Homeownership Will Always Be a Part of the American Dream

On Labor Day we celebrate the hard work that helps us achieve the American Dream.

Growing up, many of us thought about our future lives with great ambition. We drew pictures of what jobs we wanted to have and where we would live as a representation of secure life for ourselves and our families. Today we celebrate the workers that make this country a place where those dreams can become a reality.

According to Wikipedia,

“Labor Day honors the American labor movement and the contributions that workers have made to the development, growth, endurance, strength, security, prosperity, productivity, laws, sustainability, persistence, structure, and well-being of the country.”

The hard work that happens every day across this country allows so many to achieve the American Dream. The 2019 Aspiring Home Buyers Profile by the National Association of Realtors (NAR) says,

“Approximately 75% of non-homeowners believe homeownership is part of their American Dream, while 9 in 10 current homeowners said the same.”

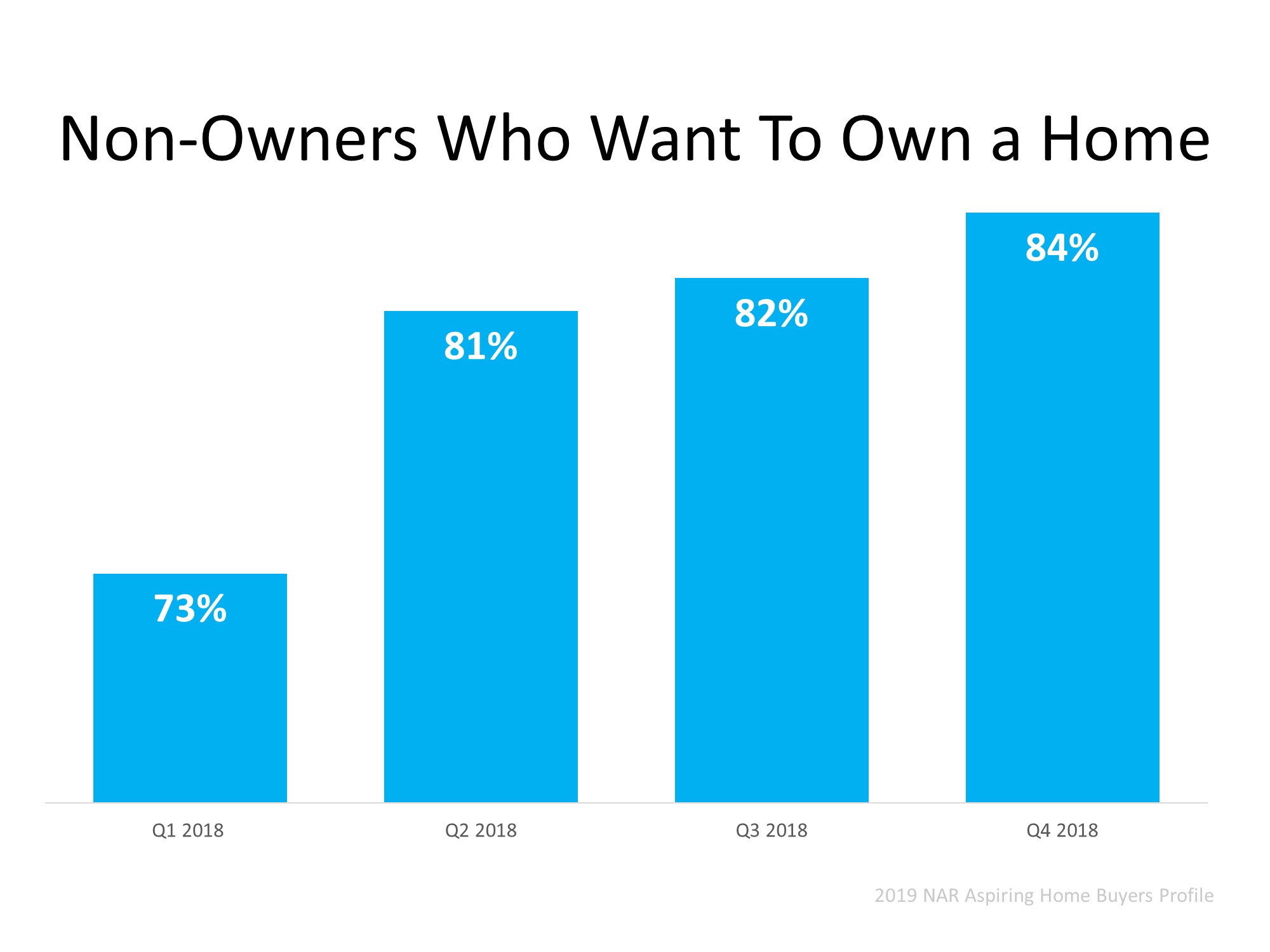

Looking at the number of non-owners, you may wonder, ‘If they believe in homeownership, why haven’t they bought a home yet?’. Well, increasing home prices and low inventory can be part of the reason why some haven’t jumped in, but that does not mean there is a lack of interest. The same report shows the increase in the desire to buy in the last year (as shown in the graph below). As we can see, there are more and more people each quarter who want to buy a home. The good news is, as more inventory comes to the market, more non-homeowners will be able to fulfill their dreams. Finally, they’ll be able to move into that home they drew when they were little kids!

As we can see, there are more and more people each quarter who want to buy a home. The good news is, as more inventory comes to the market, more non-homeowners will be able to fulfill their dreams. Finally, they’ll be able to move into that home they drew when they were little kids!

Bottom Line

If you’re a homeowner considering selling, this fall might be the right time, as there are buyers in the market ready to buy. Let’s get together to determine how you can benefit from the pent-up housing demand.

Busting the Myth About a Housing Affordability Crisis

It seems you can’t find a headline with the term “housing affordability” without the word “crisis” attached to it. That’s because some only consider the fact that residential real estate prices have continued to appreciate. However, we must realize it’s not just the price of a home that matters, but the price relative to a purchaser’s buying power.

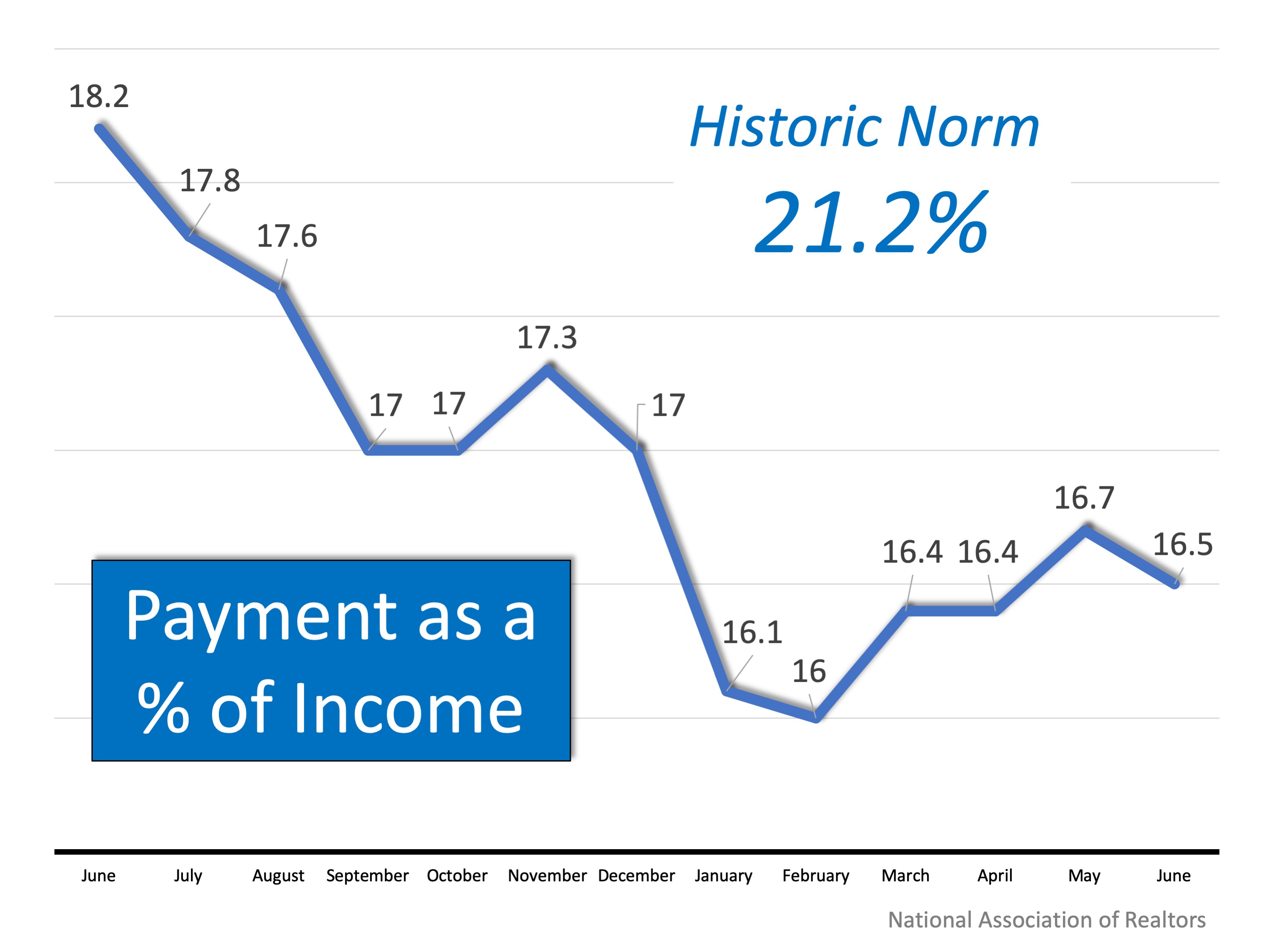

Homes, in most cases, are purchased with a mortgage. The current mortgage rate is a major component of the affordability equation. Mortgage rates have fallen by over a full percentage point since December 2018. Another major piece of the affordability equation is a buyer’s income. The median family income has risen by 3.5% over the last year.

Let’s look at three different reports issued recently that reveal how homes are very affordable in comparison to historic numbers, and how they have become even more affordable over the past several months.

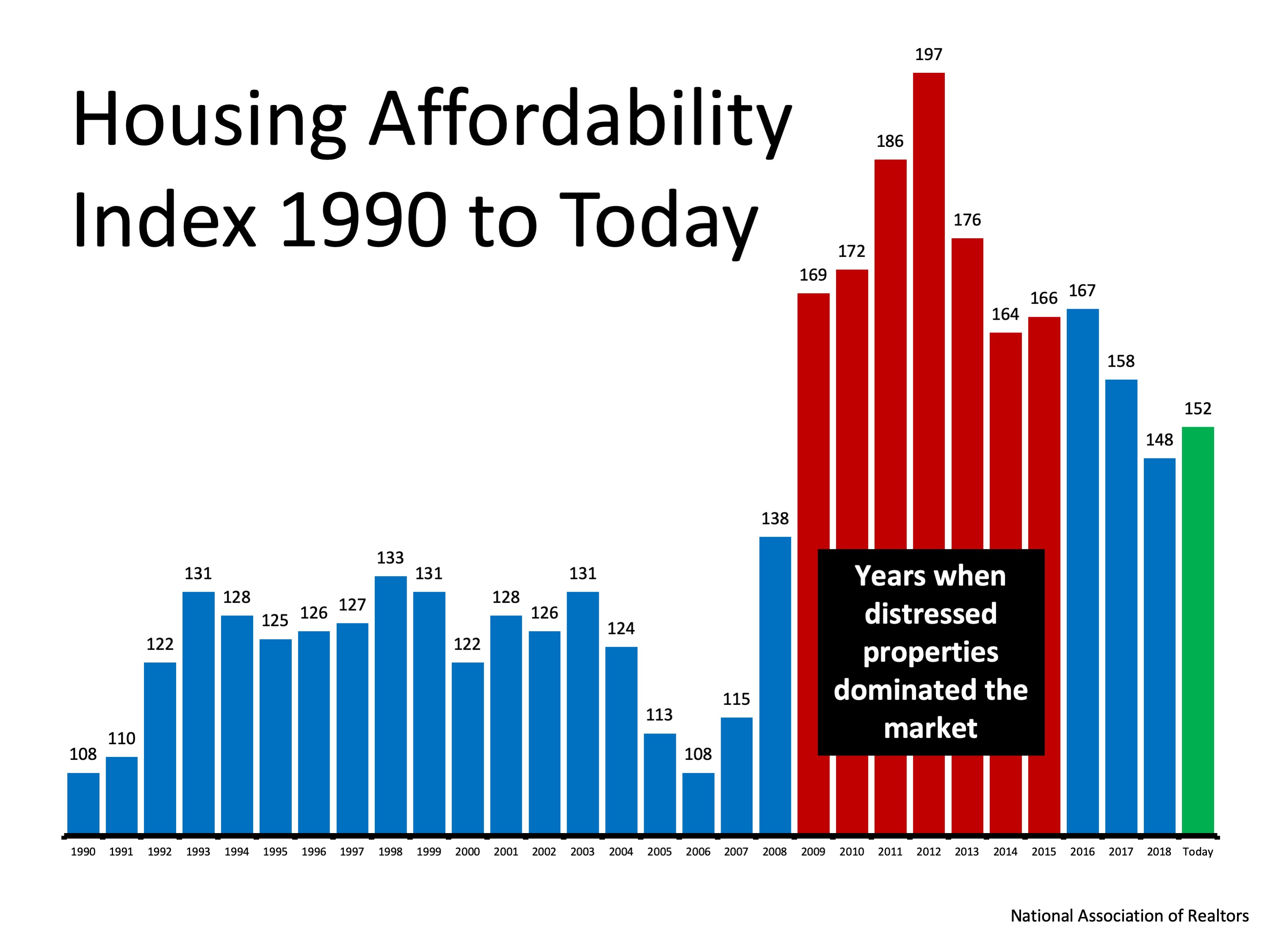

1. National Association of Realtors’ (NAR) Housing Affordability Index:

Here is a graph showing the index going all the way back to 1990. The higher the column, the more affordable homes are: We can see that homes are less affordable today (the green bar) than they were during the housing crash (the red bars). This was when distressed properties like foreclosures and short sales saturated the market and sold for massive discounts. However, homes are more affordable today than at any time from 1990 to 2008.

We can see that homes are less affordable today (the green bar) than they were during the housing crash (the red bars). This was when distressed properties like foreclosures and short sales saturated the market and sold for massive discounts. However, homes are more affordable today than at any time from 1990 to 2008.

NAR’s report on the index also shows that the percentage of a family’s income needed for a mortgage payment (16.5%) is dramatically lower than last year and is well below the historic norm of 21.2%.

2. Black Knight’s Mortgage Monitor:

This report reveals that as a result of falling interest rates and slowing home price appreciation, affordability is the best it has been in 18 months. Black Knight Data & Analytics President Ben Graboske explains:

“For much of the past year and a half, affordability pressures have put a damper on home price appreciation. Indeed, the rate of annual home price growth has declined for 15 consecutive months. More recently, declining 30-year fixed interest rates have helped to ease some of those pressures, improving the affordability outlook considerably…And despite the average home price rising by more than $12K since November, today’s lower fixed interest rates have worked out to a $108 lower monthly payment…Lower rates have also increased the buying power for prospective homebuyers looking to purchase the average-priced home by the equivalent of 15%.”

3. First American’s Real House Price Index:

While affordability has increased recently, Mark Fleming, First American’s Chief Economist explains:

“If the 30-year, fixed-rate mortgage declines just a fraction more, consumer house-buying power would reach its highest level in almost 20 years.”

Fleming goes on to say that the gains in affordability are about mortgage rates and the increase in family incomes:

“Average nominal household incomes are nearly 57 percent higher today than in January 2000. Record income levels combined with mortgage rates near historic lows mean consumer house-buying power is more than 150 percent greater today than it was in January 2000.”

Bottom Line

If you’ve put off the purchase of a first home or a move-up home because of affordability concerns, you should take another look at your ability to purchase in today’s market. You may be pleasantly surprised!

Buying a Home: Do You Know the Lingo? [INFOGRAPHIC]

![Buying a Home? Do You Know the Lingo? [INFOGRAPHIC] | MyKCM](https://desireestanley.com/files/2019/08/20190816-MEM.jpg)

![Buying a Home? Do You Know the Lingo? [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/08/13124327/20190816-MEM-1046x1354.jpg)

Some Highlights:

- Buying a home can be intimidating if you’re not familiar with the terms used throughout the process.

- To point you in the right direction, here’s a list of some of the most common language you’ll hear when buying a home.

- The best way to ensure your home-buying process is a positive one is to find a real estate professional who will guide you through every aspect of the transaction with ‘the heart of a teacher.’

Why Is So Much Paperwork Required to Get a Mortgage?

When buying a home today, why is there so much paperwork mandated by the lenders for a mortgage loan application? It seems like they need to know everything about you. Furthermore, it requires three separate sources to validate each and every entry on the application form. Many buyers are being told by friends and family that the process was a hundred times easier when they bought their home ten to twenty years ago.

There are two very good reasons that the loan process is much more onerous on today’s buyer than perhaps any other time in history.

1. The government has set new guidelines that now demand that the bank proves beyond any doubt that you are indeed capable of paying the mortgage.

During the run-up to the housing crisis, many people ‘qualified’ for mortgages that they could never pay back. This led to millions of families losing their home. The government wants to make sure this can’t happen again.

2. The banks don’t want to be in the real estate business.

Over the last several years, banks were forced to take on the responsibility of liquidating millions of foreclosures and negotiating an additional million plus short sales. Just like the government, they don’t want more foreclosures. For that reason, they have to double (maybe even triple) check everything on the application.

However, there is some good news in this situation.

The housing crash that mandated that banks be extremely strict on paperwork requirements also allowed you to get a low mortgage interest rate.

The friends and family who bought homes ten or twenty years ago experienced a simpler mortgage application process, but also paid a higher interest rate (the average 30-year fixed rate mortgage was 8.12% in the 1990s and 6.29% in the 2000s).

If you went to the bank and offered to pay 7% instead of around 4%, they would probably bend over backward to make the process much easier.

Bottom Line

Instead of concentrating on the additional paperwork required, let’s be thankful that we are able to buy a home at historically low rates.

New survey shows mortgage rates declining

Wondering about the mortgage rates? Heard that they’re going up? Worried about buying right now because rates are high? You might be surprised then to hear that the mortgage rates are actually declining according to this recent survey by Freddie Mac.

News Facts

- 30-year fixed-rate mortgage (FRM) averaged 4.14 percent with an average 0.5 point for the week ending May 2, 2019, down from last week when it averaged 4.20 percent. A year ago at this time, the 30-year FRM averaged 4.55 percent.

- 15-year FRM this week averaged 3.60 percent with an average 0.4 point, down from last week when it averaged 3.64 percent. A year ago at this time, the 15-year FRM averaged 4.03 percent.

- 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.68 percent with an average 0.4 point, down from last week when it averaged 3.77 percent. A year ago at this time, the 5-year ARM averaged 3.69 percent.

Call me @ 408-465-9290 if you’ve got questions about how you can get into the home of your dreams.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link