Home Sales Hit a Record-Setting Rebound

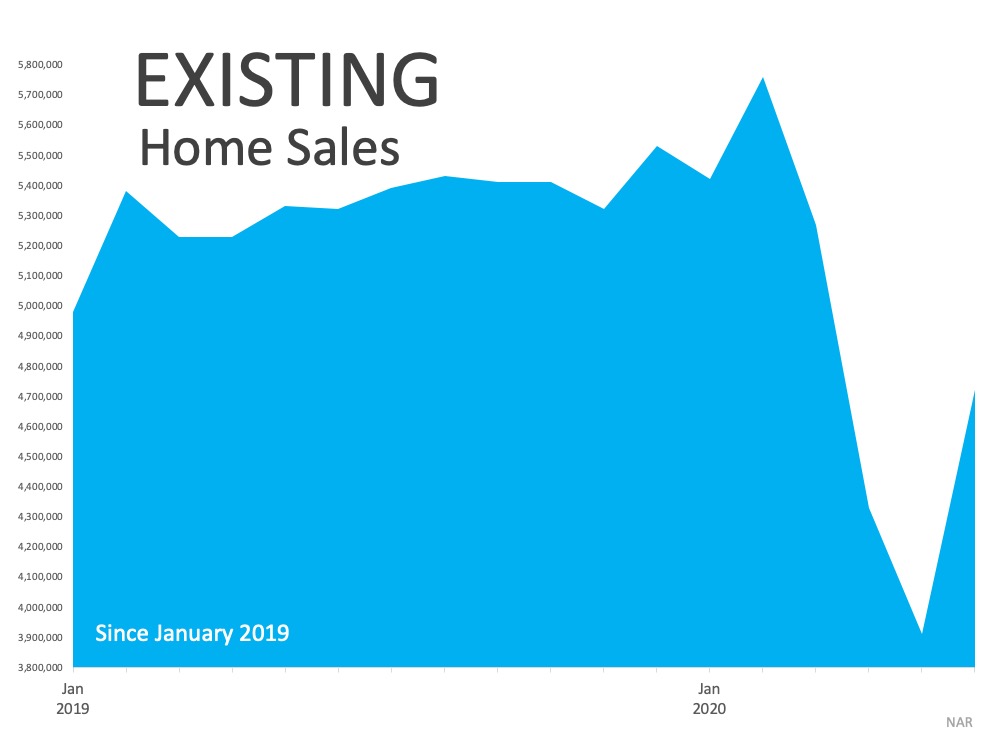

With a worldwide health crisis that drove a pause in the economy this year, the housing market was greatly impacted. Many have been eagerly awaiting some bright signs of a recovery. Based on the latest Existing Home Sales Report from the National Association of Realtors (NAR), June hit a much-anticipated record-setting rebound to ignite that spark.

According to NAR, home sales jumped 20.7% from May to a seasonally-adjusted annual rate of 4.72 million in June:

“Existing-home sales rebounded at a record pace in June, showing strong signs of a market turnaround after three straight months of sales declines caused by the ongoing pandemic…Each of the four major regions achieved month-over-month growth.”

This significant rebound is a major boost for the housing market and the U.S. economy. According to Lawrence Yun, Chief Economist for NAR, the momentum has the potential to continue on, too:

This significant rebound is a major boost for the housing market and the U.S. economy. According to Lawrence Yun, Chief Economist for NAR, the momentum has the potential to continue on, too:

“The sales recovery is strong, as buyers were eager to purchase homes and properties that they had been eyeing during the shutdown…This revitalization looks to be sustainable for many months ahead as long as mortgage rates remain low and job gains continue.”

With mortgage rates hitting an all-time low, dropping below 3% for the first time last week, potential homebuyers are poised to continue taking advantage of this historic opportunity to buy. This fierce competition among buyers is contributing to home price increases as well, as more buyers are finding themselves in bidding wars in this environment. The report also notes:

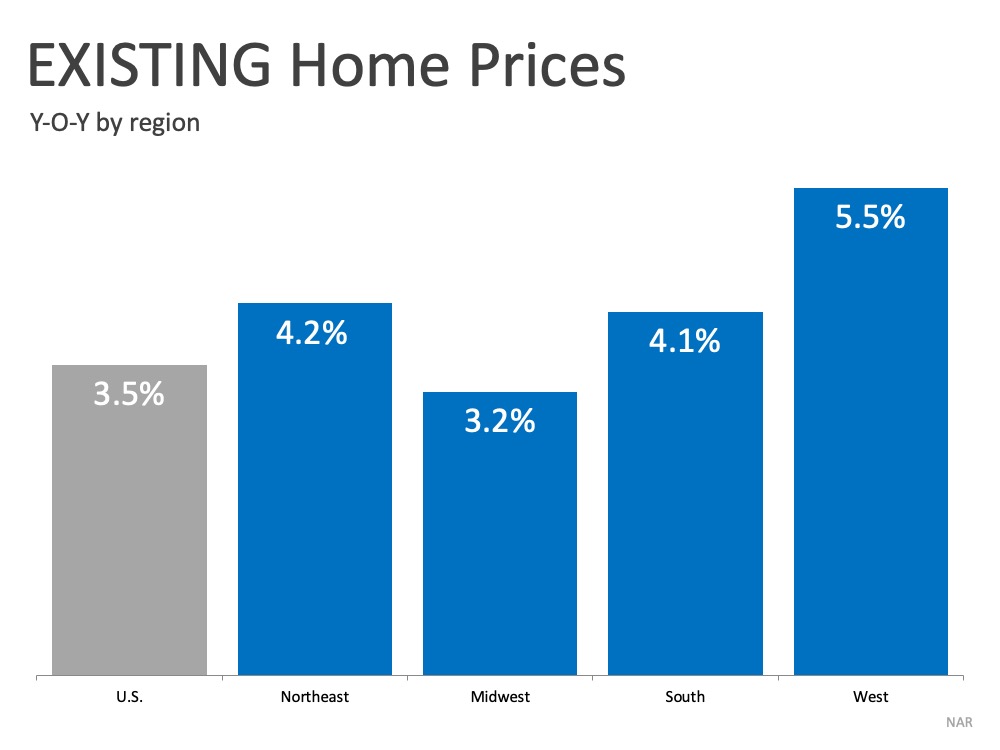

“The median existing-home price for all housing types in June was $295,300, up 3.5% from June 2019 ($285,400), as prices rose in every region. June’s national price increase marks 100 straight months of year-over-year gains.”

The graph below shows home price increases by region, powered by low-interest rates, pent-up demand, and a decline in inventory on the market: Yun also indicates:

Yun also indicates:

“Home prices rose during the lockdown and could rise even further due to heavy buyer competition and a significant shortage of supply.”

Bottom Line

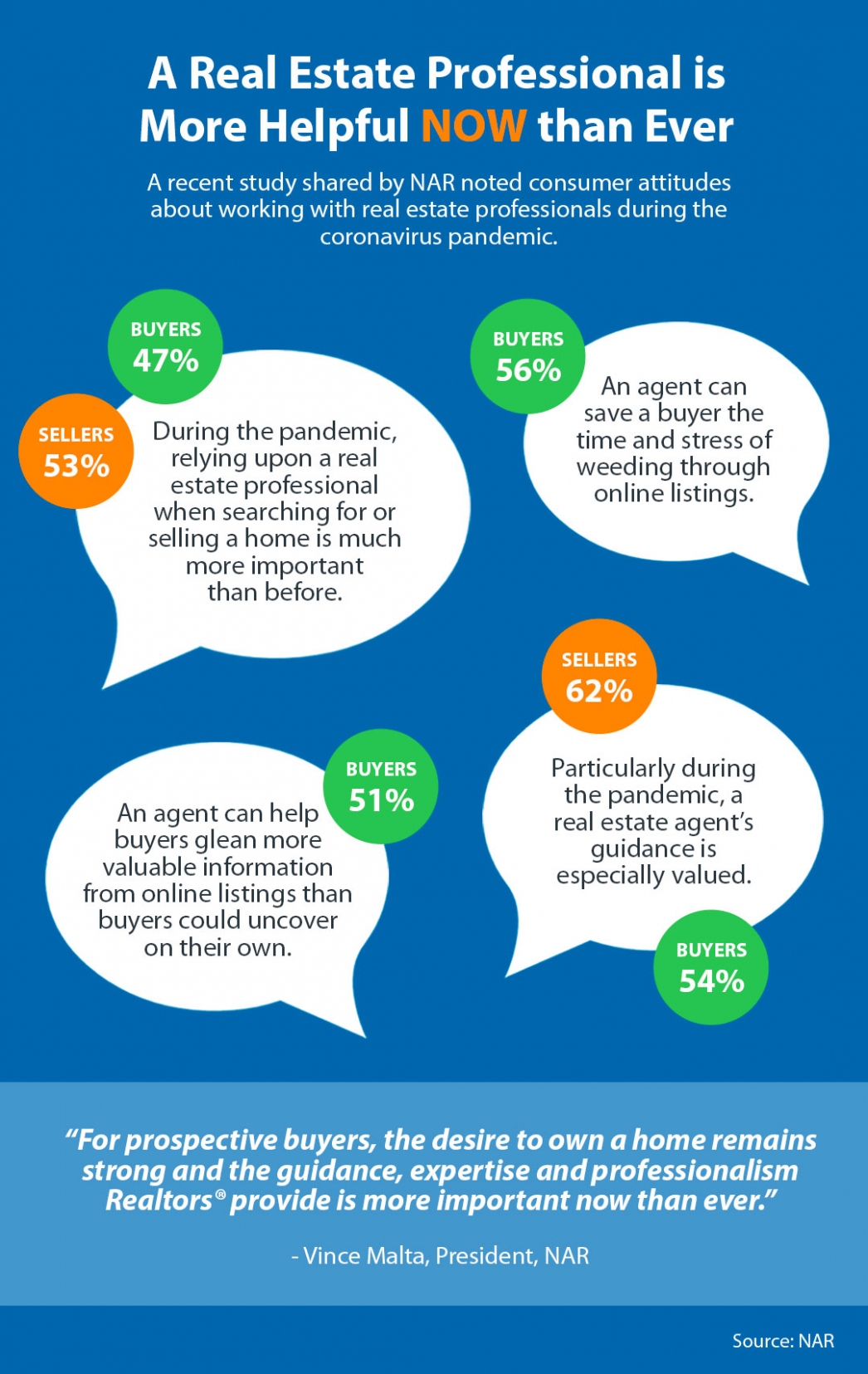

Buyers returning to the market are a great sign for the economy, as housing is still leading the way toward recovery. If you’re ready to buy a home this year, let’s connect to make sure you have the best possible guide with you each step of the way.

Two Reasons We Won’t See a Rush of Foreclosures This Fall

The health crisis we face as a country has led businesses all over the nation to reduce or discontinue their services altogether. This pause in the economy has greatly impacted the workforce and as a result, many people have been laid off or furloughed. Naturally, that would lead many to believe we might see a rush of foreclosures as we saw in 2008. The market today, however, is very different from 2008.

The concern of more foreclosures based on those that are out of work is one that we need to understand fully. There are two reasons we won’t see a rush of foreclosures this fall: forbearance extension options and strong homeowner equity.

1. Forbearance Extension

Forbearance, according to the Consumer Financial Protection Bureau (CFPB), is “when your mortgage servicer or lender allows you to temporarily pay your mortgage at a lower payment or pause paying your mortgage.” This is an option for those who need immediate relief. In today’s economy, the CFPB has given homeowners a way to extend their forbearance, which will greatly assist those families who need it at this critical time.

Under the CARES Act, the CFPB notes:

“If you experience financial hardship due to the coronavirus pandemic, you have a right to request and obtain a forbearance for up to 180 days. You also have the right to request and obtain an extension for up to another 180 days (for a total of up to 360 days).”

2. Strong Homeowner Equity

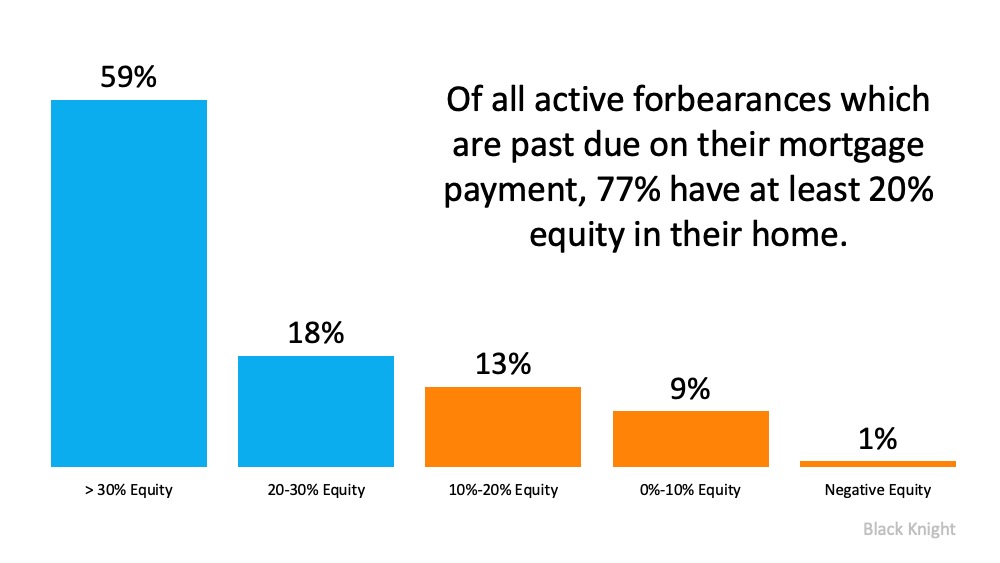

Equity is also working in favor of today’s homeowners. This savings is another reason why we won’t see substantial foreclosures in the near future. Today’s homeowners who are in forbearance actually have more equity in their homes than what the market experienced in 2008.

The Mortgage Monitor report from Black Knight indicates that of all active forbearances which are past due on their mortgage payment, 77% have at least 20% equity in their homes (See graph below): Black Knight notes:

Black Knight notes:

“The high level of equity provides options for homeowners, policymakers, mortgage investors and servicers in helping to avoid downstream foreclosure activity and default-related losses.”

Bottom Line

Many think we may see a rush of foreclosures this fall, but the facts just don’t add up in this case. Today’s real estate market is very different from 2008 when we saw many homeowners walk away when they owed more than their homes were worth. This time, equity is stronger and plans are in place to help those affected weather the storm.

What Are Experts Saying about Home Prices?

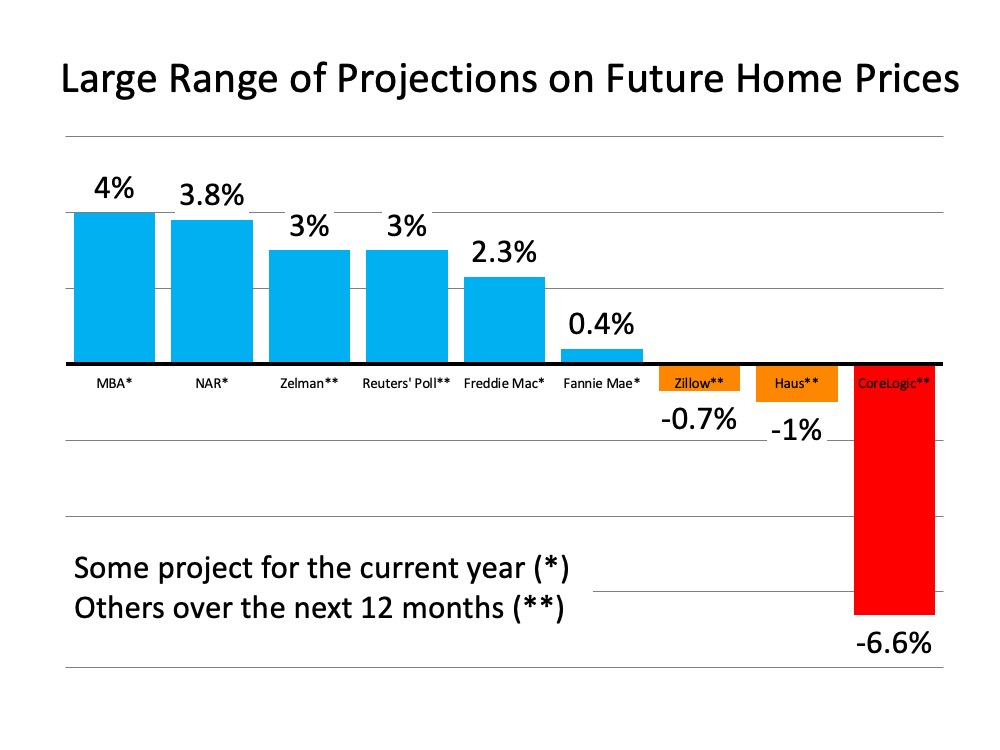

Last week, a very well-respected real estate analytics firm surprised many with their home price projection for the next twelve months. CoreLogic, in their latest Home Price Index, said:

“The economic downturn that started in March 2020 is predicted to cause a 6.6% drop in the HPI by May 2021, which would be the first decrease in annual home prices in over 9 years.”

The forecast was surprising as it was strikingly different than any other projection by major analysts. Six of the other eight forecasts call for appreciation, and the two who project depreciation indicate it will be one percent or less.

Here is a graph showing all of the projections: There’s a simple formula to determine the future price of any item: calculate the supply of that item in ratio to the demand for that item. In housing right now, demand far exceeds supply. Last week mortgage applications to buy a home were 33% higher than they were at the same time last year. The available inventory of homes for sale is 31% lower than it was last year. Normally, these numbers should call for homes to continue to appreciate.

There’s a simple formula to determine the future price of any item: calculate the supply of that item in ratio to the demand for that item. In housing right now, demand far exceeds supply. Last week mortgage applications to buy a home were 33% higher than they were at the same time last year. The available inventory of homes for sale is 31% lower than it was last year. Normally, these numbers should call for homes to continue to appreciate.

Bottom Line

Because of the uncertainty with the pandemic, any economic prediction is extremely difficult. However, looking at the limited supply of homes for sale and the tremendous demand for housing, it is difficult to disagree with the majority of analysts who are calling for price appreciation.

Americans Rank Real Estate Best Investment for 7 Years Running [INFOGRAPHIC]

![Americans Rank Real Estate Best Investment for 7 Years Running [INFOGRAPHIC] | MyKCM](https://desireestanley.com/files/2020/07/20200710-MEM-1046x1067.jpg)

![Americans Rank Real Estate Best Investment for 7 Years Running [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/07/07133310/20200710-MEM-1046x1067.jpg)

Some Highlights

- Real estate has outranked stocks, savings accounts, and gold as the best long-term investment among Americans for the past 7 years.

- The belief in the stability of housing as a long-term investment remains strong, despite the many challenges our economy faces today.

- Of the four listed, real estate is also the only investment you can also live in. That’s a big win!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

![Mortgage Rates Fall Below 3% [INFOGRAPHIC] | MyKCM](https://desireestanley.com/files/2020/07/20200717-MEM-1046x1308.jpg)

![Mortgage Rates Fall Below 3% [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/07/16135712/20200717-MEM-1046x1308.jpg)