a cornerstone of the American dream, nobody wants to lose home ownership. But let’s illustrate this simply: Recall learning to ride your first bike during your childhood. Did you stop riding it because you fell on the ground and scraped your knees? Or did you get back on and try again until you were able to ride without falling?

Purchasing a home is not as simple as learning to ride a bike, but the concept is the same! There are many things necessary to learn that affect the ability to get the financing needed to purchase a home. Past occurrences can determine if there is a waiting period. In other words, you need to let your knees heal before you try again!

As we’ve mentioned in the past, home ownership has many financial and non-financial benefits. Each person needs to go over the pros and cons, taking the time to figure out what is best for their family. Should they continue renting, or should they try to buy again?

The good news is that some “boomerang buyers” are getting back into the market. They’re getting back on their bike!

“Of 2.8 million former homeowners whose foreclosures, short sales or bankruptcies dropped off their credit reports from January 2016 to November 2018, 11.5% have obtained a new mortgage, according to a study by credit rating agency Experian for USA Today.”

NerdWallet’s report also mentioned:

- 6% plan to buy a house this year.

- 39% intend to buy over the next 3 years.

- 58% say they will purchase within 5 years.

Bottom Line

If you lost a home due to a financial event but would like to review your options, let’s get together to help you create a plan to obtain a home in the future!

New survey shows mortgage rates declining

Wondering about the mortgage rates? Heard that they’re going up? Worried about buying right now because rates are high? You might be surprised then to hear that the mortgage rates are actually declining according to this recent survey by Freddie Mac.

News Facts

- 30-year fixed-rate mortgage (FRM) averaged 4.14 percent with an average 0.5 point for the week ending May 2, 2019, down from last week when it averaged 4.20 percent. A year ago at this time, the 30-year FRM averaged 4.55 percent.

- 15-year FRM this week averaged 3.60 percent with an average 0.4 point, down from last week when it averaged 3.64 percent. A year ago at this time, the 15-year FRM averaged 4.03 percent.

- 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.68 percent with an average 0.4 point, down from last week when it averaged 3.77 percent. A year ago at this time, the 5-year ARM averaged 3.69 percent.

Call me @ 408-465-9290 if you’ve got questions about how you can get into the home of your dreams.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link