6 Reasons Why Selling Your House on Your Own Is a Mistake

There are many benefits to working with a real estate professional when selling your house. During challenging times like the one we face today, it becomes even more important to have an expert help guide you through the process. If you’re considering selling on your own, known in the industry as a For Sale By Owner or FSBO, please consider the following:

1. Your Safety Is a Priority

During this pandemic, your family’s safety comes first. When you FSBO, it is incredibly difficult to control entry into your home. A real estate professional will have the proper protocols in place to protect not only your belongings but your family’s health and well-being too. From regulating the number of people in your home at one time to ensuring proper sanitization during and after a showing, and even facilitating virtual tours for buyers, agents are equipped to follow the latest industry standards recommended by the National Association of Realtors (NAR) to help protect you and your family.

2. A Powerful Online Strategy Is a Must to Attract a Buyer

Recent studies have shown that, even before COVID-19, the first step 44% of all buyers took when looking for a home was to search online. Throughout the process, that number jumped to 93%. Today, those numbers have grown exponentially. Most real estate agents have developed a strong Internet and social media strategy to promote the sale of your house. Have you?

3. There Are Too Many Negotiations

Here are just a few of the people you’ll need to negotiate with if you decide to FSBO:

- The buyer, who wants the best deal possible

- The buyer’s agent, who solely represents the best interest of the buyer

- The inspection companies, which work for the buyer and will almost always find challenges with the house

- The appraiser, if there is a question of value

As part of their training, agents are taught how to negotiate every aspect of the real estate transaction and how to mediate the emotions felt by buyers looking to make what is probably the largest purchase of their lives.

4. You Won’t Know if Your Purchaser Is Qualified for a Mortgage

Having a buyer who wants to purchase your house is the first step. Making sure they can afford to buy it is just as important. As a FSBO, it’s almost impossible to be involved in the mortgage process of your buyer. A real estate professional is trained to ask the appropriate questions and, in most cases, will be intimately aware of the progress that’s being made toward a purchaser’s mortgage commitment.

Further complicating the situation is how the current mortgage market is rapidly evolving because of the number of families out of work and in mortgage forbearance. A loan program that was there yesterday could be gone tomorrow. You need someone who is working with lenders every day to guarantee your buyer makes it to the closing table.

5. FSBOing Has Become More Difficult from a Legal Standpoint

The documentation involved in the selling process has increased dramatically as more and more disclosures and regulations have become mandatory. In an increasingly litigious society, the agent acts as a third-party to help the seller avoid legal jeopardy. This is one of the major reasons why the percentage of people FSBOing has dropped from 19% to 8% over the last 20+ years.

6. You Net More Money When Using an Agent

Many homeowners believe they’ll save the real estate commission by selling on their own. Realize that the main reason buyers look at FSBOs is because they also believe they can save the real estate agent’s commission. The seller and buyer can’t both save the commission.

A study by Collateral Analytics revealed that FSBOs don’t actually save anything by forgoing the help of an agent. In some cases, the seller may even net less money from the sale. The study found the difference in price between a FSBO and an agent-listed home was an average of 6%. One of the main reasons for the price difference is effective exposure:

“Properties listed with a broker that is a member of the local MLS will be listed online with all other participating broker websites, marketing the home to a much larger buyer population. And those MLS properties generally offer compensation to agents who represent buyers, incentivizing them to show and sell the property and again potentially enlarging the buyer pool.”

The more buyers that view a home, the greater the chance a bidding war will take place.

Bottom Line

Listing on your own leaves you to manage the entire transaction yourself. Why do that when you can hire an agent and still net the same amount of money? Before you decide to take on the challenge of selling your house alone, let’s connect to discuss your options.

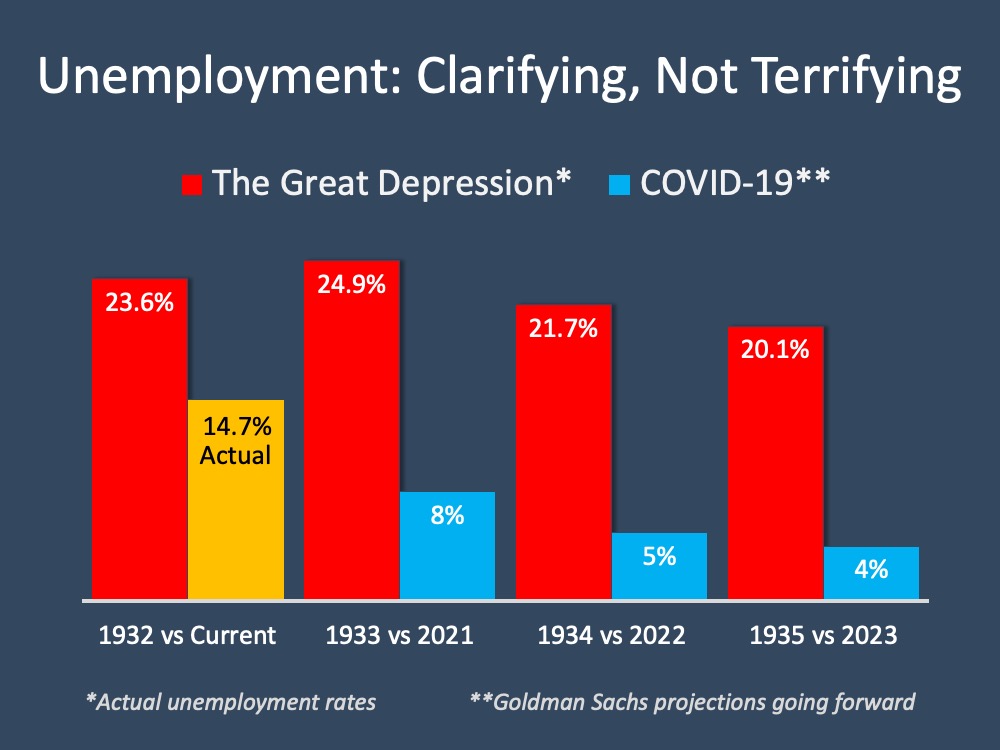

Unemployment Report: No Need to Be Terrified

Last Friday, the Bureau of Labor Statistics (BLS) released its latest jobs report. It revealed that the economic shutdown made necessary by COVID-19 caused the unemployment rate to jump to 14.7%. Many anticipate that next month the percentage could be even higher. These numbers represent the extreme hardship so many families are experiencing right now. That pain should not be understated.

However, the long-term toll the pandemic will cause should not be overstated either. There have been numerous headlines claiming the current disruption in the economy is akin to the Great Depression, and many of those articles are calling for total Armageddon. Some experts are stepping up to refute those claims.

In a Wall Street Journal (WSJ) article this past weekend, Josh Zumbrun, a national economics correspondent for the Journal explained:

“News stories often describe the coronavirus-induced global economic downturn as the worst since the Great Depression…the comparison does more to terrify than clarify.”

Zumbrun goes on to explain:

“From 1929 to 1933, the economy shrank for 43 consecutive months, according to contemporaneous estimates. Unemployment climbed to nearly 25% before slowly beginning its descent, but it remained above 10% for an entire decade…This time, many economists believe a rebound could begin this year or early next year.”

Here is a graph comparing current unemployment numbers (actual and projected) to those during the Great Depression: Clearly, the two unemployment situations do not compare.

Clearly, the two unemployment situations do not compare.

What makes this time so different?

This was not a structural collapse of the economy, but instead a planned shutdown to help mitigate the virus. Once the virus is contained, the economy will immediately begin to recover. This is nothing like what happened in the 1930s. In the same WSJ article mentioned above, former Federal Reserve Chairman Ben Bernanke, who has done extensive research on the depression in the 1930s, explained:

“The breakdown of the financial system was a major reason for both the Great Depression and the 2007-09 recession.” He went on to say that today – “the banks are stronger and much better capitalized.”

What about the families and small businesses that are suffering right now?

The nation’s collective heart goes out to all. The BLS report, however, showed that ninety percent of the job losses are temporary. In addition, many are getting help surviving this pause in their employment status. During the Great Depression, there were no government-sponsored unemployment insurance or large government subsidies as there are this time.

Today, many families are receiving unemployment benefits and an additional $600 a week. The stimulus package is helping many companies weather the storm. Is there still pain? Of course. The assistance, however, is providing much relief until most can go back to work.

Bottom Line

We should look at the current situation for what it is – a predetermined pause placed on the economy. The country will recover once the pandemic ends. Comparisons to any other downturn make little sense. Bernanke put it best:

“I don’t find comparing the current downturn with the Great Depression to be very helpful. The expected duration is much less, and the causes are very different.”

Will Home Values Appreciate or Depreciate in 2020?

With the housing market staggered to some degree by the health crisis the country is currently facing, some potential purchasers are questioning whether home values will be impacted. The price of any item is determined by supply as well as the market’s demand for that item.

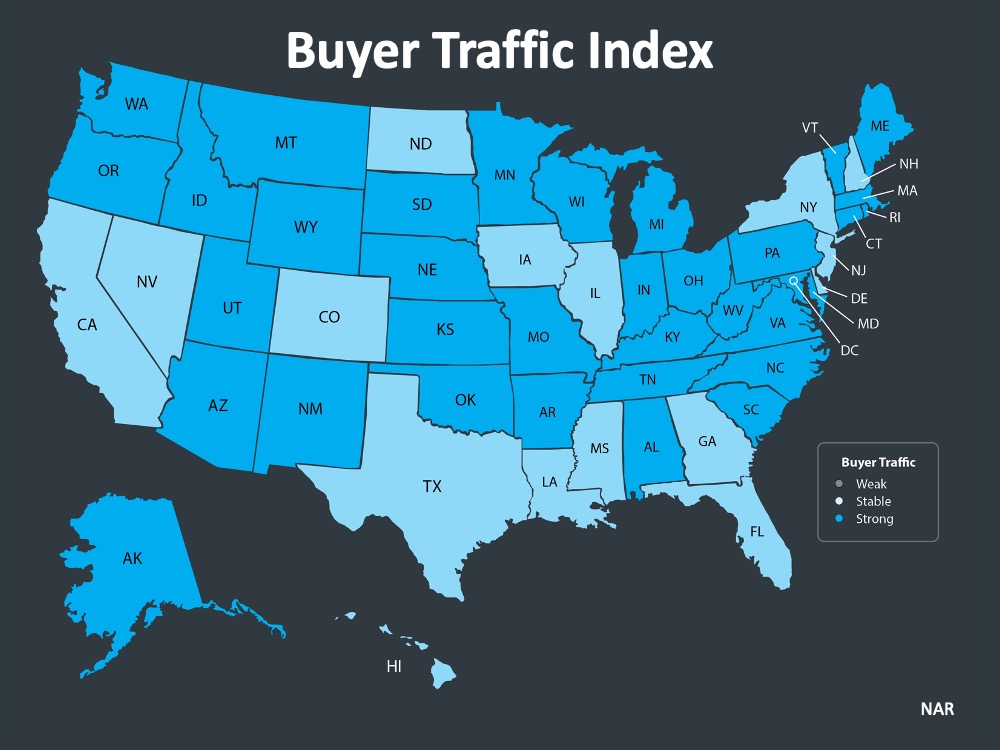

Each month the National Association of Realtors (NAR) surveys “over 50,000 real estate practitioners about their expectations for home sales, prices and market conditions” for the REALTORS Confidence Index.

Their latest edition sheds some light on the relationship between seller traffic (supply) and buyer traffic (demand) during this pandemic.

Buyer Demand

The map below was created after asking the question: “How would you rate buyer traffic in your area?” The darker the blue, the stronger the demand for homes is in that area. The survey shows that in 34 of the 50 U.S. states, buyer demand is now ‘strong’ and 16 of the 50 states have a ‘stable’ demand.

The darker the blue, the stronger the demand for homes is in that area. The survey shows that in 34 of the 50 U.S. states, buyer demand is now ‘strong’ and 16 of the 50 states have a ‘stable’ demand.

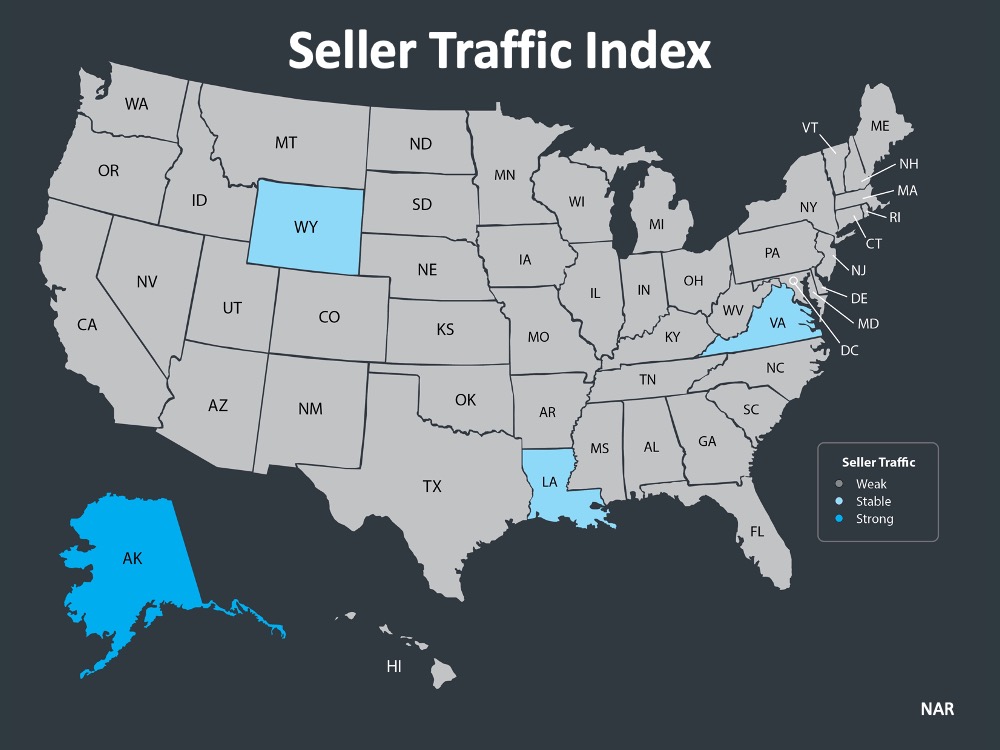

Seller Supply

The index also asks: “How would you rate seller traffic in your area?” As the map above indicates, 46 states and Washington, D.C. reported ‘weak’ seller traffic, 3 states reported ‘stable’ seller traffic, and 1 state reported ‘strong’ seller traffic. This means there are far fewer homes on the market than what is needed to satisfy the needs of buyers looking for homes right now.

As the map above indicates, 46 states and Washington, D.C. reported ‘weak’ seller traffic, 3 states reported ‘stable’ seller traffic, and 1 state reported ‘strong’ seller traffic. This means there are far fewer homes on the market than what is needed to satisfy the needs of buyers looking for homes right now.

With demand still stronger than supply, home values should not depreciate.

What are the experts saying?

Here are the thoughts of three industry experts on the subject:

“We note that inventory as a percent of households sits at the lowest level ever, something we believe will limit the overall degree of home price pressure through the year.”

Mark Fleming, Chief Economist, First American:

“Housing supply remains at historically low levels, so house price growth is likely to slow, but it’s not likely to go negative.”

“Two forces prevent a collapse in house prices. First, as we indicated in our earlier research report, U.S. housing markets face a large supply deficit. Second, population growth and pent up household formations provide a tailwind to housing demand.”

Bottom Line

Looking at these maps and listening to the experts, it seems that prices will remain stable throughout 2020. If you’re thinking about listing your home, let’s connect to discuss how you can capitalize on the somewhat surprising demand in the market now.

A Day When Americans Can Return to Work [INFOGRAPHIC]

![A Day When Americans Can Return to Work [INFOGRAPHIC] | MyKCM](https://desireestanley.com/files/2020/05/20200508-MEM-1-1046x766.jpg)

![A Day When Americans Can Return to Work [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/05/07130244/20200508-MEM-1-1046x766.jpg)

Some Highlights

- Taking a moment to reflect upon what we’ve heard from historical leaders can teach us a lot about getting through the many challenges we face today.

- We’re all eager for the day when every American can safely return to work. That day is coming. Timing is everything. Patience is essential.

- Our courage, strength, and unparalleled resilience will get us there.

Unemployment: Hope on the Horizon

Today, the unemployment rate for April 2020 will be released by the U.S. Bureau of Labor Statistics. It will hit a peak this country has never seen before, with data representing real families and lives affected by this economic slowdown. The numbers will alarm us. There will be headlines and doomsday scenarios in the media. There is hope, though, that as businesses reopen, most people will become employed again soon.

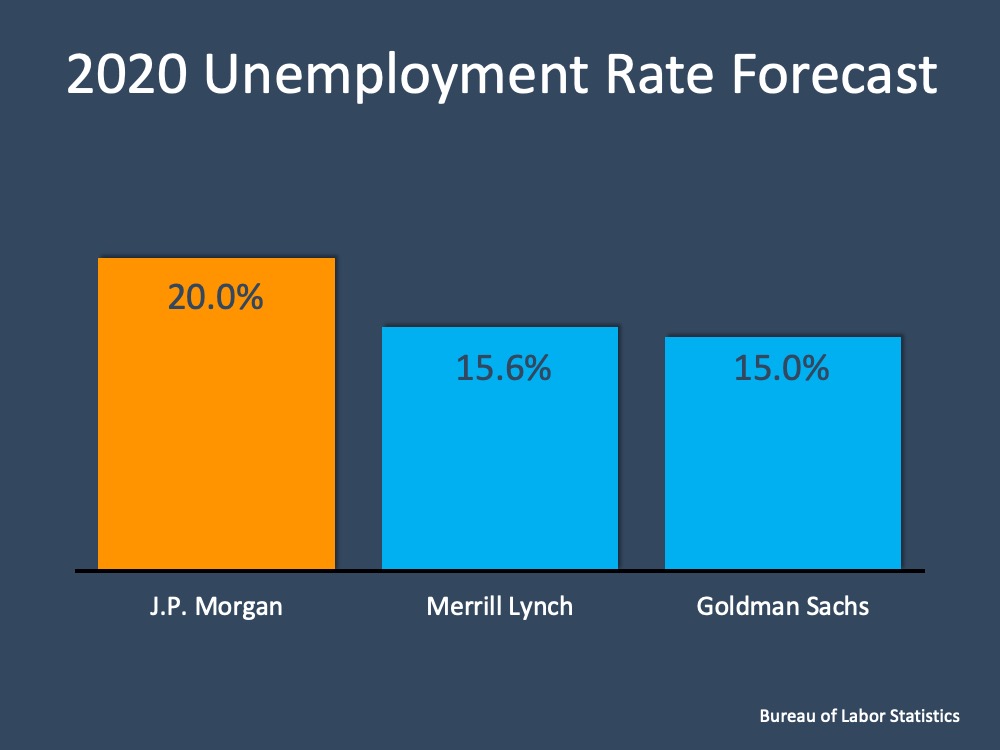

Last month’s report indicated we initially lost over 700,000 jobs in this country, and the unemployment rate quickly rose to 4.4%. With the release of the new data, that number will climb even higher. Experts forecast this report will show somewhere between a 15% – 20% national unemployment rate, and some anticipate that number to be even greater (see graph below):

What’s happened over the last several weeks?

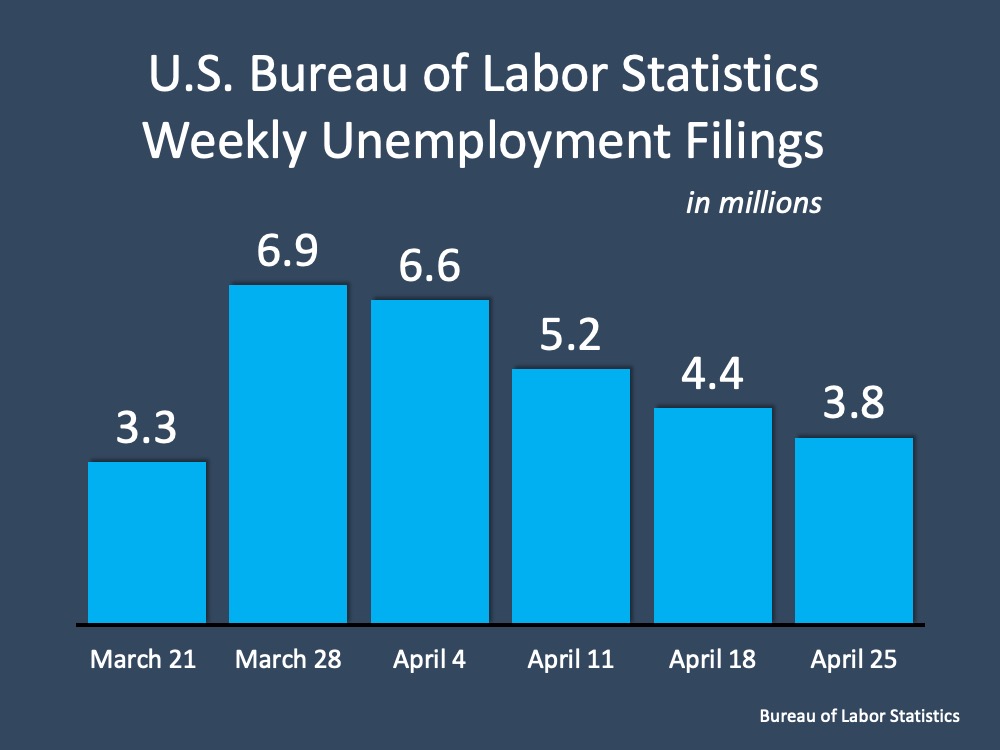

Here’s a breakdown of this spring’s weekly unemployment filings: The good news shown here indicates the number of additional unemployment claims has decreased week over week since the beginning of April. Carlos Rodriguez, CEO of Automatic Data Processing (ADP) says based on what he’s seeing:

The good news shown here indicates the number of additional unemployment claims has decreased week over week since the beginning of April. Carlos Rodriguez, CEO of Automatic Data Processing (ADP) says based on what he’s seeing:

“It’s possible that companies are already anticipating some kind of normalization, opening in certain states and starting to post jobs.”

He goes on to say that this doesn’t mean all companies are hiring, but it could mean they are at the point where they’re not cutting jobs anymore. Let’s hope this trend continues.

What will the future bring?

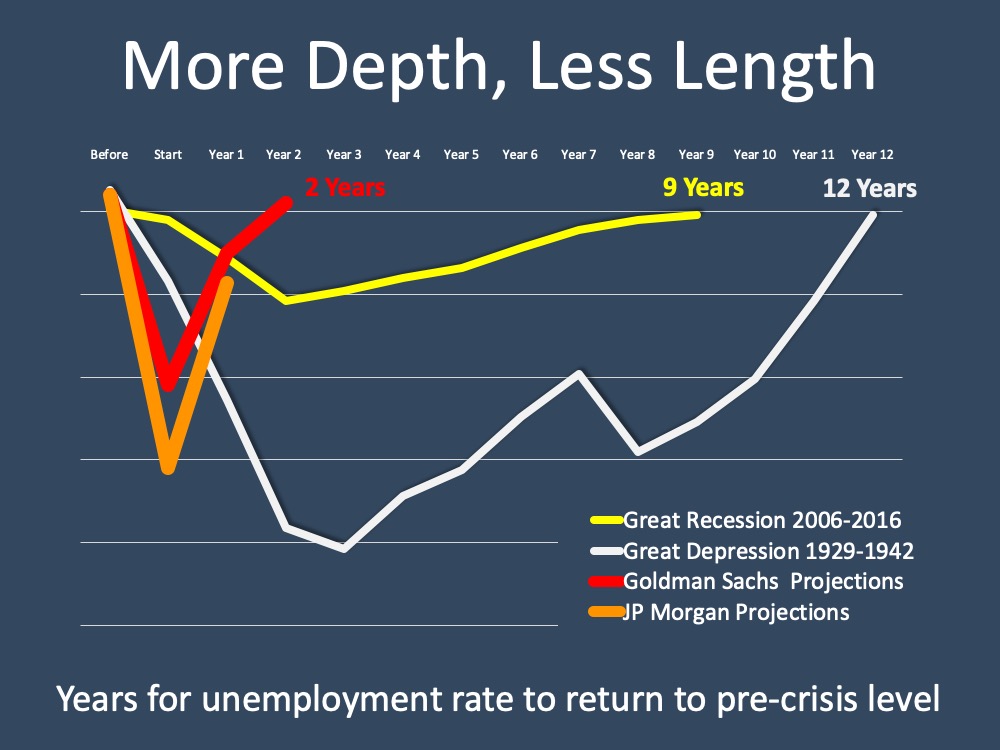

Most experts predict that while unemployment is high right now, it won’t be that way for long. The length of unemployment during this crisis is projected to be significantly shorter than the duration seen in the Great Recession and the Great Depression. While forecasts may be high, the numbers are trending down and the length of time isn’t expected to last forever.

While forecasts may be high, the numbers are trending down and the length of time isn’t expected to last forever.

Bottom Line

Don’t let the headlines rattle you. There’s hope coming as we start to safely reopen businesses throughout the country. Unemployment affects our families, our businesses, and our country. Our job is to rally around those impacted and do our part to support them through this time.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

![Interest Rates Hover Near Historic All-Time Lows [INFOGRAPHIC] | MyKCM](https://desireestanley.com/files/2020/05/20200522-MEM-1046x837.png)

![Interest Rates Hover Near Historic All-Time Lows [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/05/21093649/20200522-MEM-1046x837.png)

![2020 Homeowner Wish List [INFOGRAPHIC] | MyKCM](https://desireestanley.com/files/2020/05/20200515-MEM-1046x1448.jpg)

![2020 Homeowner Wish List [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/05/14070616/20200515-MEM-1046x1448.jpg)