Homeownership Will Always Be a Part of the American Dream

On Labor Day we celebrate the hard work that helps us achieve the American Dream.

Growing up, many of us thought about our future lives with great ambition. We drew pictures of what jobs we wanted to have and where we would live as a representation of secure life for ourselves and our families. Today we celebrate the workers that make this country a place where those dreams can become a reality.

According to Wikipedia,

“Labor Day honors the American labor movement and the contributions that workers have made to the development, growth, endurance, strength, security, prosperity, productivity, laws, sustainability, persistence, structure, and well-being of the country.”

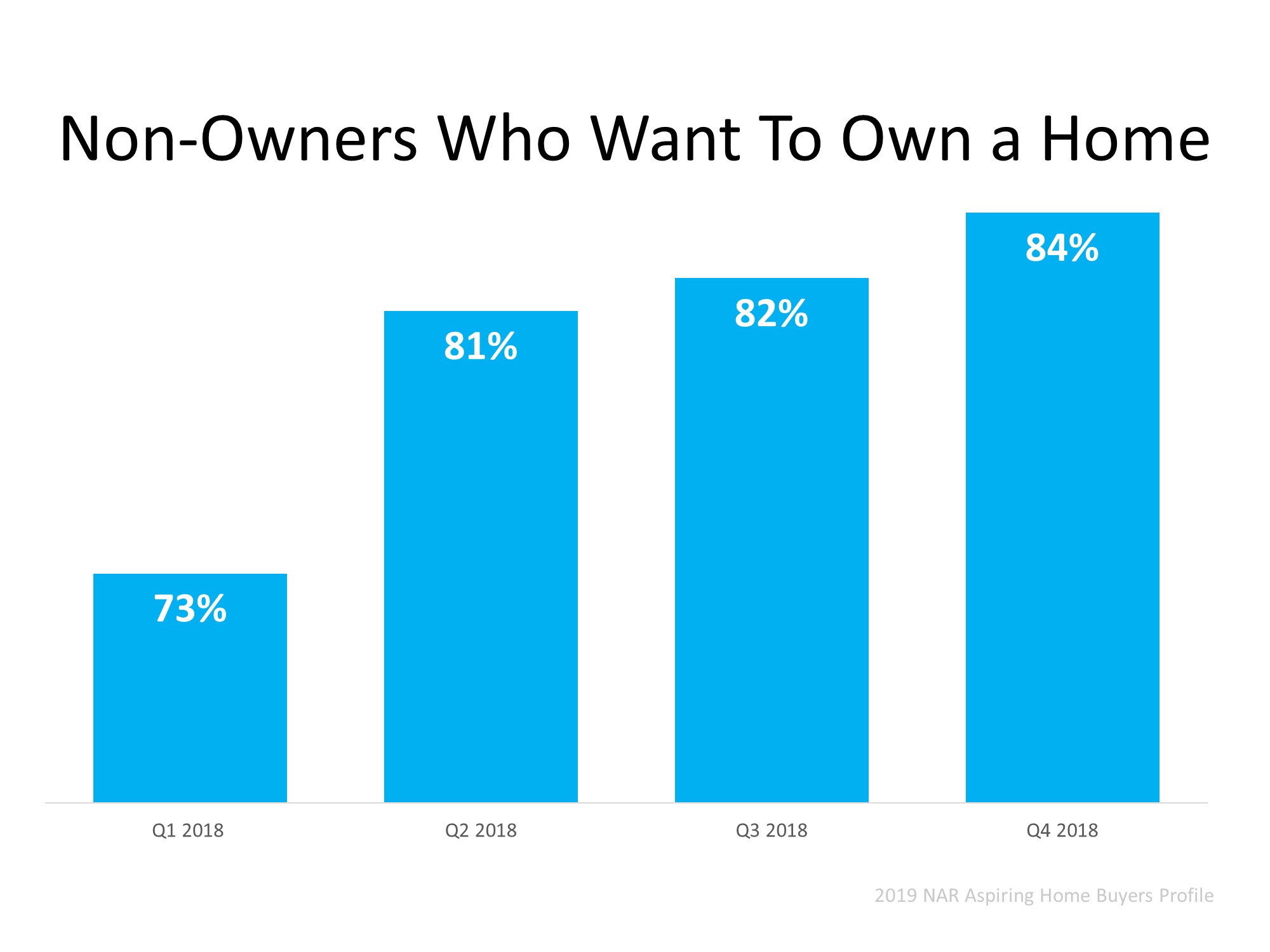

The hard work that happens every day across this country allows so many to achieve the American Dream. The 2019 Aspiring Home Buyers Profile by the National Association of Realtors (NAR) says,

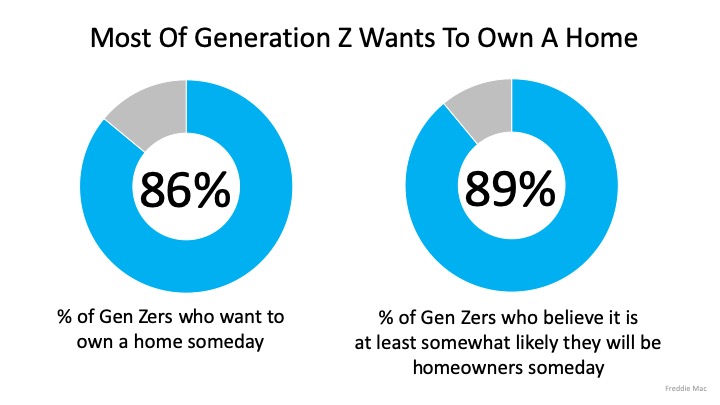

“Approximately 75% of non-homeowners believe homeownership is part of their American Dream, while 9 in 10 current homeowners said the same.”

Looking at the number of non-owners, you may wonder, ‘If they believe in homeownership, why haven’t they bought a home yet?’. Well, increasing home prices and low inventory can be part of the reason why some haven’t jumped in, but that does not mean there is a lack of interest. The same report shows the increase in the desire to buy in the last year (as shown in the graph below). As we can see, there are more and more people each quarter who want to buy a home. The good news is, as more inventory comes to the market, more non-homeowners will be able to fulfill their dreams. Finally, they’ll be able to move into that home they drew when they were little kids!

As we can see, there are more and more people each quarter who want to buy a home. The good news is, as more inventory comes to the market, more non-homeowners will be able to fulfill their dreams. Finally, they’ll be able to move into that home they drew when they were little kids!

Bottom Line

If you’re a homeowner considering selling, this fall might be the right time, as there are buyers in the market ready to buy. Let’s get together to determine how you can benefit from the pent-up housing demand.

3 Powerful Reasons to Buy a Home Now

Whether you are a first-time buyer or looking to move up to the home of your dreams, now is a great time to purchase a home. Here are three major reasons to buy today.

1. Affordability

Many people focus solely on price when talking about home affordability. Since home prices have appreciated throughout the past year, they assume homes are less affordable. However, affordability is determined by three components:

- Price

- Wages

- Mortgage Interest Rate

Prices are up, but so are wages – and interest rates have recently dropped dramatically (see #2 below). As a result, the National Association of Realtors’ (NAR) latest Affordability Index report revealed that homes are MORE affordable throughout the country today than they were a year ago.

“All four regions saw an increase in affordability from a year ago. The South had the biggest gain in affordability of 6.9%, followed by the West with a gain of 6.0%. The Midwest had an increase of 5.8%, followed by the Northeast with the smallest gain of 1.8%.”

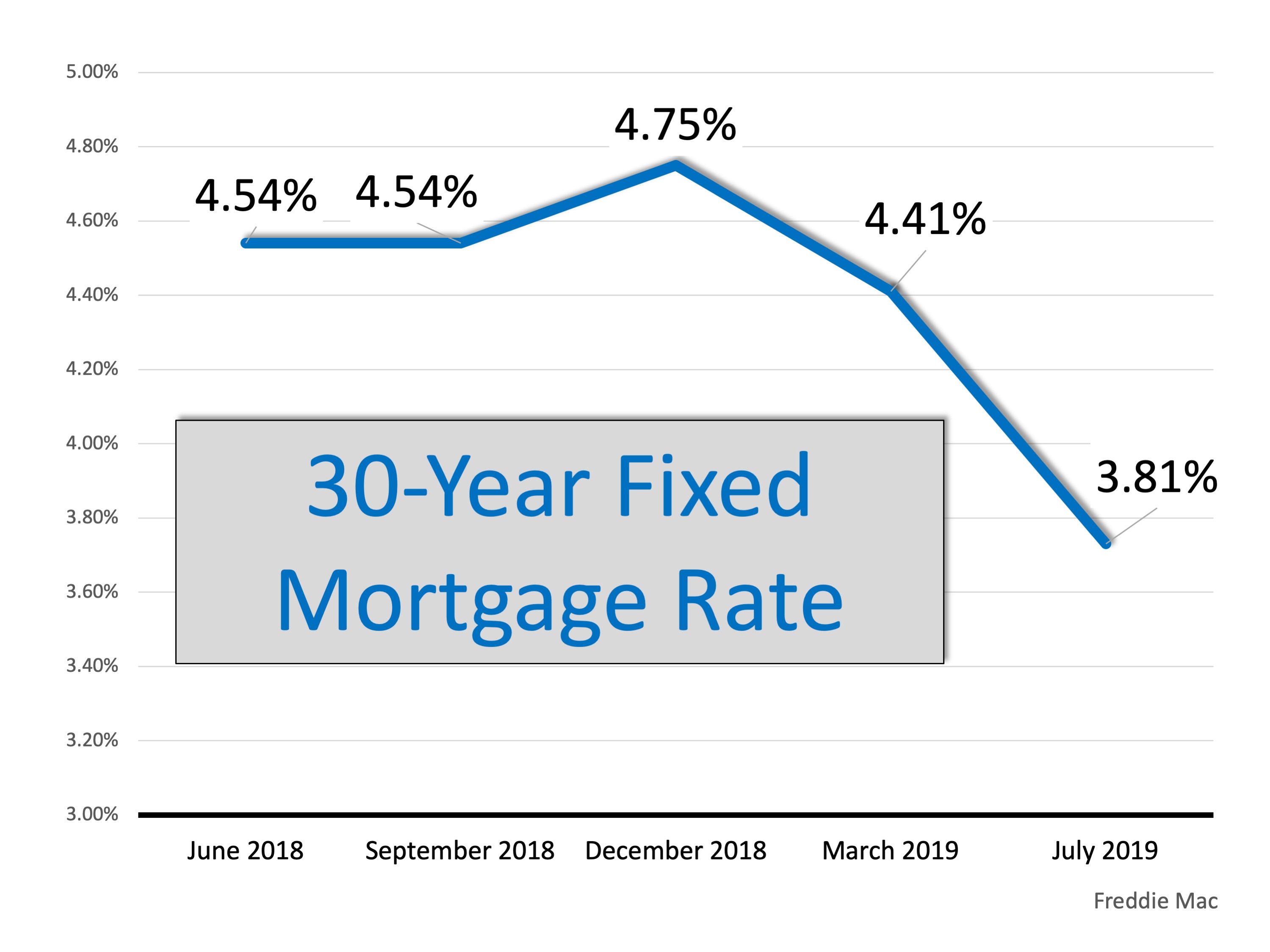

2. Mortgage Interest Rates

Mortgage rates have dropped almost a full point after heading toward 5% last fall and early winter. Currently, they are below 4%.

Additionally, Fannie Mae recently predicted the average rate for a 30-year fixed mortgage will be 3.7% in the second half of 2019. That compares to a 4.4% average rate in the first quarter and 4% in the second quarter.

Additionally, Fannie Mae recently predicted the average rate for a 30-year fixed mortgage will be 3.7% in the second half of 2019. That compares to a 4.4% average rate in the first quarter and 4% in the second quarter.

With mortgage rates remaining near historic lows, Fannie Mae and others have increased their forecasts for housing appreciation for the rest of the year. If home price gains are about to re-accelerate, buying now rather than later makes financial sense.

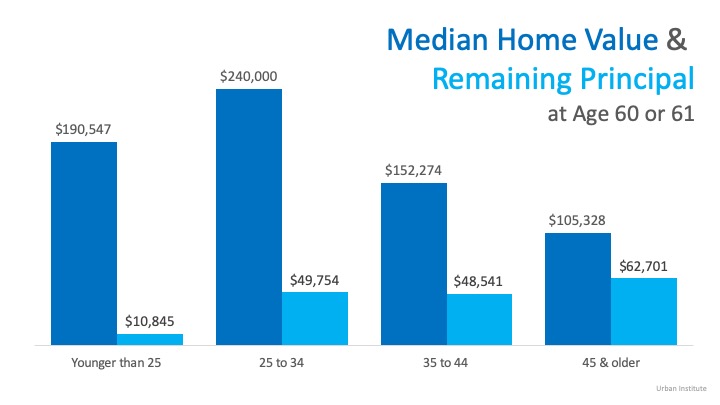

3. Increase Family Wealth

Homeownership has always been recognized as a sensational way to build long-term family wealth. A new report by ATTOM Data Solutions reveals:

“U.S. homeowners who sold in the second quarter of 2019 realized an average home price gain since purchase of $67,500, up from an average gain of $57,706 in Q1 2019 and up from an average gain of $60,100 in Q2 2018. The average home seller gain of $67,500 in Q2 2019 represented an average 33.9 percent return as a percentage of original purchase price.”

The longer you delay purchasing a home, the longer you are waiting to put the power of home equity to work for you.

Bottom Line

With affordability increasing, mortgage rates decreasing, and home values about to re-accelerate, it may be time to make a move. Let’s get together to determine if buying now makes sense for your family.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link