The 2020 Millennial Home Buyer Report shows how this generation is not really any different from previous ones when it comes to homeownership goals:

“The majority of millennials not only want to own a home, but 84% of millennials in 2019 considered it a major part of the American Dream.”

Unfortunately, the myths surrounding the barriers to homeownership – especially those related to down payments and FICO® scores – might be keeping many buyers out of the arena. The piece also reveals:

“Millennials have to navigate a lot of obstacles to be able to own a home. According to our 2020 survey, saving for a down payment is the biggest barrier for 50% of millennials.”

Millennial or not, unpacking two of the biggest myths that may be standing in the way of homeownership among all generations is a great place to start the debunking process.

Myth #1: “I Need a 20% Down Payment”

Many buyers often overestimate what they need to qualify for a home loan. According to the same article:

“A down payment of 20% for a home of that price [$210,000] would be about $42,000; only about 30% of the millennials in our survey have enough in savings to cover that, not to mention the additional closing costs.”

While many potential buyers still think they need to put at least 20% down for the home of their dreams, they often don’t realize how many assistance programs are available with as little as 3% down. With a bit of research, many renters may be able to enter the housing market sooner than they ever imagined.

Myth #2: “I Need a 780 FICO® Score or Higher”

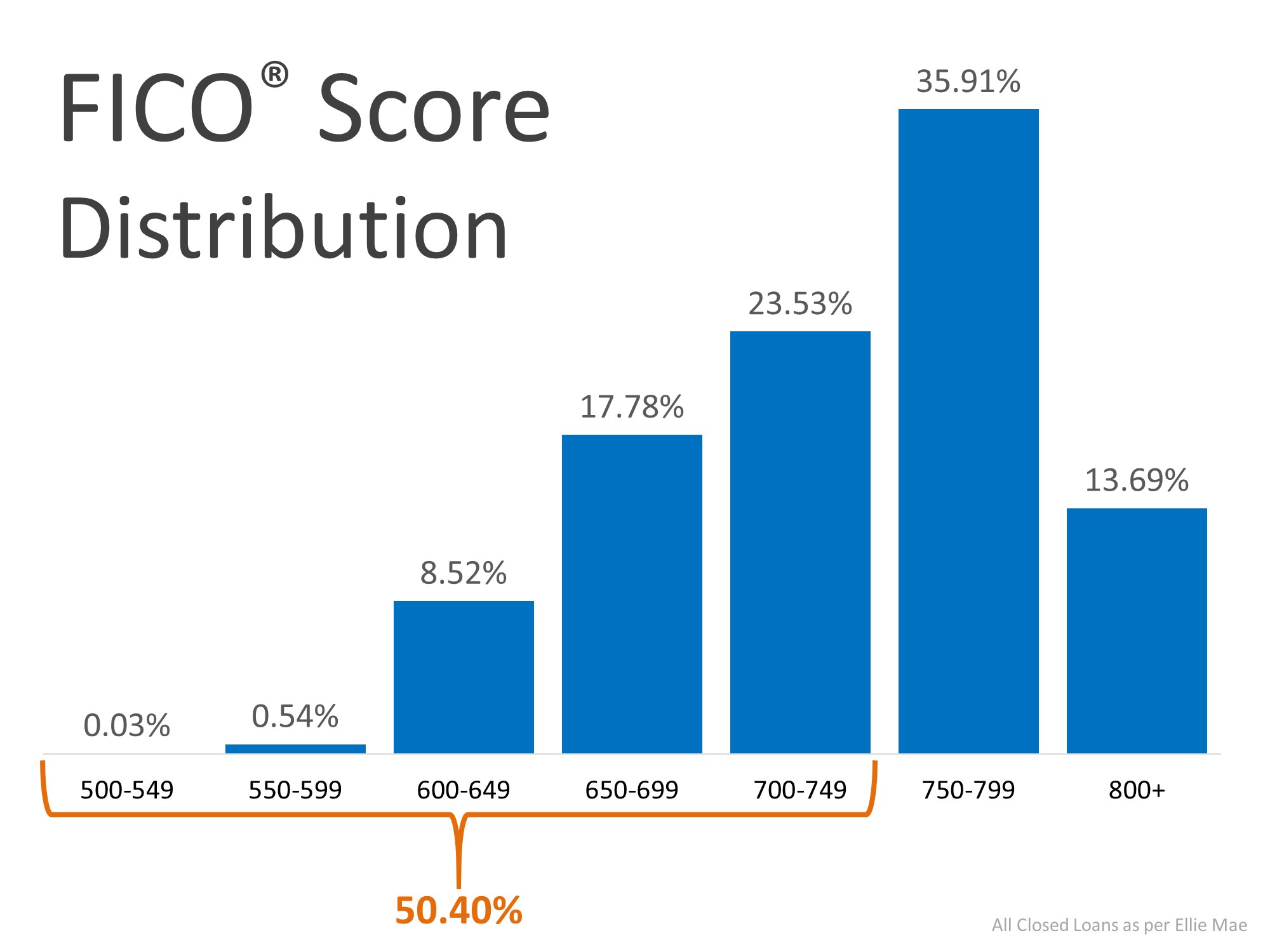

In addition to down payments, buyers are also often confused about the FICO® score it takes to qualify for a mortgage, believing they need a credit score of 780 or higher.

Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved) loans, shows the truth is, over 50% of approved loans were granted with a FICO® score below 750 (see graph below): Even today, many of the myths of the home buying process are unfortunately keeping plenty of motivated buyers on the sidelines. In reality, it really doesn’t have to be that way.

Even today, many of the myths of the home buying process are unfortunately keeping plenty of motivated buyers on the sidelines. In reality, it really doesn’t have to be that way.

Bottom Line

If you’re thinking of buying a home, you may have more options than you think. Let’s connect to answer your questions and help you determine your next steps.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link