The Beginning of an Economic Recovery

The news these days seems to have a mix of highs and lows. We may hear that an economic recovery is starting, but we’ve also seen some of the worst economic data in the history of our country. The challenge today is to understand exactly what’s going on and what it means relative to the road ahead. We’ve talked before about what experts expect in the second half of this year, and today that progress largely hinges upon the continued course of the virus.

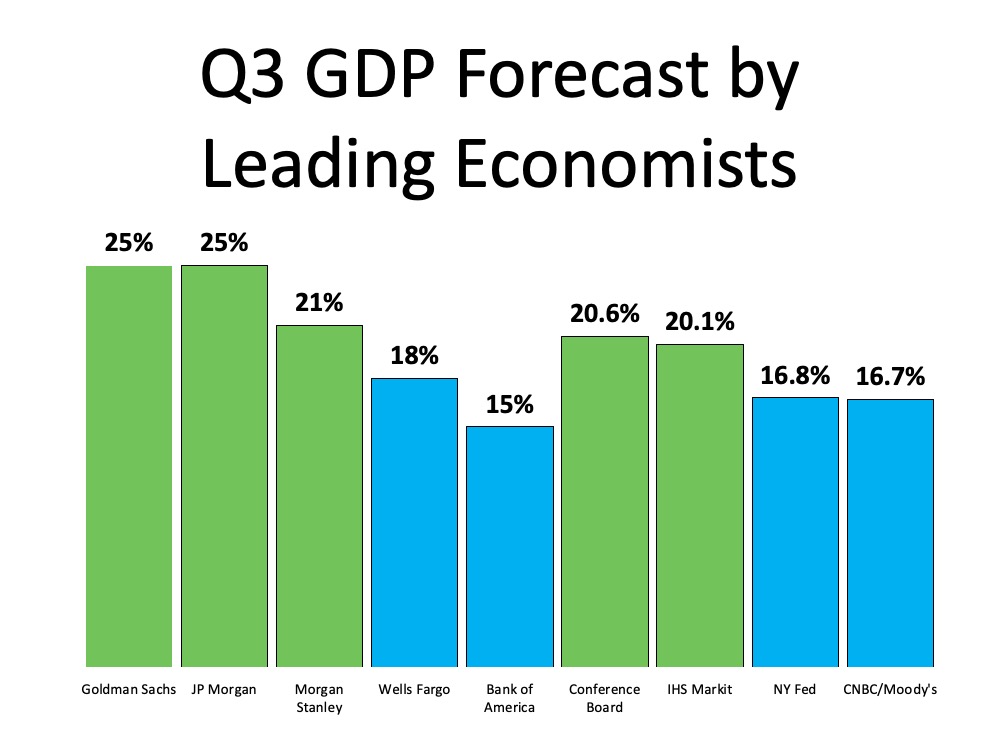

A recent Wall Street Journal survey of economists noted, “A strong economic recovery depends on effective and sustained containment of Covid-19.” Given the uncertainty around the virus, we can also see what economists are forecasting for GDP in the third quarter of this year (see graph below): Overwhelmingly, economists are projecting GDP growth in the third quarter of 2020, with 5 of the 9 experts indicating over 20% growth.

Overwhelmingly, economists are projecting GDP growth in the third quarter of 2020, with 5 of the 9 experts indicating over 20% growth.

Lisa Shalett, Chief Investment Officer for Morgan Stanley puts it this way:

“Indeed, the ‘worst ever’ GDP reading could be followed by the ‘best ever’ growth in the third quarter.”

As we look forward, we can expect consumer spending to improve as well. According to Opportunity Insights, as of August 1, consumer spending was down just 7.8% as compared to January 1 of this year.

Bottom Line

An economic recovery is beginning to happen throughout the country. While there are still questions that need to be answered about the road ahead, we can expect to see improvement this quarter.

Will This Economic Crisis Have a V, U, or L-Shaped Recovery?

Many American businesses have been put on hold as the country deals with the worst pandemic in over one hundred years. As the states are deciding on the best strategy to slowly and safely reopen, the big question is: how long will it take the economy to fully recover?

Let’s look at the possibilities. Here are the three types of recoveries that follow most economic slowdowns (the definitions are from the financial glossary at Market Business News):

- V-shaped recovery: an economic period in which the economy experiences a sharp decline. However, it is also a brief period of decline. There is a clear bottom (called a trough by economists) which does not last long. Then there is a strong recovery.

- U-shaped recovery: when the decline is more gradual, i.e., less severe. The recovery that follows starts off moderately and then picks up speed. The recovery could last 12-24 months.

- L-shaped recovery: a steep economic decline followed by a long period with no growth. When an economy is in an L-shaped recovery, getting back to where it was before the decline will take years.

What type of recovery will we see this time?

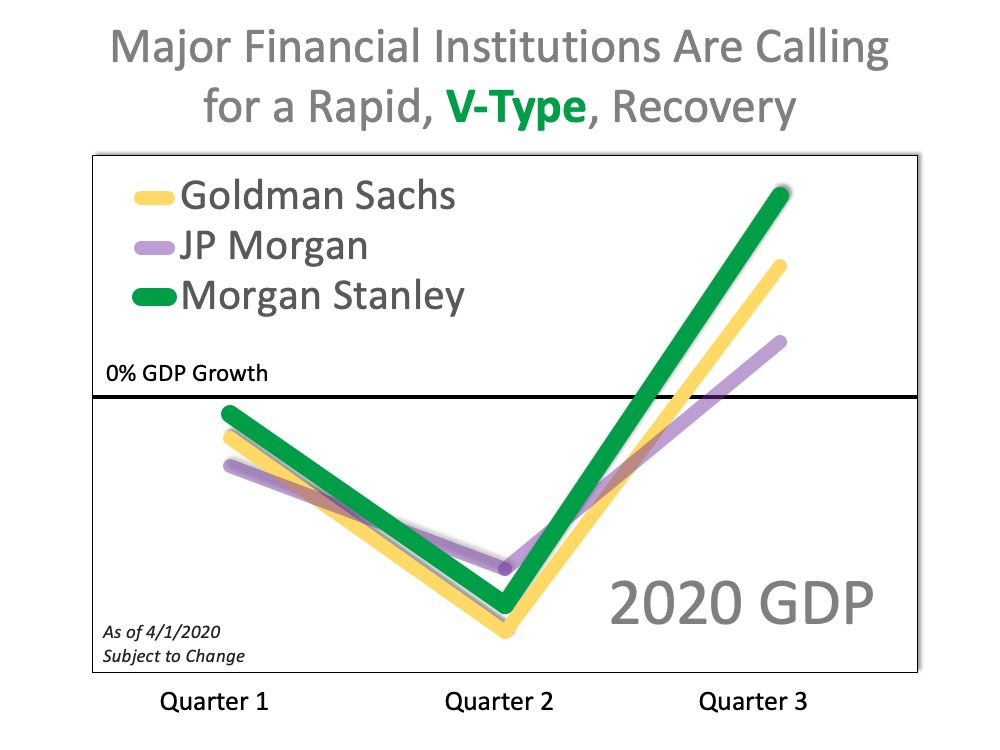

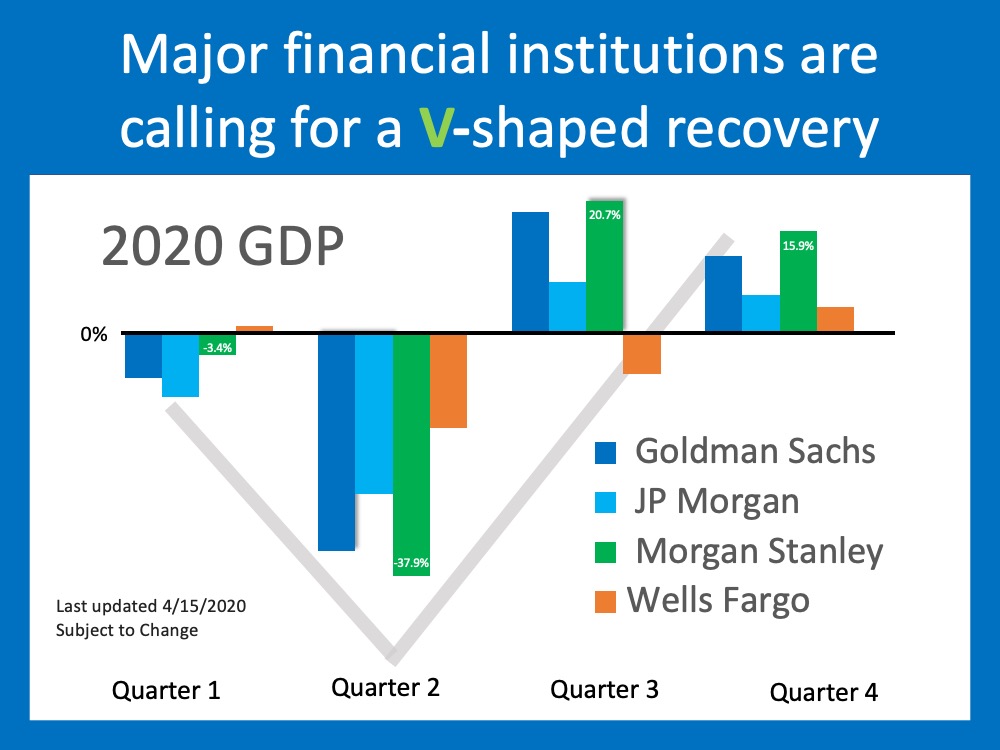

No one can answer this question with one hundred percent certainty. However, most top financial services firms are calling for a V-shaped recovery. Goldman Sachs, Morgan Stanley, Wells Fargo Securities, and JP Morgan have all recently come out with projections that call for GDP to take a deep dive in the first half of the year but have a strong comeback in the second half.

Is there any research on recovery following a pandemic?

There have been two extensive studies done that look at how an economy has recovered from a pandemic in the past. Here are the conclusions they reached:

1. John Burns Consulting:

“Historical analysis showed us that pandemics are usually V-shaped (sharp recessions that recover quickly enough to provide little damage to home prices), and some very cutting-edge search engine analysis by our Information Management team showed the current slowdown is playing out similarly thus far.”

2. Harvard Business Review:

“It’s worth looking back at history to place the potential impact path of Covid-19 empirically. In fact, V-shapes monopolize the empirical landscape of prior shocks, including epidemics such as SARS, the 1968 H3N2 (“Hong Kong”) flu, 1958 H2N2 (“Asian”) flu, and 1918 Spanish flu.”

The research says we should experience a V-shaped recovery.

Does everyone agree it will be a ‘V’?

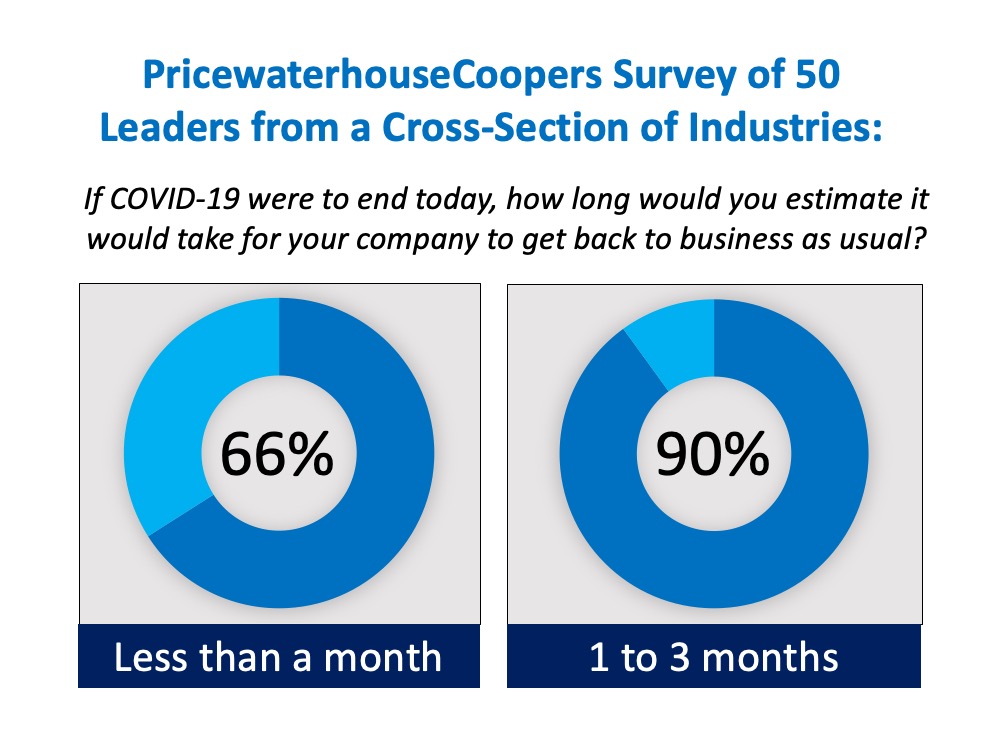

No. Some are concerned that, even when businesses are fully operational, the American public may be reluctant to jump right back in.

As Market Business News explains:

“In a typical V-shaped recovery, there is a huge shift in economic activity after the downturn and the trough. Growing consumer demand and spending drive the massive shift in economic activity.”

If consumer demand and spending do not come back as quickly as most expect it will, we may be heading for a U-shaped recovery.

In a message last Thursday, Chris Hyzy, Chief Investment Officer for Merrill and Bank of America Private Bank, agrees with other analysts who are expecting a resurgence in the economy later this year:

“We’re forecasting real economic growth of 30% for the U.S. in the 4th quarter of this year and 6.1% in 2021.”

His projection, however, calls for a U-shaped recovery based on concerns that consumers may not rush back in:

“After the steep plunge and bottoming out, a ‘U-shaped’ recovery should begin as consumer confidence slowly returns.”

Bottom Line

The research indicates the recovery will be V-shaped, and most analysts agree. We will have to wait and see as the situation unfolds just how quickly Americans will get back to “normal” life.

Don’t Let Frightening Headlines Scare You

There’s a lot of anxiety right now regarding the coronavirus pandemic. The health situation must be addressed quickly, and many are concerned about the impact on the economy as well.

Amidst all this anxiety, anyone with a megaphone – from the mainstream media to a lone blogger – has realized that bad news sells. Unfortunately, we will continue to see a rash of horrifying headlines over the next few months. Let’s make sure we aren’t paralyzed by a headline before we get the full story.

When it comes to the health issue, you should look to the Centers for Disease Control and Prevention (CDC) or the World Health Organization (WHO) for the most reliable information.

Finding reliable resources with information on the economic impact of the virus is more difficult. For this reason, it’s important to shed some light on the situation. There are already alarmist headlines starting to appear. Here are two such examples surfacing this week.

1. Goldman Sachs Forecasts the Largest Drop in GDP in Almost 100 Years

It sounds like Armageddon. Though the headline is true, it doesn’t reflect the full essence of the Goldman Sachs forecast. The projection is actually that we’ll have a tough first half of the year, but the economy will bounce back nicely in the second half; GDP will be up 12% in the third quarter and up another 10% in the fourth.

This aligns with research from John Burns Consulting involving pandemics, the economy, and home values. They concluded:

“Historical analysis showed us that pandemics are usually V-shaped (sharp recessions that recover quickly enough to provide little damage to home prices), and some very cutting-edge search engine analysis by our Information Management team showed the current slowdown is playing out similarly thus far.”

The economy will suffer for the next few months, but then it will recover. That’s certainly not Armageddon.

2. Fed President Predicts 30% Unemployment!

That statement was made by James Bullard, President of the Federal Reserve Bank of St. Louis. What Bullard actually said was it “could” reach 30%. But let’s look at what else he said in the same Bloomberg News interview:

“This is a planned, organized partial shutdown of the U.S. economy in the second quarter,” Bullard said. “The overall goal is to keep everyone, households and businesses, whole” with government support.

According to Bloomberg, he also went on to say:

“I would see the third quarter as a transitional quarter” with the fourth quarter and first quarter next year as “quite robust” as Americans make up for lost spending. “Those quarters might be boom quarters,” he said.

Again, Bullard agrees we will have a tough first half and rebound quickly.

Bottom Line

There’s a lot of misinformation out there. If you want the best advice on what’s happening in the current housing market, let’s talk today.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link