Why Selling this Fall May Be Your Best Move

If you’re thinking about moving, selling your house this fall might be the way to go. Here are four highlights in the housing market that may make your decision to sell this fall an easy one.

1. Buyers Are Actively in the Market

ShowingTime, a leading real estate showing software and market stat service provider, just reported that buyer traffic jumped 60.7% compared to this time last year. That’s a huge increase.

It’s clear that buyers are ready, willing, and able to purchase – and they’re in the market right now. In many regions of the country, multiple buyers are entering bidding wars to compete for the home they want. Take advantage of the buyer activity currently in the market so you can sell your house in the most favorable terms.

2. There Are Not Enough Homes for Sale

In the latest Existing Home Sales Report, the National Association of Realtors (NAR) announced that there were only 1.49 million units available for sale. That number was down 18.6% from one year ago. This means in the majority of the country, there aren’t enough homes for sale to satisfy the number of buyers.

Due to the health crisis, many homeowners were reluctant to list their homes earlier this year. That will change as the economy continues to recover. The choices buyers have will increase going into the new year. Don’t wait until additional sellers come to market before you decide to make a move.

3. The Process Is Going Quickly

Today’s ultra-competitive environment has forced buyers to do all they can to stand out from the crowd, including getting pre-approved for their mortgage financing. This makes the entire selling process much faster and simpler, as buyers know exactly what they can afford before shopping for a home. According to the latest Origination Insights Report from Ellie Mae, the time needed to close a loan is just 49 days.

4. There May Never Be a More Important Time to Move

You’ve likely spent much of the last six months in your current home. Perhaps you now realize how small it is, and you need more space. If you’re working from home, your children are doing virtual school, or you just need more space, your current floor plan may not work for your family’s changing needs.

Homebuilders are beginning to build houses again, so you can choose the exact floor plan to match what your family needs, and you can make sure the outdoor space is what you want too.

Bottom Line

The housing market is prime for sellers right now, so let’s connect to get the process started this fall. If the timing is right for you and your family, the market is calling your name.

Think You Should For Sale By Owner? Think Again [INFOGRAPHIC]

![Think You Should For Sale By Owner? Think Again [INFOGRAPHIC] | MyKCM](https://desireestanley.com/files/2020/07/20200626-MEM-1046x1354.jpg)

![Think You Should For Sale By Owner? Think Again [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/06/25103350/20200626-MEM-1046x1354.jpg)

Some Highlights

- For Sale By Owner (FSBO) is the process of selling real estate without the representation of a real estate broker or real estate agent.

- According to the National Association of Realtors’ Profile of Home Buyers & Sellers, 35% of homeowners who decided to FSBO last year did so to avoid paying a commission or fee. But, homes sold with an agent net 6% more than those sold as an FSBO according to Collateral Analytics.

- Before you decide to take on the challenge of selling your house on your own, let’s connect to discuss your options.

Will Home Values Appreciate or Depreciate in 2020?

With the housing market staggered to some degree by the health crisis the country is currently facing, some potential purchasers are questioning whether home values will be impacted. The price of any item is determined by supply as well as the market’s demand for that item.

Each month the National Association of Realtors (NAR) surveys “over 50,000 real estate practitioners about their expectations for home sales, prices and market conditions” for the REALTORS Confidence Index.

Their latest edition sheds some light on the relationship between seller traffic (supply) and buyer traffic (demand) during this pandemic.

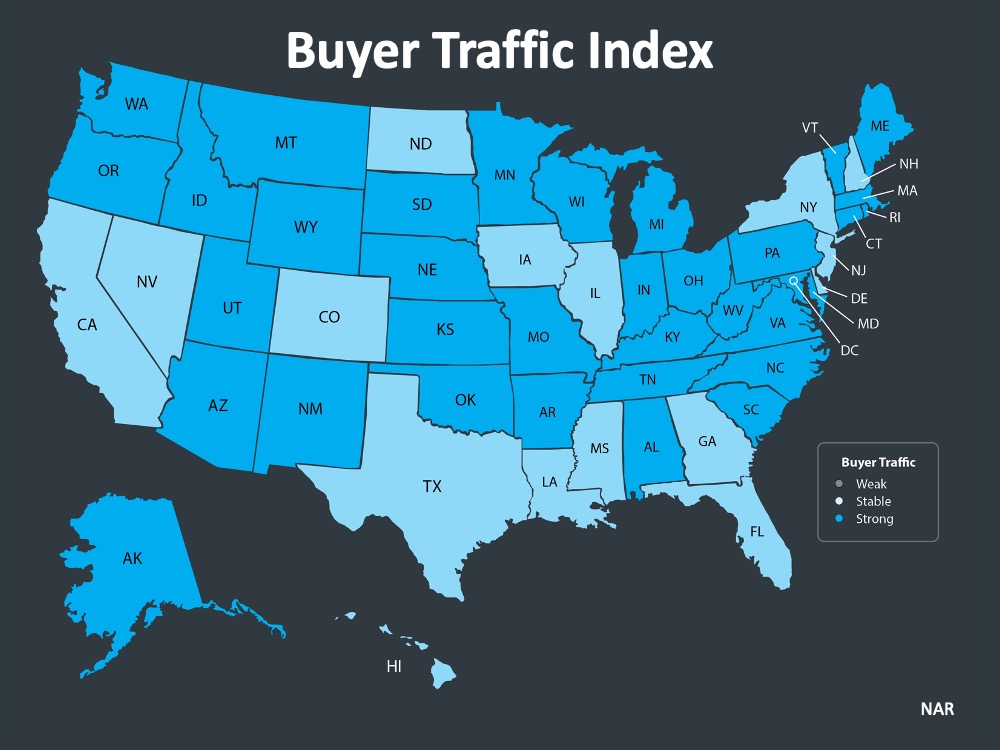

Buyer Demand

The map below was created after asking the question: “How would you rate buyer traffic in your area?” The darker the blue, the stronger the demand for homes is in that area. The survey shows that in 34 of the 50 U.S. states, buyer demand is now ‘strong’ and 16 of the 50 states have a ‘stable’ demand.

The darker the blue, the stronger the demand for homes is in that area. The survey shows that in 34 of the 50 U.S. states, buyer demand is now ‘strong’ and 16 of the 50 states have a ‘stable’ demand.

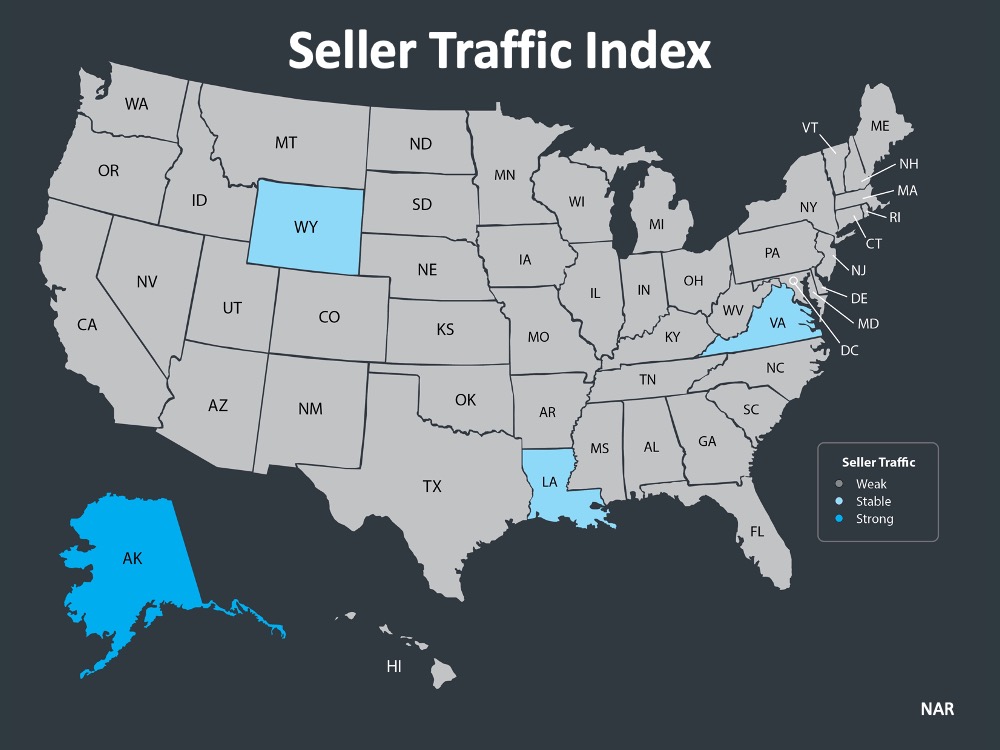

Seller Supply

The index also asks: “How would you rate seller traffic in your area?” As the map above indicates, 46 states and Washington, D.C. reported ‘weak’ seller traffic, 3 states reported ‘stable’ seller traffic, and 1 state reported ‘strong’ seller traffic. This means there are far fewer homes on the market than what is needed to satisfy the needs of buyers looking for homes right now.

As the map above indicates, 46 states and Washington, D.C. reported ‘weak’ seller traffic, 3 states reported ‘stable’ seller traffic, and 1 state reported ‘strong’ seller traffic. This means there are far fewer homes on the market than what is needed to satisfy the needs of buyers looking for homes right now.

With demand still stronger than supply, home values should not depreciate.

What are the experts saying?

Here are the thoughts of three industry experts on the subject:

“We note that inventory as a percent of households sits at the lowest level ever, something we believe will limit the overall degree of home price pressure through the year.”

Mark Fleming, Chief Economist, First American:

“Housing supply remains at historically low levels, so house price growth is likely to slow, but it’s not likely to go negative.”

“Two forces prevent a collapse in house prices. First, as we indicated in our earlier research report, U.S. housing markets face a large supply deficit. Second, population growth and pent up household formations provide a tailwind to housing demand.”

Bottom Line

Looking at these maps and listening to the experts, it seems that prices will remain stable throughout 2020. If you’re thinking about listing your home, let’s connect to discuss how you can capitalize on the somewhat surprising demand in the market now.

How Buyers Can Win By Downsizing in 2020

Home values have been increasing for 93 consecutive months, according to the National Association of Realtors. If you’re a homeowner, particularly one looking to downsize your living space, that’s great news, as you’ve likely built significant equity in your home.

Here’s some more good news: mortgage rates are expected to remain low throughout 2020 at an average of 3.8% for a 30-year fixed-rate loan.

The combination of leveraging your growing equity and capitalizing on low rates could make a big difference in your housing plans this year.

How to Use Your Home Equity

For move-up buyers, the typical pattern for building financial stability and wealth through homeownership works this way: you buy a house and gain equity over several years of mortgage payments and price appreciation. You then take that equity from the sale of your house to make a down payment on your next home and repeat the process.

For homeowners ready to downsize, home equity can work in a slightly different way. What you choose to do depends in part upon your goals.

According to HousingWire.com, for some, the desire to downsize may be related to retirement plans or children aging out of the home. Others may be choosing to live in a smaller home to save money or simplify their lifestyle in a space that’s easier to clean and declutter. The reasons can vary greatly and by generation.

Those who choose to put their equity toward a new home have the opportunity to make a substantial down payment or maybe even to buy their next home in cash. This is incredibly valuable if your goal is to have a minimal mortgage payment or none at all.

A local real estate professional can help you evaluate your equity and how to use it wisely. If you’re planning to downsize, keep in mind that home prices are anticipated to continue rising in 2020, which could influence your choices.

The Impact of Low Mortgage Rates

Low mortgage rates can offset price hikes, so locking in while rates are low will be key. For many downsizing homeowners, a loan with a shorter term is ideal, so the balance can be reduced more quickly.

Interest rates on 10, 15, and 20-year loans are lower than the rates on a 30-year fixed-rate loan. If you’re downsizing your housing costs, you may prefer a shorter-term loan to pay off your home faster. This way, you can save thousands in interest payments over time.

Bottom Line

If you’re planning a transition into a smaller home, the twin trends of low mortgage rates and rising home equity can kickstart or boost your plans, especially if you’re anticipating retirement soon or just want to live in a smaller home that’s easier to maintain. Let’s get together today to explore your options.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

![Why Pricing Your Home Right Matters This Fall [INFOGRAPHIC] | MyKCM](https://desireestanley.com/files/2020/09/20200925-MEM-1046x588-2.jpg)

![Why Pricing Your Home Right Matters This Fall [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/09/24122226/20200925-MEM-1046x588.jpg)

![How Technology is Helping Buyers Navigate the Home Search Process [INFOGRAPHIC] | MyKCM](https://desireestanley.com/files/2020/04/20200417-MEM-Eng-1046x1308.png)

![How Technology is Helping Buyers Navigate the Home Search Process [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/04/16133213/20200417-MEM-Eng-1046x1308.png)